[ad_1]

Friday 4 Play: The “Housing Market’s Loopy Practice” Version

Nice Ones, it’s loopy … however that’s the way it goes.

Tens of millions of individuals. Giving up on properties.

Possibly it’s not too late?

What? To discover ways to refinance? Nah, man, it’s approach too late.

Inflation wounds nonetheless screaming. Housing’s a bitter disgrace. It’s going off the rails on a loopy practice!

In fact, I had to hyperlink to the Randy Rhoads model. Dude was a guitar god.

Anywho, I hate to inform y’all … however I used to be useless proper on the housing market. Lifeless. Proper.

Dwelling costs rose too excessive, too quick as a consequence of simple cash that the Federal Reserve allowed for much too lengthy. A correction in housing costs was unavoidable.

Inescapable.

Inevitable, even.

I’ve chanted this mantra for concerning the previous yr to organize y’all for what was coming.

A few of you listened, however many Nice Ones pushed again, saying I used to be off my rocker. That I used to be incorrect. That this time was completely different.

Nicely, it is completely different in that we don’t have banks on the breaking point as a consequence of excessive leveraging and wonky credit score default swap derivatives. However then, I by no means claimed this time round can be precisely just like the 2008 monetary meltdown.

That is simply your odd, “run of the mill” 10% to 30% correction in housing costs after an enormous simple cash bubble.

A 30% plunge in housing costs?! You may’t be severe.

I’m useless severe. After the Federal Reserve’s string of 75-basis-point price will increase, common mortgage borrowing prices are at their highest ranges since 2008. The present common mortgage price on a 30-year mounted mortgage sits at 6.2%.

Placing that price in perspective: Homebuyers who bought a home for $600,000 again in 2021 are making the identical month-to-month fee as homebuyers who buy a $392,000 residence proper now. The one distinction is the mortgage rates of interest, which had been 2.6% again in 2021.

The results of all that is that residence bidding wars are over, and sellers are beginning to decrease residence costs. And you may’t actually blame them for decreasing costs. I imply, mortgage funds on median-priced properties at the moment are consuming up 36% of family earnings. That’s the best share since 1985!

Look, I even discovered a chart detailing the nightmare we’re going through:

And also you marvel why housing begins, new residence purchases and principally each metric related to the housing market is plummeting. At this price, it received’t be lengthy earlier than hundreds of thousands of householders are the wrong way up on their mortgages. Stranger issues, certainly.

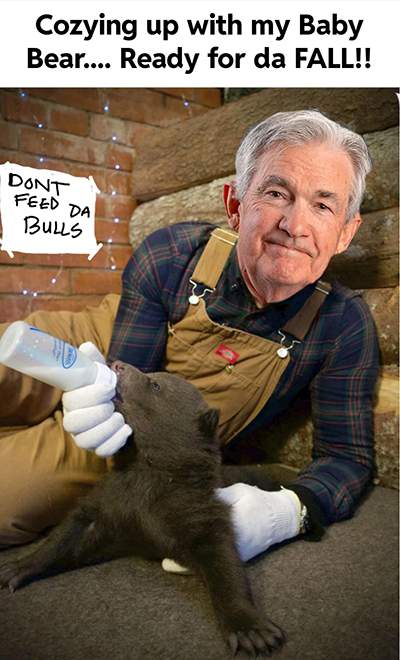

In the meantime, Federal Reserve Chairman Jerome Powell warned final Wednesday {that a} housing correction is coming. Higher late than by no means?

Who am I kidding? Powell knew this was coming all alongside and plowed forward anyway. He simply held off stating it formally as a result of he knew that Wall Road couldn’t deal with the reality.

Goldman Sachs concurred, saying it expects housing costs will fall 5% to 10% from peak costs, with costs dropping 15% to 25% within the previously hottest actual property markets. However Goldman famous that its worst-case eventualities had been primarily based on a gentle recession occurring.

Umm … I hate to inform ya, Goldman, however a gentle recession is already occurring. By the point the speaking heads all agree that we’re in a recession, we’ll have gone from “gentle” to “holy $#!t,” and that “worst case” drop of 15% to 25% in housing costs will look conservative.

Now, you’ll be able to all sit round and blame Fed Chair Powell for this mess … and also you wouldn’t be fully incorrect. The Fed waited far too lengthy to repair the straightforward cash scenario, leading to file inflation and ridiculous residence costs.

Mr. Powell … what went down in your head?

Oh, Mr. Powell. Did you speak to the Fed?

Your inflation plan to me appears so tragic. There’s no thrill right here in any respect.

You fooled all of the folks with magic. Yeah, you waited approach too lengthy…

Or you’ll be able to notice that I’ve been proper concerning the housing market correction all alongside. And perhaps some Nice Ones listened and are ready for this eventuality.

However even if you happen to didn’t pay attention, it’s not too late to save lots of your investing capital and do the suitable factor. You may actually get off this loopy practice everytime you need … however you don’t have to surrender on bringing in earnings. Bread. Money.

Let my colleague Charles Sizemore present you how one can conquer this market volatility with 5 of his favourite high-yielding dividend shares. He’ll ship you the whole checklist for FREE! And I imply it … no strings hooked up.

Plus, Charles will ship you his brand-new e book, Revenue Without end.

It’s packed stuffed with the information, methods and secrets and techniques gathered over 20 years of serving to unbiased traders achieve monetary independence.

Click on right here to get all the main points now … earlier than this FREE provide expires!

And with out additional ado, right here’s your Friday 4 Play:

No. 1: Members Solely

Whereas the housing market’s in disaster, the inventory market’s bleeding like a caught pig and the world’s at odds with itself day-after-day — hey, a minimum of Costco (Nasdaq: COST) isn’t elevating its membership costs in any case.

A retailer not passing the buck? What the $@*#?

It’s excellent news for Costco members and soon-to-be members, a minimum of.

Costco traders, nevertheless … take this information for what you’ll.

On one hand, Costco not elevating its membership costs means the chain’s doing A-OK with prices and inflation as issues stand. However if you happen to’re the kinda investor who desires your invested corporations to squeeze each final little bit of capital out of its shoppers, nicely, there’s rather less money on the desk for you proper now.

Bully for you.

So what had been Costco’s earnings anyway?

The majority-shopping stalwart simply beat estimates on each counts: Income reached $72.09 billion and beat expectations for $72.04 billion by a hair. Earnings per share rose to $4.20 and beat estimates of $4.17. Good.

For all of the glowing numbers in its earnings report, for all of the seemingly consumer-focused strikes regarding membership costs … COST inventory nonetheless sank over 3% immediately with the broader sell-off. A minimum of Costco gave y’all a free pattern of fine information although … and low-cost hotdogs. Can’t neglect a budget hotdogs.

No. 2: The Fubo Flip-Flop

Wish to see how briskly Wall Road can change its thoughts?

Wish to see them do it once more?

Wedbush Analyst Michael Pachter simply upgraded fuboTV (NYSE: FUBO) inventory from impartial to outperform.

Which is humorous, as a result of simply final month he had downgraded FUBO from outperform to impartial due to “slowing subscriber progress, competitors, inflation, and rising content material prices” … all of that are nonetheless current.

What’s with the sudden reversal? Did someone simply notice that the NFL season began up once more? And that that is in all probability going to be Fubo’s sports-streaming prime time season after a sleepy summer season?

Why don’t we see what Wedbush’s reasoning is for the improve anyway:

FuboTV has a stable head begin in providing stay sports activities programming to its subscribers, has a thriving and rising promoting enterprise, and presents a compelling alternative for a sports activities wagering firm to companion with a longtime sports activities tv broadcaster. — Wedbush Analyst Michael Pachter.

Our takeaway from this episode: Fubo’s been overwhelmed to a pulp so badly that now is perhaps a great entry level into the inventory if you happen to’re the gamblin’ type.

With that mentioned … this can be a high-quality instance of why you shouldn’t all the time put an excessive amount of weight on the opinions and scores of analysts, which change with the winds, week to week, minute to minute.

No. 3: UPS Is High-quality, However FedEx Is Faster…

Delivery instances are gradual with liquor … er, perhaps not.

Bear in mind the opposite day — was it Monday? Then, no — when FedEx (NYSE: FDX) warned everybody about that nasty, dreaded, soiled phrase known as “stagflation?” And everyone took a bottle, drowned their sorrows, considering it’d flood away tomorrows?

Yeah … about that.

Apparently, FedEx noticed the market’s horrible response to its stagflation proclamations that the corporate went: “Huh, looks as if the harm is already achieved. Would possibly as nicely launch that god-awful earnings report whereas we’re at it.” And so it did.

FedEx reported earnings of $3.44 per share — nowhere close to analysts’ targets of $5.10 per share. Issues had been barely higher on the income aspect, however not by a lot: Gross sales of $23.2 billion simply missed the mark for $23.5 billion:

We noticed a decline in our volumes in the course of the [fiscal] first quarter, which accelerated within the last weeks. Our softening volumes in Asia and the U.S. had been predominantly because of the financial system whereas the shortfall in Europe was each economic- and service-related. — CEO Rajesh Subramaniam

Softening quantity? Seems like a private drawback…

No, actually: Whereas the worldwide macroeconomic pressures definitely aren’t FedEx’s drawback — virtually everyone seems to be blaming the financial system for any misses and missteps this earnings season — coping with these pressures is FedEx’s drawback.

And but, you get analysts saying stuff like this: “Citi analyst Christian Wetherbee didn’t just like the information, writing Friday that FedEx was in a deeper gap than he anticipated.” You’re nonetheless going in charge FedEx for reporting precisely what it mentioned it was going to report? What?

And sorry to say it, Wetherbee, however the world financial system is in a deeper gap than you anticipated.

When did we cease doing “phrasing?”

No. 4: As American As…

Diabeetus.

In all probability from a mixture of apple pie and bacon cheeseburgers, if I needed to guess.

Although for any Sort 2 victims on the market, excellent news! (Sure, precise excellent news in Nice Stuff … we try this on occasion, you see.)

Eli Lilly’s (NYSE: LLY) new drug for Sort 2 diabetes, Mounjaro, simply earned the corporate an improve from the analysts over at UBS.

Mounjaro, aka tirzepatide, was authorized to deal with Sort 2 again in Might, and Eli Lilly is in search of additional approval for the drug as a therapy for weight-management remedy.

Whoa. So what you’re saying is … I’m about to let my consuming habits get lots worse?

What? No, that’s not what I’m saying in any respect! What analysts are saying is that if the drug takes off: “Tirzepatide’s sturdy efficacy in each weight problems and [Type 2 diabetes] ought to drive gross sales into a spread that we imagine may see this being one of many best-selling medicine in historical past.”

You may virtually hear Massive Pharma’s eyelids widening on the imagined riches. UBS predicts gross sales to peak round $25 billion, which is not any chump change to make certain. I can’t inform who’s extra excited, UBS or Eli Lilly itself.

What do you assume, Nice Ones? Received any ideas on immediately’s Nice Stuff? Head on over to our inbox to share your aspect of the dialog: GreatStuffToday@BanyanHill.com.

Within the meantime, right here’s the place you will discover our different junk — erm, I imply the place you’ll be able to take a look at some extra Greatness:

Regards,

Joseph Hargett

Editor, Nice Stuff

[ad_2]

Source link