ipopba

Introduction

As a dividend development investor, I continually search income-producing investments to complement my passive earnings. More often than not, I add to present positions that I discover enticing. On different events, I begin a brand new place to diversify my portfolio additional, improve my earnings and acquire publicity to new segments. The present market volatility can present a possibility to accumulate future earnings for decrease costs.

My dividend development portfolio lacks publicity to 2 essential sectors: financials and knowledge know-how. Due to this fact, I’ll analyze extra corporations from these two sectors as they each suffered through the present downturn. I personal banks, insurers, and asset managers within the monetary trade. I’ll analyze a digital financial institution, Ally Monetary (NYSE:ALLY), on this article.

I’ll analyze the corporate utilizing my methodology for analyzing dividend development shares. I’m utilizing the identical methodology to make it simpler to match researched corporations. I’ll study the corporate’s fundamentals, valuation, development alternatives, and dangers. I’ll then attempt to decide if it is a good funding.

In search of Alpha’s firm overview reveals that:

Ally Monetary, a digital monetary companies firm, supplies numerous digital monetary services and products to client, industrial, and company clients primarily in america and Canada. It operates by way of 4 segments: Automotive Finance Operations, Insurance coverage Operations, Mortgage Finance Operations, and Company Finance Operations.

Fundamentals

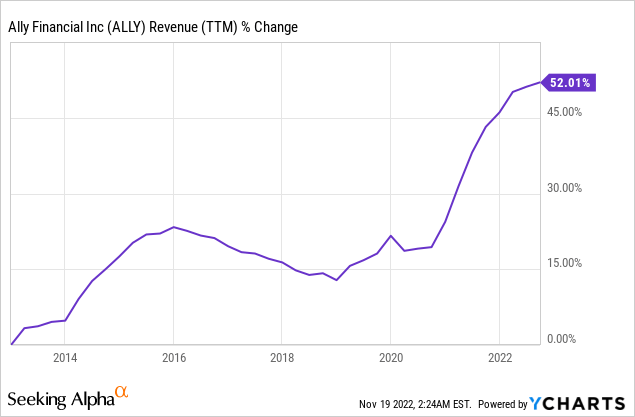

Gross sales of Ally Monetary have elevated by greater than 50% over the past decade. A lot of the gross sales come from its financing operations. The low-interest charges atmosphere over the past decade and the rising have to finance new purchases by the general public supported the corporate’s development sample. Sooner or later, analysts’ consensus, as seen on In search of Alpha, expects Ally Monetary to continue to grow gross sales at an annual fee of two.5% within the medium time period because it has to cope with slower development on account of increased charges.

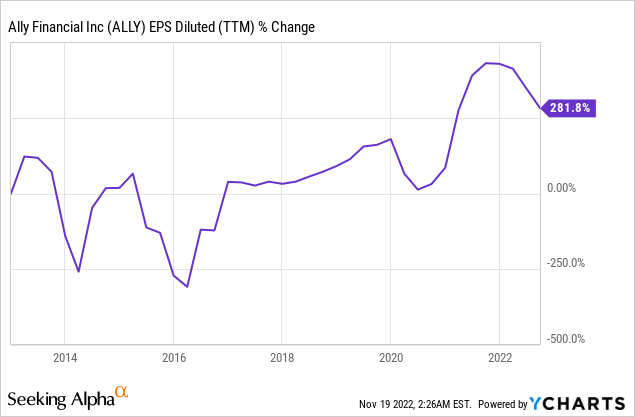

The EPS (earnings per share) has grown a lot sooner throughout that decade. EPS has nearly quadrupled throughout that decade as the corporate may increase cash cheaply, supply low curiosity on deposits, and luxuriate in a excessive margin on its loans. A decrease share rely, increased gross sales, and better margins led to quick development. Sooner or later, analysts’ consensus, as seen on In search of Alpha, expects Ally Monetary to endure from decrease EPS earlier than stabilizing in 2024 as the corporate has to cope with increased charges and presumably a recession with increased charge-offs. Even underneath that situation, the projected EPS for 2023, which stands at $4.49, will likely be increased than the 2019 and 2020 EPS.

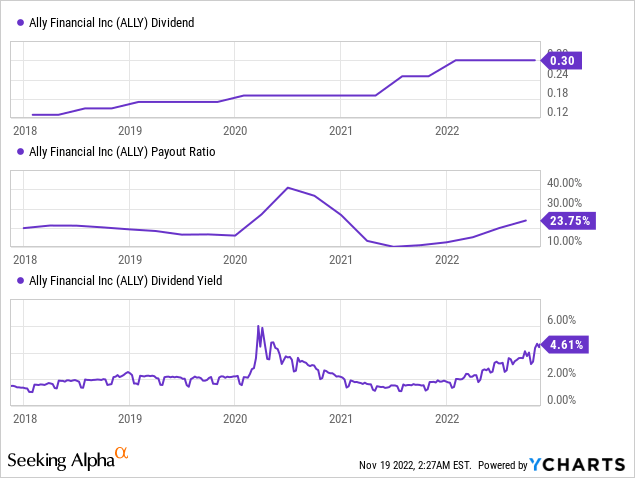

Ally Monetary is a brand new dividend payer. It lacks an extended observe report because it solely raised its payout for 5 consecutive years. Nevertheless, the fee appears comparatively secure, with a payout ratio of 24%. Furthermore, the dividend yield is enticing because of the present extraordinarily low valuation, and buyers can get pleasure from a 4.61% yield. Nevertheless, because of the present enterprise atmosphere and rising charges, buyers ought to anticipate low dividend will increase as the corporate strives to protect extra capital than wanted laws.

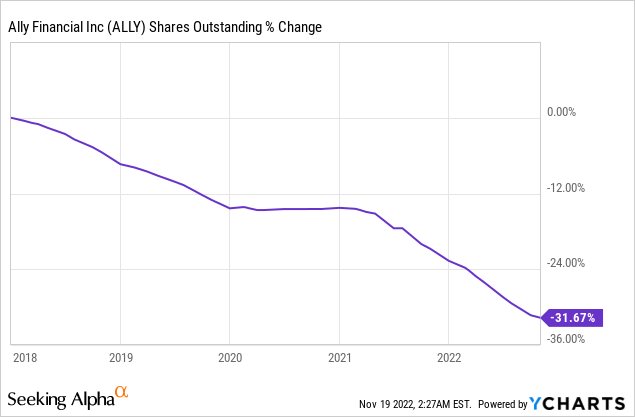

One other type of returning capital to shareholders is share repurchase. During the last 5 years, Ally Monetary has repurchased greater than 30% of its excellent share. Buybacks assist EPS development and are extremely environment friendly when the corporate grows, as they unlock even sooner development resulting in increased dividend development. If the corporate trades for such a valuation, buybacks will likely be very environment friendly.

Valuation

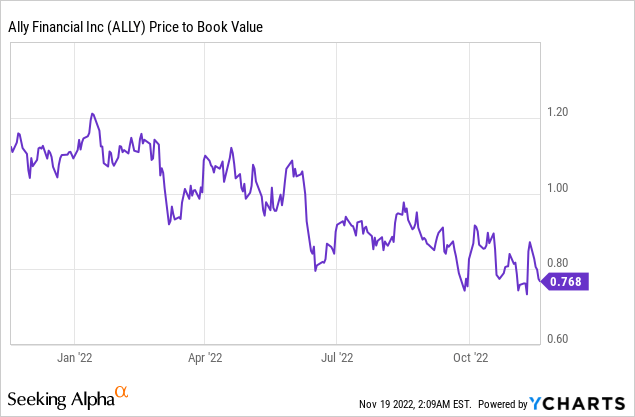

The P/B (worth to guide worth) ratio has decreased considerably over the past twelve months. At the start of the 12 months, shares of Ally Monetary traded for roughly their guide worth. Nevertheless, as we noticed rates of interest rising and the chance of a recession elevated, the valuation contracted. The shares are buying and selling for an nearly 25% low cost to guide worth. Buyers anticipate difficult instances forward, and due to this fact there’s a low cost.

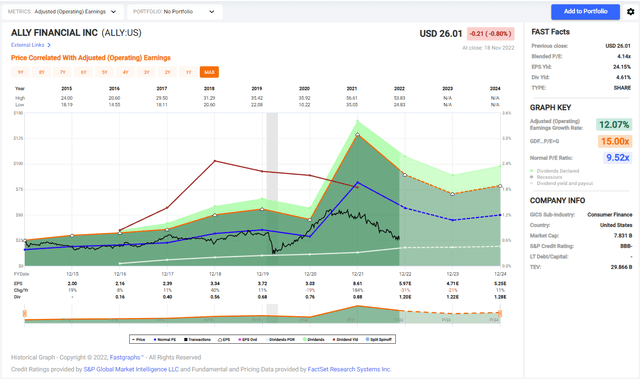

Trying on the graph under from Fastgraphs, we see that Ally Monetary is attractively valued in comparison with its previous valuation. Because the IPO in 2014, the common P/E ratio has been 9.5, and the present P/E ratio is greater than 50% decrease at 4.1. Due to this fact, some vital low cost is derived from buyers’ concern with its efficiency through the recession and high-interest charges.

Fastgraphs

To conclude, Ally Monetary is a strong firm. A observe report of gross sales and EPS development permits the corporate to pay rising dividends and purchase extra shares. The valuation is enticing as buyers are scared that the upper charges will have an effect on the corporate extra considerably than different monetary establishments. They imagine that the chance is excessive. Thus the potential appears excessive as nicely.

Alternatives

The corporate’s first development alternative is the expansion of its Ally Financial institution enterprise. The financial institution has complete deposits of $146 billion, up $6.3 billion YoY, and it manages to extend the variety of its retail clients. This is a vital long-term alternative as these deposits will likely be used for future loans. Ally Monetary now has entry to low-cost capital that can enable quick development sooner or later.

Ally Monetary is totally digital, which has a number of benefits as we advance. It appeals to the youthful technology and might roll out new merchandise sooner. The utilization of knowledge permits the financial institution to customise choices to totally different purchasers higher, and it additionally permits the financial institution to save lots of vital quantities of cash on workers, lease, and so forth., and be a really lean and environment friendly monetary establishment.

The corporate has proved that it could execute nicely even throughout instances of uncertainty. This monetary establishment has been round for over 100 years, and due to this fact, it has handled vital challenges, together with instances of excessive inflation and excessive unemployment. With the present margin of security because of the low valuation, there appears to be a medium-term alternative for valuation growth if the market turns into much less involved.

Dangers

Rates of interest are rising, and it poses a danger for Ally Monetary. On the one hand, the corporate has to supply increased charges to those that deposit their cash within the financial institution. Alternatively, because the charges it prices on its loans are already increased than common, rising them extra could decrease the variety of future clients searching for a mortgage. Some potential purchasers could favor to delay their purchases.

One other danger is the recession which will or could not come because of the increased charges. Whereas the charges could make new loans much less enticing, a recession will make it tougher for Ally Monetary to revenue from its present portfolio. As unemployment ticks increased throughout recessions, there’s a rising danger for charge-offs, and the corporate will lose cash on an rising a part of its portfolio.

This danger is very related to Ally Monetary because it targets difficult clients. The corporate targets purchasers with decrease credit score scores to cost increased rates of interest. Due to this fact, these purchasers would be the first to endure from the weakening financial system, particularly throughout a recession. Due to this fact, the consumer profile can be a danger if the weak point within the financial system is right here to remain.

Conclusions

Ally Monetary is a Excessive-risk, high-reward play within the inventory market. The corporate has robust fundamentals with gross sales and EPS development. It additionally has been rewarding shareholders for a number of years. Nevertheless, the corporate is within the dangerous enterprise of high-interest loans, and it might change into tougher to develop throughout recessions. Due to this fact, buyers ought to think about that each the upside and draw back are substantial right here.

Since there may be such a spot between the optimistic and the destructive situations, this funding is unsuitable for each dividend development investor. Most dividend development buyers search stability and a rising constant dividend stream. Ally Monetary has a distinct danger profile. Thus there may be extra room for volatility. It ought to match dividend development buyers with a better urge for food for danger.