Justin Sullivan

Hasbro (NASDAQ:HAS) has been urged as of late to rethink its funding in filmed leisure. In line with an SA information merchandise from the latter a part of August, the toy maker is contemplating its choices because it issues Leisure One, a $4 billion buy Hasbro made three years in the past.

The choices are to promote the content material studio, or promote components of it. If the corporate obtained out of the eOne enterprise altogether, it might merely license its IP to studios because it has already been doing. The eOne buy was purported to get Hasbro nearer to a direct Hollywood enterprise mannequin, to make the toy producer extra of a producer versus a passive participant that does not obtain the majority of a mission’s earnings.

However, Hollywood has a approach of spooking firms that try and play the sport; that goes particularly for a corporation like Hasbro.

Take into consideration what Hasbro is to a big extent: it mainly turns plastic into playthings. As such, it screens uncooked enter prices and watches inflation barometers and retains a watch on margins, and so forth. In different phrases, Hasbro is a by-the-numbers, economic-value-added concern that wishes to know the danger profile of any given capital funding.

Going Hollywood means, to some extent, that one cannot all the time let danger profiles rule the day. That is not to say Hasbro ought to make a bunch of unbiased movies for arthouses. One factor I all the time write about in relation to Hollywood enterprise fashions is: all the time assume commercially-minded in the beginning. Tentpoles, franchises, whether or not on silver or streaming screens, ought to be prime of thoughts in any C-suite.

Nonetheless, Hasbro did get the memo, the one that claims you want a narrative to associate with the plastic plaything to extend its model fairness. If a film equivalent to Star Wars can yield a massively profitable line of toys, then an current profitable set of toys may be the supply materials for movies and tv reveals. That solely stands to motive.

Nevertheless, Hasbro was content material for some time to permit others to do the heavy lifting and to easily take a smaller minimize, considering the large reward might be discovered within the promotional worth of its IP within the different media – i.e., gross sales would improve for playthings and collectibles tied to a Transformers or a Ouija board.

Long run, I consider Hasbro must be within the filmed-entertainment enterprise, and it might probably’t simply assume by way of hitting a single demographic. Going after the children market is actually essential and core, however going after adults can also be key to longevity in Tinseltown. That is why eOne was such an attention-grabbing acquisition to me: it made sense from the standpoint that Hasbro might make all types of content material, and generate all types of merchandise from stated content material. The decision from the activist investor to promote eOne ignores the truth that Hasbro can diversify its income stream by making content material equivalent to low-budget horror movies and broad R-rated comedies…and, sure, you may make a line of collectible figures/playsets to associate with any of that. eOne was a purchase order meant to increase alternative; promoting it now could be shortsighted and basically pulling an AT&T (T) transfer (i.e., purchase a media firm, then instantly panic and promote it). The activist name on this case is just to maneuver belongings round so a attainable pop within the inventory may be achieved – I simply do not buy the thesis. As a substitute, the thesis that investing in storytelling is a spot the place the toy maker ought to be is compelling and practically inarguable.

As has been talked about, although, SARS-CoV-2 actually masked the potential for the studio. That, and acquisition prices. The annual report discusses the losses the leisure phase has produced during the last couple years (beginning on web page 58): over $140 million in 2020, and over $90 million in 2021. Income (web page 57), nonetheless, jumped in 2021 to $1.1 billion from roughly $900 million. Over time, I anticipate the phase to do significantly better as Hasbro IP receives extra of a spotlight and administration learns the content-production ropes. Hasbro, too, has good money movement (web page 85) to assist issues alongside: going from 2019 to 2021, operational money movement was $650 million, nearly $980 million, and just below $820 million, respectively. Dividend funds and capital spending in every of these years was about $500 million. This is not to say the content material enterprise is not costly and will not hit the cash-flow assertion laborious at occasions, however Hasbro can reap the merchandising advantages of a strong movie slate to energy the corporate’s general enterprise targets.

Plus, administration has a superb maintain on what’s vital with this division. Again in April 2021, the corporate bought off the music funding held inside eOne. That divestiture yielded $385 million. Hasbro might establish different components of eOne which may not make sense to maintain; this may assist to pay attention a cohesive technique for the division, one that may concentrate on synergy with the toy IP portfolio in addition to a continued seek for new franchise concepts. Music, whereas an attention-grabbing enterprise, and one which has actually attracted quite a lot of funding capital by way of buyouts of assorted song-catalogue rights as of late, is one thing I consider is not as helpful for Hasbro (and I’ll say that will simply be based mostly on my bias towards filmed leisure as an asset). As a substitute, specializing in reveals and movies ought to promote higher synergy for the reason that visible arts are inclined to pack a extra highly effective advertising punch.

Promoting off stuff is an effective technique and possibly would have been wanted if Hasbro had bought Lions Gate Leisure (LGF.A) (LGF.B) some time again when it approached CEO Jon Feltheimer for a deal. Feltheimer apparently wished greater than Hasbro was keen to pay in order that transaction by no means got here to be, however each eOne and Lions Gate mainly strategy their enterprise fashions by stringing collectively little offers and investments alongside the way in which to a desired scale. For instance with eOne, Hasbro might see if it nonetheless is sensible to be part of Amblin Companions, Steven Spielberg’s group that features Comcast’s (CMCSA) Common Photos and Reliance Leisure.

If Hasbro did determine to unload some components, the abstract bullet factors of an general technique ought to be:

- Determine all IP on the toy facet that may be processed by the Leisure One ecosystem.

- Look to make merchandise equivalent to collective figures from nearly all acceptable IP on the leisure facet, even when it solely targets adults (for instance, perhaps there ought to be motion figures based mostly on the Yellowjackets sequence, assuming there are no already).

- Be sure you solely give a inexperienced gentle to materials that’s business in nature – edgy product that can both hit goal demos or go full-on four-quadrant.

- Watch out of budgets, so emulate the low-cost horror mannequin that many media firms have used.

- Take as a lot danger as attainable – i.e., do not mess around with too many co-financing constructions; take the danger to reap a bigger monetary return.

Leisure One might simply be a begin. As time goes on, the corporate might search for different acquisition targets – a small animation studio right here, a small comic-book IP concern there. All of the whereas the core enterprise of toys and video games (keep in mind that Hasbro owns Wizards of the Coast which distributes Magic: The Gathering and Dungeons & Dragons) helps to energy additional funding in Hollywood. The corporate may also use its experience as a toy/sport maker to draw expertise, maybe permitting monetary participation on that facet as a approach of decreasing compensation necessities on the content material facet (i.e., an even bigger proportion of merchandise gross sales in trade for rational backend offers, when acceptable – clearly Hasbro would need to hold 100% of merchandise rights for sure properties).

I’d urge Hasbro to all the time stay lengthy eOne, and Hollywood usually.

The Inventory

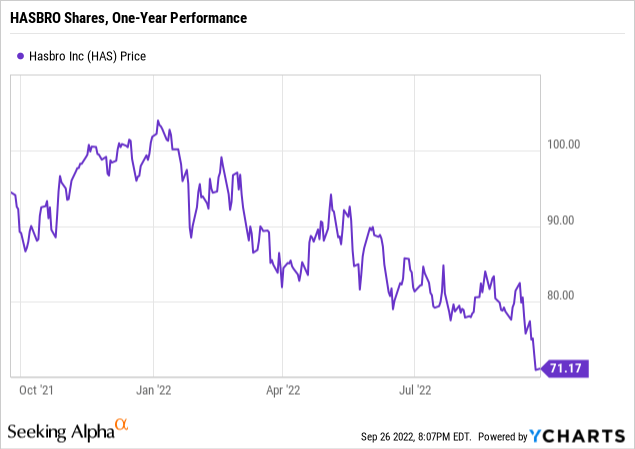

Clearly the market is what it’s, and the inventory as of this writing is simply above the $70 52-week low (at a value of $71). That is an enormous drop from $105, the excessive.

The SA valuation system provides the inventory a below-average present score. However there’s one facet that stands above the remainder.

The dividend yield proper now could be just below 4%. Hasbro has a superb dividend historical past, though the dividend had stagnated the final couple years earlier than just lately rising from $0.68 per quarter to $0.70 per quarter.

It is comprehensible, given market circumstances throughout SARS, however at this yield, Hasbro is trying engaging. Nevertheless, it goes nearly with out saying that the volatility could supply even higher costs beneath $70, so traders must hold that in thoughts.

Nonetheless, I’ve to charge this a long-term purchase, making an allowance for the dividend and the portfolio, in addition to the alternatives to increase into Hollywood. I do not at present personal the inventory; I did beforehand however bought for different causes owing to portfolio administration on the time. Sooner or later, I hope to be again in once more.