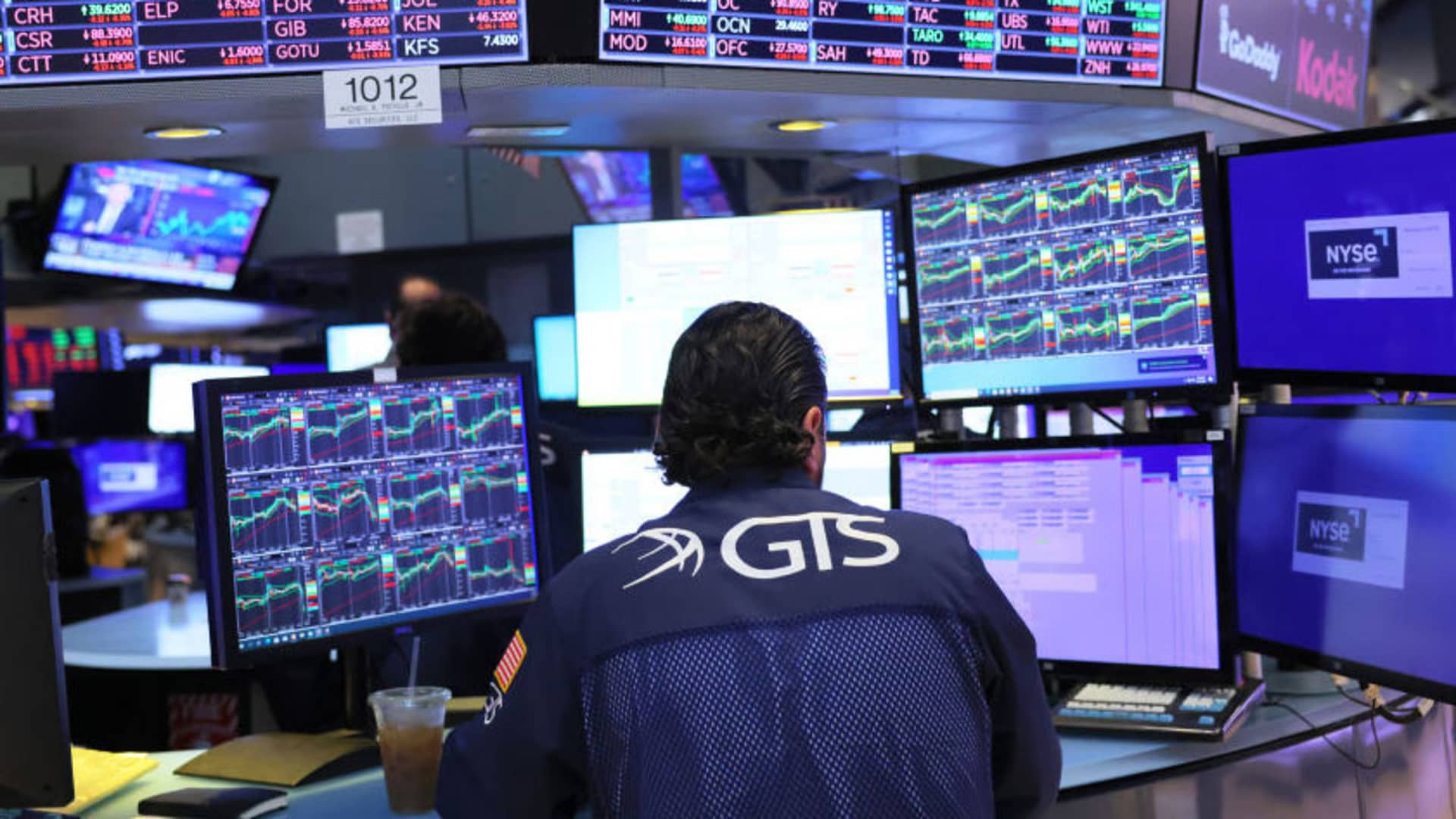

Merchants work the ground of the New York Inventory Trade throughout morning buying and selling on August 15, 2022 in New York Metropolis.

Michael M. Santiago | Getty Pictures

Economists, Wall Road analysts, hedge fund managers and public prognosticators have been all around the map currently in making an attempt to divine the methods of Wall Road.

Some have recommended the market has already bottomed and the bear market is over.

Others are calling for an additional 20% decline within the S&P 500, which is down almost 20% in 2022.

Nonetheless others are forecasting a whole collapse that may be worse than 2000-2003 or 2007-2009.

Some analysts are doing the mathematics additionally on projected reductions in earnings for the S&P 500, giving a variety for the market to backside between 3,000 and three,400 someday between now and 2023, however these estimates are all fairly different as nicely.

It is a wild time within the forecasting neighborhood today, with regards to markets, the Federal Reserve, the route of the financial system and all of the attendant dangers going ahead.

Perspective on this bear market

There’s a higher and less complicated technique to view this bear market in shares.

First, there are not any significant optimistic indicators that it is over.

Second, a number of standards have to be met for a brand new cyclical or secular bull market to start:

- The Fed should full its tightening cycle.

- Technical elements demand a re-test of the June lows.

- That momentum low (June) is commonly adopted by a worth low (TBD) earlier than the market can backside.

- The VIX ought to spike to above 40 as signal of capitulation among the many final of the bulls.

None of these standards have but been met.

The Fed remains to be elevating charges, seemingly by one other 0.75 proportion level when it delivers its choice on rates of interest subsequent week.

Some notable economists anticipate the Fed will jack up charges by a full level.

Fed audio system have indicated they’re keen to lift charges additional and — a minimum of theoretically — preserve them elevated all through 2023. This is not fertile floor for a brand new bull market.

We even have but to retest the lows.

The VIX, or so-called “worry gauge,” a volatility measure of the markets has not seen the panic ranges usually related to a capitulation backside.

It’s, certainly, a quite unusual phenomenon that varied volatility readings in shares, bonds and commodities like oil aren’t working in lockstep, regardless of very tight correlations of their respective worth actions.

I’ve but to listen to an excellent clarification as to why the fairness market VIX is depressed relative to the realized volatility within the inventory market.

That makes me fear that this bear market shouldn’t be over but.

The bottoming course of

Famous technical analyst John Bollinger schooled me way back on the bottoming course of.

A momentum low hits the market first, adopted by a subsequent “bear market rally” (or rallies) and at last a worth low, when the important thing averages take out the momentum low by a small quantity after which start to reverse course.

A catalyst of some type often triggers the start levels of a brand new bull market.

In brief, there’s quite a lot of chirping occurring proper now among the many chattering class, a lot of of it’s noisy and imprecise.

An easier and extra simple evaluation is named for right here, relative to the jawboning during which many are at present engaged.

Merely put, meet all of the aforementioned standards and begin once more.

Much less noise, extra historical past: A easy lesson in a quite complicated atmosphere.

Within the meantime, long-term buyers ought to keep on with their disciplines and make the most of a bear market that at some point will come to a quite “surprising” and “unexpected” finish.

— Ron Insana is a CNBC contributor and a senior advisor at Schroders.