[ad_1]

Wall Road: Tesla, Develop Up!

Nice Ones, we’re no strangers to earnings. the foundations, and so do I. Tesla (Nasdaq: TSLA) deliveries are what I’m pondering of.

Are we being Rick-rolled?

You wouldn’t get this from some other man.

Why?

I simply wanna inform you how I’m feeling. Gotta make you perceive.

Expensive God, please finish the track and assist us perceive this madness!

Have you ever not seen the Elon Musk tweet about Tesla earnings?

Right here, have a Snickers and check this out:

Wait. That’s an actual tweet?

Yup, and it hit simply earlier than Tesla launched its Q3 earnings report … which, satirically, was a really massive letdown. Thanks, Elon.

Tesla reported earnings of $1.05 per share on income of $21.5 billion. Wall Road … effectively, it anticipated earnings of $1.00 per share on income of $22 billion.

Moreover, Tesla mentioned working revenue was $3.7 billion, effectively shy of Wall Road’s goal for $3.9 billion. And … gross revenue margins had been 26.7%, down massive from Q2 margins of 30%.

However that wasn’t even the worst of it…

It will get worse?!

Tesla missed each inner and Wall Road’s Q3 supply forecasts. The corporate blamed continued rolling shutdowns in China as a result of China’s “Zero COVID” polices … although Tesla CFO Zachary Kirkhorn didn’t phrase it that approach:

As we glance forward, our plans present that we’re on observe for the 50% annual development in manufacturing this yr, though we’re monitoring provide chain dangers that are past our management.

Y’all know there’s completely no approach Tesla is gonna chunk the hand that feeds and bash China instantly. However y’all additionally know that anytime an organization mentions “provide chain points” … it’s China.

However maintain up a second. See that “on observe for the 50% annual development” a part of the quote? Now take a look at the very subsequent assertion Kirkhorn issued:

On the supply facet, we do anticipate to be just below 50% development as a result of a rise within the automobiles in transit on the finish of the yr, as famous, simply above.

You may’t triple-stamp a double-stamp, Elon. You may’t triple-stamp a double-stamp!

Tesla is attempting to say that it each will and gained’t hit its 50% annual development goal. So … it’s like Schrödinger’s development? We gained’t know till we have a look at it … or one thing. There’s a motive I’m not an experimental physicist, y’all.

The purpose is, the admission that Tesla won’t hit its 50% annual development plans — plans that Wall Road had already baked into TSLA inventory value — went over like a lead balloon.

Each analyst and their mom is now involved that Tesla is having manufacturing development points … particularly Bernstein’s Toni Sacconaghi:

Apart from the financials, the earnings name didn’t sit effectively with us. Solutions to many questions on the earnings name had been curt and virtually dismissive, with CEO Musk as a substitute repeatedly making very daring prognostications about Tesla’s future and capabilities.

Toni, meet Elon — he’s at all times been like this. It’s simply that now issues aren’t all that scorching at Tesla, so Musk is greater than a bit of testy.

That mentioned, Bernstein’s Toni already has an underperform ranking on TSLA inventory with a $150 value goal. Ouch.

Elsewhere, RBC Capital Markets lower its goal from $340 to $325 following Tesla’s earnings, whereas analysts at Mizuho slashed TSLA from $370 to $330.

On a closing be aware, Elon Musk did speak about a possible TSLA inventory buyback plan:

We’ve debated the buyback thought extensively on the board stage. The board typically thinks that it is smart to do a buyback. However we need to work via the suitable course of.

The appropriate course of, huh? I’m pondering the “proper course of” may lastly come round after Musk settles his Twitter (NYSE: TWTR) acquisition.

I’m fairly certain Tesla’s board is greater than a bit of fearful how that one is gonna end up, contemplating that Musk may have to promote billions of {dollars} extra in TSLA inventory to finish the acquisition. Simply saying…

Nicely, Nice Ones, we’ve identified one another for thus lengthy. Your portfolio’s breaking, however you’re too shy to say it (say it).

Moreover, we each know what’s been happening (happening). We all know the sport, and we’re gonna play it…

I simply wanna inform you how I’m feeling. Gotta make you perceive … that Ian King simply went reside at the moment in an occasion known as “Bear Market Fortunes.”

Sound acquainted? It ought to: Ian King and Amber Lancaster simply gave you the thin on all of it yesterday. In case you missed that unique invitation — the nerve! — don’t fear, we’ve bought you lined with the recap.

In “Bear Market Fortunes,” you’ll uncover Ian King’s best possible technique for making fortunes in powerful occasions.

Through the worst 19-month stretch of the 2008 monetary disaster, he turned $350,000 into over $6 million. Ian will pull again the curtain on his finest technique for producing a bear market fortune.

Every thing you must know is correct right here.

It’s At all times AT&Tease, Tease, Tease

And fortunately, we don’t have to listen to any extra of AT&T’s (NYSE: T) dithering sport of “ought to I keep within the streaming market or ought to I am going?”

What a coincidence, then, that AT&T ought to go on to submit an excellent, double-beat report at the moment … the inventory’s finest post-earnings rally since 1997. All instructed, the corporate introduced in $30 billion, up considerably from $29.1 billion a yr in the past, should you account for the companies that AT&T divested.

It’s virtually like we’ve been ready for AT&T to get its act collectively for, effectively, years now.

Keep in mind that time when Nice Stuff famous that the one a part of AT&T that’s rising is its wi-fi division? Yeah, somebody lastly bought the trace and capitalized on this: AT&T noticed 708,000 new post-paid cellphone subscribers final quarter, and the corporate is focusing on 4.5% to five% mobility development for the total yr.

However what about, uhh, recessionary market situations? Inflation?!

No concern right here, buckaroo:

You want cellphone and broadband most likely extra now than within the final recession. — Investor Relations Head Amir Rozwadowski

AT&T lastly awakened and realized that, whereas individuals may lower out a streaming service or two from their budgets to save lots of money … they’re not gonna surrender their telephones and web, their solely lifeline to the skin world.

You can simply … go exterior.

Don’t convey logic into this, we’re speaking about AT&T. I’m extra shocked that the oldsters at AT&T lastly realized they’ll solely give attention to one enterprise at a time … as if it ought to’ve by no means been within the streaming house within the first place.

Worldwide Enterprise Machines Of Thriller

First AT&T reported respectable earnings … now IBM (NYSE: IBM) too?

What is that this, March of the Blue Chips?!

However doesn’t it make you’re feeling higher! Blue chips have gained tonight. They will all sleep soundly. And every thing is alright!

That’s what I’m saying. And what IBM’s saying really let its blue-chip traders sleep soundly … for as soon as. Massive Blue blasted massive beats throughout the board: Software program income? Up 7%, or 14% in fixed forex. Infrastructure income? Up 15%, or 23% in fixed forex.

Even consulting income was up 5%, or 16% in fixed forex.

What’s all this “fixed forex” nonsense?

What, you thought IBM bought that “Worldwide” in its identify simply to play with just one forex? Oh, nay nay. Mix international forex fluctuations and the same old ol’ inflationary pressures and huzzah, you’ve traders attempting to juggle numerous percentages in an try to seek out some kind of fixed consistency. Which is kinda arduous to do with the ol’ buck going gangbusters. However anyway…

Again on the ranch, IBM is laying on its finest Sinatra impression, with CEO Arvind Krishna crooning: “It was an excellent quarter.” And we’ll depart it at that.

I Am Develop into Dick’s, The Destroyer Of Pessimism

Maintain up. Bullishness? In my Thursday Throwdown?!

It was sure to occur ultimately…

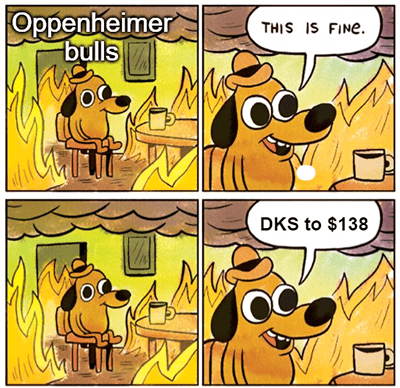

Oppenheimer Analyst Brian Nagel was feeling a lil’ optimistic at the moment — may delete later — in the case of Dick’s Sporting Items (NYSE: DKS).

Nagel raised his Dick’s ranking from carry out to outperform, with a value goal of $138 on the inventory. That’d be about 26% larger than at the moment’s value for DKS.

The explanation? “Typically overly pessimistic” investor sentiment.

Now, let me get this straight… Oppenheimer watched the market’s latest breakneck rallies … watched DKS shares rally a complete 53% off their earlier Might lows … and it’s gonna name THIS peak pessimism? Actually?

You bought a foul storm comin’, Oppenheimer. That’s the key about gauging peak pessimism: There’s at all times room for extra pessimism.

Particularly should you’re banking on, oh, I don’t know, a retailer in a recession.

WD-40 Shares Slide

That’s it. That’s the joke.

Aight, Imma head out now.

Don’t you go anyplace, there’s extra to the WD-40 (Nasdaq: WDFC) story to let it slip away so quickly.

The WD-40 firm simply reported a 13% uptick in income for final quarter, and it even forecast income to develop 5% to 10% for the total fiscal yr. Full-year gross sales are supposed to succeed in $545 million to $570 million — and that’s a complete lot of WD-40, my Nice Ones.

However the place does the unhealthy information are available? I’m right here for the unhealthy information.

Nicely, Mr. Schadenfreude, simply have a look at gross margins. A lot to my dismay, inflation appears to be one of many few issues that WD-40 can’t loosen up. Based on WD-40’s high brass, CEO Steve Brass:

Sadly, gross margin was the Achilles heel of fiscal yr 2022. The present inflationary atmosphere has severely disrupted our potential to attain our 55 % gross margin goal over the near-term.

These are some good margins you bought there. It’d be a disgrace if one thing had been to … occur … to them.

Nonetheless, even at 47.4% for the quarter, these margins ain’t unhealthy in any respect. It could possibly be far worse. You can be Tesla.

And so, WDFC shares slid 11%, like a lubed-up aluminum can on a greased-up conveyer belt (and that’s most likely the place our metaphor wants to finish).

I’ve bought an thought to assist perk up WD-40 inventory although. Hear me out: WD-41.

Keep in mind, should you ever have a inventory or investing thought you’d wish to see Nice Stuff cowl, tell us at: GreatStuffToday@BanyanHill.com. We’ve bought a rip-roaring version of Reader Suggestions deliberate for tomorrow, and there’s one teeny little spot to squeeze you onto the invoice.

However we are able to’t reply to your electronic mail should you haven’t despatched it but, now can we? So go on! Get to ranting and raving.

And you probably have that burning craving that solely extra Nice Stuff can fulfill, you must take a look at our deets right here:

Regards,

Joseph Hargett

Editor, Nice Stuff

[ad_2]

Source link