[ad_1]

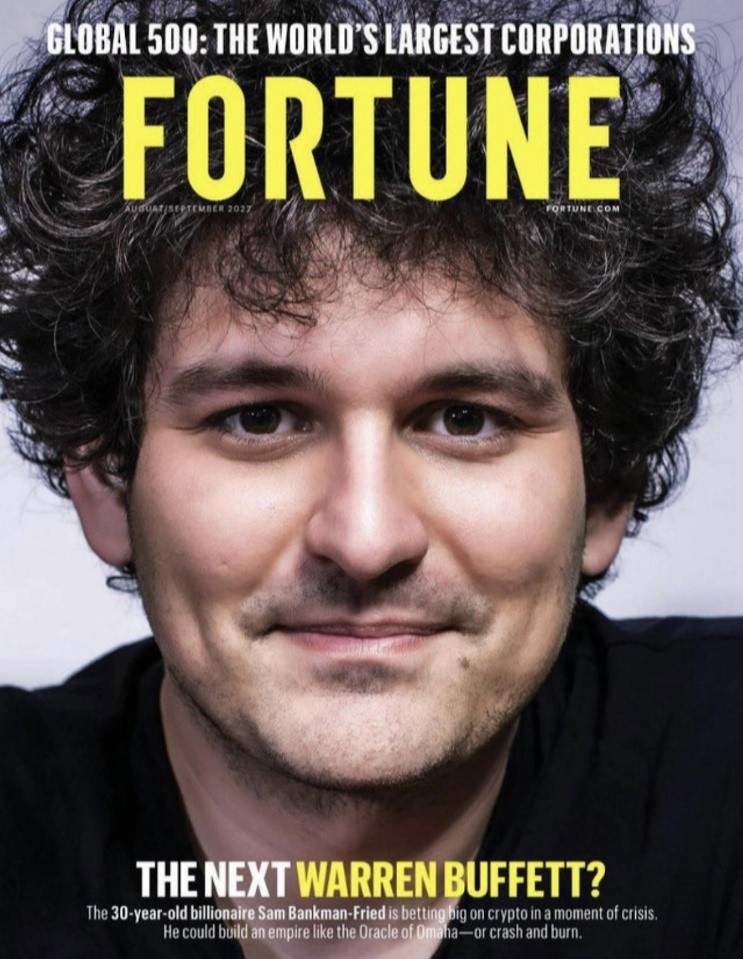

Fortune known as him “The Subsequent Warren Buffett”…

Sam Bankman-Fried (SBF) was crypto’s boy surprise.

He based the world’s second-largest cryptocurrency change — FTX.

However he didn’t simply present a spot the place folks might purchase and promote their favourite cryptos…

He spent a fortune on promoting, roping in everybody from Tom Brady to Larry David.

He even paid $135 million to sponsor FTX Area, the place the Miami Warmth play basketball.

Tens of millions believed this was the man who’d lead crypto into the long run.

However on November 8, all of it got here crashing down.

After rumors that FTX is likely to be quick cryptos, they suffered an old school run on the financial institution.

Inside hours, the change ran out of cash to pay for withdrawals, and SBF’s wealth was worn out.

And sadly, $50 billion in buyer funds went up in smoke.

All within the span of about 24 hours.

It was sufficient to shake the crypto world to its core.

FTX declared chapter and it’s a snowball’s likelihood in hell if clients ever get well a nickel.

The CEO that changed SBF took a take a look at FTX’s books and mentioned it was worse than Enron.

The contagion from FTX is already spreading among the many crypto world.

Who is aware of what number of clients are going to lose all their cash.

But I can’t say any of this surprises me, not within the least.

Reality About Crypto

If you happen to’ve been studying for any period of time, you’ll know I’m no fan of crypto.

Actually, I’ve had some fairly harsh phrases for it. (As you may see right here…)

I by no means understood how electrical energy might produce a make-believe coin.

And other people would commerce them in hopes of creating large fortunes.

Cryptocurrencies are making the Holland tulip mania look respectable!

A minimum of when the tulip mania collapsed in 1637, traders nonetheless had tulip bulbs.

When cryptocurrencies collapse, all that’s left is empty area.

I’ve a easy rule relating to investing my cash…

If I can’t perceive it, I can’t worth it. And if I can’t worth it, I don’t spend money on it.

My view was typically mocked by my colleagues.

They advised me I used to be lacking out huge time and simply wasn’t getting it.

However I completely received it.

Crypto has the false cloak of legitimacy mixed with the concern of lacking out.

That could be a mixture that causes large losses to those who had no thought what they had been moving into.

That’s why I advised you — my readers — to steer clear of it.

From the emails I obtained from a lot of you, I’m glad you took my recommendation.

Don’t Wager on a “Larger Idiot”

If you happen to solely purchase one thing in hopes of promoting it for extra money…

You’re not investing. You’re speculating.

You’re betting on discovering a “better idiot” to make it work.

That’s what crypto is.

However while you deal with the enterprise — one in an trade with a powerful tailwind, run by a rock-star CEO after which purchase shares when they’re buying and selling at a cut price value — then you definately’re investing.

So don’t be intimidated by fast-talking pitches about digital forex or the way you’re lacking the chance of a lifetime.

As an alternative, simply deal with the info and the evaluation.

As a result of whereas bitcoin is down over 15% prior to now month alone…

A few of my most up-to-date inventory suggestions are up 19% … 32% … and 33%.

Behind every certainly one of these “M-Class Shares” is an excellent enterprise that’s producing actual worth for the world.

So keep away from the noise and hype.

As an alternative, associate up with nice corporations. Then allow them to make you wealthy.

And click on right here for the main points on my M-Class Shares now.

Regards,

Charles Mizrahi

Founder, Actual Discuss

[ad_2]

Source link