[ad_1]

“This flight has been focused for an unique supply,” the flight attendant broadcasts to your fourth straight flight. “Join in-flight and get 500 bonus miles on high of the welcome supply.”

These days, each flight appears to incorporate a bank card gross sales pitch from a flight attendant.

With the hard-selling techniques some flight attendants make use of, you would possibly surprise if these in-flight bank card presents are an excellent deal. The truth is, they are often. However do not get away your pen to use in your subsequent flight. This is why.

Be cautious of in-flight bank card pitch claims

Airways instruct flight attendants to stay to the script when selling a bank card supply. However, flight attendants could deviate from the script to make a card sound extra interesting.

Generally that is as minor as referring to a card profit as “precedence boarding” quite than the “most well-liked boarding” perk the cardboard really presents. Different claims would possibly earn a “pants on hearth” score when fact-checked.

Why would a flight attendant need to make a bank card sound extra interesting than it’s? Nicely, flight attendants do not pitch bank cards simply that will help you get extra miles. Flight attendants are sometimes instantly compensated for every permitted utility they generate.

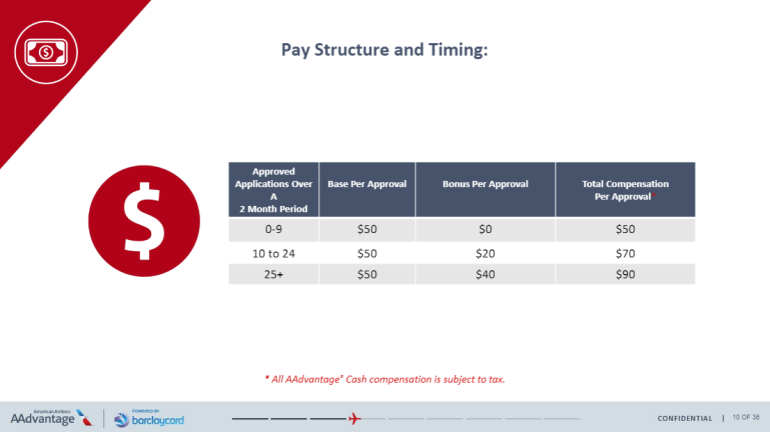

In response to an American Airways coaching memo, flight attendants earn a base of $50 per permitted utility. If the flight attendant sells greater than 25 playing cards in a two-month interval, these earnings soar to $90 per approval.

An article from DoctorOfCredit.com, a bank card weblog, suggests {that a} $50 bonus per approval appears to be the trade customary. Nevertheless, airways will generally enhance the inducement to drive extra gross sales. For instance, in 2018, journey trade writer Skift reported that United Airways doubled its incentive to $100 per approval.

Not all flight attendants are excited concerning the alternative. “The bank card pitches make us sound like used automobile salesmen. It is cheesy. It is unprofessional,” says Heather Poole, a flight attendant and creator of Cruising Perspective: Tales of Crashpads, Crew Drama and Loopy Passengers at 35,000 Toes.

Nonetheless, she understands the enchantment of the additional pay and does not begrudge flight attendants who make one brief announcement.

Do not act now

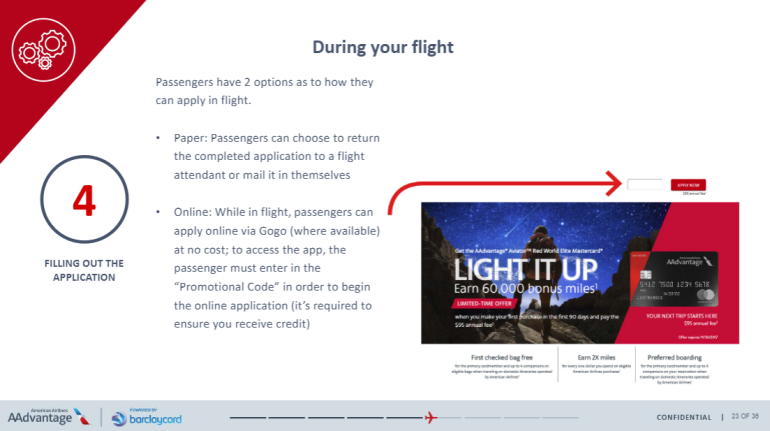

Like every good gross sales approach, these in-flight bank card pitches are designed to rush you into a call. Some airways will even supply to allow you to use the in-flight Wi-Fi without cost to use on-line, or the flight attendant would possibly supply to gather and securely ship your utility.

Each the flight attendant and the airline need you to use now — whenever you’re offline and unable to match different choices. Nevertheless, when you’re tempted by an in-flight bank card supply, take the time to analysis the small print on the brochure. You’ll be able to possible take the brochure dwelling with you and nonetheless get the “unique” in-flight bonus supply even when you apply later on-line. When you’re again on Wi-Fi, evaluate the supply with NerdWallet’s listing of the finest journey bank card presents at the moment accessible.

It is potential that the in-flight bank card supply is your best option. Nevertheless, most U.S. airways supply a minimum of two bank card choices — and the perks on one other bank card is likely to be higher suited to your wants. By taking the in-flight bank card brochure dwelling, you may evaluate what’s accessible, and nonetheless get the bonus miles from the in-flight supply.

How a lot are in-flight bank card presents price?

Bank card presents will differ. This is a snapshot of potential values throughout a handful of various airline miles for a theoretical 50,000-mile bank card supply.

|

American Airways AAdvantage |

||

Must you apply for in-flight bank card presents?

In brief: No, do not instantly apply for a bank card in-flight.

Nevertheless, after doing a bit of further analysis, you would possibly discover that an in-flight supply finally ends up being your best choice. So, snag that brochure throughout your flight, after which evaluate it on-line whenever you get dwelling so you may be sure you’re getting the most effective supply.

The way to maximize your rewards

You desire a journey bank card that prioritizes what’s essential to you. Listed below are our picks for the finest journey bank cards of 2022, together with these finest for:

[ad_2]

Source link