PaulGrecaud

Thesis

I imagine that West Fraser Timber Co. Ltd. (NYSE:WFG) (TSX:WFG:CA) is a well-managed firm that’s at the moment buying and selling at a gorgeous valuation. The corporate faces near-term challenges with larger rates of interest impacting housing affordability and funding demand. Nevertheless, power underinvestment within the US and Canadian housing inventory within the final twenty years offers long-term demand for the corporate’s merchandise.

Background on West Fraser

West Fraser is a Canadian diversified wooden merchandise firm that produces lumber, engineered wooden merchandise (OSB, LVL, MDF, plywood, and particleboard), pulp, newsprint, wooden chips, different residuals and renewable vitality. The corporate relies in B.C., Canada and has operations in Canada, Southeastern U.S., the UK and Europe.

What attracts me to West Fraser over their friends is their capital allocation throughout the current interval of robust earnings.

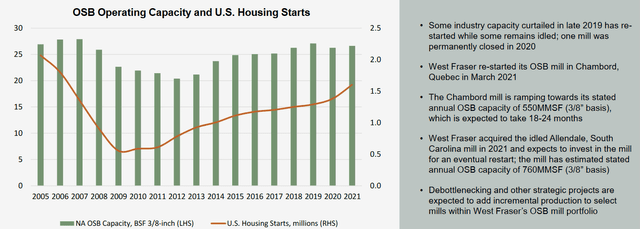

On February 1, 2021 West Fraser acquired Norbord, the world’s largest producer of OSB, for $3,482 million by means of the issuance of 54.5 million further widespread shares. This acquisition considerably modified their earnings combine, lowering their dependence on lumber costs which ought to cut back their earnings volatility over the long run (slide 3). They’ve additionally acquired an OSB mill and a lumber mill within the U.S. South.

For the reason that acquisition, West Fraser has repurchased 37 million shares, roughly 67% of the shares issued. They’ve additionally elevated their dividend twice in 2022, from $0.20 per quarter in This autumn 2021 to $0.30 per quarter in Q2 2022. They’ve paid a dividend for the final 32 years throughout each robust and weak years for the trade.

West Fraser has little or no debt and the little that they’ve is locked in at fairly low rates of interest, both as mounted charge debt or by means of an rate of interest hedge. They at the moment have enough money to pay all their debt. That is in step with their enterprise technique of sustaining a prudent steadiness sheet. This low debt degree provides them borrowing capability for future accretive acquisitions utilizing debt, and makes the corporate a extra engaging to me than Weyerhaeuser (WY) with its larger debt.

The corporate additionally has a staff of senior leaders which have navigated earlier cycles with the corporate. Three of the 5 named govt officers have over 20 years of expertise with the corporate (web page 91), and three of the eleven members of the Board have over 11 years of expertise with the corporate (web page 36). This offers me confidence that the corporate has a staff with expertise navigating financial downturns.

Finally, as a provider of wooden merchandise, the corporate is uncovered to the present market value for his or her merchandise. I’ll discover on the market provide and long-term demand for wooden within the sections under.

Lumber and OSB Provide

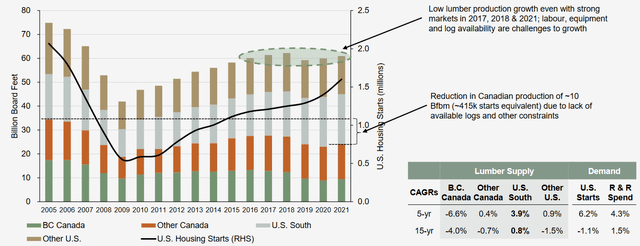

The provision for lumber decreased by roughly 45% between 2005 and 2009 earlier than recovering and since 2016 has been secure.

West Fraser Q2 Earnings Presentation, Slide 28

West Fraser Q2 Earnings Presentation, Slide 30

Whereas billions have been spent on enhancing manufacturing at current mills and restarting outdated mills that have been idled, there was little urge for food for investing in new mills.

Some forest-products executives mentioned they’re contemplating acquisitions with their fast-accumulating money. However there aren’t many new mills on the drafting board for North America.

“We’re going to be extremely cautious on what we do in these regards,” Canfor Corp. Chief Govt Don Kayne advised traders final month when the corporate reported document quarterly income. “We don’t thoughts in any respect having a bit additional money round for certain, contemplating what this trade goes by means of.”

B.C., Canada has additionally had a big discount in lumber provide which isn’t more likely to abate given the present political local weather and a discount within the variety of timber allowed to be harvested. That is mentioned additional within the part outlining dangers under. In consequence, manufacturing capability and provide will probably improve slowly with enhancements at current services, however there aren’t any important investments in new mills which were publicly introduced.

Lengthy-Time period Demand for Wooden

I stay bullish on the long-term demand for wooden on account of power underinvestment within the US and Canadian housing inventory within the final decade.

Freddie Mac launched a analysis observe on Could 7th, 2021 that highlighted the rising deficit within the housing inventory. Right here is an extract from their observe, emphasis added by me:

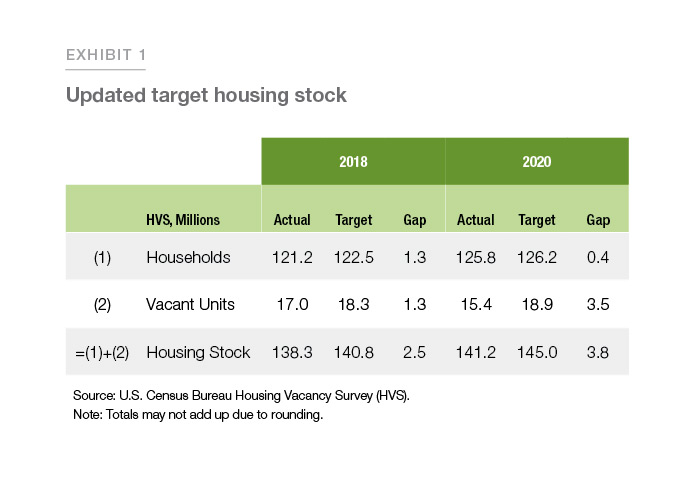

Our evaluation estimates the housing scarcity not solely based mostly on the precise variety of households but in addition considers the latent demand and the variety of vacant items. A well-functioning housing market requires some vacant properties on the market and for lease.

Exhibit 1 reveals the up to date goal housing inventory numbers. As of the fourth quarter of 2020, the U.S. had a housing provide deficit of three.8 million items. These 3.8 million items are wanted to not solely meet the demand from the rising variety of households but in addition to take care of a goal emptiness charge of 13%. Between 2018 and 2020, the housing inventory deficit elevated by roughly 52%.

The principle driver of the housing shortfall has been the long-term decline within the building of single-family properties. That decline has been exacerbated by a fair bigger lower within the provide of entry-level single-family properties, or starter properties.

Freddie Mac Freddie Mac

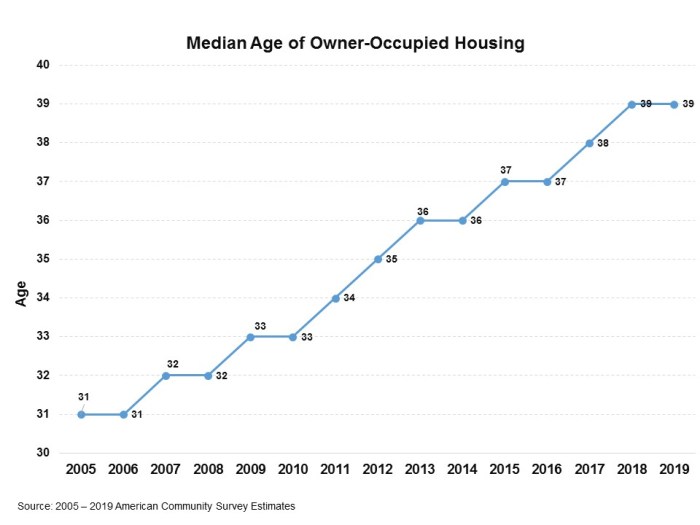

It doesn’t come as an enormous shock then that the median age of the US home has elevated from 31 years in 2005 to 39 in 2019, suggesting that additional renovations shall be required to take care of the prevailing housing inventory or to deliver these homes as much as present code.

EyeonHousing.org

There may be a rise within the variety of potential makes use of of wooden sooner or later. In 2015, Ontario modified legal guidelines permitting wooden frames for as much as 6-stories (up from 4-stories). British Columbia made this transformation in 2009 and had over 50 6-story wooden framed buildings within the first 5 years after passing the regulation. The extra jurisdictions that that is utilized to creates an extra improve in potential demand for wooden.

Politically, there have additionally been a variety of insurance policies to advertise each demand and funding within the housing sectors of each the US and Canada. This at minimal reveals that the governments see a necessity for funding within the sector, additional supporting the case for strong demand.

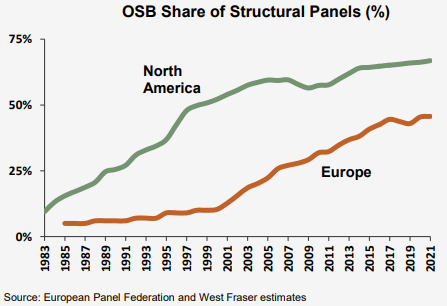

Lastly, West Fraser is increasing into the European OSB market which has a decrease penetration charge than North America. If the adoption of OSB in Europe continues its constructive development, this helps an assumption that EU OSB margins ought to enhance with quantity and many others.

West Fraser Q2 2022 Earnings Presentation, Web page 20

Discounted Money Circulation Valuation

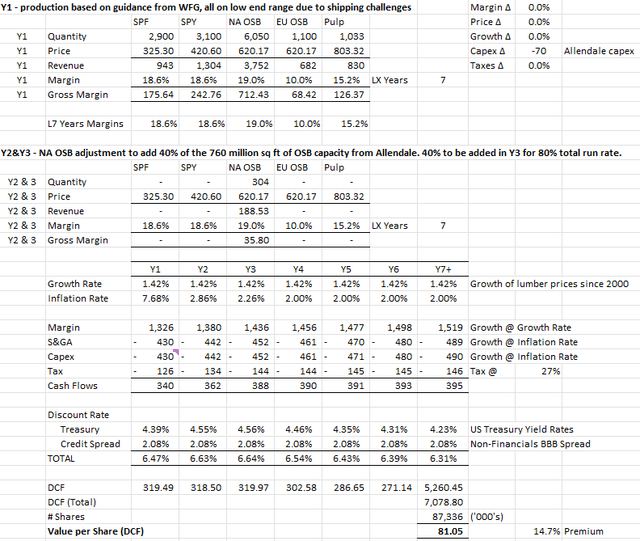

The next is my Discounted Money Circulation mannequin, with my assumptions outlined under:

Ready by Writer

The assumptions on this mannequin are outlined under. References to the 2022 steerage comes from the Q2 Report, pages 3-4.

Manufacturing / Gross sales Amount relies on midpoint of the manufacturing steerage for 2022 as a projection of long-term manufacturing/gross sales. Y2 and Y3 improve in OSB quantity replicate the Allendale plant producing at 40% in Y2 and 80% from Y3+. Gross sales Worth relies on the common value of every product from 2014 to 2019, as disclosed within the firm’s earlier annual stories. 2020 and 2021 are excluded as the costs replicate the surge in gross sales costs on account of COVID-19 which make them unlikely to characterize future gross sales costs.

Margins are based mostly on the common margins achieved from 2015 to 2018. 2019 to 2021 are excluded: 2019 as a result of margin compression occurred that has since resolved, and 2020 and 2021 because the margins have been considerably above long-term developments throughout COVID-19. EU OSB margin is assumed to be 47% decrease than NA as this was their proportionate margin in 2021, however there isn’t a lot historical past on this.

Progress charge relies on their development in manufacturing quantity from 2012 to 2021. Inflation relies on the projected annual inflation charge within the US from 2022 to 2027.

SG&A bills are based mostly on 2022 steerage, rising with inflation. Capital expenditures are based mostly on 2022 steerage, adjusted for $70 million as a result of Allendale of expenditures being incurred this 12 months, rising with inflation. Taxes are based mostly on the 27% statutory tax charge.

Threat free charge and credit score spreads are based mostly on related period US Treasury charges and non-Financials BBB spreads as of October 20th.

A few of these assumptions are conservative.

Manufacturing/Gross sales Amount assumes that they function at midpoint vs peak capability in the long run. Utilizing excessive finish quantity estimates provides $6.16 to the per share worth. If administration’s quantity estimates for F2022 included a discount on account of transportation challenges then this may additional improve manufacturing / gross sales amount above the mannequin worth.

The mannequin assumes that Allendale solely ever operates at 80% capability past Y3 on account of uncertainty concerning the most potential output of the mill. Utilizing 100% manufacturing capability provides $2.66 to the per share worth.

Assumed EU margins are low, however they’re anticipated to spend money on that market and develop margins. It was additionally the primary 12 months of operations and so additional efficiencies needs to be anticipated. Growing margins from 10% to 11% will increase the valuation by $1.12 per share. As well as, purchase value accounting elevated the European EWP price of products offered by $7 million. Adjusting for the acquisition value adjustment provides $0.35 to the valuation.

On August 20, 2021 West Fraser carried out a Substantial Issuer Bid to accumulate 10.3 million shares at $76.84 USD per share. On April 20, 2022 they carried out a second Substantial Issuer Bid to accumulate 11.9 million shares at $95.00 USD per share. For the 6 months ended June 30, 2022 they acquired 6.7 million shares at $83.76 USD per share on common below a Regular Course Issuer Bid (web page 50). All these knowledge factors level to administration believing that the share value needs to be larger than what they’re buying and selling at at the moment, additional supporting the mannequin’s valuation.

Dangers

As with every discounted money stream valuation, rates of interest have an inverse correlation to the current worth of the money flows. A 1% improve within the rates of interest throughout the curve would cut back the mannequin valuation to $67.00, 5.2% under the present share value.

West Fraser’s enterprise is uncovered to a variety of dangers:

- Curiosity Charge

- British Columbia Allowable Reduce

- Transportation Challenges

Increased rates of interest would influence housing affordability and due to this fact demand for constructing supplies, not less than within the brief time period. I imagine the historic underinvestment within the U.S. housing sector would make the restoration quicker than earlier cycles the place there was a surplus in homes.

Administration has highlighted that the provincial authorities in BC, Canada, a area the place West Fraser has six lumber mills and two pulp mills, has diminished the variety of timber allowed to be harvested. This may increasingly cut back the effectivity of West Fraser’s mills. The corporate has managed this danger by transferring capability from BC to the US South. From 2004 to 2021, West Fraser’s publicity to BC fiber was diminished from 77% to 24% (slide 17).

The corporate should transport its fiber and completed merchandise from rural areas the place the timber are harvested, to populations that demand their product. In This autumn 2021, Administration highlighted that flooding in BC has additionally created transportation challenges for the corporate as railway traces and truck routes had been washed out. This may stay a danger that administration just isn’t capable of management.

Whereas these dangers are current, I imagine that, general, Administration has carried out a superb job of lowering publicity to the corporate, and don’t see these dangers outweighing the positives outlined beforehand.

Conclusion:

West Fraser is a gorgeous firm on the present valuation ranges. I stay bullish for its long-term potential and the demand for its merchandise.

The Discounted Money Circulation worth of the shares is $81.05 utilizing conservative assumptions, with as much as $10.29 of further per share worth if barely extra aggressive assumptions are used. As with every Discounted Money Circulation, any future improve in rates of interest will cut back the valuation; nevertheless, I imagine the strengths of the corporate outweigh the dangers.