Torsten Asmus/iStock through Getty Pictures

Kudos to these traders who’ve appropriately guess on rising rates of interest in 2022 and acquired the ProShares UltraPro Brief 20+ 12 months Treasury ETF (NYSEARCA:TTT). Nevertheless, I feel it’s now time to money out your winnings, as long-term rates of interest look like inflecting decrease on recession fears. TTT is an inverse levered product and isn’t meant to be held over the long-term, as demonstrated by its 10Yr common annual whole returns of -10.2%.

Fund Overview

The ProShares UltraPro Brief 20+ 12 months Treasury ETF seeks every day returns that’s -3x the return of the ICE U.S. Treasury 20+ 12 months Bond Index. The fund achieves its -3x every day publicity goal via whole return swaps with funding banks which are reset nightly.

Technique

Readers are inspired to try a few of the different articles I’ve written on levered ETFs to be taught the mechanics of how levered ETFs work. The 2 key factors to know are that levered ETFs have “optimistic convexity” within the path of their guess (place grows as it’s entering into your favour) and “detrimental decay” as a result of volatility and the every day reset of exposures.

The TTT’s aim is to offer 1-day returns equal to -3x the return of the ICE U.S. Treasury 20+ 12 months Bond Index (“Index”). The index is designed to measure the efficiency of U.S. dollar-denominated, fastened fee treasury securities with minimal time period to maturity better than 20 years. In layman’s phrases, the TTT is betting that long-term rates of interest will rise, and long-term treasury bond costs will fall.

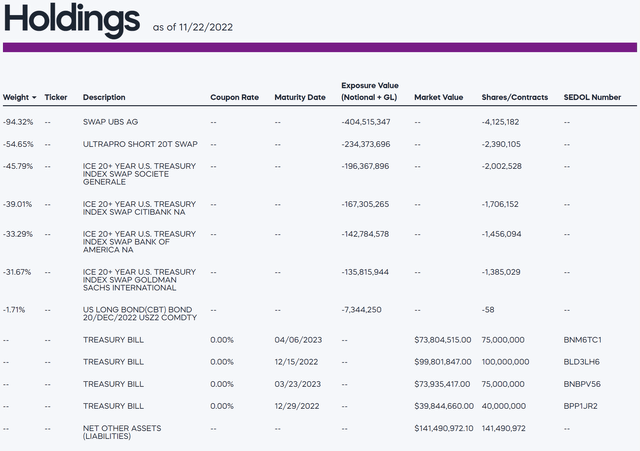

Portfolio Holdings

As mentioned above, the TTT ETF’s holdings are whole return swaps with main funding banks like UBS and Citibank on the underlying index. In whole, the fund holds -300% of property in swaps vs. 100% of property in treasury payments (performing as money) used to settle accounts every day with the funding banks (Determine 1).

Determine 1 – TTT ETF holdings (proshares.com)

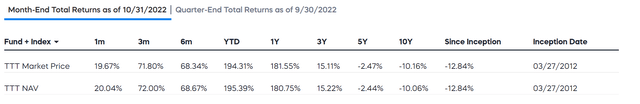

Returns

To date in 2022, the TTT ETF has returned an unimaginable 181.6% to October 31, 2022, on the again of rising rates of interest (Determine 2).

Determine 2 – TTT ETF returns (proshares.com)

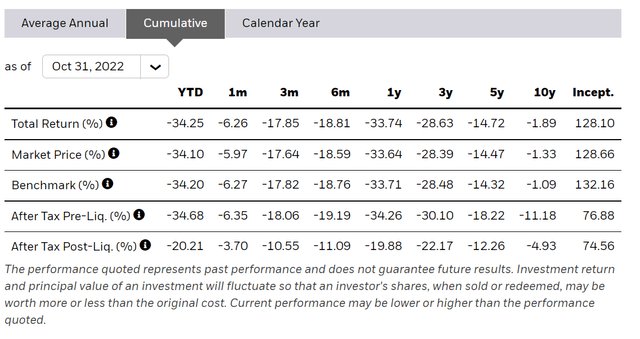

Notice, TTT’s return has considerably outperformed -3x the return of the underlying index, as represented by the iShares 20+ 12 months Treasury Bond ETF (TLT), which misplaced 34.3% YTD. This reveals the ‘optimistic convexity’ impact talked about above (Determine 3).

Determine 3 – TLT ETF returns (ishares.com)

Nevertheless, TTT’s long-term returns have been abysmal regardless of the short-term YTD enhance, with 10Yr common annual whole returns of -10.2%, which is reflective of the ‘detrimental decay’ issue.

Distribution & Yield

The TTT ETF doesn’t pay a distribution.

Charges

The fund costs a 0.95% expense ratio.

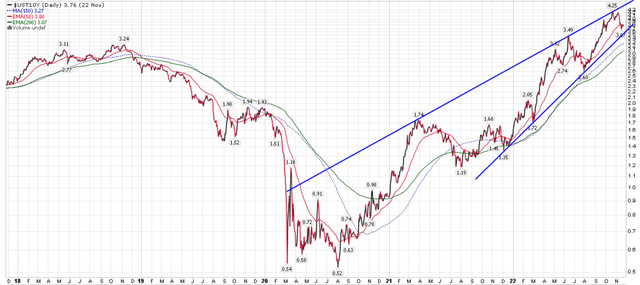

Lengthy-term Treasury Yields Might Be Peaking

Whereas TTT’s efficiency had been excellent YTD to October 31, the fly within the ointment is that the fund has suffered a 30%+ drawdown in the previous couple of weeks, as long-term rates of interest have backed off their highs. Determine 4 reveals the US 10 12 months Treasury yield as an illustrative instance.

Determine 4 – US 10 12 months treasury yields is forming a bearish wedge (Creator created with worth charts from stockcharts.com)

Lengthy-term yields have eased in latest days as a result of financial situations proceed to deteriorate, with many indicators pointing to a possible recession in 2023. For instance, the latest S&P World Flash U.S. Composite PMI readings of 46.3 was an enormous miss to consensus and is “in keeping with the economic system contracting at an annualised fee of 1%”, based on S&P World Market Intelligence’s Chief Enterprise Economist.

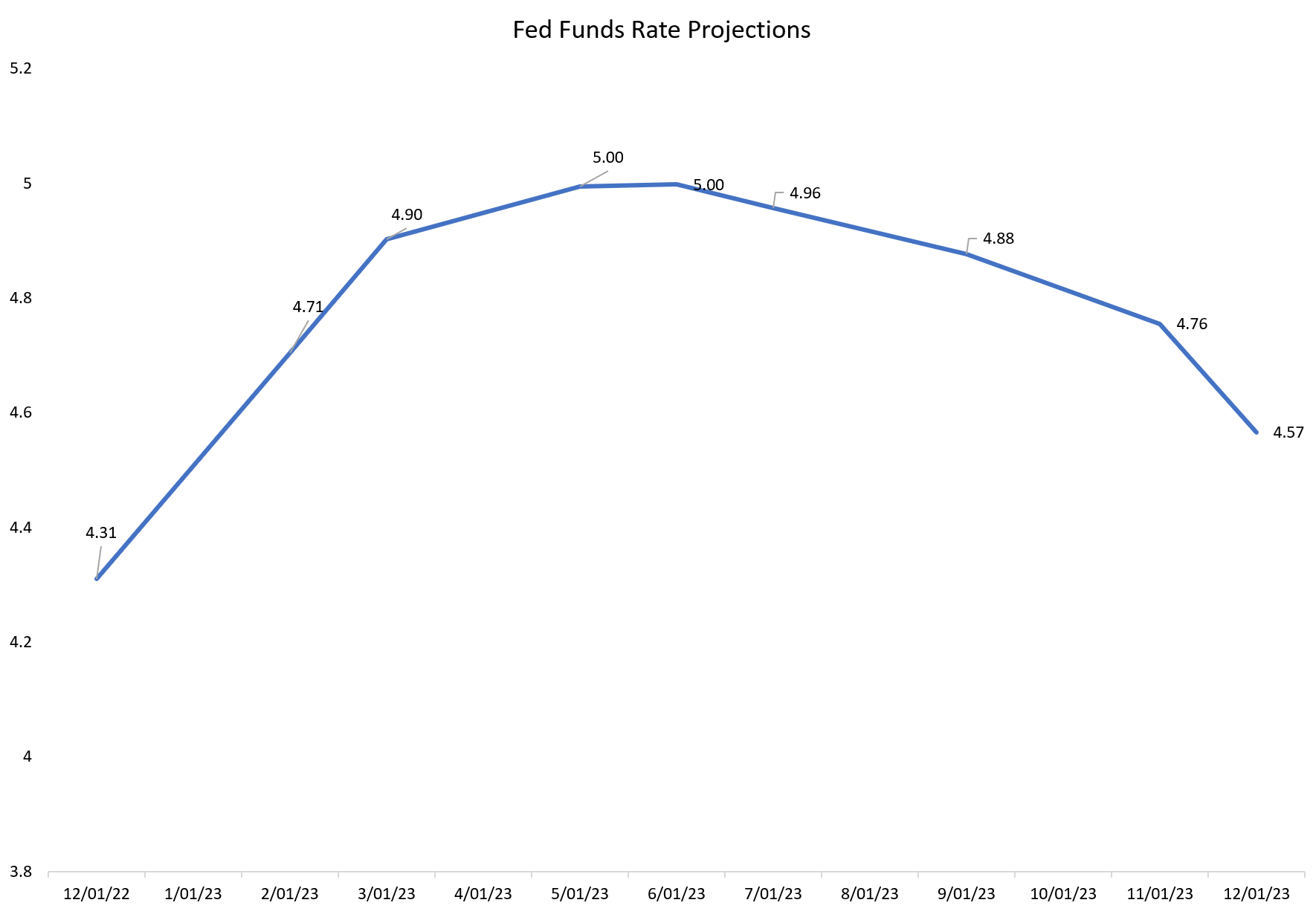

With an impending recession, the market is beginning to worth within the Federal Reserve ‘reducing’ rates of interest within the again half of 2023 (Determine 5).

Determine 5 – Market implied Fed Funds fee (Creator created with knowledge from CME)

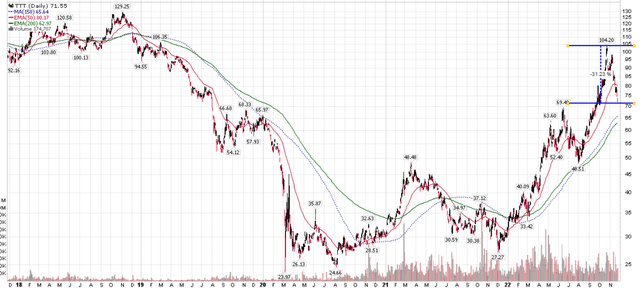

This has led to TTT’s dramatic 30%+ drawdown from October highs (Determine 6).

Determine 6 – TTT is struggling an enormous 30% drawdown (stockcharts.com)

Conclusion

Kudos to these traders who’ve appropriately guess on rising rates of interest in 2022 and acquired the TTT ETF. Nevertheless, I feel it’s time to money out your winnings, as long-term rates of interest look like inflecting decrease. TTT is an inverse levered product and isn’t meant to be held over the long run, as demonstrated by its abysmal long-term returns.