[ad_1]

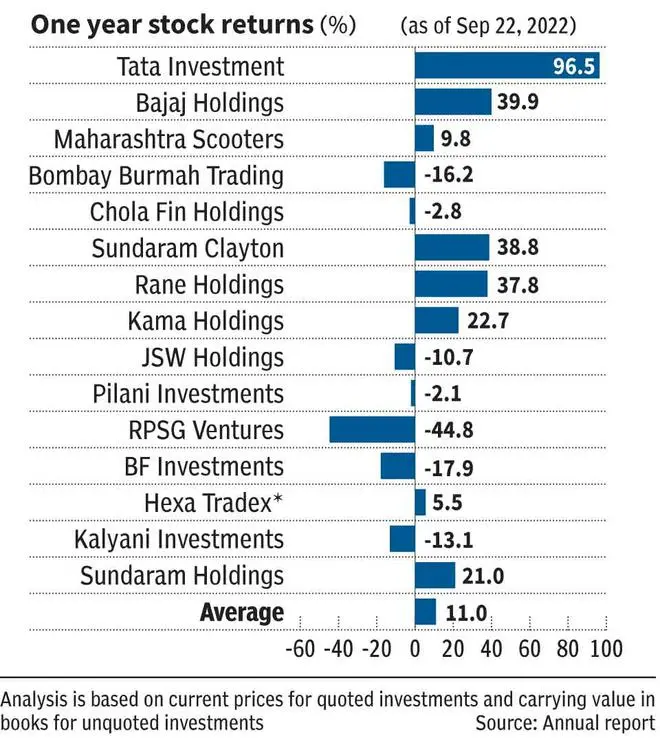

‘Purchase and maintain good firms’ is an oft-emphasised funding technique. However how good is it to purchase and maintain firms that simply maintain shares of different good firms? For instance, traders of Tata Funding Company (TIC) discovered the final one month to be exceedingly rewarding, with 60 per cent returns . The inventory has additionally returned over 90 per cent within the final 12 months. Previous to this run-up, TIC, just like many different holding firms in India, was buying and selling at a major holding firm (holdco) low cost for years. Holdco low cost refers back to the markdown in worth of underlying belongings owned, whereas valuing a holding firm. This markdown will be attributed to causes resembling inefficiencies resulting from further company layer, pursuits of promoters and minority shareholders not being aligned, decrease liquidty of the inventory, and many others.

Within the case of TIC, this low cost was slightly over 55 per cent a month again and round 60 per cent a 12 months again. It has now decreased to 26 per cent submit this run-up. Thus, it’s primarily the expectation of worth unlocking to cut back the low cost sooner or later in time in future, that makes a case for proudly owning holding firm shares.

Holdcos in India

Amongst the highest 2000 firms by market cap in India, there are round 15 well-known holdcos (excluding financial institution holding firms resembling Equitas, Ujjivan ). On this context, we’re proscribing our definition of holdcos to firms that don’t have important standalone operations and derive virtually their complete worth from their underlying investee firm. These holdcos are all a part of enterprise teams with investments primarily in group entities (besides TIC, which has important investments in non-Tata group firms as effectively)

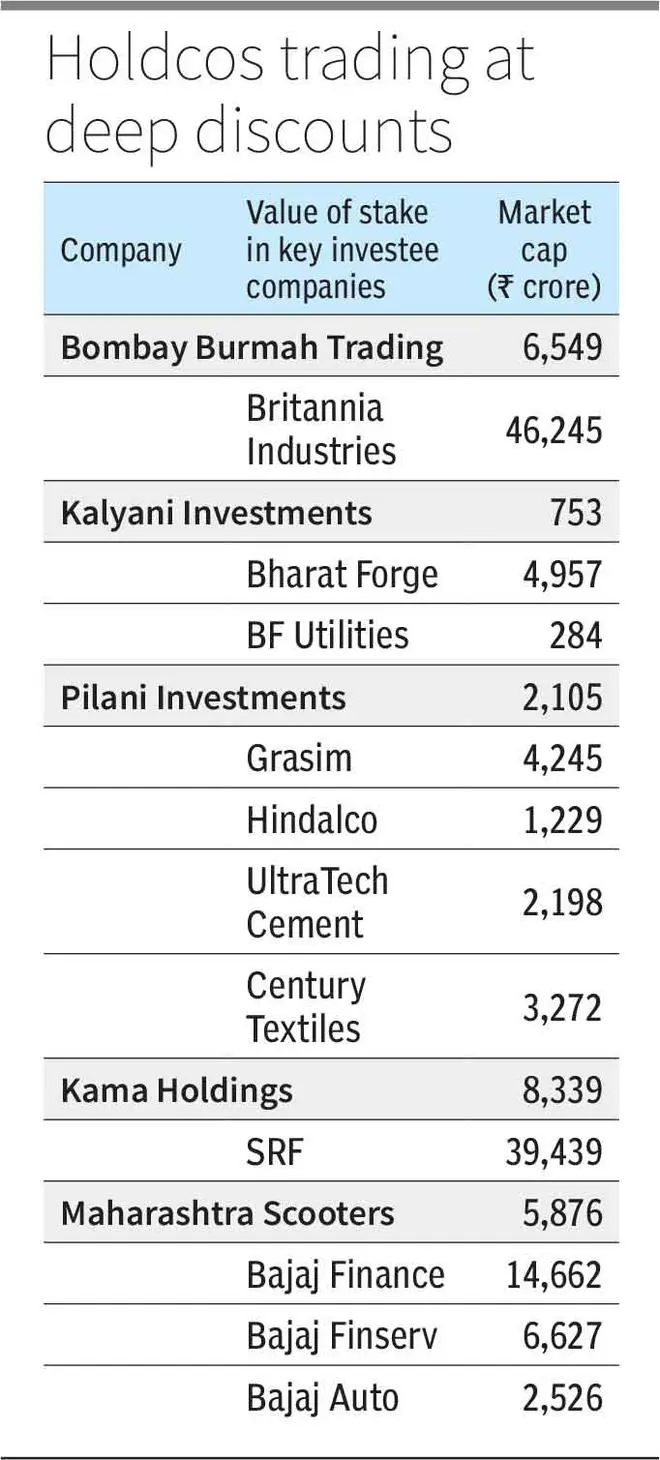

Out of those 15 firms, the holdco low cost ranges from as excessive as 85 per cent (Bombay Burmah and Kalyani Investments) to a premium of 30 per cent (Rane Holdings) ( see infographics). A premium is a uncommon occasion, although, and will both be resulting from market notion of the particular worth of unquoted investments (often carried at price in books) or could possibly be a case of mispricing by the market. Additional, besides within the case of Rane, TIC and Hexa Tradex, in all different firms, the holdco low cost is above 50 per cent. During the last one 12 months, there has solely been a marginal enchancment in holdco low cost at an mixture degree (see infographics). The straightforward common holdco low cost for these 15 firms is at 57 per cent now, whereas it was at 60 per cent identical time, final 12 months.

Now coming to the necessary query – are reductions in extra of fifty per cent justified in valuing a holdco? Additional, what justifies holdco low cost as excessive as 85 per cent? Within the developed markets, there’s hardly an instance of such excessive holdco reductions. Within the Indian context, most often, holdcos are entities by way of which promoters can retain majority management of the underlying investee group firm. In developed markets, promoters, uncommon as they’re, use differential voting rights to train management and the case for a holdco to retain management just isn’t frequent.

The rationale for low urge for food for holdcos in India could possibly be investor notion that promoters might not be fascinated with worth unlocking of holdcos as they could primarily wish to wield management over group firms through holdcos.

Does that imply there is no such thing as a alternative for traders in holdcos? Removed from it. There are two methods during which traders can profit from shopping for holdcos purchased at enough reductions. Even when holdco low cost stays intact, if underlying investee firm continues to carry out effectively and its shares do effectively, then the holdco can also present related returns, monitoring its efficiency. Add to it the prospects of holdco low cost shrinking over a time period; traders might then get to make compounded returns. For instance, if the underlying asset strikes up by 50 per cent in a selected interval, and through the identical time the holdco low cost shrinks from 80 per cent to 50 per cent, the holdco investor will get to make 275 per cent returns. Thus, whereas there is no such thing as a assure of returns, there could also be benefit in contemplating holdco firms buying and selling at excessive reductions, supplied different elementary components assist the funding case.

Traders want to notice that, in contemplating a holdco firm, the first technique to worth it’s primarily based on underlying worth of its holdings. Whereas holdco firms have revenue within the type of dividends and curiosity revenue from their investments (fairness and choice share investments) these will not be materials most often as dividend yields in India are low by world requirements. Thus, the revenue the holdco receives from subsidiary/affiliate firms might not be reflective of its worth, though this seems to be the best way markets are valuing firms the place reductions are as excessive as 80 per cent. Ratios like PE or P/B might not be a lot useful.

Different issues being equal, monitoring the holdco low cost, evaluating it with historic common and extremes is necessary. During the last 12 months, as talked about above, the traits in holdco low cost have been combined, with reductions decreasing for some and growing for others. In some instances the low cost charges have stayed in a slim vary by way of the 12 months as effectively. Thus, it seems the volatility of the final 12 months, shift of market temper in favour of worth shares, haven’t made a lot of a distinction on this area for now, at an mixture degree.

Guidebook for traders

Maintaining the above components in thoughts, listed below are a couple of methods during which traders can strategy holding cos :

One, have a long-term view. If success in investing is a sport of persistence, then success in investing in holdcos is a sport of ultra-patience. TIC’s personal long-term traders would have realised this because the shrinkage in firm’s holdco low cost occurred after a few years. One other instance is Hexa Tradex (now within the means of getting delisted with promoters shopping for out minority shareholders), which has given 5x returns within the final 10 years, and a surprising 26x returns from Covid lows! Hexa Tradex is a holdco whose worth is principally derived from its investments in Jindal Metal and Energy.

Whereas these returns are assessed with full advantage of hindsight, the evaluation highlights the alternatives in shopping for holdcos at excessive reductions in addition to the necessity for persistence. Since its itemizing in 2012 after being demerged from a Jindal group firm, Hexa Tradex, solely in current quick interval (January 2021-August 2021), outperformed the investee firm, leading to shrinkage of holdco low cost.

Two, assess the enterprise and the valuation of the underlying investee firm. There might not be any profit in shopping for a holdco firm at deep low cost, if the underlying investee firm is overvalued. One of the best time to purchase can be if the investee firm is undervalued, and the holdco low cost is larger than historic common.

Three, analyse the company governance monitor document of the promoter group. Are their enterprise actions and disclosures clear? Have they got a great monitor document of addressing minority shareholder issues? This must be an uncompromising think about shopping for holdcos. Whereas promoters with good company governance monitor document could wish to proceed to make use of holdcos to wield management over group firms, one can atleast be hopeful that they might be extra receptive to minority shareholder recommendations for worth unlocking.

For instance, Sundaram-Clayton, which is the holding firm of TVS Motors, introduced an inner restructuring train early this 12 months to unlock worth and in addition return extra money to shareholders. Whereas the holdco low cost stays excessive, such initiatives lend confidence that promoters will issue creating worth for minority shareholders as effectively, over the long run. Consistency in such actions may end up in compression of holdco reductions.

4, regulate the regulatory panorama. For instance, in accordance with a closed-end PMS fund that goals to faucet alternatives from higher-than-warranted holdco reductions, alternatives could come up on this area as promoters really feel the warmth of the change in regulatory panorama. Of their opinion, the thrust by MCA and SEBI on larger compliance necessities, repeatedly, might immediate promoters to think about delisting their holding firms, resulting in worth unlocking.

5 , one thing that has occurred in promotor teams many occasions previously is that, as possession requires to get cut up throughout a number of members of the family, restructuring and worth unlocking could grow to be inevitable sooner or later in time. This has occurred in teams like Bajaj (twice) and Reliance. Thus, for an ultra-long-term investor, this too is an element which will work in favour.

Six, have an exit plan. If the holdco low cost has shrunk considerably beneath historic norms in a brief span of time or has gone right into a premium, within the absence of any catalyst, then there could also be some imply reversion within the low cost. One have to be alert to reserving earnings as effectively. For instance, at this time, traders in TIC should assess whether or not it’s price holding to inventory any extra, when the holdco low cost has decreased considerably.

Taking a leaf out of US markets

Whereas we’ve many greatest practices of our personal, adopting greatest practices from different markets may also help deal with among the distortions in our markets, like the best way it exists in holdco valuations. The worth in these firms remaining unrealised advantages nobody, and relatively may additionally trigger distortions within the pricing of the underlying investee firm, as many traders shun the oblique route of investing through holding firm in favour of instantly investing within the underlying firm, even when it’s overvalued.

Monitoring inventory

The idea of monitoring inventory that exists within the US helps overcome this distortion there. A monitoring inventory is a type of fairness that tracks particular segments or division in an organization. These are traded in exchanges like every other fairness instrument. For instance, if rules permit this, promoters can concern monitoring shares that replicate financial curiosity within the underlying investee firm, to the minority shareholders. The monitoring inventory will be issued with out voting rights or decrease voting rights, and that method, promoters can proceed to manage the group firms, whereas minority shareholders can profit from worth unlocking. The instrument of monitoring inventory was extensively utilized by billionaire and media mogul John Malone. His enterprise empire beneath the Liberty model has a protracted profitable monitor document of worth creation by way of acquisitions/investments and consolidating his management whereas distributing financial possession through monitoring inventory.

Revealed on

September 24, 2022

[ad_2]

Source link