Wendy Townrow/iStock by way of Getty Photographs

What Are Advertising and marketing Exclusivity Gross sales and Why Is Amyris In a position to Promote Unique Advertising and marketing Rights for a Particular Use At Such a Excessive Worth vs. Promoting Full Possession of the Molecule?

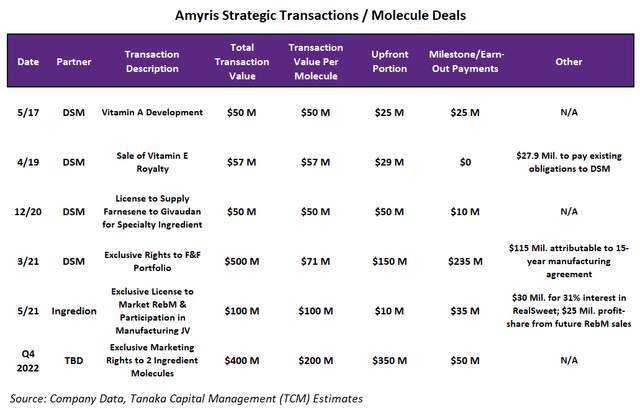

In 2021, Amyris (NASDAQ:AMRS) offered “advertising exclusivity” for its portfolio of seven Taste and Perfume molecules to DSM for $500 million with $150 million upfront. Amyris additionally offered to Ingredion advertising exclusivity for its RebM sweetener and a minority share of a producing JV for $100 million with $10 million upfront.

These weren’t outright molecule gross sales just like the sale of Vitamin A in 2017 and Vitamin E in 2019. They’re as an alternative the sale of unique advertising rights to a trusted accomplice that Amyris determines can higher entry the buyer finish markets sooner than Amyris may by itself. For instance, CFO Han Kieftenbeld defined Amyris tried to get meals and beverage corporations to make use of Amyris’ Reb M no calorie sweetener of their merchandise however solely had 2 gross sales reps vs. the 1500 reps Ingredion can use to method Coke, Pepsi and so forth. It made sense to promote the unique advertising rights for RebM to Ingredion whereas sustaining the rights to make use of RebM in Amyris’ personal PureCane sweetener model.

In promoting solely the unique advertising rights, Amyris nonetheless retains the possession of the IP and the manufacturing of the elements at a gross margin we estimate to be about 20-30% going ahead at Barra Bonita with 2/3 decrease prices than through the use of CMOs as defined in our August 8, 2022 Looking for Alpha “Amyris’ Vertically-Built-in Enterprise Mannequin Transitioning From Funding Mode To Payoff Mode.

There would additionally usually be royalty sort earn-outs that Amyris would obtain because the exclusivity accomplice reaches sure quantity ranges. We imagine that earn-outs for a median exclusivity deal may add about 2000 foundation factors on a internet foundation to the 30% gross margins that Barra Bonita-produced molecules would have had with out an exclusivity deal. This boosts that molecule’s ingredient gross margin to shut to 50% which is sort of excellent for the elements or specialty chemical compounds industries.

The business accomplice, on this case Ingredion, would have the best to be the unique purchaser of the Amyris RebM off its manufacturing strains, permitting Ingredion to have whole management over advertising and distribution of the Amyris RebM. In essence, Ingredion turns into the one marketer of the Amyris fermented and processed RebM to the 1000’s of meals and beverage corporations globally, together with Pepsi or Coke.

Being the one provider may be enormously worthwhile if the product turns into in nice demand as DSM has seen with vanillin within the final 12 months. We perceive that vanillin volumes have gone by the roof which is one purpose that Amyris is anticipating increased earn-outs from DSM and improved money move in 2022.

Why Did Amyris Begin Promoting Advertising and marketing Exclusivity for its Substances Solely a Couple of Years In the past and Not In Prior Years?

Early this 12 months I requested CEO Melo why Amyris was in a position to negotiate offers to in impact promote advertising exclusivity and ship its bio-produced molecules to 1 and just one business accomplice at a premium worth and obtain such giant funds. He stated {that a} couple years in the past they realized that a few of its business companions would favor to turn into the only purchaser of Amyris’ Hero Substances and would pay a premium for this privilege.

CEO Melo went on to clarify that they realized these exclusivity offers may very well be made simpler by not promoting its elements to all prospects beneath multi-year contracts. If approached by a single market main industrial buyer who would pay a premium to turn into the unique distributor or person, Amyris wouldn’t be encumbered by pre-existing long run provide agreements with its current prospects.

Two years later, Amyris is now ready to have the ability to promote exclusivity for extra of its elements at a better worth, thanks. We’re simply now realizing that that is growing into a big and more and more extra frequent profit-enhancing characteristic of the Amyris enterprise mannequin which we didn’t totally respect once we revealed our final Looking for Alpha article.

It Begins With The Finest Engineered Organisms, Precision Fermentation and Downstream Processing to Produce the Most Pure Molecules on the Lowest Price

The “Bio-manufacturing Business” is new to many and has been evolving quickly after a gradual begin 10-15 years in the past because of the demise of biofuels from the final oil worth collapse. (I choose to make use of the time period “bio-manufacturing” somewhat than “artificial biology” which means the merchandise are artificial. The time period derives from the artificial engineering of latest strains of organisms that produce the molecules which are precisely an identical with these present in nature. The molecules are usually not artificial, the organisms that produce them are. The time period “SynBio” additionally does little to mirror the significance of the opposite half of the manufacturing course of, precision fermentation and downstream processing required for bio-manufacturing.)

The power to supply exclusivity at a materially increased worth exists as a result of Amyris is the one firm within the business in a position to design organisms and really bio-manufacture by fermentation and downstream processing molecules reliably at scale — and at superior purity and decrease prices. Every molecule is uniquely produced in a course of proprietary to Amyris. We are going to turn into extra anxious if we see a competitor emerge that may produce the identical molecule effectively at scale, however we do not see any on the horizon. In reality, we imagine that bio-manufacturing rivals will most definitely keep away from competing straight with Amyris which is now well-known to have the bottom price manufacturing and can probably selected to supply a number of the different 10,000s of recognized molecules.

Why Are We Simply Studying Now About This Revenue Enhancing Advertising and marketing Exclusivity Technique?

The business is so new and altering so shortly that its members are having to regulate methods “on the fly” very similar to through the Digital Revolution. Within the meantime, traders ought to be glad to know that Amyris is growing modern enterprise methods together with its nice science to maximise returns shareholders and companions.

For us, the lightbulb second was being shocked by administration responses to questions on the 2022 Q2 convention name on August 9, 2022 in regards to the progress of the continued H2 2022 $400 million two molecule exclusivity sale. CEO Melo responded “we have already been approached for one more molecule in our portfolio that we anticipate to … find yourself doing a while in 2023 … we’re not at all carried out … We monetize the advertising rights as a result of we won’t market to everyone on a regular basis.”

This clearly steered extra frequent molecule exclusivity gross sales sooner or later. As for justification, CEO Melo went on to obviously recommend that Amyris will proceed to deal with Shopper finish markets: “We have to focus our personal direct functionality on the Shopper and let our companions deal with the B2B gross sales.”

We imagine that the rising degree of curiosity in shopping for exclusivity on the a part of its business companions could have even caught Amyris abruptly. In any case, the primary exclusivity deal was solely signed in March of final 12 months with DSM after which with Ingredion in Could of 2021. These first two “exclusivity gross sales” adopted extra conventional molecule asset gross sales in 2017, 2019 and 2020 the place Amyris offered the possession of the mental property (engineered yeast strains, enzymes, and so forth.) and rights to supply these molecules:

Amyris firm information and Tanaka Capital Administration Estimates

Notice: All tables had been ready by my accomplice Benjamin Bratt, CFA

Causes Why We Anticipate Advertising and marketing Exclusivity Offers to Turn into Extra Widespread for Amyris, More likely to Occur Each Yr and Ought to Subsequently Be Included in Earnings Fashions:

- We thought Amyris was lucky to have curiosity in two exclusivity offers signed in 2021 at giant premium costs ($500 million from DSM and $100 million from Ingredion). Then Amyris introduced two giant molecule exclusivity offers anticipated to shut in 2022 for a complete of “about $350 million upfront money and round $400 million of whole worth” as talked about on the Q2 2022 convention name on August 9, 2022. We perceive that there’s curiosity from a number of patrons, suggesting growing business consciousness of the worth of unique provide of a molecule from Amyris’ fermentation strains.

- Shock early curiosity in a molecule for 2023 talked about within the August 9, 2022 convention name. We imagine it may very well be for a cannabinoid CBD, CBG or for squalene which may very well be category-specific for beauty use or to be used as a vaccine adjuvant as talked about in our September 30, 2020 Looking for Alpha article “R&D Surprises Provide Amyris Unbounded Upside”. Our November 19, 2021 Looking for Alpha piece “Amyris Shopping for Alternative Created by Q3 Miss, Mega Convert and Potential Revolutionary COVID Vaccine” additional discusses the usage of the Amyris squalene adjuvant within the ImmunityBio/Amyris/AAHI 2nd Gen COVID vaccine human trials at present underway in South Africa and Botswana.

- The seen bodily presence of a large state-of-the-art 6-fermentation tank facility in June 2022 that’s already brewing tons of vanillin per day in addition to RebM and farnesene and shall be producing 16-20 molecules by the top of the 12 months is proof constructive that Amyris can ship quantity for a brand new accomplice in a short time.

- Vanillin and Reb M exclusivity offers (DSM and Ingredion, respectively) are producing in quantity and are apparently changing into nice success tales for Amyris’ two business companions. We imagine “success sells itself” and can inform different potential companions what new exclusivity offers may ship to them.

- A big evergreen R&D pipeline of 25 molecules beneath improvement will ship 5-6 new molecules yearly to feed into the exclusivity candidate pool that Amyris can market to business companions, outdated and new. We’re assuming just one new exclusivity candidate per 12 months the following few years which may very well be conservative.

- CEO Melo has identified to me it is very important understand that Amyris has added far more helpful molecule candidates to its R&D pipeline. We imagine that this might end in extra helpful molecules with bigger upfront exclusivity charges and probably higher upside in earn-outs in future years.

- It seems that cycle occasions are shortening between the manufacturing of a brand new molecule, supply of samples and negotiations to signal exclusivity offers to a couple months from 1-2 years prior to now. This means that prior successes appear to be promoting the worth of the exclusivity mannequin to new companions.

- Amyris is aware of it does not have the bandwidth to deal with every new vertical because the bio-manufacturing revolution proliferates broadly to extra new industries. As fermentation turns into extra accepted and acknowledged as a viable supply of pure elements at a decrease price, Amyris may turn into the go-to supplier or foundry for a lot of new business verticals as TSMC has carried out for the semiconductor business.

- By gathering giant upfront funds for promoting exclusivity to particular person companions, Amyris can re-liquify its steadiness sheet sooner than many imagine. As well as, by promoting exclusivity at a premium worth, we estimate Amyris would possibly increase costs and margins by about 20% which all goes to the pretax backside line for these elements. Importantly, these exclusivity worth premiums ought to shorten Amyris’ path to profitability as we imagine that will probably be in a position to signal exclusivity offers annually within the subsequent few years and that analysts must embody these earn-out premiums of their earnings fashions as we’ve carried out beneath.

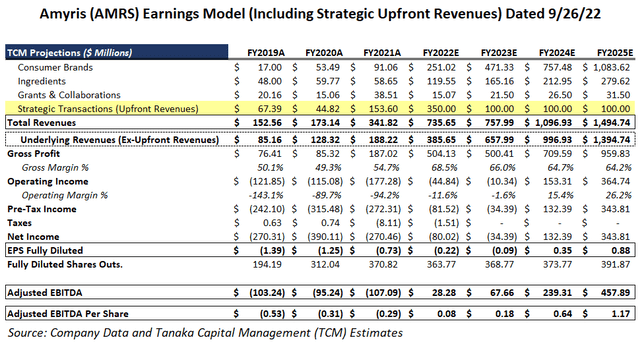

Under, my accomplice Ben Bratt is now incorporating Exclusivity Upfronts and annual earn-outs in our 2022-2025 Amyris earnings and money move mannequin.

Close to time period, including $350 million of upfront revenues and pretax income by 12 months finish makes This fall 2022 worthwhile at $0.85/share of GAAP revenue. Assuming an extra $100 million per 12 months of upfronts for one molecule advertising exclusivity deal per 12 months for every of the following 3 years would add about $0.25/share to pretax EPS in 2023, 2024 and 2025. This might convey 2023 near worthwhile at a lack of ($0.09/share) and make 2024 solidly worthwhile at $0.35/share of earnings growing to $0.88/share in 2025.

Closing the 2 molecule exclusivity gross sales introduced for 2022 would make our 2022 full 12 months money move estimate a constructive $0.08/share of Adjusted EBITDA. We estimate one exclusivity sale per 12 months with $100 million upfront would assist generate estimated constructive EBITDA of $0.18/share in 2023, $0.64/share in 2024 and $1.17/share in 2025:

Amyris Earnings Estimates Mannequin Together with Strategic Upfront Revenues to 2025 (Amyris firm information and Tanaka Capital Administration Estimates)

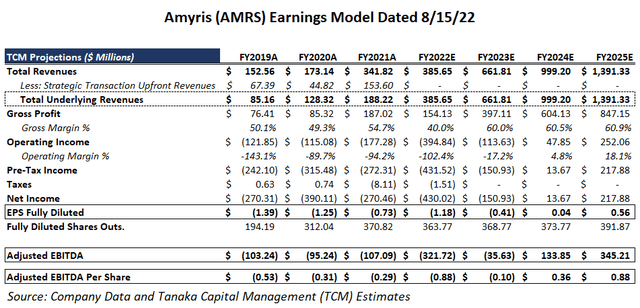

For comparability functions, beneath is our post-Q2 Earnings Mannequin previous to together with ongoing advertising exclusivity gross sales:

Prior Amyris Earnings Mannequin dated 8/15/22 (Amyris firm information and Tanaka Capital Administration estimates)

How Lengthy Will this Window of Alternative Final?

Whereas it’s in all probability apparent that this skill to cost premium costs for advertising exclusivity exists as a result of no different firm is at present in a position to take action, we’re assured that Amyris will be capable of preserve its lead in quantity, effectivity and price for the foreseeable future as its present lead could be about 5 years.

Intel maintained its 2-5 12 months lead in microprocessor efficiency/price for 3 many years and whereas a tall order, we imagine that Amyris has an analogous multi-year head begin given its very giant patent pool in yeast design, enzymes, fermentation and downstream processing in addition to unpublished know-how benefits and future advances and economies of scale which we mentioned in our earlier evaluation.

We Have Validated The Thesis That Exclusivity Offers May Doubtlessly Improve Ingredient Revenue Margins by 20% and Present $100 million of Upfront Charges Per Molecule

After bouncing our theories on the potential monetary advantages of Amyris’s distinctive new Exclusivity Premium addition technique off of administration, we at the moment are comfy assuming that Amyris will probably be capable of signal at the least one deal per 12 months going ahead and that deal sizes may very well be estimated to common $100 million or extra of upfront charges and improve Ingredient pricing and margins by about 20% factors. We are going to focus on how the Ingredient Exclusivity offers mix with the brand new Barra Bonita plant’s 2/3 discount in Price Of Items Offered (COGS) for Substances in our subsequent article to focus on its vital potential to speed up Amyris’ path to sustainable profitability.

Whereas new methods must be born out in apply over repeated cycles, we’re inspired by the monitor file of the 2 Advertising and marketing Exclusivity offers signed in 2021, the 2 giant offers nearing completion in This fall in 2022 and the early curiosity in a deal for 2023.

Dangers:

- Pure disasters which may disrupt the secure provide of sugar cane to the Barra Bonita fermentation plant in Brazil.

- A rebound in COVID may disrupt ingredient manufacturing and delay the timing of exclusivity earn-outs.

- Delays in closing or modifications in phrases on further Advertising and marketing Exclusivity gross sales.

- Disruptions within the ongoing Barra Bonita plant startup, however at the least three of the 5 strains have reportedly been introduced up and operating since June.

- Look of competitors sooner than anticipated for any of the prevailing ingredient molecules at aggressive pricing and purity however we aren’t conscious of any fermentation services with related capabilities.

Timing Is Essential

We acknowledge that reaching profitability was delayed 2 years by Amyris’ administration choice to speed up investments and spending on launching 8 new Shopper Manufacturers and making a number of acquisitions along with constructing new downstream vegetation to bolster its personal provide chain. These investments burned money and delayed our funding time horizon however strengthened Amyris by making its enterprise mannequin far more full.

Following this 2-year hiatus, we really feel it’s much more essential for us to explain this new strategic Ingredient Advertising and marketing Exclusivity catalyst that we imagine can really speed up Amyris reaching profitability and will probably be in our lifetime.

We observe that we nonetheless firmly imagine that Amyris may very well be the following Tesla (TSLA) for all the explanations we identified in our first Looking for Alpha article again on Could 29, 2020 “Why Amyris May Be the Subsequent Tesla”.

We’d be remiss if we did not level out that Tesla’s inventory tripled within the first 4 months and has appreciated 17 occasions since reporting its first worthwhile quarter for Q3 2019, and Amyris may very well be reporting its first worthwhile quarter very quickly.

We are going to current our different monetary fashions within the subsequent Looking for Alpha article which can even focus on why Amyris ought to deserve a premium valuation (just like Tesla and Apple (AAPL)). Our final Looking for Alpha article described the distinctive Amyris enterprise mannequin together with its proprietary science, know-how, skill to scale precision fermentation and downstream processing, the worth of Shopper Manufacturers producing 100 occasions the income per milliliter of product and 60-70% gross margins, a cutting-edge fermentation facility lowering Ingredient COGS by 2/3 and now the power to layer in advertising exclusivity rights to probably increase Ingredient gross margins by 20% to the 50% degree. This opens up a multi-lane tremendous freeway to new markets for the rising Bio-manufacturing Industrial Revolution to journey within the years forward.