Sebastian Rothe / Eyeem | Eyeem | Getty Photos

Households might quickly be capable to declare 1000’s of {dollars} in tax breaks and rebates in the event that they take steps to cut back their carbon footprint.

However eco-friendly customers should wait till 2023 — even perhaps 2024 or later — to see lots of these monetary advantages.

The Inflation Discount Act, which President Joe Biden signed into legislation on Aug. 16, represents the most important federal funding to combat local weather change in U.S. historical past. Amongst different measures, the legislation gives monetary incentives to customers who purchase high-efficiency home equipment, buy electrical automobiles or set up rooftop photo voltaic panels, for instance.

These incentives and numerous qualification necessities kick in in accordance with totally different timelines. This is when customers can anticipate to see them and determine when to make a purchase order.

When to get tax breaks for brand new, used electrical autos

Tomekbudujedomek | Second | Getty Photos

There are numerous shifting items tied to incentives for brand new and used electrical autos — and every might affect when a client chooses to purchase.

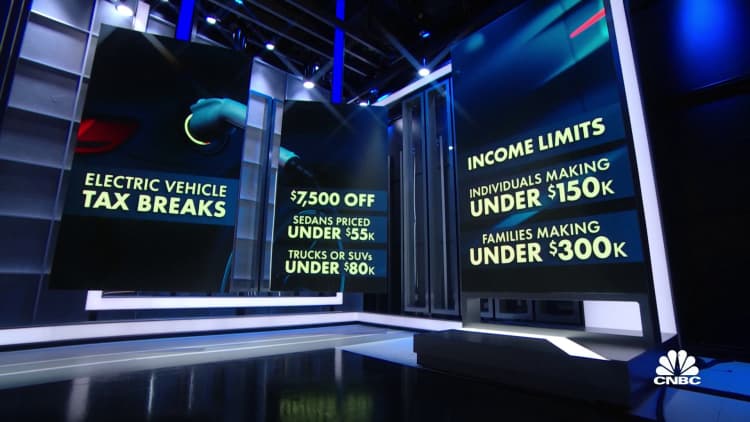

Shoppers who purchase a brand new electrical car can get a tax credit score value as much as $7,500. Used autos qualify for as much as $4,000. Every credit score comes with numerous necessities tied to the patron and car, reminiscent of family earnings and gross sales value.

Shoppers might also be eligible for added electric-vehicle incentives from state and native governments or utility suppliers, per guidelines already on the books.

The timing for used autos is comparatively easy: Purchases qualify for the brand new federal tax break beginning in 2023. This “credit score for previously-owned clear autos” is out there to the tip of 2032. Nonetheless, customers out there for a used car might want to wait till 2024 or later (extra on that in a bit).

Extra from Private Finance:

What you possibly can anticipate from Labor Day weekend automobile purchasing

Id scams are at an all-time excessive

48 million households can get free or low cost high-speed web

Timing for brand new autos is extra complicated. There are three timeframes value contemplating, every with their very own advantages and disadvantages: purchases in 2022, 2023 and 2024 onward, in accordance with Joel Levin, government director of Plug In America.

There was a tax break for brand new electrical autos already on the books — additionally value as much as $7,500. However the Inflation Discount Act tweaked some guidelines that will restrict who qualifies within the close to time period.

One rule took impact when Biden signed the legislation Aug. 16. It stipulates that remaining meeting of the brand new automobile should happen in North America.

Advantages and disadvantages of shopping for in 2022 or 2023

Maskot | Maskot | Getty Photos

Two different guidelines take impact in 2023. One carries necessities for sourcing of the automobile battery’s vital minerals; the second requires a share of battery elements be manufactured and assembled in North America. Shoppers lose half the tax credit score’s worth — as much as $3,750 — if a kind of necessities is not met; they’d lose the total $7,500 for failing to fulfill each.

Moreover, customers’ family earnings and a car’s retail value should fall beneath sure thresholds beginning in 2023 to qualify for a tax break.

Shoppers who purchase in 2022 can keep away from these necessities; nonetheless, they might nonetheless be topic to the North American final-assembly guidelines that took impact in August. The IRS and U.S. Division of Power have suggestions to assist customers decide which automobile fashions qualify.

Many new electrical autos is probably not instantly eligible for the tax break in 2023 as firms work to fulfill new manufacturing guidelines, in accordance with consultants.

“If you’d like an EV, go purchase an EV, [but] to attend 4 months for the credit score is dangerous,” Levin mentioned. “There’s lots of uncertainty what might be accessible Jan. 1.”

One potential upside to ready till 2023 or later: Purchases of Common Motors and Tesla automobile fashions can be eligible. They don’t seem to be eligible in 2022 attributable to current restrictions on the tax credit score that can expire subsequent 12 months.

“If you happen to’re these two and are actually involved about getting a [tax] credit score, you need to wait,” Levin mentioned. In fact, customers would want to fulfill earnings and sales-price guidelines at that time.

Shoppers who purchase qualifying automobiles in 2022 or 2023 would solely get the tax credit score after they file their tax returns — after which provided that they’ve a tax legal responsibility. Meaning customers might wait a number of months to a 12 months for his or her profit, relying on buy timing.

“In case your tax legal responsibility is $5,000, you should use $5,000 of the credit score — the opposite $2,500 goes poof,” Steven Schmoll, a director at KPMG, mentioned of the new-vehicle credit score.

A extra ‘consumer-friendly’ EV rule in 2024

Maskot | Maskot | Getty Photos

However, beginning in 2024, a brand new mechanism would basically flip the tax break right into a point-of-sale low cost on the value of latest and used electrical autos. Shoppers would not have to attend to file their taxes to reap the monetary profit — the financial savings can be speedy.

“That is actually invaluable, significantly for individuals who do not have some huge cash within the financial institution,” Levin mentioned. “It is a ton extra consumer-friendly.”

This is how the mechanism works: The Inflation Discount Act lets a purchaser switch their tax credit score to a automobile supplier. A supplier — which should register with the U.S. Division of the Treasury — would get an advance fee of the patron’s tax credit score from the federal authorities.

In principle, the supplier would then present a dollar-for-dollar break on the automobile value, Levin mentioned. He expects sellers to make use of the funds as a purchaser’s down fee, which would cut back the upfront money obligatory to purchase a automobile. Some negotiating could also be concerned on the patron’s half, he added.

These transfers apply to new and used automobiles bought beginning Jan. 1, 2024.

When to get tax breaks for house effectivity upgrades

Artistgndphotography | E+ | Getty Photos

There are two tax credit accessible to householders who make sure upgrades.

The “nonbusiness vitality property credit score” is a 30% tax credit score, value as much as $1,200 a 12 months. It helps defray the value of putting in energy-efficient skylights, insulation and exterior doorways and home windows, for instance. The annual cap is larger — $2,000 — for warmth pumps, warmth pump water heaters and biomass stoves and boilers.

The “residential clear vitality credit score” can be a 30% tax credit score. It applies to set up of photo voltaic panels or different tools that harness renewable vitality like wind, geothermal and biomass gasoline.

Every coverage enhances and tweaks current tax breaks set to run out quickly, extending them for a couple of decade.

That is actually invaluable, significantly for individuals who do not have some huge cash within the financial institution.

Joel Levin

government director of Plug In America

The tax credit cowl venture prices and apply within the 12 months that venture is completed. In authorized phrases, the venture is accomplished when it’s “positioned in service.”

The improved residential clear vitality credit score is retroactive to the start of 2022. So, photo voltaic panel installations and different qualifying initiatives accomplished between Jan. 1, 2022 and the tip of 2032 qualify for the 30% credit score. These completed in 2033 and 2034 qualify for lesser credit — 26% and 22%, respectively.

The improved nonbusiness vitality property credit score is out there for initiatives completed after Jan. 1, 2023 and earlier than the tip of 2033. There are some exceptions — oil furnaces and sizzling water boilers with sure effectivity scores solely qualify earlier than 2027, for instance.

“If you happen to full and set up a venture in 2022, it is not going to be eligible for the brand new incentive,” Ben Evans, federal legislative director on the U.S. Inexperienced Constructing Council, mentioned of the nonbusiness vitality property credit score. “Look forward and begin planning initiatives, as a result of it will take time to do a few of them.”

Prices incurred in 2022 for a venture accomplished in 2023 would nonetheless depend towards the general worth of the house owner’s tax break, in accordance with Schmoll of KPMG.

One caveat: Since these are tax credit, customers will solely get the monetary profit after they file their annual tax returns.

When rebates for house upgrades might be accessible

Florian Roden / Eyeem | Eyeem | Getty Photos

The Inflation Discount Act additionally creates two rebate packages tied to wash vitality and effectivity: one providing as much as $8,000 and one other as much as $14,000.

Not like a few of the tax credit, these rebates are designed to be supplied on the level of sale — that means upfront financial savings for customers.

One catch: They probably will not be broadly accessible till the second half of 2023 or later, in accordance with consultants. That is as a result of the Power Division should concern guidelines governing these packages; states, which can administer the rebate packages, should then apply for federal grants; after approval, they will begin issuing rebates to customers.

In case your tax legal responsibility is $5,000, you should use $5,000 of the credit score. The opposite $2,500 goes poof.

Steven Schmoll

director at KPMG

The legislation would not set a required timeframe for this course of.

Even in accordance with probably the most optimistic timeline, these funds might not grow to be accessible to customers till summer season 2023, in accordance with Kara Saul-Rinaldi, president and CEO of AnnDyl Coverage Group, an vitality and environmental coverage technique agency

“All the pieces goes to rely on how rapidly these pointers will be written and put in place,” mentioned Saul-Rinaldi, who helped design the rebate packages.

Some states might also determine to not apply for the grants — that means rebates would not be accessible to householders in these states, Saul-Rinaldi added.

The HOMES rebate program gives as much as $8,000 for customers who lower their house vitality through effectivity upgrades, reminiscent of insulation or HVAC installations. Total financial savings rely on vitality discount and family earnings stage.

Vitranc | E+ | Getty Photos

The “high-efficiency electrical house rebate program” gives as much as $14,000. Households get rebates after they purchase environment friendly electrical home equipment: as much as $1,750 for a warmth pump water heater; $8,000 for a warmth pump for house heating or cooling; and $840 for an electrical range or an electrical warmth pump garments dryer, for instance. Non-appliance upgrades like electrical wiring additionally qualify.

Rebates from the “high-efficiency” program are solely accessible to lower-income households, outlined as these incomes much less 150% of an space’s median earnings.

Steve Nadel, the manager director of the American Council for an Power-Environment friendly Economic system, expects most states to take part; they’re unlikely to move up free cash for residents from the federal authorities, he mentioned.

Giant states “who’ve their act collectively and have the workers” could possibly begin providing the rebates as quickly as early 2023, he mentioned.