DedMityay/iStock by way of Getty Photographs

Despite the fact that Calumet Specialty Merchandise (NASDAQ:CLMT) smashed earnings at its most up-to-date report, the inventory value offered off precipitously. We strongly imagine that this generates a shopping for alternative for these with sources to take action. Within the earnings presentation portion of the name, administration additionally provided perception into its operations and imaginative and prescient. Let’s choose up that hammer and smash our manner by way of to the core points impacting the enterprise.

The Quarter

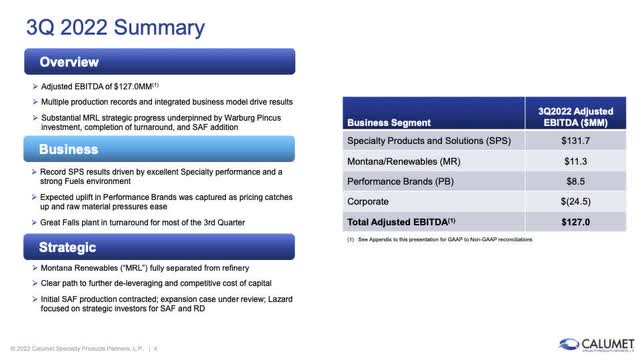

The primary blow opens our view into the reported monetary outcomes. The next slide summarizes the report.

Calumet Shows

Of be aware from the slide and name:

- Reported whole EBITDA was $127 million.

- MRL EBITDA equaled $11 million down from close to $70 million within the final quarter. (Nice Falls operation was idled for many of the quarter due to the conversion/turnaround.)

- Firm paid $35 million towards extinguishing among the 11.5% 2025 bonds.

- WCS/WTI unfold at Nice Falls equaled $20.

- MRL started operation at low charges.

- Firm mentioned the fee and manufacturing benefit it has for the much more profitable SAF.

- Shreveport processed 51,000 barrels of feed per day, 40% larger than 2021 and 10% greater than the earlier file. Spectacular understates the outcome.

A number of notes: From our personal information collected utilizing EIA information, we had the typical Gulf Coast 2-1-1 unfold at $40, down $10 from the June quarter. In our final article, Calumet Specialty Merchandise: Benefiting From Tight Crack Spreads, we estimated the EBITDA for the quarter at $130 million plus with MRL (Nice Falls) working for not less than a number of months. It did not; it was mainly off line. The remaining enterprise carried out excellently.

The Calumet Execution Benefit

In our view, profitable corporations present stellar imaginative and prescient coupled with strong and predictable execution. In the course of the name, an in depth dialogue occurred in the course of the Q&A demonstrating these idea for fulfillment; predictable execution and imaginative and prescient. Amit Dayal of H.C. Wainwright, requested about timing for monetizing MRL, Bruce Fleming, Calumet’s, EVP Montana/Renewables and Company Growth, answered,

We have to deal with getting this up safely and delivering what we have promised to the market. However at that time, Montana Renewables is standalone itself, funding the entire issues that we talked about for future progress growth SAF. Montana Renewables can do this by itself.

Calumet had fastidiously deliberate, rolled when it was wanted, and created a imaginative and prescient within the correct order with every bit fastidiously executed on-time. The execution of the imaginative and prescient leaves the corporate fully within the driver’s seat when it comes time to monetize belongings. Below Steve Mawer, imaginative and prescient and execution took on a brand new, larger stage of efficiency.

Persevering with, Todd Borgmann, CEO, added concerning the file EBITDA being achieved:

This can be a mixture of a good market, a competitively advantaged enterprise and a step change in execution throughout the board. When [] our ops and business groups have maximized the worth of optionality[,] that units our built-in platform aside.

That remark additionally refers back to the impeccable achievement in working excellence set in place below Tim Go. He might have struggled with different points, however it was clear that in his tenure, operational excellence appeared. Calumet operations, visions and execution align collectively making a synergy for fulfillment. Traders take be aware.

Was It Promote the Information or?

So why the large sell-off after earnings? For traders, understanding the possible cause helps in buying at extra advantageous costs. A number of components got here to bear after the decision. A overview follows:

- The inventory was overbought and had been for the reason that center of October. Any destructive feedback will likely be handled harshly.

- Administration mentioned the lag time for constructive money circulation from MRL. Scaling is required with the startup of the hydrogen unit and pretreatment models coming later this yr and subsequent. (The plant is working at low charges utilizing larger price handled feed-stocks.)

- The remark by Fleming on timing for monetizing MRL additionally added uncertainty. The corporate was/is in no hurry except a “cannot refuse” supply comes alongside.

- A big block of $8 choices that have been to run out in November have been being rolled contributing to inventory promoting.

Lastly maybe, the market was simply promoting the information after the lengthy interval of shopping for the rumor. However the overbought nature of the inventory did drive us to dump a number of $8 calls as a consequence of expire in November. We plan to purchase inventory as a substitute. Nothing within the outcomes or plans modified the long-term imaginative and prescient and certain considerably larger value for the inventory.

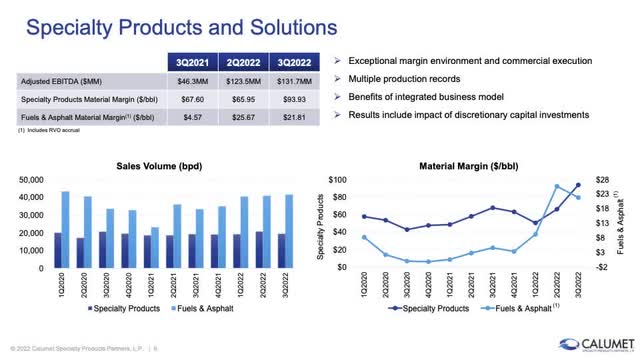

Dangers & Rewards

Trying ahead, there are a number of points that needs to be mentioned. First, within the slide deck, Calumet provided us nice perception when displaying the relative hedge that every of the 2 companies present, fuels and specialty. In unsure markets, this pure hedge proves worthwhile. On the decrease proper, a graph of fabric margins for the 2 companies exhibits that in occasions of rising crude costs, speciality margins drop whereas gasoline margins improve. The alternative can also be true.

Calumet Shows

This efficient hedge strategy has some stage of bias in each instructions with margins on specialty extra worthwhile, however nonetheless offsetting. The margin on specialty, on this case, jumped $16 whereas the margin on the fuels dropped $4. However if you happen to look carefully, gasoline’s volumes usually exceed specialty by an element of two. Definitely, numbers and variations can change relying on the circumstances, however the thought would not. Now we have pointed this out a number of occasions over time when writing on Calumet.

Persevering with, into the subsequent few quarters, administration said that demand is robust, although seasonally weaker, whereas margins are prone to return to extra regular values. What’s extra regular margins seems to be considerably larger than up to now. Handle added a remark:

our specialty enterprise continues to generate a number of money and it appears like for the foreseeable future, that continues to be the case. And, we’ll handle it accordingly.

Our personal crack unfold numbers for the December quarter are comparable with prior quarters.

On this article, we have now centered extra on the underlining crucial company cultures obligatory for a enterprise to carry out profitable returns to traders. And sure, there are dangers. Financial softening stands on the forefront from worldwide recessions. Our nation is heading right into a deeper recession induced by the Federal Reserve. Demand might slip. The Shreveport refinery might discover itself shutdown for vital repairs. Investing is at all times dangerous, however Calumet confirmed its true colours and potential over the last two years. Pushed by imaginative and prescient, ordered execution and operational excellence, it is a progress firm certain for the stratosphere. The merchandise match future calls for and wishes. We’re holding our shares and manipulating choices in a even handed style. This can be a purchase on weak spot. Our smasher opened doorways into essential funding points for traders to comply with and located pay grime. We’re at a purchase.