gesrey

The ProShares UltraShort Yen ETF (NYSEARCA:YCS) has been among the best performing funds in 2022 as coverage variations between the Fed and the BOJ has led to dramatic declines within the Japanese yen. Whereas the elemental driver behind YCS efficiency stays sturdy, the weak Japanese yen is now drawing policymaker consideration. Buyers ought to have one foot out the door, able to e book their winnings from the YCS ETF if/when the BOJ adjustments coverage.

Fund Overview

The ProShares UltraShort Yen ETF seeks to supply traders with -2x publicity to the each day returns of the Japanese yen, relative to the U.S. greenback. The YCS ETF has $52 million in belongings.

Technique

The YCS ETF achieves its funding goal by holding Japanese yen by-product devices, and rebalancing the publicity each day such that the -2x each day publicity is maintained.

Portfolio Holdings

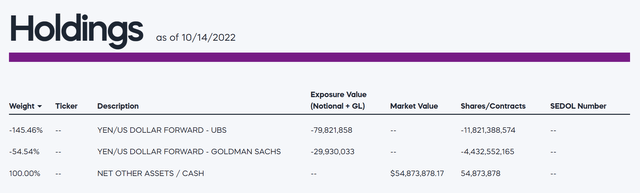

The YCS ETF’s funding portfolio could be very simple. It holds money and JPY/USD ahead contracts with main funding banks reminiscent of UBS and Goldman Sachs (Determine 1). Each night time, relying on the each day actions of the JPY/USD relationship, the YCS ETF adjusts its holdings.

Determine 1 – YCS Holdings (ProShares)

Returns

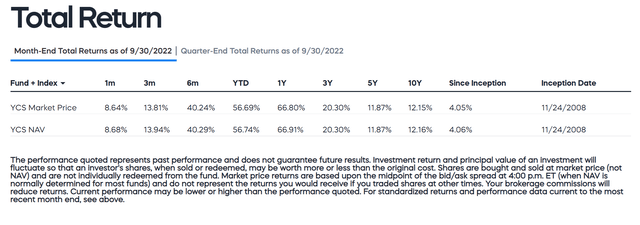

The YCS ETF has delivered sturdy returns, particularly in 2022. The fund delivered 3/5/10 Yr common annual returns of 20.3%/11.9%/12.2% respectively. YTD to September 30, 2022, YCS has returned 56.7%.

Determine 2 – YCS Returns (ProShares)

Distribution & Yield

The YCS ETF doesn’t pay a distribution.

Charges

As a specialty product, the YCS ETF costs a better expense ratio of 0.95% in comparison with vanilla fairness funds just like the SPY.

Differing Central Financial institution Insurance policies Main To Phenomenal Returns For YCS

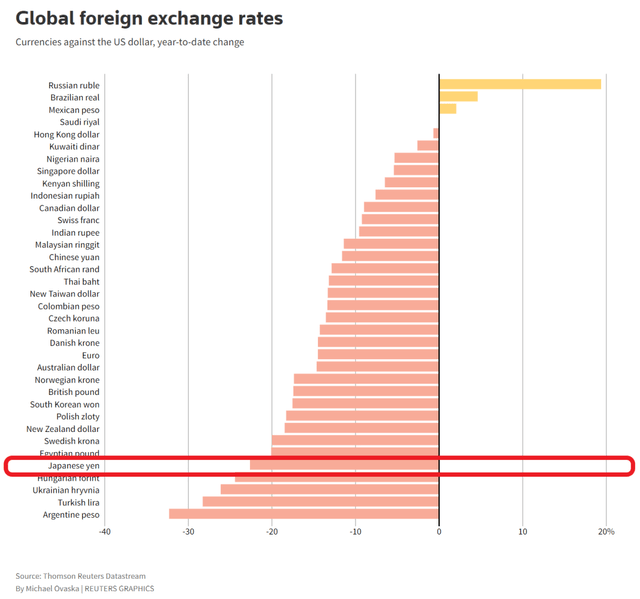

Whereas 2022 has been a yr to overlook for a lot of traders, with each bonds and shares struggling a nasty rout, that has not been the case for FX merchants. 2022 has been an excellent yr for a lot of forex merchants who have been lengthy the U.S. greenback in opposition to foreign currency echange. Determine 3 reveals the YTD change in worth of world currencies relative to the U.S. greenback, with the Japanese yen highlighted.

Determine 3 – YTD efficiency of main currencies in opposition to USD (Reuters)

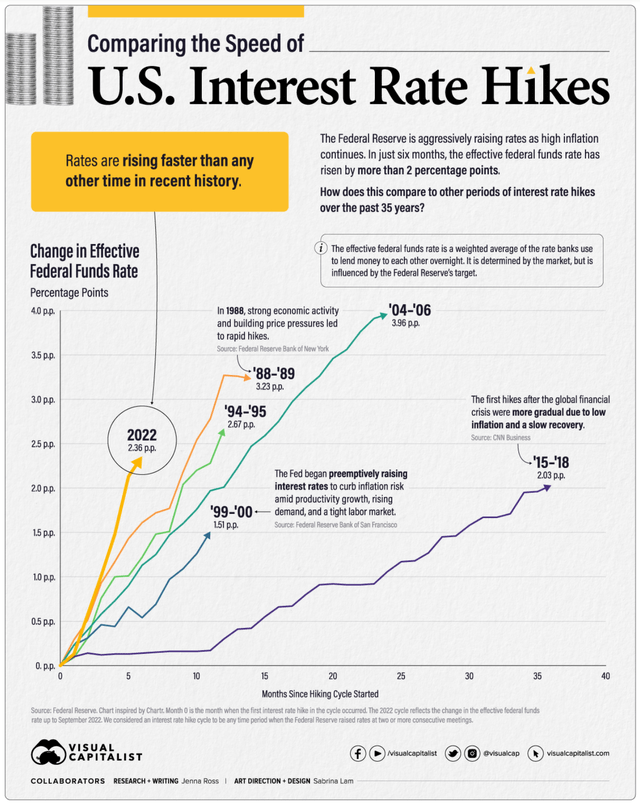

The primary cause behind the forex strikes YTD has been the actions of the Federal Reserve vis-a-vis that of international central banks. The Federal Reserve has launched into the quickest rate of interest mountaineering cycle ever to tame hovering inflation (Determine 4). Any international central financial institution that hasn’t adopted go well with noticed their currencies routed.

Determine 4 – Federal Reserve has raised rates of interest on the quickest tempo ever (Visible Capitalist)

The worth of the Japanese yen has been hit notably exhausting, as a result of the Financial institution of Japan had been participating in yield curve management (“YCC”) since 2016.

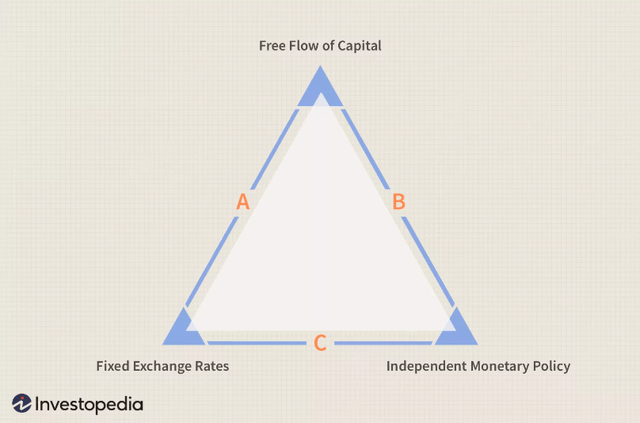

College students of economics ought to have heard of the Mundell-Fleming trilemma. Primarily, what the Mundell-Fleming mannequin says is that policymakers in an financial system can solely management 2 of three doable issues at any given time: autonomous rate of interest coverage, fastened alternate charges, or free circulate of capital (Determine 5).

Determine 5 – Mundell Flemming Trilemma (investopedia)

Within the case of Japan, because it permits free circulate of capital and the Financial institution of Japan (“BOJ”) is intent on conserving Japanese rates of interest at zero, due to this fact, the alternate fee of Japanese yen needed to fall. And boy did the Japanese yen fall.

USDJPY At Multi-Decade Highs

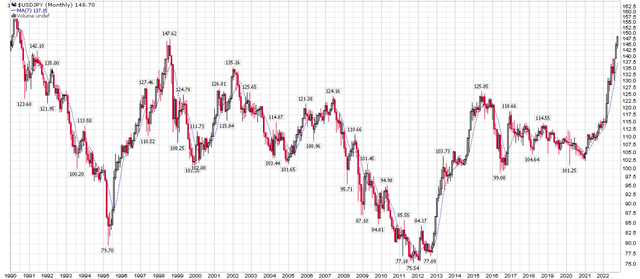

Determine 6 reveals the USDJPY cross (creator’s observe, the Japanese yen is most frequently quoted as what number of yen might be purchased with 1 U.S. greenback) over the previous 30+ years. At USDJPY 148, the Japanese yen is buying and selling at ranges not seen for the reason that Asian Foreign money Disaster in 1998.

Determine 6 – USDJPY at multi-decade highs (stockcharts.com)

BOJ Starting To Intervene; Count on 2-Method Volatility To Improve

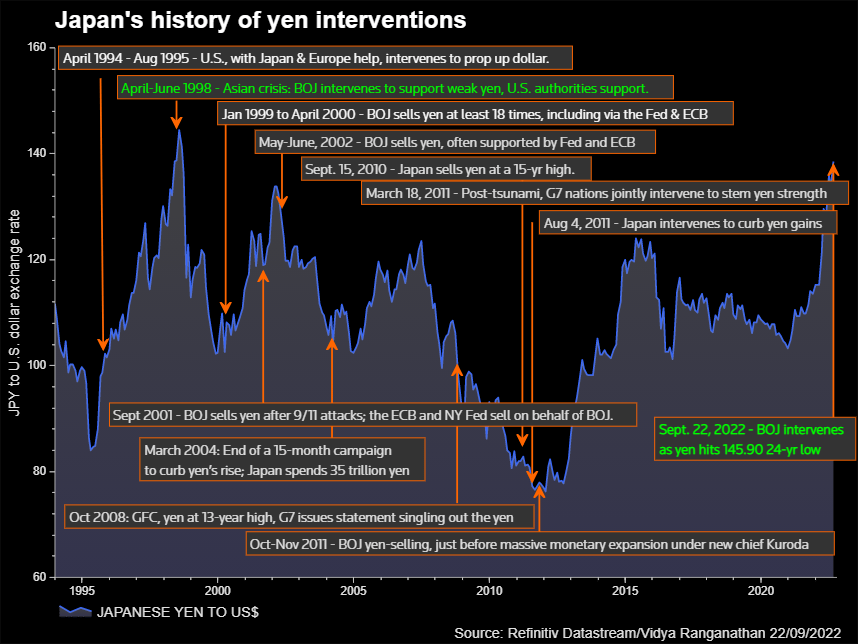

Lately, on September 22, 2022, the BOJ intervened within the FX markets in an try and halt the fast decline of the Japanese yen. This was the primary intervention by the BOJ to purchase Japanese yen since 1998, highlighting the seriousness of the state of affairs. The USDJPY reached a low of 140.35 from the intraday excessive of 145.90 (3.8%, a big transfer by forex requirements) because the BOJ offered U.S. {dollars} and acquired Japanese yen (Determine 7).

Determine 7 – BOJ interventions (Reuters)

Sadly, the BOJ’s intervention solely lasted a day, because the Japanese yen continued to commerce weaker shortly afterwards, and is now quoted at over USDJPY 148.

Whereas the elemental cause behind a weaker Japanese yen – coverage variations between the Fed and the BOJ, stays as sturdy as ever, traders within the YCS ETF must be mentally ready for elevated 2-way volatility, because the Japanese authorities and the BOJ is clearly involved concerning the Japanese yen’s weak point and can more and more attempt to halt its declines.

In the end, additional weak point within the Japanese yen hinges on the BOJ persevering with with its ultra-loose financial coverage and the Federal Reserve persevering with to lift rates of interest within the U.S.

Danger

The largest short-term danger is extra interventions by the BOJ, and even perhaps the U.S. Federal Reserve. Be aware in 1998, the Fed and BOJ coordinated collectively to help a weak yen. Thus far, the intervention has been small and unsuccessful. Nonetheless, because the sturdy U.S. greenback places extra pressure on the worldwide monetary system, there’s a rising chance of one thing ‘breaking’, and a coordinated response from central banks around the globe. The latest U.Okay. sterling and pension disaster is a main instance of pressures constructing and issues ‘breaking’.

Within the longer-run, the BOJ’s ultra-loose financial coverage is clearly unsustainable. Already, Japanese inflation has surpassed its 2% inflation goal. The present cussed BOJ coverage response more and more seems to be one man’s (Governor Kuroda) try to go away behind a legacy of not ‘buckling to market stress’ earlier than his time period ends in early 2023. If the BOJ adjustments coverage course within the coming months, YCS holders might see a dramatic reversal, as quick Japanese yen has been probably the most crowded macro trades lately.

Conclusion

In conclusion, the YCS ETF supplies traders with publicity to -2x the each day value returns of the Japanese yen vs. the U.S. greenback. Quick Japanese has been among the best macro trades in 2022, as coverage variations between the Fed and the BOJ has led to dramatic returns for the YCS ETF. Whereas the elemental driver behind YCS efficiency stays sturdy, the weak Japanese yen is now drawing policymaker consideration. Buyers ought to have one foot out the door, able to e book their winnings on the signal of a BOJ coverage change.