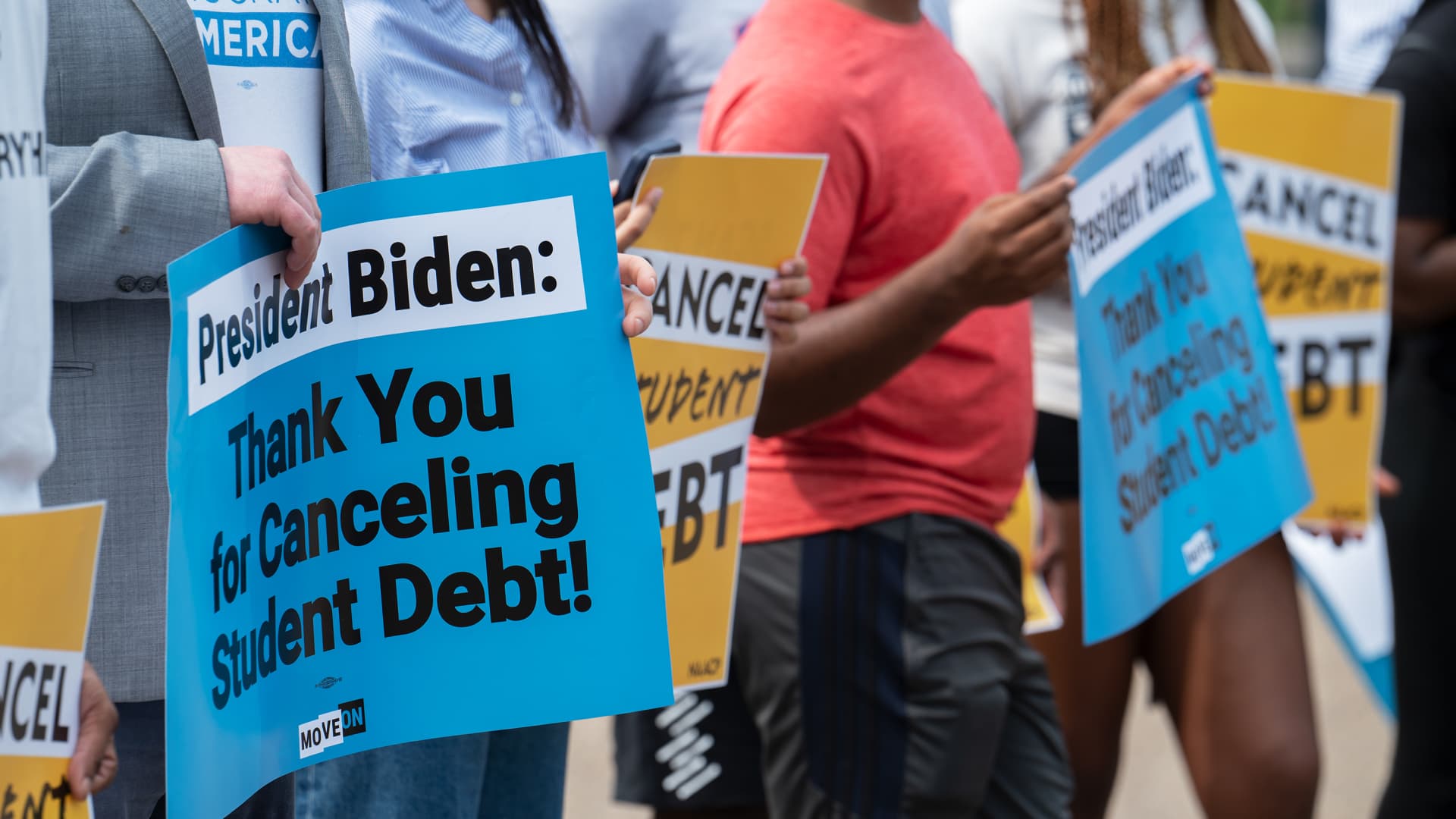

Scholar-loan debt activists rally exterior the White Home a day after President Biden introduced a plan that may cancel $10,000 in scholar mortgage debt for these making lower than $125,000 a yr in Washington, D.C., on Aug. 25, 2022.

The Washington Publish | The Washington Publish | Getty Photographs

Federal scholar mortgage debtors might stand up to $10,000 in debt reduction — or $20,000 if they’ve Pell Grants — underneath President Joe Biden’s new plan.

Nonetheless, critics say taxpayers will in the end decide up the tab, which estimates peg at a whole bunch of billions of {dollars}.

That might end in a mean burden of $2,500 per taxpayer, based on calculations from the Nationwide Taxpayers Union, a fiscally conservative advocacy group.

“There is a switch of wealth from the society at giant to individuals who borrowed to go to school proper now,” stated Andrew Lautz, director of federal coverage on the Nationwide Taxpayers Union.

Extra from Private Finance:

Biden cancels $10,000 in federal scholar mortgage debt for many

Biden’s forgiveness plan: The way it works, when to use

Timeline: Key occasions on the trail to scholar mortgage forgiveness

Scholar mortgage pay pause prolonged via December

What President Biden’s scholar mortgage forgiveness means for taxes

Lawmakers, client teams push again on forgiveness

“That has penalties for shoppers,” Lautz stated. “It has penalties for taxpayers.”

The common burden per U.S. taxpayer might be $2,503.22, based on new estimates from the Nationwide Taxpayers Union based mostly on the specifics of Biden’s plan. The federal scholar mortgage debt forgiveness applies to people with lower than $125,000 in earnings and {couples} with lower than $250,000.

This doesn’t imply taxpayers will instantly face $2,500 in greater taxes.

However the $400 billion-plus price of Biden’s scholar mortgage forgiveness plan will incur extra debt for the federal government. The estimated price per taxpayer relies on the belief that policymakers would want to make up for the full tally of the forgiveness via tax will increase, spending cuts, borrowing or a mix of these methods.

The Nationwide Taxpayers Union’s calculation relies on a complete price of debt cancellation of greater than $400 billion divided by the full variety of U.S. taxpayers, 158 million.

Notably, the prices wouldn’t be unfold evenly throughout the earnings spectrum, based on the Nationwide Taxpayers Union’s estimates.

Low-income taxpayers, incomes lower than $50,000, would have a mean further price per taxpayer of $190. That might enhance to about $1,040 for these with adjusted gross incomes between $50,000 and $75,000; $1,774 for these between $75,000 and $100,000; and $3,791 for incomes of $100,000 to $200,000.

Taxpayers who make between $200,000 and $500,000 would have a mean further price of $11,940.

‘Shifting one type of borrowing to a different’

Canceling scholar debt will enhance near-term inflation greater than the Inflation Discount Act that was not too long ago enacted would scale back it, the Committee for a Accountable Federal Finances present in a current evaluation. Furthermore, it discovered that canceling scholar debt would additionally undermine the deficit reductions in that legislation not too long ago handed by Democrats.

Whereas the transfer will erase debt for tens of millions of scholar mortgage debtors, it additionally means the federal government will borrow on their behalf to pay for it.

The Committee for a Accountable Federal Finances estimates Biden’s broad debt cancellation will price between $330 billion and $390 billion. The general plan will price between $440 billion and $600 billion over the following 10 years, based on the nonpartisan group, with a central estimate of roughly $500 billion.

“This isn’t paid for,” stated Maya MacGuineas, president of the Committee for a Accountable Federal Finances. “That is simply shifting one type of borrowing to a different.”

The Penn Wharton Finances Mannequin now estimates debt cancellation alone will price as much as $519 billion. Mortgage forbearance will price one other $16 billion, the analysis discovered, whereas the brand new income-driven compensation might price $70 billion.

About 75% of the scholar mortgage debt cancellation will profit households incomes $88,000 or much less per yr, based on the Penn Wharton Finances Mannequin.

The Congressional Finances Workplace has but to guage the full price of the coverage.

Each Lautz and MacGuineas stated Biden’s forgiveness plan fails to get at the foundation trigger of why scholar debtors wind up with such big debt burdens within the first place.

“Greater schooling is without doubt one of the most troublesome, thorny issues that you actually need to get into how universities and graduate colleges are financed and what sorts of modifications would make it extra inexpensive,” MacGuineas stated. “This accomplishes none of that.”