[ad_1]

This text is a part of the Gong Labs collection, the place we publish findings from our information analysis workforce. We analyze gross sales conversations and offers utilizing the Gong Actuality Platform’s proprietary AI, then share the outcomes that can assist you win extra offers. Subscribe right here to learn upcoming analysis.

“Look, I’ve bought dangerous information…”

“It’s bought nothing to do with you as a rep, your product, or something like that. It’s COVID, its influence on our pipeline and finances, and we needed to make a fast choice on the place to make a lower proper now.”

The rep seemed surprised.

After a profitable pilot, the inexperienced mild from his purchaser’s finance workforce, he was getting “damaged up” with. It was March twenty fifth, 2020, barely one week after shelter-in-place orders have been put in place and he hadn’t absolutely acknowledged the influence the financial uncertainty of the pandemic would have on his deal.

His enablement workforce had put collectively a COVID-19 discuss monitor to deal with this objection, however he was too late. After doing every thing proper, components outdoors of his management finally misplaced him the deal proper because it was crossing the end line.

True story.

If solely he noticed it coming.

At the moment, we discover ourselves in a time of continued uncertainty. You see it within the information every day. Headlines addressing provide chain points, political turmoil, layoffs, rising inflation, and rates of interest.

Whether or not you’re a gross sales chief driving GTM technique or an SDR prospecting, what does it really imply?

What influence is the financial system having on prospects? Your present clients?

Happily, we’ve bought some solutions.

We analyzed over 486,600 gross sales calls to know how prevalent macroeconomic components have been in latest conversations and the influence they’ve on offers. Use these insights to regulate your promoting technique and switch challenges and obstacles into closed-won alternatives.

To run this evaluation we used Financial Pulse, new performance inside Gong’s Actuality Platform that identifies, tracks, and alerts income groups when financial triggers are talked about in buyer conversations.

Financial Pulse detects widespread references associated to financial uncertainty. (Consider phrases like: “modifications in market circumstances, value will increase, loopy market, till issues are again to regular, inflation, and so forth.”)

Right here’s what we discovered…

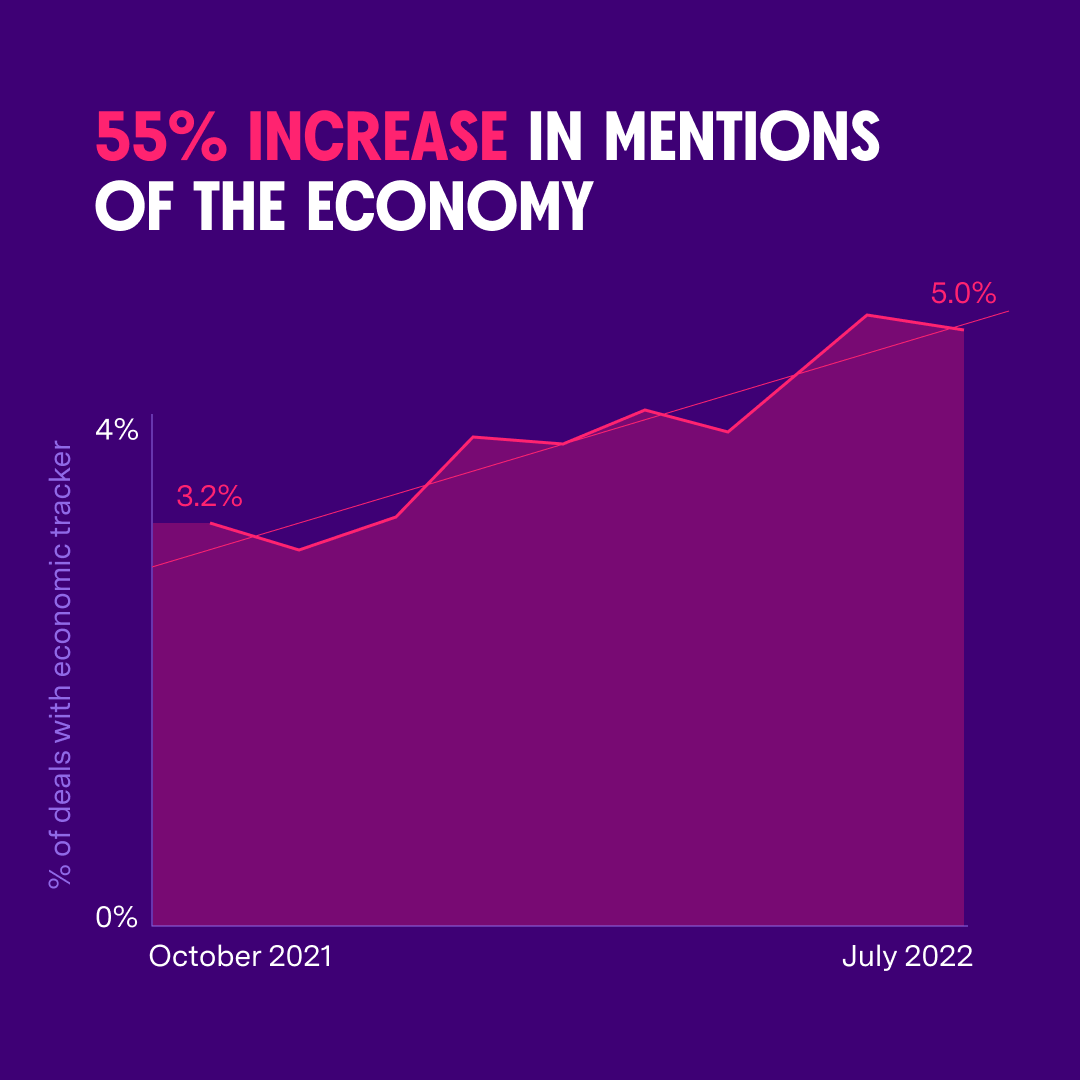

CUSTOMER MENTIONS OF MACROECONOMIC FACTORS HAVE INCREASED 55% IN ACTIVE DEALS

Mentions of the macroeconomic surroundings have elevated considerably: 55% in energetic offers since October 2021. Which means you’re not alone whenever you hear these objections in your gross sales cycles.

Even with this improve, solely 5% of energetic offers have been impacted. Of the industries and shopping for facilities you’re promoting into, lots of your clients could not but be feeling the strain of an unsure financial local weather.

So what determines the chance of macroeconomic components being talked about?

Who you’re speaking to.

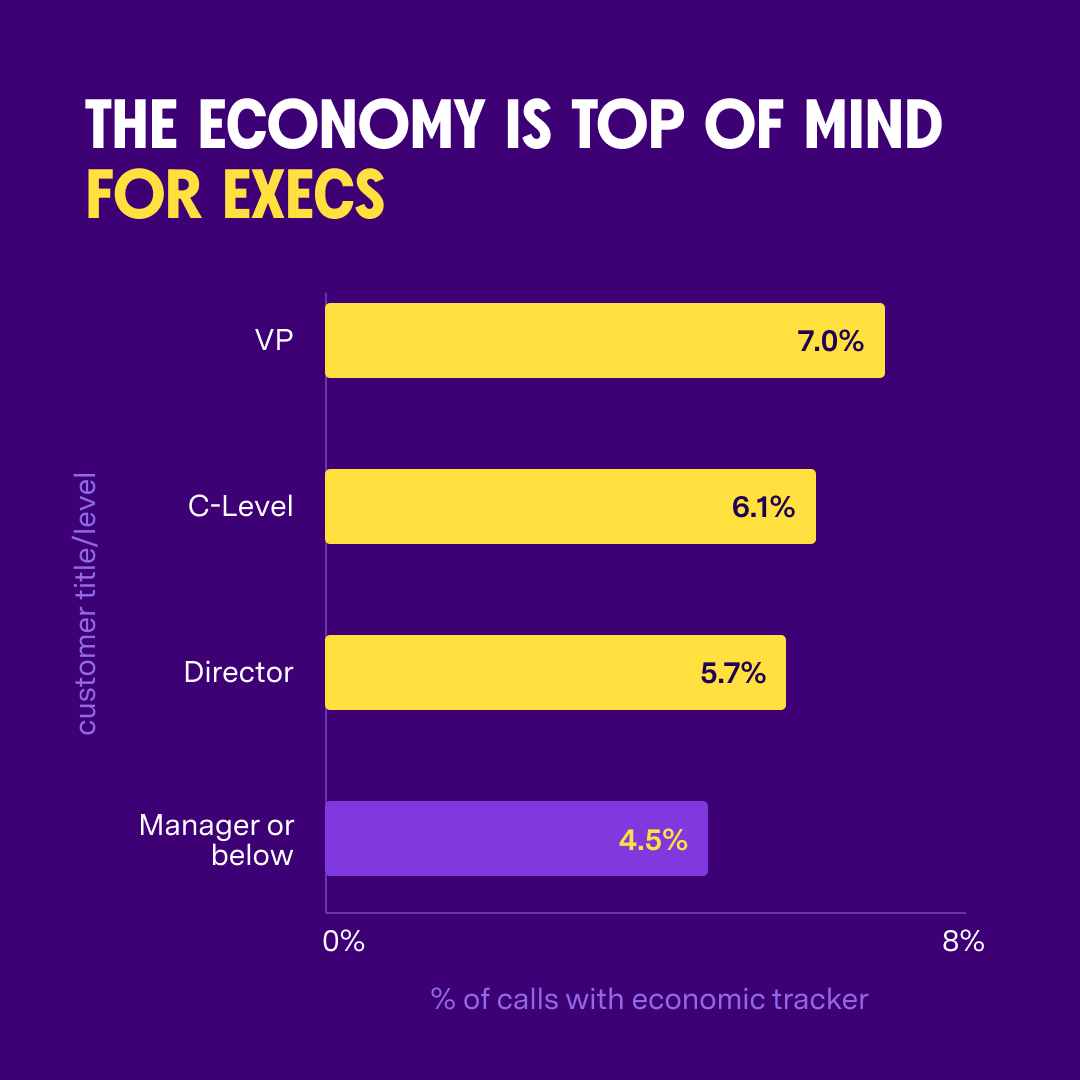

THE MORE SENIOR THE CONTACT AT THE ACCOUNT, THE MORE LIKELY THEY ARE TO BRING UP THE IMPACT THE ECONOMY HAS ON THEIR BUSINESS

This makes whole sense.

When promoting to higher-level execs be ready to deal with objections pertaining to reducing prices or shrinking budgets to climate financial uncertainty.

Be sincere with your self.

- Have you ever clearly positioned your self as a associate to assist clients thrive via turbulent occasions?

- What’s the value in the event that they follow the established order?

Should you’re unable to reply these questions, analysis how your buyer’s industries are being impacted and tailor talk-tracks and messaging to proactively tackle their probably issues. Not solely will this present an intimate information of their enterprise, however can really show you how to body the dialog.

As new spend is put beneath extra scrutiny, CFOs can be concerned in additional of your offers. It’s necessary that you just and your champion use phrases and language that can resonate when making their enterprise case to finance.

Right here’s a ready-to-use template you may leverage with clients to win over their CFO and get your deal inked.

Talking of shoppers…

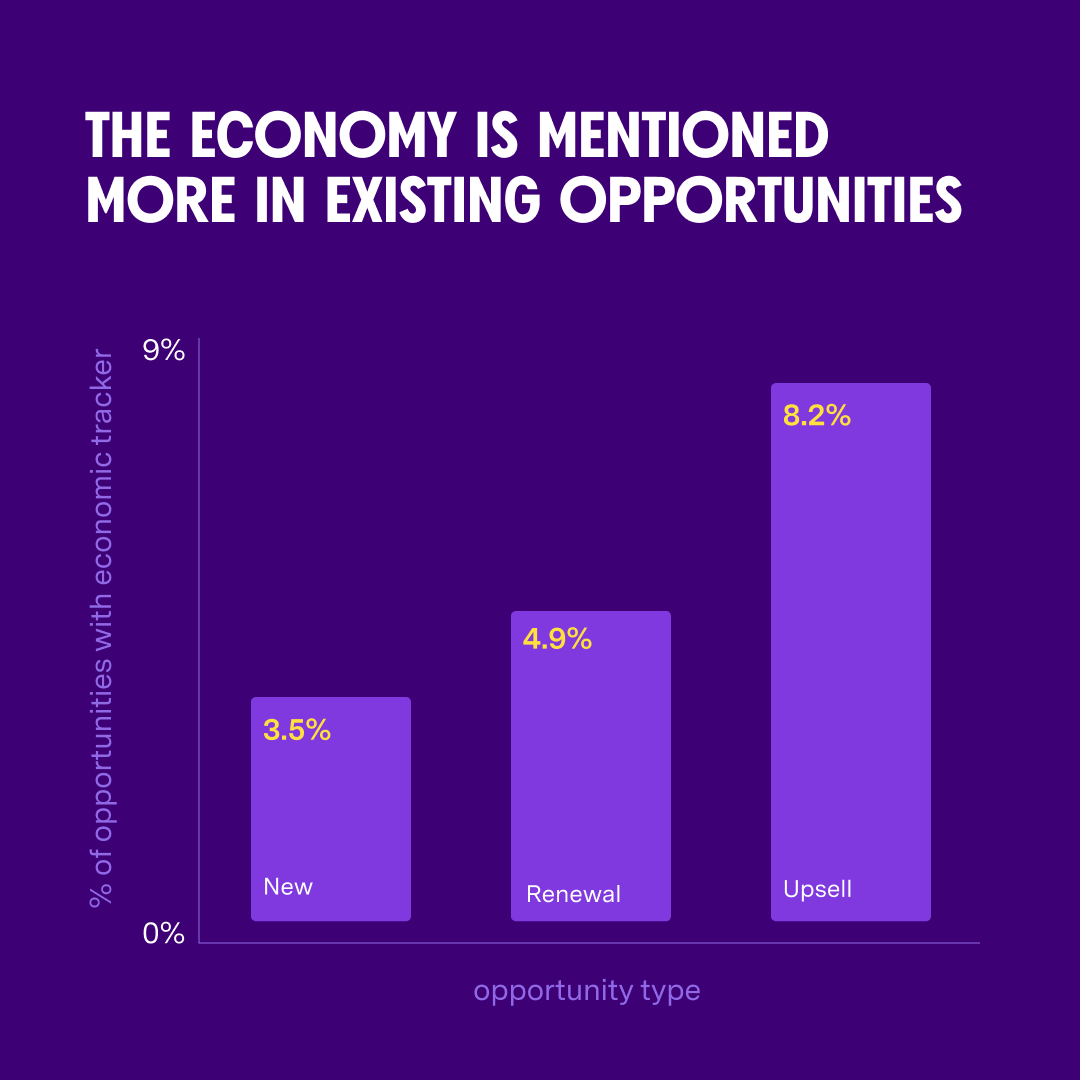

RENEWALS AND UPSELLS ARE IMPACTED THE MOST BY ECONOMIC MENTIONS

Preserving current clients is normally simpler and less expensive than buying new ones. However when confronted with financial headwinds, the stakes are raised even greater. Rising churn charges have critical penalties in your group’s progress objectives.

Trying on the information, the financial pulse tracker popped up extra steadily in renewal and upsell conversations inside current accounts.

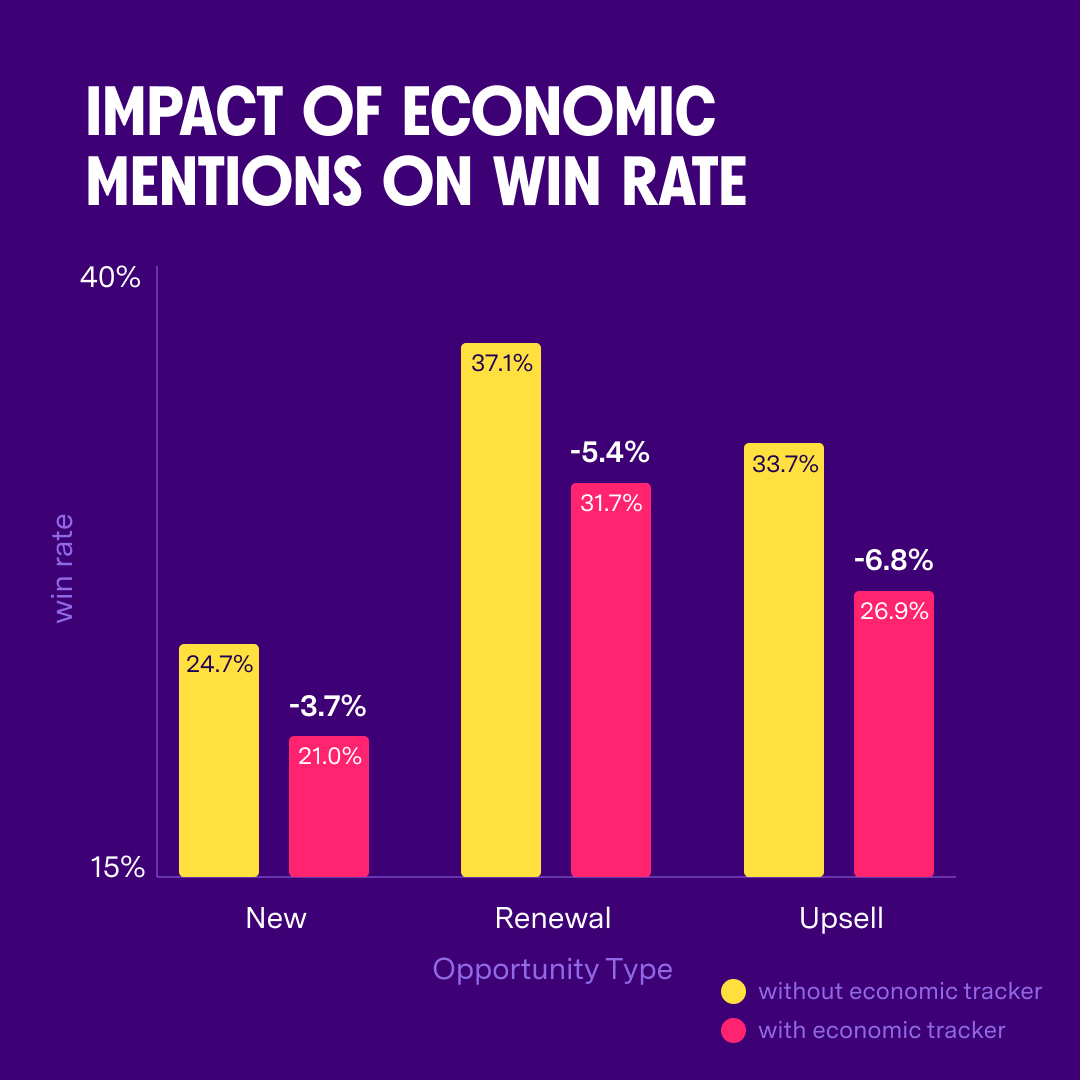

Not solely was the tracker extra prevalent in a lot of these alternatives, however we additionally noticed the most important affect on their win charges when the present state of the financial system was talked about.

The influence?

A lower in upsell win price by practically 7 share factors.

To extend retention of worthwhile clients when budgets tighten due to financial uncertainty, proactively tackle challenges throughout your QBRs and even replace phrases to higher profit the client.

Should you’re a income chief, discover this and extra tricks to adapt and win in Gong’s Financial Downturn Guidelines.

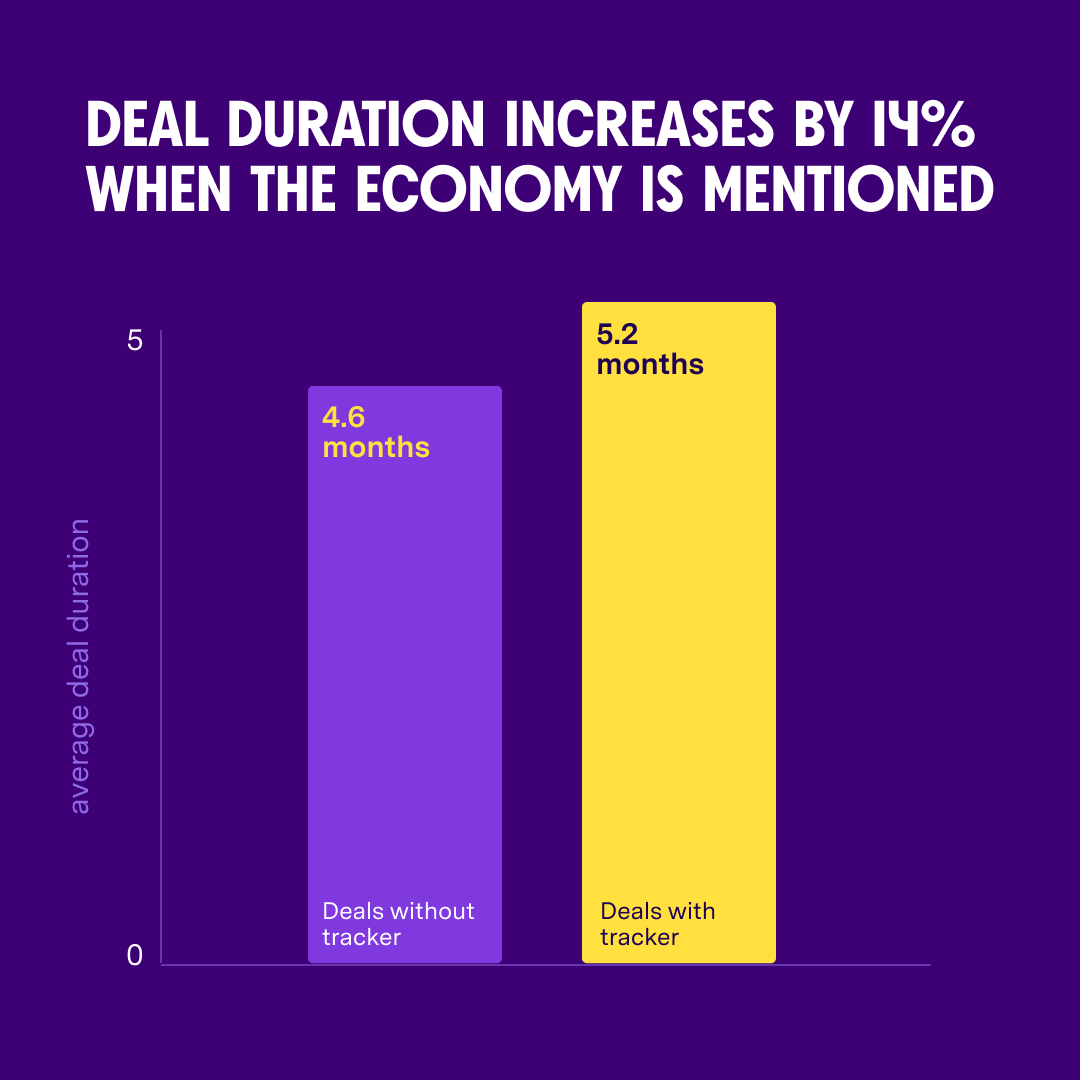

WHEN MARKET CONDITIONS ARE TOP OF MIND FOR CUSTOMERS YOUR SALES CYCLE LENGTH INCREASES

Whereas most steadily introduced up throughout prequalification, we discovered that mentions of the financial system really happen extra steadily after contracts are despatched. Nevertheless, the influence to win price is much less extreme.

When wanting into the context of those mentions, many purchasers leverage the financial surroundings throughout pricing negotiations. (Typical!) This backwards and forwards can extend gross sales cycles, as we see a rise in total deal period by a mean of 14% when market circumstances are talked about.

Along with taking longer to shut, offers recognized by the financial pulse tracker have been twice as prone to lower in greenback quantity.

Time kills offers. Don’t let the added strain of an unsure market make issues worse. When you get your “sure,” set clear expectations at the start of the contract course of and confidently ship throughout paperwork with agency deadlines.

CHANGE IS HERE, BUT YOU’RE READY FOR IT

Unpredictable market circumstances will be scary, however by creating a deep understanding of the way it impacts your prospects, clients, and offers will let you proceed to thrive.

We’ve bought your again.

We’ve put collectively a guidelines for income leaders with 9 inquiries to ask as we speak to take a proactive strategy to thrive via change.

[ad_2]

Source link