gorodenkoff/iStock through Getty Photographs

Nearly 60% of merchants stated it feels just like the U.S. financial system has tipped right into a recession or will achieve this by the top of the yr, in accordance with the This autumn Charles Schwab Dealer Sentiment Survey. Most, 55% count on a recession to final lower than a yr. Nonetheless, a major proportion, 45%, see a downturn lasting longer than that.

Nonetheless, merchants expressed confidence of their means to carry out in a recession, with 91% saying they really feel they’re going to attain their monetary targets. Some 4 out of 10 merchants (42%) are dialing again on threat within the present atmosphere.

About 55% of survey respondents see a “January impact” — the place markets rise on optimism for the yr forward — as considerably seemingly. To maintain the optimism going, merchants would most prefer to see a decline in inflation gauges (54%), improved geopolitical stability (53%), a change in Federal Reserve coverage (51%), and powerful company earnings (38%).

Concern in regards to the Fed’s hawkish coverage elevated throughout the quarter, with 17% saying it is their main concern, up from 5% within the final quarter. Most merchants count on the central financial institution to extend rates of interest by at the least 50 foundation factors in December and do not see charges dropping in 2023.

About 56% of the merchants are hopeful that inflation will ease in 2023, and 22% have been anticipating inflation to ease within the final half of 2022.

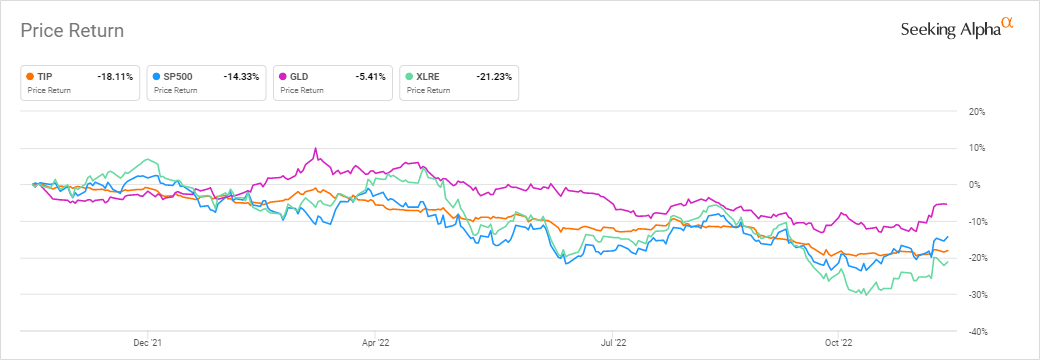

Whereas virtually half of the merchants do not count on to take particular actions to hedge towards inflation, those that do plan to purchase actual property (25%), gold (21%) and Treasury Inflation-Protected Securities (16%). See the efficiency of the iShares TIPS Bond ETF (TIP), SPDR Gold Belief ETF (GLD), and Actual Property Choose Sector SPDR ETF (XLRE) towards the S&P 500 within the chart beneath.

By trade sector, merchants are most bullish on power (71%) and well being care (52%) they usually’re most bearish on actual property (75%) and shopper discretionary (62%). By asset class, the respondents have been most bullish on worth shares (48%), fastened earnings (37%), and home shares (30%).

BlackRock, in the meantime, is not bought on a tender touchdown even after a lighter CPI print