[ad_1]

Working your startup with out a finances or forecast is rather a lot like packing a suitcase for a visit you recognize nothing about.

Think about I invited you on this journey however didn’t provide you with any extra data. How would you even start to pack? You don’t know the size of your keep, the place you’re going, what the climate’s like, and so on.

And not using a plan, you’ll doubtless deliver quite a lot of stuff you don’t want whereas forgetting some necessities. You may exit and purchase a fleece-lined parka, solely to seek out out you’re having fun with a tropical seashore trip. Maybe you don’t deliver your work laptop computer, however then uncover that on the seashore, we’re assembly with a number of high-profile buyers.

Early-stage firms that function with out a monetary plan run the chance of misallocating assets, losing time and failing to align on enterprise targets. A correct finances or forecast, however, spurs useful resource effectivity, acceleration of timelines, accountability, and the flexibility to adapt on the fly with data-driven insights.

Startup founders will give themselves an ideal begin by understanding the variations between a finances and forecast.

Desk of Contents

Price range vs. Forecast

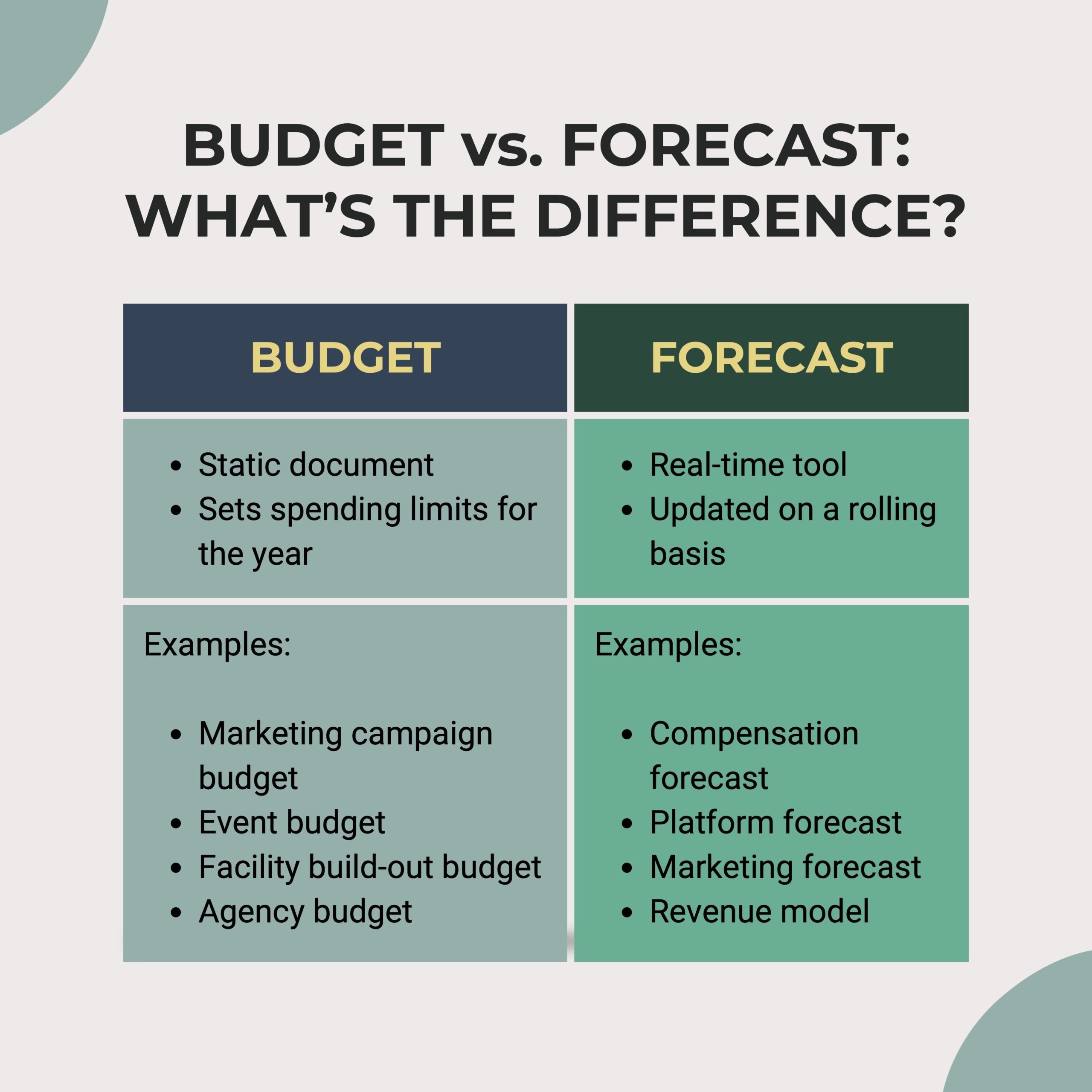

The phrases finances and forecast are typically used interchangeably, however they’re not fairly the identical. Each are monetary instruments used to mirror the outcomes of your startup’s strategic plans, with a couple of key variations.

A finances is a reasonably static doc that firms typically use to set their spending limits for the yr. A forecast, however, is a extra real-time instrument that will get up to date on a rolling foundation.

Let’s dive into extra of the variations between finances and forecast:

What Is a Price range?

A finances is a monetary plan that displays the outcomes of the strategic plan if executed precisely as modeled over the fiscal yr. It’s inflexible and will be interpreted as the boundaries for spending. Many people are acquainted with the query, “Is that this in finances?” when making buy selections. Within the startup world, there are various extra elements that must be thought-about.

As with all monetary plans, budgets facilitate accountability for monetary outcomes. They’re generated earlier than the beginning of the fiscal yr and are normally up to date semi-annually or quarterly. Budgets keep extra static than their cousin, the forecast.

Excessive-growth firms ought to align targets with their budgets but additionally remember that circumstances change shortly. Agility, responsiveness and adaptation are key traits of a profitable startup, so it’s finest to make use of a monetary mannequin that shares these attributes.

Sorts of Budgets

The most important kinds of budgets embrace:

- Advertising Marketing campaign Price range

- Occasion Price range

- Facility Construct-Out Price range

- Company Price range

Budgets are helpful for targeted, well-defined, short-term initiatives. They’re good for occasions with pre-determined begin and finish dates.

Due to their static nature, budgets will be dealt with by particular person contributors — not like forecasts, that are usually managed by firm leaders. Listed below are a couple of examples of budgets:

Advertising Marketing campaign Price range

Let’s say you’re planning a marketing campaign for Q1 of subsequent yr. Your entire actions — LinkedIn advert spend, paid media, hours billed to freelancers, and so on. — ought to fall inside this finances.

Occasion Price range

It’s typically useful to stipulate a finances for an occasion or convention. The occasion finances will embrace room for a sales space reservation, flights, airways, meals and extra. Budgeting ensures your individuals are staying inside purpose — and never shopping for a first-class flight and the most costly bottle of wine on the corporate dime.

Facility Construct-Out Price range

Whether or not you’re renovating an previous facility or constructing a brand new one, a finances will turn out to be useful. Furnishings, electrical work and different development can get expensive, so that you wish to set expectations beforehand.

Company Price range

Company spend is an efficient instance of a finances that may be devoted by way of a proportion of a variable goal. Many startups will spend a sure proportion of their income on company work for advertising and marketing, promoting, consulting and extra.

[ad_2]

Source link