MicroStockHub

Government Abstract

Just a few market occasions in an investor’s profession actually matter, and among the many most vital of all are superbubbles. 1 These superbubbles are occasions not like any others: whereas there are only some in historical past for buyers to check, they’ve clear options in frequent.

A kind of options is the bear market rally after the preliminary derating stage of the decline however earlier than the economic system has clearly begun to deteriorate, because it at all times has when superbubbles burst.

This in all three earlier instances recovered over half the market’s preliminary losses, luring unwary buyers again simply in time for the market to show down once more, solely extra viciously, and the economic system to weaken. This summer time’s rally has up to now completely match the sample.

The U.S. inventory market stays very costly and a rise in inflation just like the one this yr has at all times damage multiples, though extra slowly than regular this time. However now the basics have additionally began to deteriorate enormously and surprisingly: between COVID in China, struggle in Europe, meals and vitality crises, report fiscal tightening, and extra, the outlook is way grimmer than might have been foreseen in January. Long term, a broad and everlasting meals and useful resource scarcity is threatening, all made worse by accelerating local weather harm.

The present superbubble options an unprecedentedly harmful mixture of cross-asset overvaluation (with bonds, housing, and shares all critically overpriced and now quickly dropping momentum), commodity shock, and Fed hawkishness. Every cycle is totally different and distinctive – however each historic parallel means that the worst is but to return.

The Occasions that Actually Matter for Buyers

More often than not (85% or thereabouts) markets behave fairly usually. In these intervals, buyers (managers, purchasers, and people) are completely satisfied sufficient, however alas these intervals don’t actually matter.

It is just the opposite 15% of the time that issues, when buyers get carried away and change into irrational. Principally (about 12% of the time 2 ), this irrationality is extreme optimism, once you see meme inventory squeezes and IPO frenzies, comparable to within the final 2 years; and simply every now and then (about 3% of the time), buyers panic and promote no matter worth, as they did at 666 on the S&P in 2009 and with many shares buying and selling at a 2.5 P/E in 1974.

These occasions of euphoria and panic are a very powerful for portfolios and probably the most harmful for careers. (Keynes’ well-known Chapter 12 would recommend that when confronted with a bubble, operating off the cliff with firm is the most secure technique for managers, whose enterprise crucial, in any case, is to be a permabull, the place the true cash could be made. This can be a technique adopted fairly sufficient by nearly everybody.3)

This 15% may be very totally different from extraordinary bull and bear markets. Averaging extraordinary bull and bear markets with this handful of outliers dilutes the information and produces deceptive indicators. My robust suggestion is to deal with the superbubbles – 2.5 to three sigma occasions – as particular, collectively distinctive events.

It’s as if there’s a section change in investor habits. After an extended financial upswing and an extended bull market, when the monetary and financial programs look almost good, particularly with low inflation and excessive revenue margins, as does the friendliness of the authorities, particularly towards low cost leverage, there will get to be a flashpoint, like that summer time night when each final flying ant takes off concurrently.

This impact fortunately creates measurable occasions available in the market. So you possibly can see the explosion of confidence and hypothesis and loopy wishful considering no matter worth nevertheless you want to outline it.

And outcomes from this distinctive group of superbubbles (simply three in trendy occasions within the U.S. earlier than this present one) are certainly particular: the a lot mentioned (by us) divergence between conservative and speculative shares; the speedy bear market rallies mentioned later right here; the speedy onset of recession (3 out of three incidents to this point, with 1 gentle – 2000 – and the opposite 2 – 1929 and 1972 – extreme); and eventually, the a lot elevated possibilities of additional sudden monetary and financial accidents.

We’ve been in such a interval, a real superbubble, for a short while now. And the very first thing to recollect right here is that these superbubbles, in addition to extraordinary 2 sigma bubbles, have at all times – in developed fairness markets – damaged again to development. The upper they go, subsequently, the additional they must fall.

The Phases of a Superbubble

My idea is that the breaking of those superbubbles takes a number of phases. First, the bubble kinds; second, a setback happens, because it simply did within the first half of this yr, when some wrinkle within the financial or political atmosphere causes buyers to comprehend that perfection will, in any case, not final endlessly, and valuations take a half-step again. Then there may be what now we have simply seen – the bear market rally. Fourth and eventually, fundamentals deteriorate and the market declines to a low.

Let’s return to the place we’re on this course of at this time. Bear market rallies in superbubbles are simpler and sooner than another rallies. Buyers surmise, this inventory bought for $100 6 months in the past, so now at $50, or $60, or $70, it should be low cost.

Exterior of the late stage of a superbubble, new highs are gradual and nervous as buyers understand that nobody has ever purchased this inventory at this worth earlier than: so it’s 4 steps ahead, three steps again, gingerly exploring terra incognita. Bear market rallies are the alternative: it bought at $100 earlier than, perhaps it might promote at $100 once more.

The proof of the pudding is the pace and scale of those bear market rallies.

- From the November low in 1929 to the April 1930 excessive, the market rallied 46% – a 55% restoration of the loss from the height.

- In 1973, the summer time rally after the preliminary decline recovered 59% of the S&P 500’s whole loss from the excessive.

- In 2000, the NASDAQ (which had been the primary occasion of the tech bubble) recovered 60% of its preliminary losses in simply 2 months.

- In 2022, on the intraday peak on August sixteenth, the S&P had made again 58% of its losses since its June low. Thus lets say the present occasion, up to now, is trying eerily just like these different historic superbubbles.

Fundamentals Threaten to Fall Aside

Financial knowledge inevitably lags main turning factors within the economic system. To make issues worse, on the flip of occasions like 2000 and 2007, knowledge collection like company income and employment can subsequently be massively revised downwards. It’s throughout this lag that the bear market rally usually happens.

Why are the historic superbubbles at all times adopted by main financial setbacks? Maybe as a result of they occurred after a really prolonged build-up of market and financial forces – with a serious surge of optimism thrown in on the finish.

On the peak, the economic system at all times seems to be close to good: full employment, robust GDP, no inflation, report margins. This was the case in 1929, 1972, 1999, and in Japan (a very powerful non-U.S. superbubble). The ageing cycle and momentary close to perfection of fundamentals go away financial and monetary knowledge with just one technique to go.

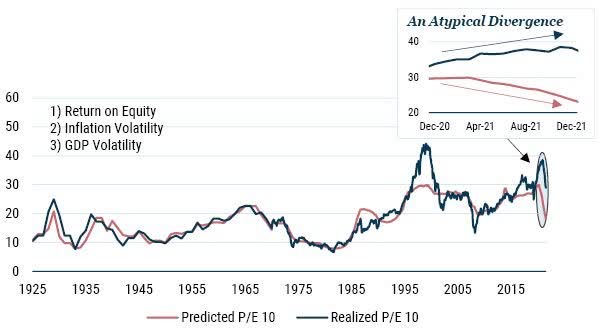

Our “Explaining P/E” 4 exhibit says one thing related. The primary leg down in at this time’s superbubble was “defined” by rising inflation, which has been the primary driver of historic valuations, after an unprecedented lag through the second half of 2021. (Though probably the most speculative shares had been hit quick and exhausting from the start of 2021.)

If something, the query for us at GMO is why such a historic inflation surge in 2021 didn’t instantly hit broad market P/Es extra considerably: new gamers within the inventory market unfamiliar with inflation? Extreme perception within the Fed’s skill to help markets and therefore an excessive amount of religion that inflation can be transitory? The subsequent leg for the mannequin is more likely to be pushed by falling margins.

Our greatest guess is that the extent of defined P/E will fall towards 15x, in comparison with the present degree of defined P/E of just below 20x, whereas the precise P/E simply rose from 30x to 34x in mid-August in what was most likely a bear market rally. (In fact, if the mannequin is certainly pushed by falling margins within the close to future, then the E will fall in addition to the P/E. As you possibly can see, this could indicate a considerably decrease market than even now we have instructed!)

GMO “Explaining P/E” Mannequin

As of seven/20/2022 | Supply: GMO

My papers, “Ready for the Final Dance” and “Let The Wild Rumpus Start,” made a easy level: within the U.S., the three close to good markets with loopy investor habits and a couple of.5+ sigma overvaluation have at all times been adopted by huge market declines of fifty%.

The papers stated nothing about fundamentals besides to count on some deterioration. Now right here we’re, having skilled the primary leg down of the bubble bursting and a considerable bear market rally, and we discover the basics are far worse than anticipated.

The entire world is now fixated on the growth-reducing implications of inflation, charges, and wartime points such because the vitality squeeze. As well as, there are a number of much less apparent short-term issues. In the meantime, the long-term issues of demographics, assets, and local weather are solely getting worse and now are starting to chunk even within the quick run.

Close to-term issues

- The meals/vitality/fertilizer issues, exacerbated by the struggle in Ukraine, are even worse within the rising world (particularly Africa) than the European vitality issues now we have heard about. Russia and Belarus account for 40% of world exports of potash, a key fertilizer, driving wheat/corn/soybean costs to information earlier this yr. Elevated meals and vitality costs are inflicting acute commerce imbalances and civil dysfunction in probably the most susceptible international locations, as seen for instance within the extraordinarily speedy digital collapse of the Sri Lankan economic system. The vitality shock is now all however assured to tip Europe into recession; whereas the U.S. market has an extended historical past of ignoring overseas issues and interactions, international development is assuredly coming down.

- In China, which has carried by far the most important load of world development for the final 30 years, too many issues are going incorrect on the similar time. The COVID pandemic continues, massively affecting its economic system. Concurrently, the Chinese language property advanced – key to Chinese language financial development – is now underneath dire stress. This actual property weak spot is mirrored world wide, with U.S. homebuilding for instance now declining quickly to nicely under common ranges, as maybe it ought to given the report unaffordability of recent mortgages. The state of affairs seems to be even worse in these international locations the place mortgages are usually floating charge. Traditionally, actual property has been a very powerful asset class for financial stability.

- We’re coming off one of many biggest fiscal tightenings in historical past as governments withdraw COVID stimulus, each within the U.S. and globally. Traditionally, there was a powerful relationship between fiscal tightening and subsequent decline in margins (see Appendix). On the similar time, the brand new U.S. excise tax on inventory buybacks seems to be like a harbinger that the U.S. authorities is starting to shift its angle towards the everlasting battle between labor and capital (which capital has been profitable for a lot of a long time now). This may occasionally even stream via in time to renewed antitrust motion, which might be improbable for customers however much less improbable for inventory buyers.

Longer-term issues

- Inhabitants: staff are starting to be briefly provide and can keep that method for the indefinite future in China and the developed world, the place no single nation is producing infants at alternative charge. 5 Along with speedy ageing, this will likely be a drag on development and a push on inflation. Assets: many metals, particularly these required for decarbonizing, are in an unavoidable squeeze, missing adequate reserves – which presently are a mere 5-20% of what’s wanted 6 – and capex is woefully low. It merely doesn’t compute, and it makes clear that our existence in any faintly passable situation will rely on our sustained success with alternative, recycling, and new applied sciences. A second important useful resource scarcity is fertilizer. Potash and phosphate, each presently mined and each needed for all life, are: a) finite; and b) very erratically distributed: Morocco controls 75% of the world’s greatest phosphate, and Russia and Belarus mine 45% of present potash with much more than that mined in Canada. Meals: with deteriorated and eroded soil, freshwater shortages, and more and more resistant pests, meals productiveness is slowing down whilst African inhabitants development outweighs the slowdown elsewhere. The UN international meals index was not too long ago at an all-time excessive.

- Local weather could be seen this yr as in peril of spiraling uncontrolled. By no means earlier than have main droughts, and dangerously excessive temperatures and fires, beset China, India, Europe, and North America on the similar time. That is extreme sufficient to behave as a drag on international GDP: the Rhine, which strikes almost 20% of German heavy visitors, is closed by drought; French nuclear energy stations have needed to cut back manufacturing as a result of rivers are too scorching for use for cooling; China has needed to halve its hydropower (18% of its electrical energy), which has additionally been diminished in Canada, Norway, India, and elsewhere by low water ranges; rising temperatures in India, Asia, and components of Africa are all of the sudden excessive sufficient to pose well being issues for these with out air-con and out of doors staff, particularly farmers. The collective affect of adverse farming climate is starting to impose its personal international prices and should destabilize a rising variety of poorer international locations within the close to future. It’s all occurring a lot sooner than anybody anticipated 10 years in the past.

- All that’s to say: these long-term destructive points that I’ve stored behind my thoughts (and hopefully yours) for years – local weather, human fertility, meals, and different assets – at the moment are turning into related short-term points that bear on each inflation (upwards) and development (downwards). Certainly, collectively, they pose a possible threat to our long-term viability.

Put together for an Epic Finale

Earlier superbubbles noticed a a lot worse subsequent financial outlook in the event that they mixed a number of asset courses: housing and shares, as in Japan in 1989 or globally in 2006; or in the event that they mixed an inflation surge and charge shock with a inventory bubble, as in 1973 within the U.S. and elsewhere.

The present superbubble options probably the most harmful combine of those components in trendy occasions: all three main asset courses – housing, shares, and bonds – had been critically traditionally overvalued on the finish of final yr.

Now we’re seeing an inflation surge and charge shock as within the early Nineteen Seventies as nicely. And to make issues worse, now we have a commodity and vitality surge (as painfully seen in 1972 and in 2007) and these commodity shocks have at all times solid an extended growth-suppressing shadow.

Given all these destructive components, it’s unsurprising that client and enterprise confidence measures are testing historic lows. And within the tech sector, the forefront of the U.S. (and international) economic system, hiring is slowing, layoffs are rising, and CEOs are more and more bracing for recession.

Lately, now we have seen a bear market rally. It has up to now performed out precisely in keeping with its three historic precedents, the bear market rallies that marked the center section of deflating superbubbles.

If the bear market has already ended, the parallels with the three different U.S. superbubbles – up to now so surprisingly in line – can be fully damaged. That is at all times attainable. Every cycle is totally different, and every authorities response is unpredictable.

However these few epic occasions appear to behave in response to their very personal guidelines, in their very own play, which has apparently simply paused between the third and last act. If historical past repeats, the play will as soon as once more be a Tragedy. We should hope this time for a minor 7 one.

Appendix

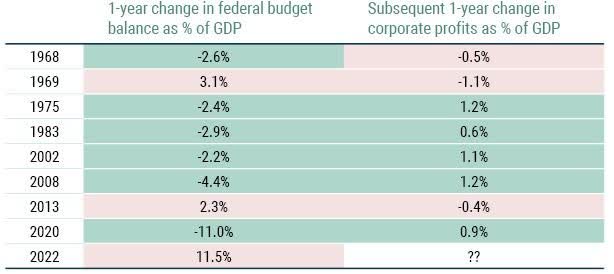

Fundamental accounting – the Kalecki equation – reveals that authorities deficits and company income are on reverse sides of a ledger that sums to zero.

Traditionally, there’s been a strong statistical relationship between adjustments within the authorities deficit and subsequent adjustments in income margins: main will increase in deficits have led to rising revenue margins over the subsequent few years, and main decreases in deficits have led to falling revenue margins.

We’ve simply seen one of many largest decreases within the authorities deficit in historical past. It is extremely more likely to be matched by a subsequent drop in income.

All events since 1960 that the 1-year change within the federal funds steadiness has been higher than 2% of GDP

As of 6/30/2022 | Supply: BEA, GMO

1 Atypical bubbles are, to us, those who attain a 2 sigma deviation from development. Superbubbles attain 2.5 sigma or higher. The true U.S. superbubbles – 2.5+ sigma occasions – are 1929, 2000, and 2021. The honorary member is 1972, the “Nifty Fifty” interval. This final one was an “extraordinary” simply 2-sigma bubble occasion on worth however the market declined 62% in actual phrases after breaking, nonetheless the worst drop since 1929. In some methods, it lacked the loopy hypothesis of the others however precipitated, for the one time ever, the best high quality phase (that dominates the S&P 500) to go to a 50% premium versus the remainder of the market and to be referred to as “one-decision shares” as a result of as soon as purchased they might be held endlessly, as a result of they had been so good – a perception system purchased into by your complete banking institution that also managed all the cash again then. Maybe, in hindsight, to have your complete system purchase into the assumption in one-decision shares – a number of of which went bust within the following 5 years – was simply as loopy as another hypothesis.

2 Our tough estimate of those occasions of utmost bullishness and bearishness since 1925.

3 Nothing annoys the monetary institution greater than bearish feedback throughout these bullish frenzies, when a lot cash is being made by the monetary neighborhood. Thus, following Propaganda 101, this large majority of permabulls accuse the tiny minority making bearish feedback of being permabears. (Luckily – he claims – in my case, my precise Quarterly Letters and different reviews are on file and obtainable; they earned me the epithet of “worth apostate” for my bullish “this time is totally different” argument from Jim Grant in 2017. The information additionally present me making bullish instances in each March 2009 in Reinvesting When Terrified and January 2018 in Bracing Your self for a Potential Close to-Time period Soften-Up, in addition to arguing in opposition to the existence of a market bubble in 2016 with Edward Chancellor, no much less, the bubble skilled – creator of Satan Take The Hindmost and The Value Of Time.) Permabulls use the method of 100% invested always and detest adjustments in publicity, as if the market had been environment friendly and weren’t 17 occasions extra risky in worth than is justified by the precise progress of earnings and dividends as proved by Shiller. For those who can imagine it, you possibly can nonetheless learn justifications of 1929 as fairly priced and the 87 crash as an inexpensive response to vary.

4 This mannequin doesn’t try to justify market costs in any method. It merely reveals these monetary inputs which have prior to now statistically defined contemporaneous P/E multiples.

5 Besides Israel.

6 It’s Time to Wake Up – The At present Identified World Mineral Reserves Will Not Be Enough to Provide Sufficient Metals to Manufacture the Deliberate Non-fossil Gas Industrial Techniques | GTK

7 2000 was minor, 1972 main, and 1929, in fact, horrific.

Disclaimer: The views expressed are the views of Jeremy Grantham via the interval ending August 31, 2022, and are topic to vary at any time based mostly on market and different circumstances. This isn’t a proposal or solicitation for the acquisition or sale of any safety and shouldn’t be construed as such. References to particular securities and issuers are for illustrative functions solely and are usually not meant to be, and shouldn’t be interpreted as suggestions to buy or promote such securities.

Copyright © 2022 by GMO LLC. All rights reserved.

Authentic Put up

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.