[ad_1]

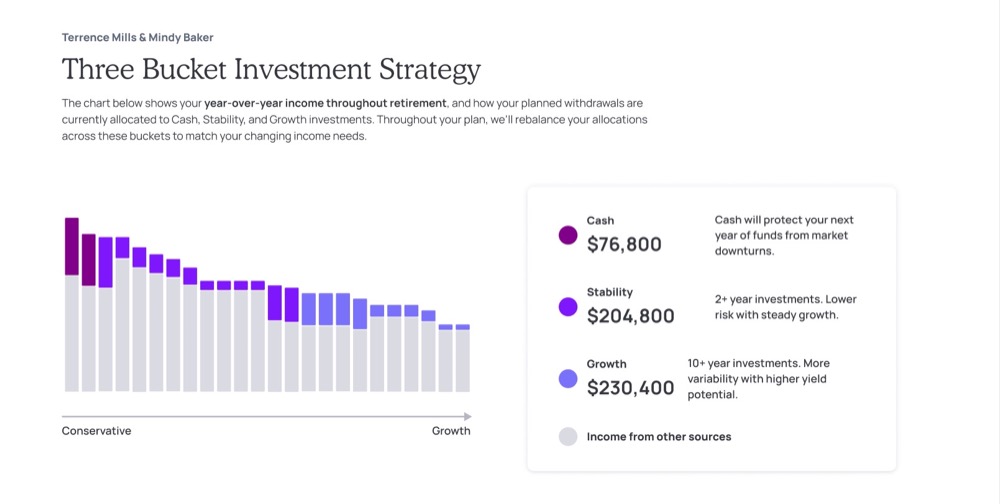

Specialists recommend that retirees have $514,800 saved for retirement however the common retirement financial savings is $191,659, far wanting the really useful retirement financial savings quantity. 75% of retirees carry debt into retirement. Retirable is a monetary planning platform created particularly for these in retirement or close to retirement. Whereas the prosperous have lengthy had entry to personalised wealth administration advisory companies, the vast majority of retirees don’t meet the minimal investable asset tiers to obtain the sort of recommendation from standard companies. Retirable seeks to deal with this hole by providing tailor-made, tech-enabled advisory companies together with entry to managed investments by means of an accessible payment construction – .75% on the primary $500K belongings below administration on the platform. The corporate builds a three-pronged strategy to portfolio building for retirees by specializing in development, money, and stability. Retirable has constructed 50,000 retirement plans during the last two years and has not had a single consumer go away the platform.

AlleyWatch caught up with Retirable CEO and Cofounder Tyler Finish to study extra in regards to the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the whole funding raised to $10.7M, and far, far more…

Who had been your buyers and the way a lot did you increase?

$6M was raised in a further Seed funding led by Main, with further investments from Vestigo Ventures, Diagram, Portage, and Primetime.

Inform us in regards to the services or products that Retirable affords.

Retirable is the first-of-its form holistic retirement answer for adults in or close to retirement. We provide services and products throughout the retirement investing, planning and spending spectrum — all with the continued care of an advisor.

What impressed the beginning of Retirable?

What impressed the beginning of Retirable?

I witnessed firsthand how most adults weren’t receiving the recommendation they wanted to thrive in retirement throughout my time as a retirement advisor at outstanding monetary companies companies. From these experiences, I used to be impressed to create a service that would totally help soon-to-retirees to really feel assured about their retirement, no matter their web value.

How is Retirable totally different?

Retirable helps the vast majority of middle-class Individuals who haven’t had the chance to obtain personalised, skilled recommendation for his or her retirement planning journey. Conventional retirement advisors overlook tens of millions of people who don’t meet asset minimums however nonetheless want clear and assured retirement options. Retirable is filling this hole available in the market by specializing within the retirement planning, investing and spending wants of mass-market retirees.

What market does Retirable goal and the way massive is it?

Retirable primarily targets the 50 million Individuals approaching retirement within the subsequent decade who lack a proper retirement plan. This phase of soon-to-be retirees has sometimes not had entry to a monetary advisor long-term. These people are continually navigating the method alone and are in extreme want of retirement planning companies.

What’s what you are promoting mannequin?

Retirable is a wealth administration fintech and retirement advisory platform that costs .75% of managed belongings on the primary $500K {that a} consumer invests. Retirable’s capped-fee construction offers better entry to a broader group of retirees and pre-retirees that in any other case couldn’t have afforded such a service.

How are you making ready for a possible financial slowdown?

Retirable is making ready for any potential financial downturn by remaining targeted on offering clear and assured retirement plans for each American. Financial downturns are inclined to create a surge in demand for monetary advisory like ours—notably amongst those that are about to retire or already retired.

As pre-retirees and retirees are confronted with market uncertainty and rising inflation, exhausting choices round Social Safety, Medicare and taxes are extra essential than ever. Retirable’s mission-driven work revolves round empowering our shoppers to rise above potential financial slowdowns with training, steerage and holistic methods that assist them attain their retirement potential.

What was the funding course of like?

The funding course of has been unbelievable as now we have been lucky to work with a few of the most concerned Enterprise Capitalists within the trade. This most up-to-date addition in seed funding was notably profitable in furthering our mission of empowering everybody by means of a assured, worry-free retirement.

What are the largest challenges that you just confronted whereas elevating capital?

Our largest challenges had been skepticism round 1: If we might attain older adults remotely, and a couple of: was it too late to assist individuals who didn’t have any retirement financial savings so near retirement?

Each of those points, and the truth that they got here up so typically, solely reinforce the necessity for our product. Extra adults aged 50+ are on-line than folks suppose, and Retirable believes that it’s by no means too late for a person to take steps towards a calming and comfortable retirement. We’re seeing these assumptions show out in each day interactions with our shoppers as we help their retirement journey.

What elements about what you are promoting led your buyers to put in writing the verify?

Traders have shared that our workforce’s strong and various expertise is their predominant driver for his or her investments. Our enterprise addresses a big market and a transparent societal want. Our workforce’s ardour for serving to people by means of a holistic lens additionally impressed buyers who share these values and strategic strategy. Our shoppers’ success and total satisfaction helps to make our case as properly.

What are the milestones you propose to attain within the subsequent six months?

Within the coming months, Retirable plans to concentrate on rising its advisor workforce, strengthening its partnerships, distribution channels, and constructing out extra options for shoppers — together with the upcoming launch of its beta debit card.

What recommendation are you able to supply firms in New York that wouldn’t have a contemporary injection of capital within the financial institution? T

The enterprise cycle ebbs and flows, however in an setting like this—when fundraising is more durable—it’s time to hunker down and concentrate on the steak greater than the sizzle. Profitable firms might be borne out of the resilience it takes to persevere by means of downturns, so ensure you have the runway to climate the storm and concentrate on sturdy unit economics.

“Development in any respect prices” is resonating much less in 2022, so it’s finest to concentrate on worthwhile development and prioritize what you understand works. Deal with discovering readability round your best-performing channels and buyer profiles whereas making tradeoffs/prioritizations the place wanted. Don’t be afraid to be opportunistic in rising sources in direction of CAC-efficient channels and ways.

“Development in any respect prices” is resonating much less in 2022, so it’s finest to concentrate on worthwhile development and prioritize what you understand works. Deal with discovering readability round your best-performing channels and buyer profiles whereas making tradeoffs/prioritizations the place wanted. Don’t be afraid to be opportunistic in rising sources in direction of CAC-efficient channels and ways.

The place do you see the corporate going now over the close to time period?

We’re rising the scope of Retirable’s attain and specializing in offering the simplest energetic asset administration for present Retirable prospects.

What’s your favourite restaurant within the metropolis?

Final time we chatted, I discussed Pierozek in Greenpoint. I stand by that however should add Ginjan Cafe in Harlem! The 2 brothers that began it have an extremely inspiring story, the flagship ginger juice is a life changer, and the meals is uniquely scrumptious!

You’re seconds away from signing up for the most well liked checklist in Tech!

Enroll at present

[ad_2]

Source link