[ad_1]

India’s inventory market rally bought an additional increase on the again of indicators from the US that the Federal Reserve could decelerate on the tempo of rate of interest hikes. It merely means there wouldn’t be an enormous squeeze on the worldwide cash liquidity and overseas portfolio flows may proceed for India, analysts stated.

As per US Fed minutes, substantial members favoured decelerate in charge hikes. The subsequent Fed assembly for charge hikes is in December.

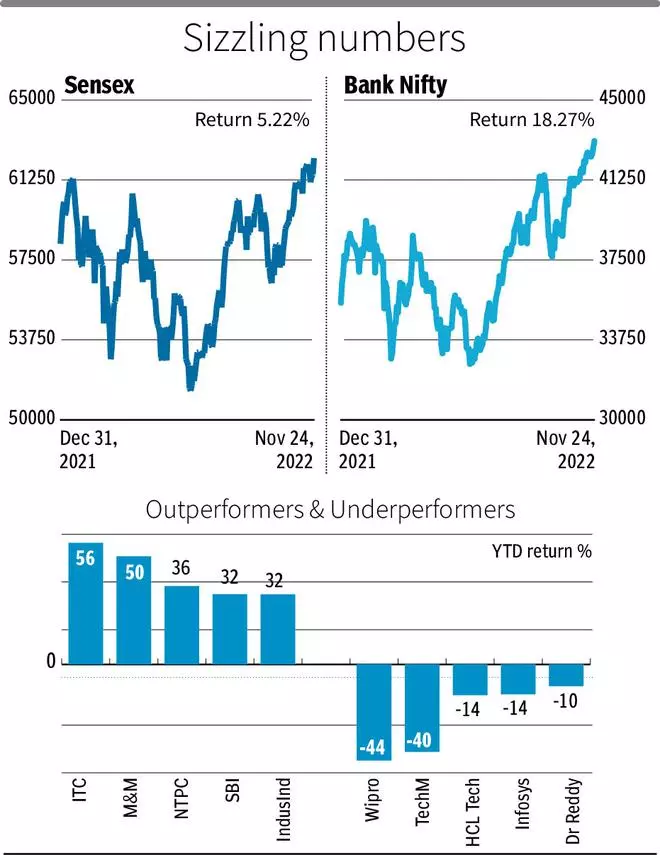

The Sensex closed at a brand new lifetime excessive of 62,272 with good points of 1.24 per cent or 762 factors. The Nifty, which is now round 1 per cent away from hitting a brand new excessive, closed at 18,484 with good points of 1.19 per cent or 216 factors. The Nifty Financial institution, too, hit a brand new excessive, which was a sign that broader market participation was selecting up.

Thursday’s rally in impact was additionally attributable to a swift rise in IT shares led by Infosys, as a overseas financial institution issued its optimistic outlook on the corporate. Majority of the market good points got here within the final 45 minutes of the buying and selling session because the indices witnessed a sudden spurt.

Vinod Nair, Head of Analysis at Geojit Monetary Providers, stated, “The optimism was additional boosted by falling crude costs and the declining greenback index. Crude oil costs dropped over talks of a doable worth cap on Russian oil and an increase in US product stockpiles.”

A slowdown in charge hikes implies that fears associated to quick working inflation had been subsiding. International Brent crude costs have now declined to round $84 per barrel. Costs above $100 had brought about fear amongst central bankers about runaway inflation. However analysts say if the costs fall beneath $50, it may spark a fear over a drastic fall in international commerce and demand.

Because the Rupee has come off from its lows, it leaves quite a lot of room for the RBI to place a brief halt to its financial tightening exercise. Additionally, the truth that the benchmark Nifty was buying and selling at a worth to earnings a number of of lower than 21 exhibits {that a} main downfall was not within the offing.

“Till we see a breakout within the midcap index, one ought to proceed to concentrate on inventory particular strikes within the sectors that are collaborating together with the uptrend within the index and keep away from the underneath performing ones,” stated Ruchit Jain, lead researcher, 5paisa.com.

“Shopping for has lastly emerged available in the market and because the instant resistance of 18,400 has been taken out on the upside, Nifty is anticipated to maneuver above 18,606 ranges. Now the instant help is positioned at 18,400,” stated Nagaraj Shetti, Technical Analysis Analyst, HDFC Securities.

FPIs purchase shares

In the meantime, overseas portfolio buyers (FPIs) bought shares value ₹1,231 crore within the money phase on Thursday and the home institutional buyers had been internet sellers to the tune of ₹235 crore. To this point in November, FPIs bought shares value ₹11,000 crore within the money segments.

“Technically, on every day charts, the Nifty has now shaped an extended bullish candle and can also be holding larger excessive and better low formation on every day and intraday charts which is broadly optimistic. For merchants, so long as the index holds the help of 18,400, there are probabilities it may hit 18,600-18,700 ranges. However, beneath 18,400, the uptrend can be susceptible,” stated Shrikant chouhan, Head of Fairness Analysis ( Retail), Kotak Securities Ltd.

[ad_2]

Source link