Jean-Luc Ichard

Microsoft Company (NASDAQ:MSFT), like most different tech names, completed final week robust with a achieve of greater than 10% unfold over two days. Is that this the beginning of a brand new uptrend for the inventory? We imagine so. This text presents just a few causes to help Microsoft as an funding each within the quick time period and the long run. Not many shares provide relative quick time period security, nice long run potential, dividend yield (though small), and affordable valuation. Microsoft is one such inventory. Allow us to get into the small print.

First In, First Out

Microsoft was one of many first giant tech names to announce layoffs. They weren’t solely amongst the primary to react to the decelerate but in addition one of many few that suffered minimal impression, with the layoff impacting nearly 0.50% of the workforce. This reveals two issues: (1) they’re fast on their heels and adapt to adjustments; and (2) that they didn’t get over-bloated by way of head depend. To place these two factors into context, have a look at Meta Platforms, Inc (META). Meta was gradual to react and was even adamant on rising bills. However once they lastly reacted, they ended up slashing 13% of the work power.

Why is that this vital? It reveals Microsoft administration’s basic consciousness and their capacity to behave rapidly. It additionally reveals their self-discipline that watching bills will not be one thing you do sooner or later hastily however extra an ongoing self-discipline.

Sport On

Microsoft’s Activision Blizzard Inc, (ATVI) acquisition is on observe for closure in summer time of 2023. Whether or not it’s Sweet Crush or Warzone, Activision is aware of learn how to entice players. However the firm bumped into critical office disaster that maybe accelerated the choice to promote. That is proper up Microsoft’s alley, as CEO Satya Nadella expressed:

“Gaming has been key to Microsoft since our earliest days as an organization. As we speak, it is the biggest and fastest-growing type of leisure, and because the digital and bodily worlds come collectively, it should play a important function within the improvement of metaverse platforms.“

Everybody is aware of and talks about Apple Inc.’s (AAPL) ecosystem empire. However think about Microsoft’s management over customers with the:

- Working System which makes these actions potential

- Productiveness instruments together with however not restricted to Workplace

- Units (not their strongest level however nonetheless a presence)

- Internet hosting (Azure)

- Gaming Consoles and Content material

- And final however not the least, Metaverse. Augmented Actuality within the bodily world should still be an idea in infancy however Digital Actuality in video games is much extra superior. Whereas Microsoft and Meta are companions for now, anticipate Microsoft to change into a dominant participant, if not the dominant participant right here.

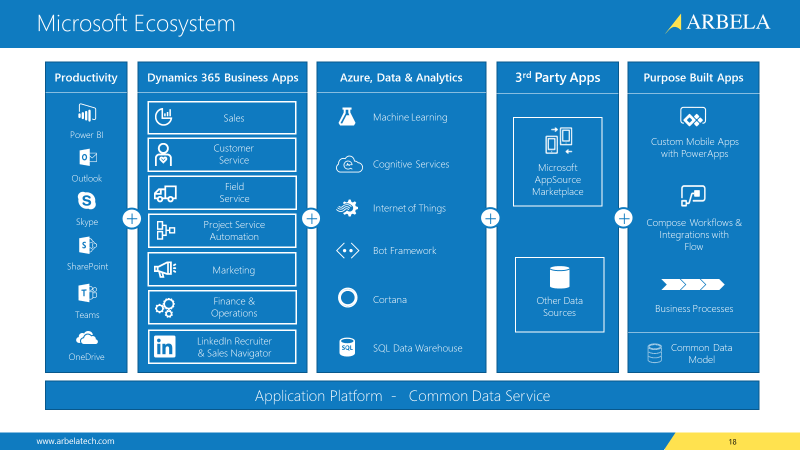

The sketch proven under is likely one of the greatest representations of Microsoft’s highly effective ecosystem, because it reveals how these silos not simply present worth on their very own but in addition cross-sell throughout platforms. To this, add Metaverse and Gaming potential and you’ll see Microsoft’s future dominance taking form.

Microsoft Ecosystem (Arbelatech.com)

Not All Gloom In The Cloud

Whereas the latest earnings report confirmed that Azure development was slowing down, the report had loads of positives:

- Microsoft beat on each EPS and income.

- Azure’s “disappointing” development was nonetheless 24% YoY and accounting for foreign money fluctuations, was truly a formidable 31%.

- Google (GOOG, GOOGL) cloud gaining market share is impacting each different participant, however Azure and Amazon Internet Providers (“AWS”) are working at ridiculous revenue margins nonetheless with Azure’s latest margin coming in at 70%.

- The COVID period accelerated the transfer to cloud for current companies in addition to introduced a flurry of recent corporations immediately onto the cloud. This was sure to slowdown because the pandemic restrictions eased. As soon as the sudden excesses are adjusted, it should change into extra evident that the “digital tailwind” quoted by Satya Nadella is right here to remain.

Grounded Expectations

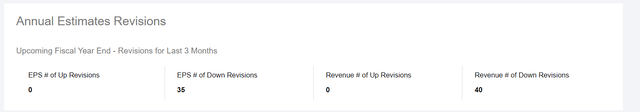

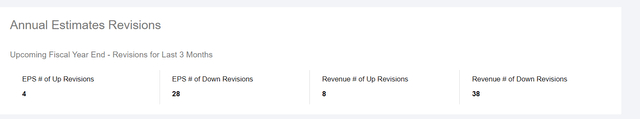

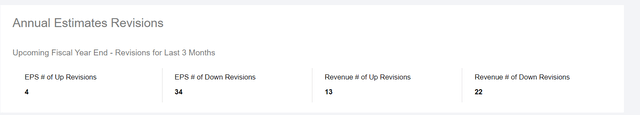

Though Microsoft’s ahead a number of appears to be like pretty wholesome at 25, we should keep in mind that investing and returns are all about expectations. If an organization does higher than expectations, it goes up typically and the opposite means round too. Microsoft’s income and EPS projections have all been revised downwards. To ensure this wasn’t a pattern amongst mega caps, we seemed up two different corporations: one stronger than Microsoft typically fame (Apple) and one weaker than Microsoft at current (Meta Platforms), and each fare higher than Microsoft on this regard.

MSFT Earnings Revisions (SeekingAlpha.Com) Meta Earnings Revisions (SeekingAlpha.Com) Aapl Earnings Revisions (SeekingAlpha.Com)

Technical Setup

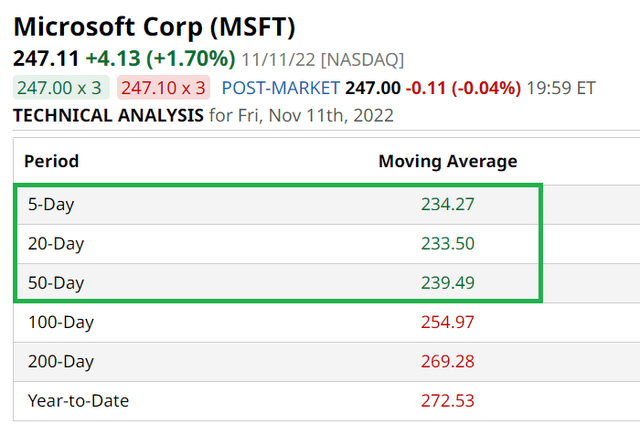

From a technical perspective, Microsoft has now damaged above its 5, 20, and 50 day shifting averages. This implies the inventory has been in an uptrend and is accumulating power

And earlier than you attribute this to the market strikes on Thursday and Friday, not all mega caps have achieved this. Amazon (AMZN), for instance, remains to be under its 20 and 50-day shifting averages. Google remains to be under its 50 day shifting common. The one comparable giant cap that’s matching Microsoft on this class proper now could be Apple and this might not be a coincidence. Apple and Microsoft are typically thought of extra well-rounded corporations that may climate most storms as a consequence of their stickiness of their services and products. This implies when issues flip round for know-how shares typically, anticipate Microsoft to be among the many strongest as soon as once more.

MSFT Transferring Averages (Barchart.Com)

Conclusion

“This isn’t your father’s Oldsmobile” was a well-known Common Motors (GM) tagline once they launched a brand new era of automobiles. In hindsight, the identical would have utilized to Microsoft when Satya Nadella took over. The corporate has gone from being a boring returns killer to being a rising bellwether for all seasons. The truth that Microsoft inventory is down “solely” 26% this 12 months speaks volumes.

We imagine Microsoft inventory has paid sufficient of its dues with its decline and is exhibiting sufficient indicators right here that the underside could also be in. Whereas we imagine that is the beginning of an uptrend, regardless of what occurs over the subsequent few months, Microsoft is a juggernaut that deserves a place in any portfolio.