SeventyFour

This text was coproduced with Wolf Report.

As most readers know, I am an enormous fan of web lease REITs, for just a few causes:

First. I used to be a web lease developer for round 20 years wherein I realized the business actually “from the bottom up”. I’ve constructed over 100 free-standing shops for corporations like Advance Auto (AAP), O’Reilly (ORLY), Walgreens (WBA), and others.

Second. As an investor, I am interested in the very predictable revenue that web lease properties generate. That is why I contemplate this sector the last word “sleep properly at night time” classification.

Third. Internet lease properties are extraordinarily liquid because the 1031 alternate market gives sturdy capital flows for traders. As well as, many web lease properties are smaller ($500,000 to $3 million) which makes them rather more fungible.

On this article, we’ll be investing in Internet lease REITs – a selected subset of REITs which have very enticing qualities that make them interesting investments with a long-term timeframe.

It additionally makes them enticing from a pure security perspective – as a result of good web lease REIT money flows are based mostly on extraordinarily credit-worthy tenants which ideally are unfold in a diversified method among the many REITs collective ABR (or annualized base hire).

If we now have the mixed qualities of:

- Elementary high quality (not less than BBB or equal security, respectable market cap, good administration)

- Portfolio diversification by way of each sq. footage and ABR.

- Good historical past by way of FFO progress, and rising their dividend.

- Round 4%, or greater than 4% dividend yield.

- A sensible, conservative upside of round double digits or larger

Then you may in all probability beat inflation whereas staying secure, and whereas getting interesting dividend funds from good corporations.

And there are attention-grabbing web lease REITs accessible – at low worth and with nice safeties. There are many interesting locations to, as I see it, make investments your cash with a excessive probability of fine returns.

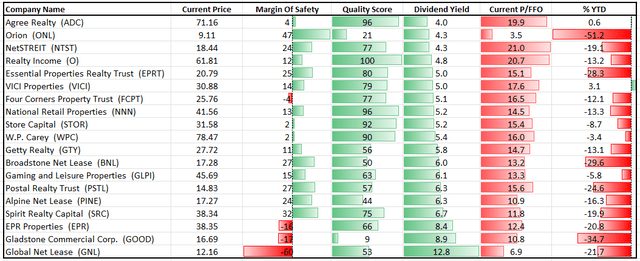

On this article, we will present you 3 of our present prime picks within the sector, and why we’re recommending them – particularly with STORE Capital (STOR) lately being taken personal and basically being “out of the sport”.

We nonetheless need a good yield and good progress out of our investments – listed here are some good picks for that.

1. Spirit Realty Capital (SRC)

Spirit Realty is our presently highest conviction purchase within the web lease area. There are just a few causes for this.

To begin with, let’s make it clear that the corporate fulfills all the bullet factors set out above. There’s vital elementary high quality available right here. The corporate is BBB rated with an excellent market cap, of above $5.6B.

It has good diversification, with prime tenants in its ABR. Most of its sq. footage/ABR is aimed toward distribution, not manufacturing or flex, and the corporate has a mean lease size of over 10 years, which is superb within the context of web lease. The common dimension of an SRC asset is simply above 100k sq. ft.

SRC just isn’t the identical firm it was even solely 4 years in the past. Diversification has gone down 3%, which means that the highest 10 tenants are actually lower than 22.5%.

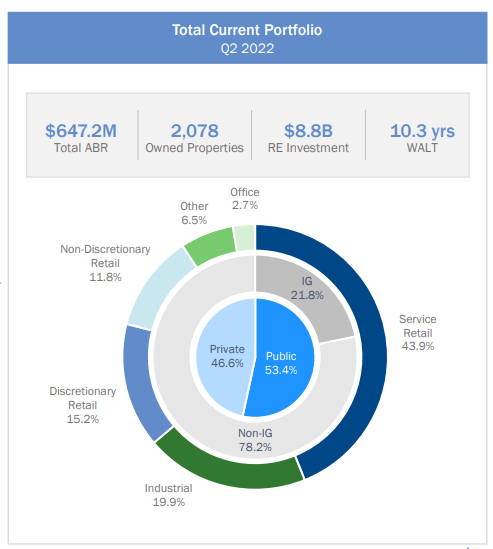

The corporate’s industrial publicity is as much as 20%, from shut to eight% again in 2017, and public publicity is as much as 53.4% from 36.7% in 2017. The corporate did have some misplaced hire throughout COVID-19 and even earlier than COVID – nevertheless it’s now right down to 0.0% as of the newest quarterly.

SRC IR

There are such a lot of good tenants to love right here – from Walgreens to issues like Circle Okay, Greenback Common, Advance Auto Components, CVS (CVS), Residence Depot (HD), and others. The highest 20 tenants have lower than 45% of the corporate’s ABR as of 2Q22.

FFO progress historical past and dividend progress historical past are “okay”.

The corporate has had down years and bounced again. However the dividend has stayed secure or rising since not less than 2018 – which is the interval we examine the corporate in, given its portfolio modifications. However I shall be clear that there are web lease REITs which have higher dividend and FFO progress histories than SRC.

Nonetheless, SRC makes up for this with just a few issues.

To begin with, the dividend is superb. On the present share worth, you are getting a really well-covered 6.45% when investing in SRC.

Secondly, even when FFO progress is not actually stellar past this 12 months – 1-3% yearly in 2023E and 2024E based mostly on present forecasts – the whole RoR or upside is closest to twenty-eight% till 2024E, and that is based mostly on extraordinarily conservative multiples.

SRC trades at an FFO a number of of no larger than 11.4x, and the upside I discussed relies on a 12.1x ahead P/FFO. Comps are valued at far larger multiples. If we take a look at what this might indicate by way of cap charges once we spend money on SRC, the present LTM Money NOI provides us a cap price of 9.8% based mostly on the present NAV when investing in SRC.

That is an expression of simply how the market undervalues SRC – the identical quantity for Realty Revenue (O), for example, is purchased at a lower than 5% cap price presently, making sense given its buying and selling vary of 17-20x P/FFO.

This in itself is not sufficient – we additionally must ask whether or not the corporate’s property are qualitative sufficient to ensure this is not a worth entice. I might recommend that this isn’t the case, based mostly on diversification, tenants, and safeties right here.

All in all, we give this enterprise a margin of security of virtually 26.5% and contemplate Spirit Realty a “STRONG BUY” right here. The upside is 25% conservatively, simply.

So, SRC is the primary “BUY” right here.

2. Important Properties Realty Belief (EPRT)

One other web lease that I lately co-produced an article on with Brad. Its focus is on lengthy leases with excessive unit-level hire protection.

The corporate’s WALT is longer than SRC at nearly 14 years, and the corporate additionally has very excessive unit-level hire protection, including one other interesting dimension to a mixture that is already very interesting. A few of these very interesting issues are coated within the article that you’re going to discover right here.

This consists of qualities like:

- 4.6x web debt/EBITDAre, and 32% gross debt/gross property on an undepreciated foundation.

- A 0.01% emptiness.

- 99% of ABR is roofed by unit-level P&Ls.

- Low common asset dimension.

- Over 84% of the corporate’s enterprise is internally originated sale-leaseback.

- Wonderful underwriting requirements.

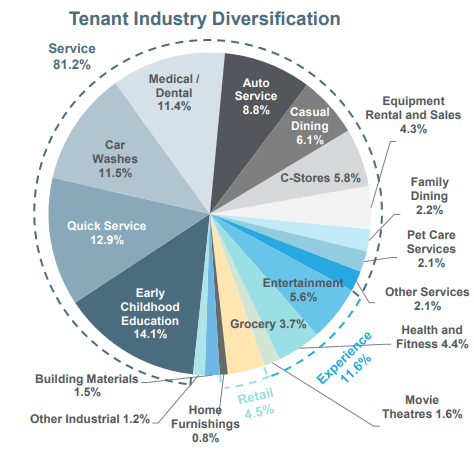

And the portfolio, with its tenants, is fairly nice too.

EPRT IR

With closing on 1,600 properties totaling 14.3M sq. ft. leased to 325 prospects. No portfolio firm is in any kind of main misery right here, and protection metrics are glorious. Whereas tenants with sub-1x present protection ratios do exist, nearly 75% have 2x or larger. Cleanup however, this can be a very good web lease REIT. And low leverage is strictly what we’re on the lookout for on this atmosphere.

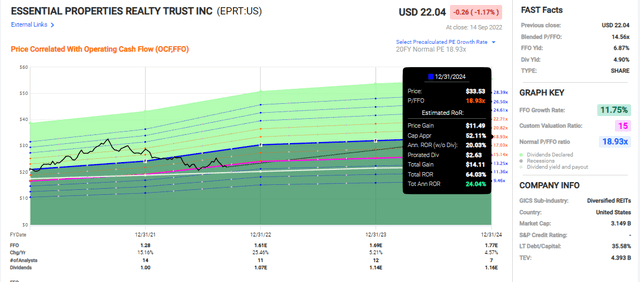

The yield is properly above 4.5% as properly. Not as excessive as SRC – however a few of its metrics are even higher. It trades at a better a number of than does SRC, nevertheless it additionally has a better historic premium, a lot nearer to O than SRC. At a present P/FFO a number of of simply south of 14.6x, the corporate has a major upside to its 5-year common.

FAST Graphs

As earlier than, the cap price right here implied by valuation is spectacular. The corporate has considerably larger margins than SRC and O, managing to eke out round 59% on LTM with adjusted NOI (D&A added again in), coming to a present cap price of seven.4% given how the market is valuing issues right here. This is not nearly as good as SRC (The a number of is larger), however to me, it is extra enticing than O presently, even when yields are nearer to comparable than SRC and O.

We contemplate EPRT a “STRONG BUY” with a worth goal of at least $27.5, contemplating reversal probably for the corporate within the mid to long-term. It is not as if we at iREIT on Alpha are alone on this estimate. Analysts following the corporate have a $27.1 PT, with 9 out of 12 analysts at a “BUY” or equal ranking right here. The upside for EPRT is evident to us.

That is why we’re shopping for extra.

3. Netstreit (NTST)

We perceive why some may want among the security of credit score scores to only the security of a tremendous portfolio. Nonetheless, it is our job as analysts to seek out undervalued companies with maybe nearly as good upsides and safeties as are supplied by among the larger rated but much less appealingly valued friends.

Right here we now have Netstreit. Why is Netstreit so good, then, in our estimate?

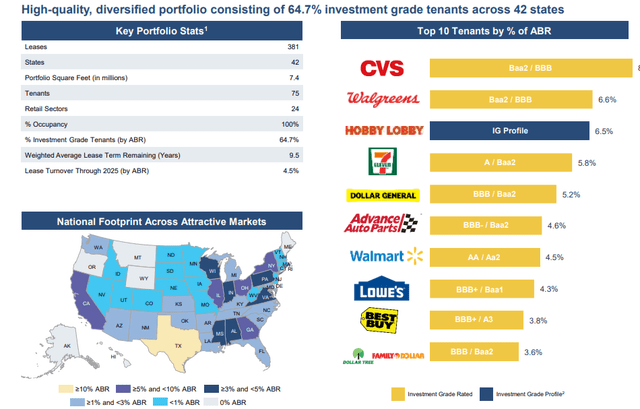

Netstreit lacks a credit standing – so we take a look at tenant credit score scores right here, that are arguably as vital for a web lease REIT similar to this one. Like the opposite corporations on this record, NTST operates with very stringent underwriting necessities, and it is one of many very, only a few REITS with an ideal occupancy ratio – which means no vacancies in any respect. NTST has maintained this for over 2.5 years at this level.

The REIT focuses on defensive industries and discount-oriented retailers which have a better probability of having the ability to make ends meet and thrive throughout a troublesome time, similar to a downturn, a recession, or stagflation.

NTST is maybe the worst performer right here by way of common diversification – prime 10 make up round 45%.

NTST IR

Nonetheless, these tenants are all stellar and should not actually be thought-about “dangerous” as such. 54.5% of the portfolio is leased to necessity companies like Walgreens, Walmart (WMT), Goal (TGT), Lowe’s (LOW), Kroger (KR), CVS. 18.1% {discount}, similar to Massive Tons (BIG), TJX (TJX) and 14.8% service, similar to Taco Bell, 7-11, Wawa, or KFC.

It may due to this fact be mentioned that the corporate, whereas least diversified, may be greatest ready for an eventual downturn. NTST’s portfolio diversification has modified considerably since its Pre-IPO again in 2019.

Again then, the corporate had 93 leases in 28 states, 12% of which had been CVS. Now the corporate is 8.2% CVS with 381 leases in 42 states. The corporate has expanded massively.

Nonetheless, it is also nonetheless the smallest of those REITS, producing lower than $100M in rental income. It could be fully unfair to name this REIT “too dangerous”, but when we wish to take a look at the riskiest of those three, then it is NTST.

It is merely the smallest, and it is nonetheless in what might be thought-about a “larger progress” part for a web lease REIT. It is annual FFO progress for 2021 was 56%, and it is anticipated to develop one other 16% this 12 months – averaging nearly 10% till 2024 on an annual foundation.

The yield is the bottom of the bunch – round 4.1%, nevertheless it’s progress potential warrants a better potential upside than do the opposite REITs, which supplies it a possible for the by-far-highest price of outperformance till 2024E – over 88% RoR till 2024E based mostly on the 5-year common.

Like different REITs, this one has been buying and selling down barely over the previous few weeks and months, and is comparatively low-cost, seen to its averages.

Netstreit is a purchase for just a few causes – however the principle ones are its perfection in occupancy, having the ability to develop $100M/quarter at its present dimension. A 20x P/FFO common, and even 25x P/FFO is not unattractive to me if we contemplate the truth that the corporate grows the way in which it does.

This REIT is our present third selection. We give Netstreit a present valuation goal of at least $24.2, an upside of 18.5% right here.

S&P World has an general common goal of $24.3 right here, in step with ours, and 10 out of 10 analysts contemplate the corporate a “BUY” or equal presently.

Nothing However Internet!

These are the three REITS we presently contemplate to be probably the most buyable available on the market amongst people who we observe.

This, in fact, doesn’t imply that there aren’t dangers to REITs and web lease ones particularly. Hire progress charges usually lag inflation fairly considerably, however regardless of this, many web lease REITs are on tempo to ship double-digit FFO progress charges for this 12 months.

Usually, such outsized progress charges come on account of mixing enticing exterior progress components which in flip offsets a decrease inner hire progress price.

The factor to keep watch over, and which (sadly) favors both scale-capable REITs or REITs with very low leverage is that price of capital is changing into ever-more vital on this market atmosphere.

“Free cash” is over at this level – and the REITs which have entry to progress alternatives that require capital have this for one among two causes. Low debt, permitting for gearing, or low price of debt, permitting for including extra (normally on account of scale).

It is inconceivable to say when this inflation atmosphere abates. What we are able to say is that we can’t be in 7-9% inflation ceaselessly. The present base case we now have is a 1-4% standardized price of inflation.

If we take a look at historic efficiency indicators for web lease REITs, these are likely to work alongside with expectations of inflation and long-term rate of interest patterns, versus short-term and precise, present charges of inflation. On this, they work very similar to their hire progress price – extra for the long run.

Many traders anticipate REITS to go down when charges go up – that is nothing new. The idea that REITs underperform in a rising rate of interest atmosphere is one we discipline typically – and let’s simply say that historic patterns don’t give this assumption any credence.

It doesn’t appear this fashion this time round both – as earnings assumptions and efficiency have saved web lease REITs comparatively excessive. Many web leasers have elevated their upsides, with Realty Revenue, EPR (EPR), Spirit Realty and others only some amongst them.

Inflation dangers are undoubtedly current – and we do acknowledge them. Nonetheless, neither historic nor present indicators for earnings progress give any kind of credence to the idea of a significant downturn.

Even with hire progress displaying an anticipated large lag to realized inflation numbers, these corporations nonetheless have double-digit FFO progress of their estimates – a number of of them, on the very least.

These causes, along with the fundamental attraction of those corporations, are why we proceed to spend money on web lease REITs, and why we imagine it’s best to contemplate doing the identical.

iREIT

As at all times, thanks for the chance to be of service!