Lisa Maree Williams

Microsoft (NASDAQ:NASDAQ:MSFT) has made a behavior of coming into industries comparatively late and subsequently dominating them. The corporate’s quickly increasing presence because the quantity two participant in cloud computing is an ideal instance of this. Even supposing Microsoft’s Azure turned commercially accessible ~4 years after Amazon’s (AMZN) AWS, Azure is now scorching on the tails of AWS by way of market share.

Though Microsoft nonetheless makes a large portion of its income on its conventional companies, from its Home windows OS to its software program instruments, the corporate has expanded its attain dramatically lately. Microsoft’s clever cloud enterprise, as an illustration, generated $20.9 billion in This autumn and reveals no indicators of slowing down. Microsoft’s means to repeatedly adapt to a quickly shifting technological panorama is to not be underestimated.

Leveraging Software program Experience

Microsoft’s means to quickly acquire market share in extremely aggressive sectors has a lot to do with its industry-leading software program capabilities. Microsoft’s progress in cloud is an ideal instance of how the corporate is leveraging its software program experience for outsized success. This feat has been particularly spectacular contemplating the expertise heavyweights concerned within the cloud house, most notably Amazon’s AWS.

On the finish of the day, success within the cloud enterprise comes all the way down to an organization’s means to fabricate/buy {hardware} at a comparatively low value and to supply high-quality cloud providers. Given that almost all giant expertise companies have the power and assets to satisfy the previous requirement, the actual differentiator amongst such firms is the power to supply nice cloud providers. Microsoft stands out on this entrance on account of its software program experience and established software program ecosystem.

There are numerous cloud providers for a variety of use instances, i.e. compute, storage, database, serverless, and so on. The a whole bunch of well-liked cloud providers like Lambda, Lively Listing, EC2, CosmosDB, DynamoDB, Memorystore, and so forth, are all competing for enterprise each on the smaller-scale enterprise and enormous enterprise fronts.

Microsoft’s expertise constructing software program and its established Home windows ecosystem has allowed the corporate to leapfrog many well-established cloud suppliers in lots of respects. Even cloud heavy-weight AWS is struggling to maintain up with Microsoft relating to the cloud enterprise section. Whereas AWS servicers are simpler to make use of and perceive, Azure is extra geared in direction of the enterprise market.

Microsoft’s pre-existing Home windows ecosystem additionally provides the corporate an edge within the {industry}. Many organizations are already accustomed to Microsoft merchandise, from its working system to its suite of productiveness instruments, Microsoft 365. This makes the transition to the Azure cloud platform a no brainer for such organizations. For the organizations that pure Home windows outlets, of which there are a lot of, selecting Azure as a cloud supplier is a no brainer.

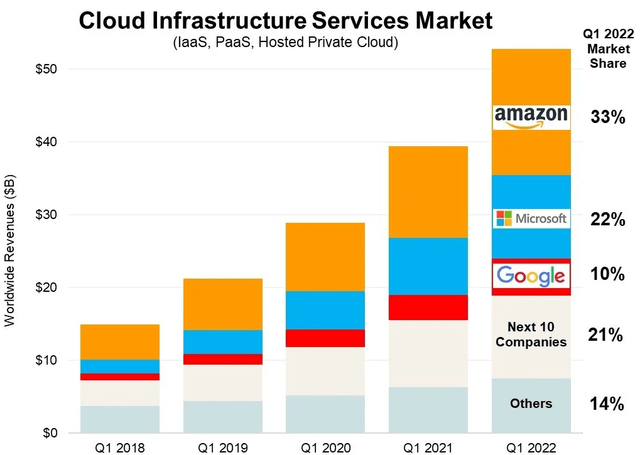

Microsoft continues to take market share within the extremely aggressive cloud market.

Synergy Analysis Group

Underappreciated Gaming Ecosystem

A lot of the concentrate on Microsoft has been centered round its software program choices and cloud enterprise. Whereas these companies nonetheless account for a majority of Microsoft’s income, the corporate’s burgeoning gaming division holds probably the most long-term progress potential. Microsoft has had a powerful presence in gaming for many years now with Xbox. Nonetheless, the corporate is beginning to put much more consideration on its gaming division.

Microsoft not too long ago acquired gaming behemoth Activision Blizzard for $68.7 billion. In what’s the {industry}’s largest acquisition by far, Microsoft now owns a number of the most iconic gaming franchises of all time. Titles like Name of Obligation, World of Warcraft, and Overwatch now all fall beneath Microsoft’s umbrella. The addition of Activision Blizzard’s properties to Microsoft’s already expansive gaming library positions the corporate to be the dominant pressure in gaming for the foreseeable future.

Microsoft’s imaginative and prescient to be the Netflix (NFLX) of the fast-growing online game {industry} seems to be coming to fruition. The corporate’s XBox Recreation Go and Cloud Gaming providers already made waves within the gaming {industry}. With the addition of gaming powerhouses like Activision Blizzard, Microsoft seems set to dominate the gaming panorama over the long run. No different firm is even near catching as much as Microsoft by way of constructing a gaming ecosystem.

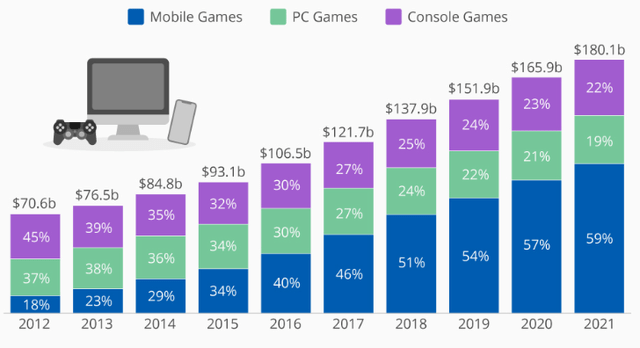

In keeping with Statista, the online game {industry} was value $180.1 billion {dollars} in 2021. Actually, gaming has displaced all different main types of leisure by way of world income, beating out each music and flicks mixed. Microsoft’s present technique of constructing out an unparalleled gaming ecosystem is a smart transfer contemplating the place the {industry} is headed.

The online game {industry} continues to develop at an extremely quick tempo regardless of its appreciable measurement.

Statista

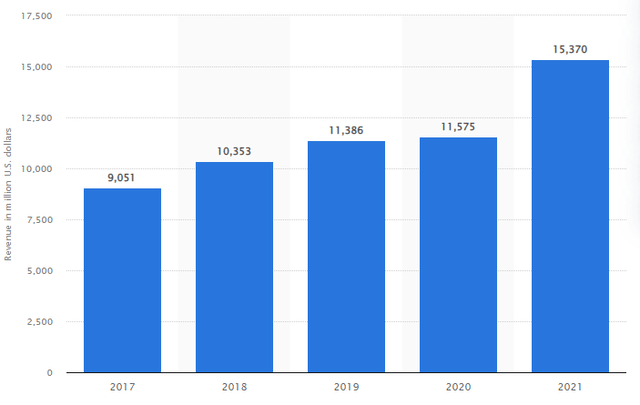

Microsoft reported ~$15.367 billion of gaming income in 2021, which represents a pointy improve from the corporate’s $11.57 billion in 2020. As extra shoppers are in a position to get their palms on the most recent consoles within the coming years and as extremely anticipated titles launch, Microsoft ought to see this determine develop considerably.

Microsoft Gaming Income

Statista

Challenges Forward

Microsoft dangers spreading itself too skinny with its increasing enterprise ventures and quite a few acquisitions. What’s extra, competitors is ramping up dramatically within the firm’s main enterprise segments. Whereas Microsoft nonetheless has a stable grip on the non-public computing software program and productiveness markets, the identical can’t be mentioned about lots of the firm’s different companies.

Given Microsoft’s stunning success within the cloud, it’s simple to overlook that the cloud {industry} continues to be dominated by AWS. On prime of this, different expertise giants like Alphabet (GOOGL) and IBM (IBM) are beginning to make investments much more closely within the cloud house, which isn’t stunning given how worthwhile it has been for each Amazon and Microsoft.

The gaming {industry} presents its personal set of distinctive challenges to Microsoft. For one, the online game service mannequin might not be a long-term winner just like the video streaming service has been for Netflix (NFLX). Given that customers spend much more time on single sport titles versus time spent on single film/television titles, Microsoft’s Recreation Go subscription mannequin could not have the identical pull as a Netflix or Disney+.

It might finally make extra sense to purchase video games individually, given common shopper habits. Not like a film or TV present the place most shoppers watch a few times, video games have a far higher repeatability issue. As such, Microsoft is taking a big danger by focusing so closely on a Netflix-like online game service mannequin.

Conclusion

Microsoft reported a This autumn income of $16.6 billion, $20.9 billion, and $14.4 billion for its productiveness/enterprise processes, clever cloud, and private computing segments, respectively. All three of those segments skilled reasonable progress regardless of comparatively powerful market situations. Even supposing Microsoft is returning to pre-Covid ranges, the corporate has seen its valuation drop ~30% to $1.8T. Given Microsoft’s progress alternatives and its current downturn, the corporate seems comparatively low cost at its present market capitalization.