adaask

Each Ares Capital Corp. (NASDAQ:ARCC) and FS KKR Capital (NYSE:FSK) are excessive yield enterprise improvement firms (i.e., BDCs) (BIZD) that boast investment-grade credit score scores. On this article, we’ll evaluate them aspect by aspect and supply our tackle which one is a greater purchase.

Ares Capital Vs. FS KKR Capital – Stability Sheet

As was already acknowledged, each boast funding grade credit score scores of Baa3 (Secure) or equal.

ARCC boasts immense liquidity of $4.6 billion, with a leverage ratio of 1.23x as of the top of Q2. Whereas the leverage ratio is on the excessive finish of its goal vary, its substantial liquidity and robust underwriting observe file offset this threat to a substantial extent. Moreover, after Q2 ended, ARCC issued a substantial quantity of fairness, which has seemingly lowered its leverage ratio by a substantial quantity.

In the meantime, FSK’s leverage ratio is a bit of decrease at 1.15x as of the top of Q2, whereas its complete liquidity stands at $2.7 billion. The corporate’s debt maturity ladder is conservatively positioned, with no maturities till 2024 and the overwhelming majority of its debt not maturing till 2027 or later.

Whereas each look like in stable form, we give ARCC the slight edge right here provided that its liquidity is superior to FSK’s in addition to the truth that a higher proportion of its debt is fastened fee.

Ares Capital Vs. FS KKR Capital – Funding Portfolio

ARCC’s funding portfolio may be very effectively positioned to profit from rising rates of interest. ARCC’s CEO acknowledged throughout the Q2 earnings name:

As of quarter finish, holding all else equal and after contemplating the impression of income-based charges, we calculated {that a} 100-basis level enhance in short-term charges might enhance our annual earnings by roughly $0.23 per share, a 14% enhance above this quarter’s core EPS run fee.

A 200-basis level enhance in short-term charges might enhance our complete annual earnings by roughly $0.44 per share, a 26% enhance above this quarter’s core EPS run fee.

On high of that, its portfolio firms have sturdy curiosity protection of two.9x, giving them appreciable capability to deal with rising rates of interest. Moreover, with a conservative 44% common mortgage to worth ratio amongst its portfolio companies, there may be appreciable safety for its investments ought to they enter into default. Total, 71% of its investments are senior secured debt and its non-accruals stood at a mere 0.9% at truthful market worth as of the top of Q2.

FSK can be well-positioned to profit from rising rates of interest, provided that 87% of its debt investments have floating rates of interest. However, its portfolio underwriting efficiency continues to lag behind ARCC’s as non-accruals at truthful worth now stand at 2.9% as of the top of Q2. Shifting ahead, this efficiency ought to enhance provided that administration continues to prune legacy investments from the portfolio, with 90% of the funding portfolio now originated by both KKR credit score or the FS KKR advisor. Among the many 90% of the portfolio that has been originated by KKR/FS KKR, the non-accrual fee on a good worth foundation is a mere 0.5%. Lastly, with 93% of its portfolio invested in senior secured debt or asset-based finance investments, its portfolio is positioned moderately defensively.

Total, we give the sting to ARCC right here as its non-accruals are significantly decrease than FSK’s.

Ares Capital Vs. FS KKR Capital – Dividend Security

ARCC’s dividend is clearly safer than FSK’s proper now, provided that it has fairly a little bit of spillover revenue:

We at present estimate that our spillover revenue from 2021 into 2022, will probably be roughly $651 million or $1.32 per share. We consider having a powerful and significant undistributed spillover helps our purpose of sustaining a gentle dividend all through market cycles and units us aside from many different BDCs that shouldn’t have this degree of spillover.

In distinction, FSK employs a variable dividend payout coverage. Whereas its yield is significantly larger than ARCC’s in the intervening time, traders ought to remember that the precise degree of it is usually far much less dependable than ARCC’s payout.

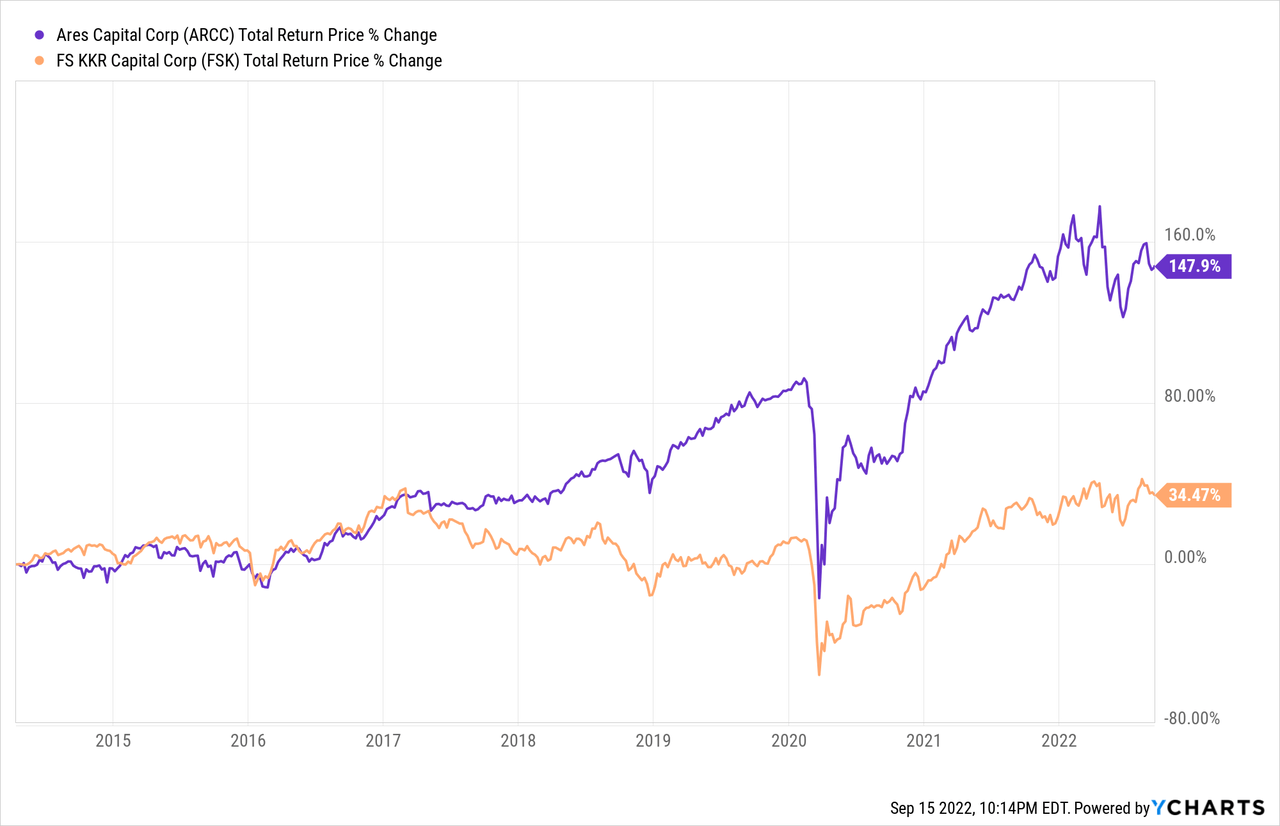

Ares Capital Vs. FS KKR Capital – Observe Document

ARCC has a hands-down higher observe file than FSK, because it has crushed SLRC since FSK went public:

Nonetheless, you will need to observe that FSK just lately accomplished a merger that led to improved efficiencies and synergies, improved diversification, and likewise set off a buyback program. Consequently, we anticipate FSK’s efficiency to enhance transferring ahead.

Ares Capital Inventory Vs. FS KKR Capital Inventory – Valuation

FSK’s valuation is significantly cheaper than ARCC’s throughout a wide range of metrics in each a relative and historic method:

| Valuation Metric | FSK | ARCC |

| P/E | 7.22x | 9.40x |

| P/E (5-12 months Common) | 8.05x | 10.24x |

| Dividend Yield | 12.64% | 9.33% |

| Dividend Yield (5-12 months Common) | 12.60% | 9.35% |

| P/NAV | 0.78x | 1.01x |

| P/NAV (5-12 months Common) | 0.76x | 1.02x |

The deep worth at FSK is obvious given administration’s plan to purchase again tens of tens of millions of {dollars} in inventory within the coming quarters.

Given how excessive FSK’s dividend yield is at about 330 foundation factors larger than ARCC’s, it has appreciable margin of security that may offset an inferior progress fee relative to ARCC. Moreover, its steep low cost to NAV helps to insulate traders from e-book worth losses on account of write-offs from the legacy portfolio, and it additionally offers administration a straightforward technique to create worth by merely shopping for again inventory.

Investor Takeaway

Unsurprisingly, this comes right down to a contest between worth and high quality. On the subject of total BDC high quality, ARCC wins palms down, as its steadiness sheet, funding portfolio, dividend security, and efficiency observe file crush FSK’s. Nonetheless, FSK nonetheless boasts an funding grade credit standing, and its underwriting efficiency is poised to enhance transferring ahead as KKR originated loans are more and more dominating the portfolio and are having fun with a better efficiency fee. On high of that, the low cost at FSK is overwhelmingly higher than it’s at ARCC, the place the inventory seems to be buying and selling roughly in-line with the truthful worth of the underlying investments.

Consequently, we favor FSK in the intervening time as we consider its fundamentals will proceed to enhance on a relative foundation whereas its steep low cost offers it an infinite margin of security and traders an infinite dividend revenue yield. We fee FSK a Sturdy Purchase and ARCC a Maintain at present costs.