xeni4ka

Final week, I wrote an article wherein I argued that actual property funding trusts (“REITs”) are anticipated to generate increased returns than rental properties as a result of they take pleasure in many structural benefits and commerce at materially decrease valuations.

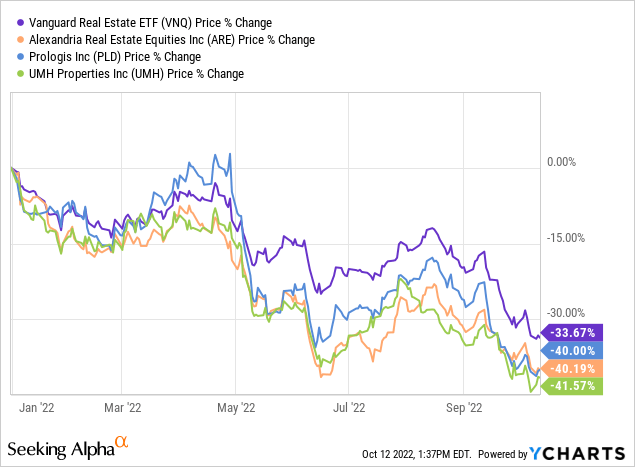

So far this yr, REITs (VNQ) have dropped by 33% on common, and plenty of particular person REITs have dropped by nearer to 40%. Good examples embody Alexandria (ARE), Prologis (PLD), and UMH Properties (UMH).

But, the worth of the true property that they personal has not modified materially. In consequence, they’re now priced at steep reductions relative to the worth of the true property they personal.

As such, REIT buyers at this time have the chance to purchase actual property for as little as 50 cents on the greenback by REITs and benefit from the added advantages of diversification, skilled administration, restricted legal responsibility, and liquidity – without spending a dime on high of it.

I imagine that the decrease valuation, coupled with all of the structural benefits loved by REITs, ought to lead to increased returns than what’s achievable for rental property buyers.

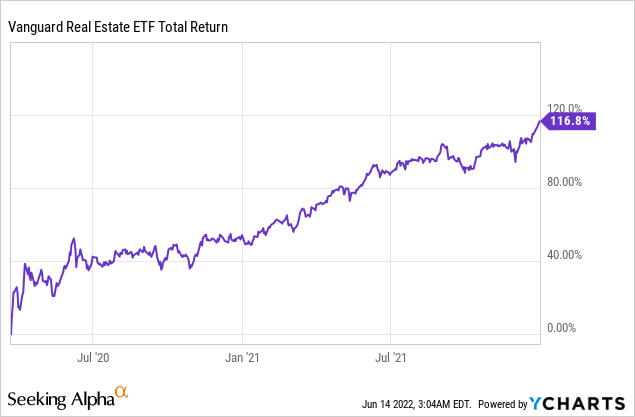

The final time REITs have been so low cost, it was early into the pandemic after they bought off closely, and so they proceeded to greater than double within the subsequent yr:

YCHARTS

However, to my shock, many readers appeared to disagree.

Rental buyers refuse to simply accept that individuals who merely purchase REITs are more likely to earn increased returns than them regardless of placing in rather a lot much less effort and taking much less danger.

The principle pushback that I preserve receiving in remark sections and through direct messages is that…

-

You should buy rental properties with mortgages.

-

Rental properties are extra resilient to rising rates of interest.

-

You take pleasure in vital tax benefits with rental properties.

… and so I made a decision to put in writing this follow-up article specializing in these actual factors as a result of there are numerous misconceptions that must be addressed. Let’s go over every of those three factors one after the other:

You should buy rental properties with mortgages

Rental property buyers argue that REITs can’t compete with rental property investments as a result of you possibly can’t purchase them with a mortgage.

Naturally, if you’re having fun with a lot better leverage, then you might be additionally anticipated to earn increased returns. Rental buyers generally purchase properties with as a lot as 80% leverage within the type of a mortgage, which materially will increase their returns.

However there’s a main false impression right here.

What rental buyers seem to disregard is that REIT buyers take pleasure in the very same advantages of leverage – with out truly having to take a mortgage themselves.

That is as a result of what you might be shopping for as a REIT investor is the fairness. It’s the fairness worth that is traded on the inventory market. REITs then take this fairness and add debt on high of it to leverage your investments.

Due to this fact, a $100,000 funding in a REIT will generally characterize $200,000 and even $300,000 price of property. What you see is the fairness worth however the overwhelming majority of REITs additionally use leverage.

So it’s flawed to say that REITs do not take pleasure in the advantages of leverage. The distinction right here is that REIT buyers needn’t tackle mortgages themselves. The REIT does it for you already. That is preferable as a result of REITs are sometimes in a position to get higher phrases than you’ll and it additionally protects your private legal responsibility. As a shareholder of a REIT, you might be by no means personally chargeable for the entire debt, however you continue to take pleasure in its advantages.

Moreover, should you suppose that the leverage of a REIT is inadequate, you possibly can all the time tackle extra debt with a margin mortgage or one other supply. This isn’t wanted, however it is usually an possibility for extra aggressive buyers.

Rental properties are extra resilient to rising rates of interest.

The second level that I’ve seen some buyers make is that REITs are extra closely uncovered to the chance of rising rates of interest. They seem to justify this level by stating the latest drop in REIT share costs and evaluating that to the better resilience of property values.

However this logic is flawed.

Sure, REITs are down considerably in 2022, however this isn’t simply because rising rates of interest are negatively impacting the basics of REITs.

REIT steadiness sheets are at this time the strongest of their historical past with simply 35% LTVs on common, largely fastened fee debt, and lengthy maturities. Due to this fact, the affect on their fundamentals shouldn’t be materials. REITs have truly been rising their money circulation at a fast tempo in 2022 and greater than 100 REITs have even hiked their dividend funds.

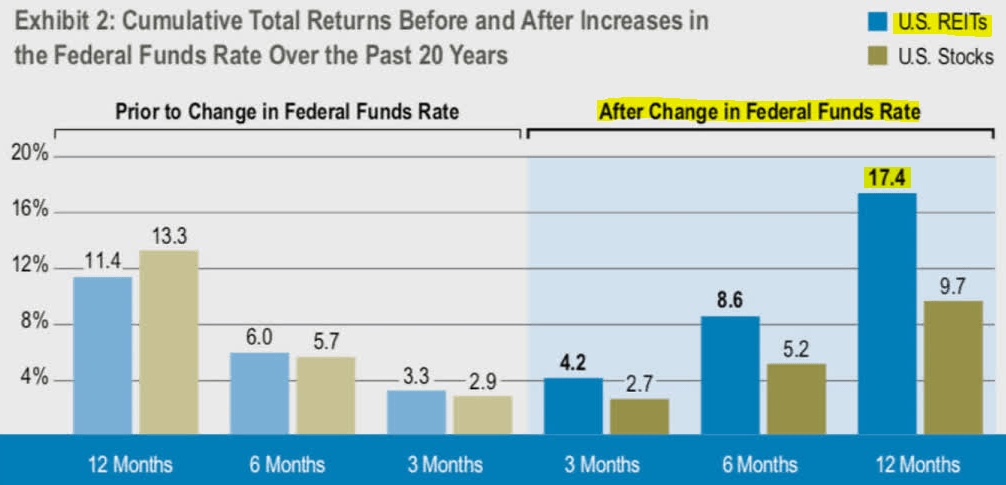

Traditionally, REITs have truly generated excessive whole returns throughout most occasions of rising rates of interest. On common, they’ve generated a 17% return within the 12 months following a fee hike up to now.

Cohen & Steers

So merely wanting on the latest inventory market efficiency is kind of deceptive and tells you nothing in regards to the future. The inventory market is risky and does humorous issues at occasions, however the fundamentals of REITs are resilient to rising rates of interest, and their valuations are additionally now closely discounted, which ought to present margin of security.

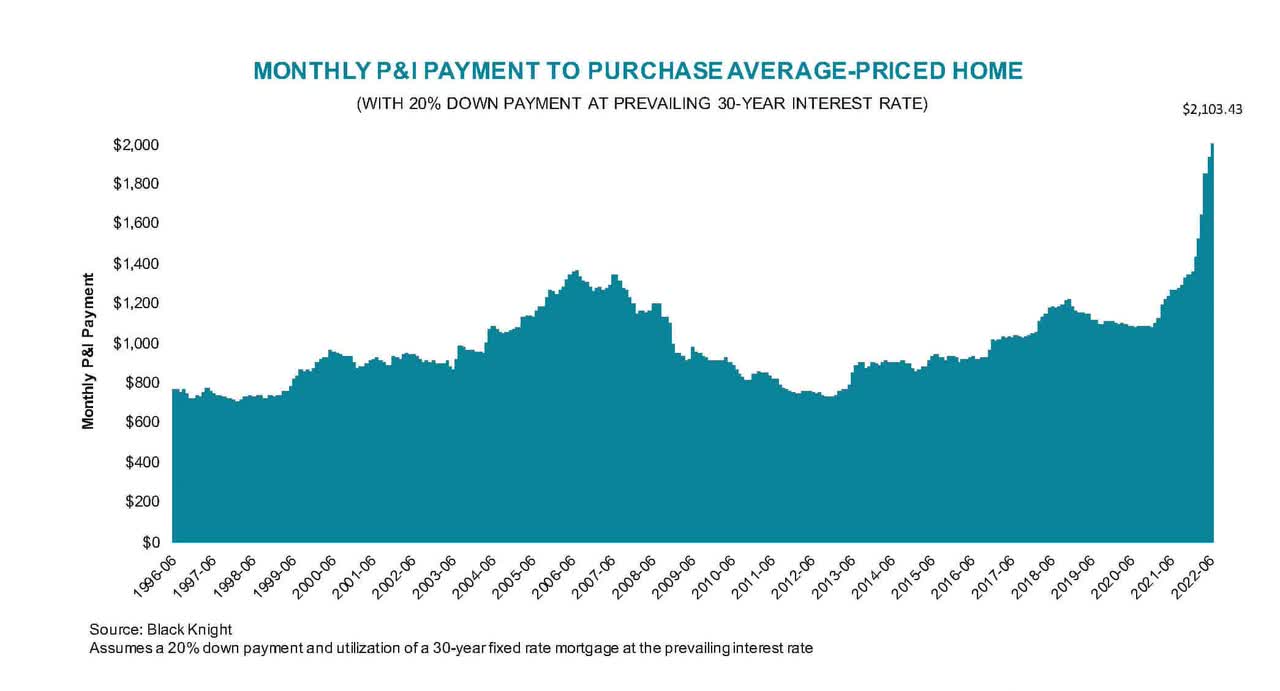

I’d argue that rental properties are literally way more uncovered to the detrimental penalties of rising rates of interest. It’s because most rental buyers use way more leverage than REITs. As an alternative of 35% LTVs, rental buyers will generally use as much as 80% LTVs to finance their properties. As a result of the debt was so low cost lately, the house market was getting bubbly. Now charges are rising and, because of this, residence affordability has dropped to a multi-decade low:

Black Knight

This clearly reveals you that the house market was artificially propped up by the ultra-low charges and that the previous values is probably not sustainable in at this time’s rising fee setting. In different phrases, residence costs are more likely to drop sooner or later, hurting the returns of rental buyers.

REIT buyers are significantly better protected as a result of:

-

Solely 2 (AMH; and INVH) out of 200+ REITs put money into single-family houses. Business actual property shouldn’t be as closely uncovered to rising rates of interest.

-

REITs use rather a lot much less leverage than most rental buyers.

-

In contrast to residence costs, REIT share costs have already dropped closely, which limits future draw back danger and offers margin of security.

You take pleasure in vital tax benefits with rental properties

The ultimate argument of rental buyers is that they take pleasure in appreciable tax benefits that can enable them to outperform REITs.

Once more right here, there are many misconceptions which can be inflicting rental buyers to overestimate the tax advantages of leases and underestimate these of REITs.

Sure, rental properties might be depreciated, which permits buyers to defer the taxation of a portion of their money circulation. However depreciation is not a tax break, it’s only a deferral device. It lowers the price foundation of your property, which signifies that you may be hit with a good bigger tax invoice sooner or later while you promote your property at a revenue. You might defer the tax invoice even additional by doing a 1031 and redeploying the proceeds into one other property, however once more, you might be simply deferring taxes, not eliminating them. This additionally means that you’re caught with the true property for the remainder of your life, until you settle for to pay the tax invoice. This might have vital oblique prices as a result of you’ll lose flexibility. At occasions, actual property might develop into overpriced and unattractive as an funding. Even then, you will not be capable of promote to reinvest elsewhere. Additionally, the 1031 rule has typically been rumored to be eradicated and this can be a actual risk someday sooner or later.

REITs, however, additionally permit you to defer taxes by holding them in a tax-deferred account, however you take pleasure in a lot better flexibility over your funding. If and when REITs develop into unattractive, you possibly can simply promote them and reinvest elsewhere. Moreover, REITs are very tax environment friendly even when held in a taxable account, and people tax advantages are severely underestimated:

-

REITs are totally exempt from all company taxes, however nonetheless provide the restricted legal responsibility advantages of an organization.

-

REITs usually solely pay out 50-70% of their FFO within the type of dividends. Because of this 30-50% of the money circulation is tax deferred since it’s retained and reinvested by the REIT.

-

A portion of the money circulation that is paid within the type of dividends is often categorised as “return of capital” which can be tax deferred.

-

The portion of the dividend that is taxed enjoys a 20% deduction.

-

And eventually, about 2/3 of REIT returns truly come from appreciation, which can be tax-deferred. REITs usually are sooner development / decrease yield investments when in comparison with rental properties, which will increase their tax effectivity.

So, no, rental properties don’t take pleasure in materials tax advantages that will make them much more rewarding than in any other case.

I truly pay fewer taxes investing in REITs than in rental properties.

Backside Line

The rationale why I like the subject of REITs vs. Rental properties is that there are sturdy opinions on each side and there are many misconceptions.

I’ve invested in each and analyzed this matter for years. I’ve even written tutorial analysis papers about it. And the principle conclusion is that REITs are rewarding usually, and that is significantly true when they’re discounted relative to rental properties. That is the case at this time, and because of this I’m shopping for REITs as an alternative of rental properties.