Unfavourable financial progress within the 12 months’s first half could also be a foreshock to a a lot deeper downturn that would final into 2024.

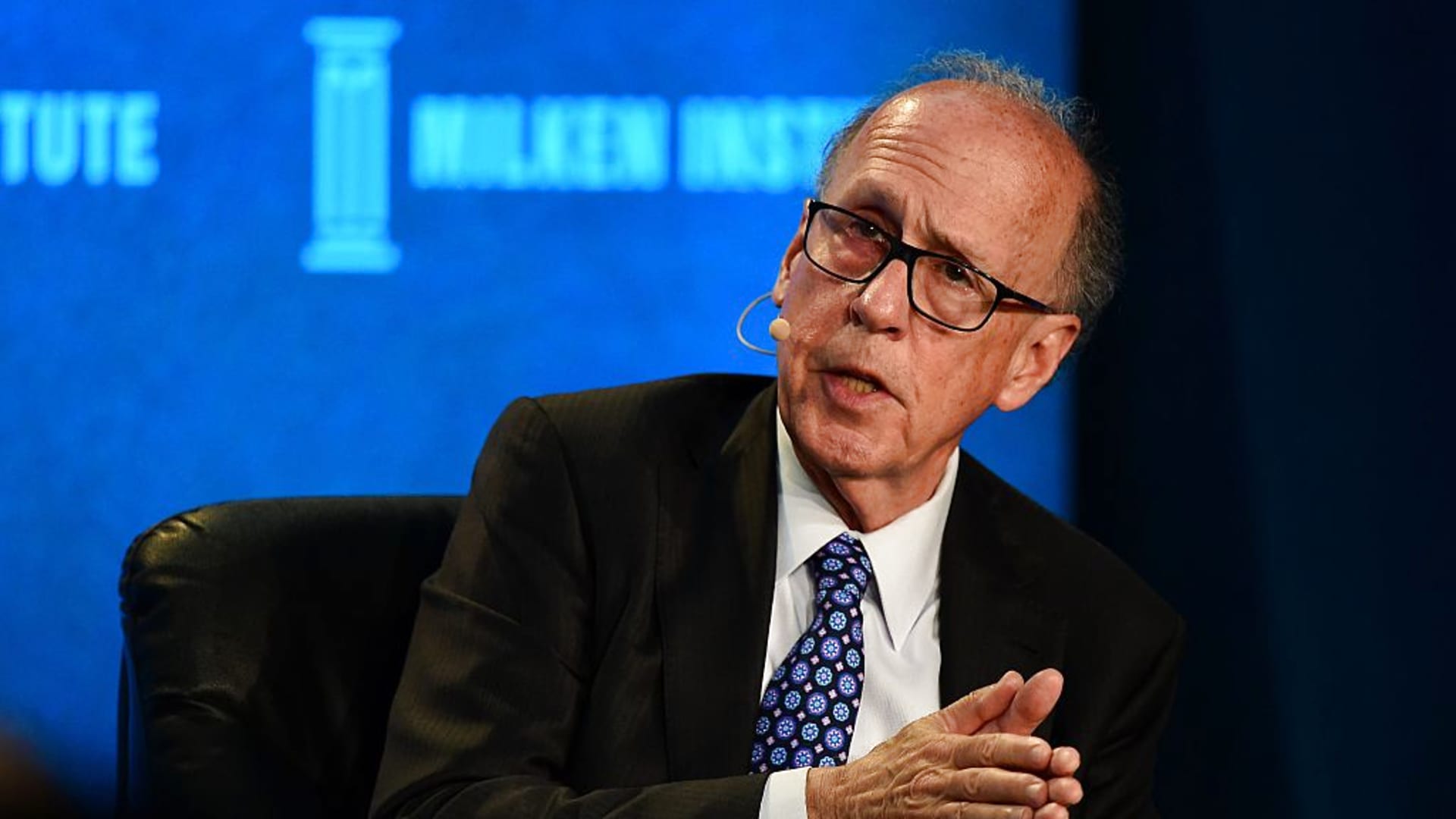

Stephen Roach, who served as chair of Morgan Stanley Asia, warns the U.S. wants a “miracle” to keep away from a recession.

“We’ll positively have a recession because the lagged impacts of this main financial tightening begin to kick in,” Roach instructed CNBC’s “Quick Cash” on Monday. “They have not kicked in in any respect proper now.”

Roach, a Yale College senior fellow and former Federal Reserve economist, suggests Fed Chair Jerome Powell has no alternative however to take a Paul Volcker strategy to tightening. Within the early 1980’s, Volcker aggressively hiked rates of interest to tame runaway inflation.

“Return to the kind of ache Paul Volcker needed to impose on the U.S. economic system to ring out inflation. He needed to take the unemployment fee above 10%,” mentioned Roach. “The one method we’re not going to get there’s if the Fed beneath Jerome Powell sticks to his phrase, stays targeted on self-discipline, and will get that actual Federal funds fee into the restrictive zone. And, the restrictive zone is an extended methods away from the place we’re proper now.”

Regardless of the Fed’s sharp rate of interest hike trajectory, the unemployment fee is at 3.5%. It matches the bottom degree since 1969. That would change on Friday when the Bureau of Labor Statistics releases its August report. Roach predicts the speed is certain to start out climbing.

“The truth that it hasn’t occurred and the Fed has achieved a big financial tightening thus far exhibits you the way a lot work they must do,” he famous. “The unemployment fee has received to go in all probability above 5%, hopefully not an entire lot greater than that. However it may go to six%.”

The final word tipping level could also be shoppers. Roach speculates they are going to quickly capitulate on account of persistent inflation. As soon as they do, he predicts the pullback in spending will reverberate by means of the broader economic system and create ache within the labor market.

“We’ll must have a cumulative drop within the economic system [GDP] someplace of round 1.5% to 2%. And, the unemployment fee goes to must go up by 1 to 2 proportion factors in a minimal,” mentioned Roach. “That may be a backyard selection recession.”

‘Chilly struggle’ with China

The prognosis overseas is not significantly better.

He expects the worldwide economic system can even sink right into a recession. He doubts China’s financial exercise will cushion the affect, citing the nation’s zero-Covid coverage, severe provide chain backlogs and tensions with the West.

Roach is especially fearful in regards to the U.S. and China relationship, which he writes about in his new ebook “Unintended Battle: America, China and the Conflict of False Narratives” due out in November.

“Within the final 5 years, we have gone from a commerce struggle to a tech struggle to now a chilly struggle,” Roach mentioned. “While you’re on this trajectory of esclating battle as we’ve got been, it does not take a lot of spark to show it into one thing much more extreme.”

Disclaimer