Streaming video’s share of tv utilization time ticked up once more in August, whilst back-to-school season meant general TV utilization dipped.

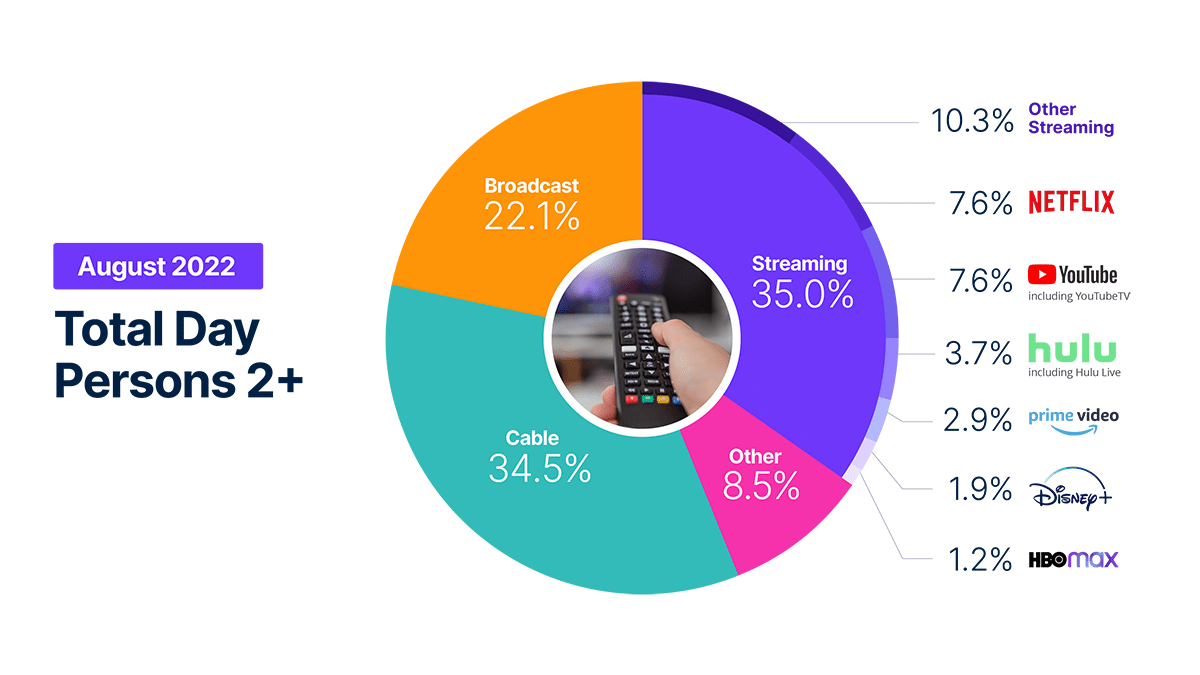

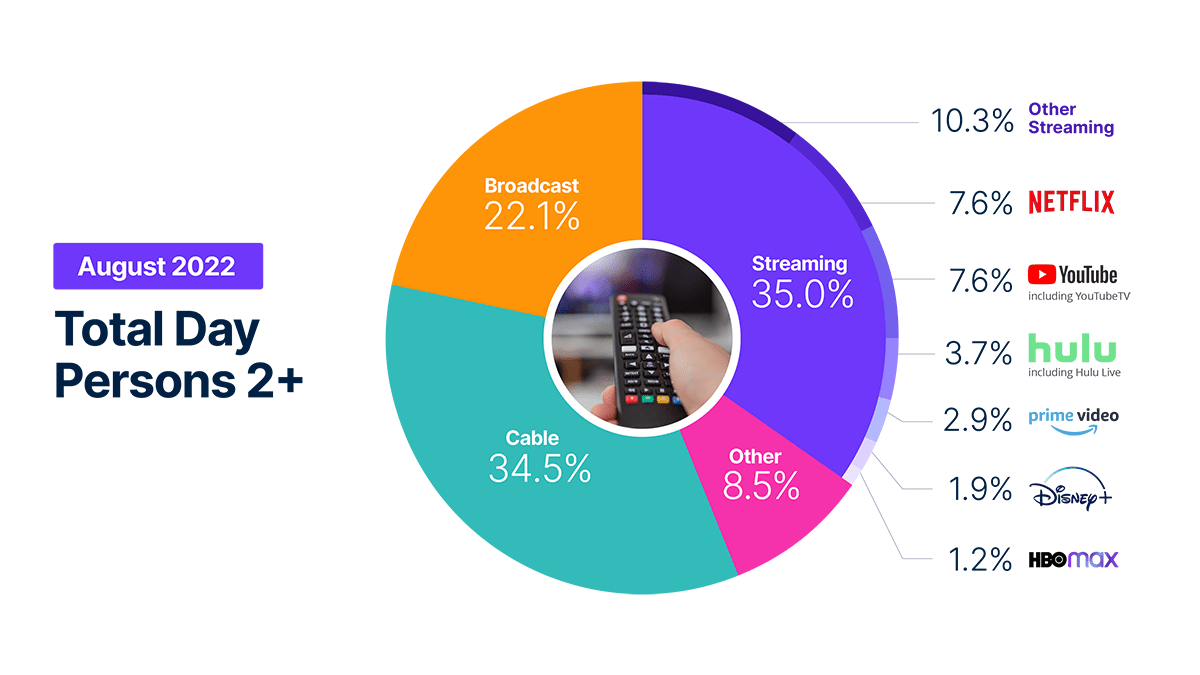

For the fifth straight month, streaming’s share of the TV pie elevated, rising to 35% following some high-profile new content material releases, in accordance with “The Gauge” from Nielsen, the rankings big’s month-to-month macro have a look at TV supply platforms.

The earlier month, streaming had surpassed cable to develop into the highest single use of TV for the primary time.

And whereas streaming elevated its share, cable additionally ticked again up, to 34.5%. Broadcast elevated its share as nicely, 22.1%. All of these share good points got here out of the Different class, which fell to eight.5% share from the prior month’s 9.2%. (The “Different” class is closely videogaming use, which takes a success as kids return to varsities across the nation, but in addition consists of viewing video discs.)

From a quantity perspective, complete TV utilization was down in August, typical for the season, although broadcast quantity rose, helped by basic selection applications in addition to a lift from sports activities. Cable quantity declined, however that drop was mitigated by a heavy improve in sports activities viewing quantity as nicely. Streaming quantity was flat from the earlier month, however up 22.6% year-over-year.

Digging into the streaming slice exhibits audiences shifting to comply with new and powerful content material. Longtime class chief Netflix (NASDAQ:NFLX) misplaced some share in August, to 7.6% from 8.0%, in a little bit of withdrawal from the massive July supplied by Stranger Issues. YouTube/YouTube TV (NASDAQ:GOOG) (GOOGL) boosted its share from 7.3% to tie Netflix for the primary time, at 7.6%.

Hulu (NYSE:DIS) (CMCSA) raised its share to three.7% from final month’s 3.6%, whereas Amazon Prime Video (NASDAQ:AMZN) ticked right down to 2.9% from 3.0%. Disney+ (DIS) gained barely, to 1.9% from 1.8%, and the debut of Recreation of Thrones spin-off Home of the Dragon helped HBO Max (WBD) enhance its share to 1.2% from a previous 1.0%.

“Different streaming” (together with smaller companies like Crackle (CSSE) in addition to linear streamers like Spectrum (CHTR), DirecTV and Sling TV (DISH)) ticked as much as 10.3% from 10.2%.

Turning to weekly streaming rankings, a (relative) lull within the sizzling content material spring and summer season meant that no single program streamed a billion minutes for the primary week since April.

The roost was dominated by a powerful second week from Netflix’s (NFLX) Jamie Foxx film Day Shift, which hit 957M minutes.

That was a part of every week the place Netflix dominated as the general content material tide receded. The streaming pioneer had 9 of the ten most streamed exhibits.

Day Shift was adopted by Netflix’s (NFLX) The Sandman (946M minutes); Stranger Issues (919M minutes); By no means Have I Ever (883M minutes); NCIS (810M minutes); Locke & Key (776M minutes); and Gray’s Anatomy (702M minutes). The one non-Netflix streamer within the general prime 10 was Disney+ (DIS), with Bluey (681M minutes).

(A reminder that Nielsen streaming rankings now incorporate viewing from six main streamers: Amazon Prime Video (AMZN), Apple TV+ (AAPL), Disney+ (DIS), HBO Max (WBD), Hulu (DIS) (CMCSA), and Netflix (NFLX).)

Pay TV distributors: Comcast (CMCSA), Constitution (CHTR), Dish Community (DISH), Verizon FiOS (VZ), Optimum/Suddenlink (ATUS), Atlantic Broadband (OTCPK:CGEAF), Sparklight (CABO).

Related native broadcast tickers: Nexstar Media Group (NXST), Sinclair Broadcast Group (SBGI), Grey Tv (GTN), Tegna (TGNA), E.W. Scripps (SSP). Nationwide broadcasters: ABC (DIS), NBC (CMCSA), CBS (PARA) (PARAA), Fox (FOX) (FOXA). And a few ad-tech names tied to linked TV: The Commerce Desk (TTD), Magnite (MGNI), PubMatic (PUBM), Criteo (CRTO), Roku (ROKU).