Jamakosy/iStock by way of Getty Pictures

Co-produced with “Hidden Alternatives”

Most well-liked shares are a category of economic safety that pays a set schedule of dividends. They mix elements of each widespread inventory and bonds in a single safety, together with common earnings and possession in the corporate. These securities are structured to offer steady and constant earnings funds like bonds whereas offering fairness possession benefits of widespread inventory, together with the potential for the inventory to understand in worth when purchased at discounted costs. Preferreds are vital if you wish to get extra constant dividends with larger safety for the funds.

Why do firms subject most popular shares?

Firms requiring capital typically select to not use the bond market since overuse can influence their credit standing and improve borrowing prices. Secondary choices are dilutive to shareholders and are frowned upon by worth traders. By issuing most popular inventory, the corporate can elevate capital whereas reducing its debt-to-capital ratio and supporting (and even bettering) the energy of its general stability sheet.

Let’s speak about rate of interest danger

Buyers are shying away from fixed-rate preferreds due to the sentiment that CDs are paying excessive yields with no danger for the capital. I anticipate attention-grabbing discussions within the feedback part for saying this, however do not fall for these non permanent excessive yields. The Fed is preventing above-average inflation and can convey down the charges as soon as they get inflation down. We anticipate the U.S. economic system to see considerably decrease charges once more in a few years, and your cash market earnings will dry out.

if we over tighten, and we do not need to, we need to get this precisely proper, but when we over tighten, then we’ve the flexibility with our instruments, that are highly effective, to, as we confirmed firstly of the pandemic episode, we will help financial exercise strongly if that occurs, if that is needed – Jerome Powell

Lengthy-term earnings traders ought to add high quality most popular securities to their portfolio, particularly when they’re buying and selling at engaging reductions. We now have two picks with as much as 8.5% yields to get you began with fixed-income investing.

Decide #1: GMRE-A, Yield 7.5%

International Medical REIT, 7.50% Collection A Cumulative Redeemable Perpetual Most well-liked Inventory (GMRE.PA)

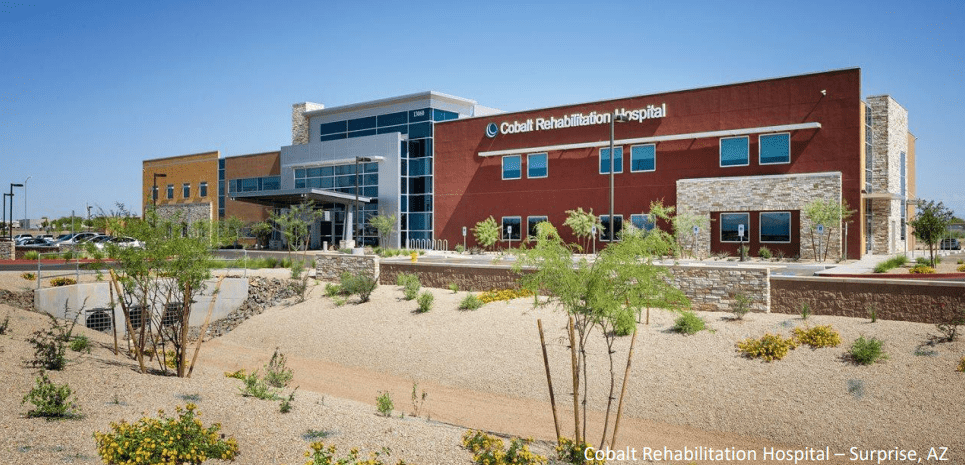

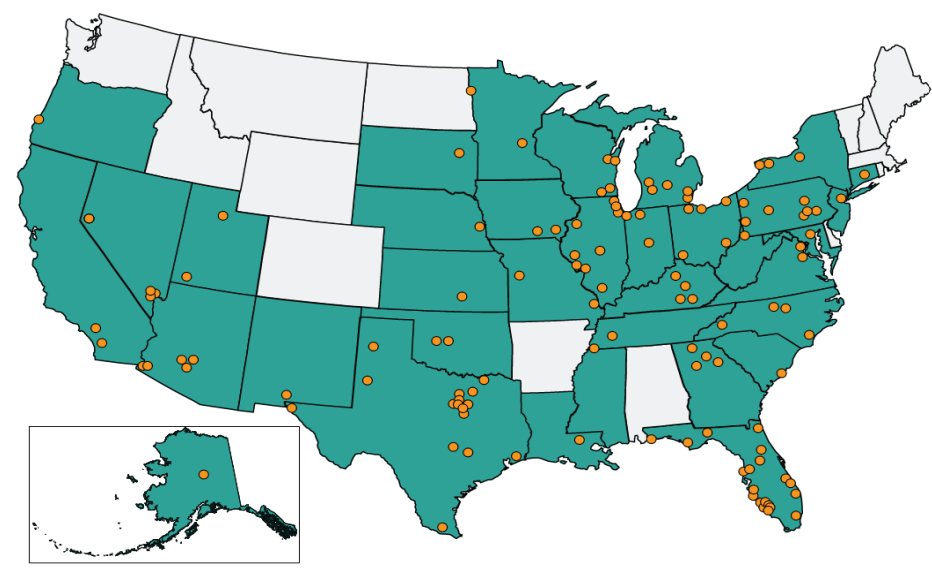

International Medical REIT (GMRE) is a net-lease medical workplace actual property funding belief (‘REIT’) that acquires healthcare amenities and leases these amenities to main healthcare techniques and doctor teams. The corporate owns 189 buildings in 35 states rented out to 269 tenants. No tenant accounts for greater than 10% of the corporate’s revenues. (Supply: GMRE Sept 2022 Investor Presentation)

GMRE Investor Presentation

Regardless of their identify, their properties are all positioned within the U.S.

GMRE Investor Presentation

The REIT’s leases carry a 2.1% common hire escalation, offering a cushion underneath long-term inflation pressures. On the finish of September 2022, the corporate reported a 96.8% portfolio occupancy and a wholesome hire protection ratio of 4.7x.

Being a landlord of clinics and hospitals, GMRE’s enterprise is well-protected from recession pressures since medical illnesses don’t differentiate between good and unhealthy economies. Throughout this bear market, many firms are shedding employees and rethinking their progress ventures; GMRE is opportunistically rising. The REIT accomplished 5 acquisitions, encompassing an combination 247,346 leasable sq ft, for an combination buy value of $50.8 million at a weighted common cap charge of seven.1%. Notably, the corporate has accomplished 14 acquisitions YTD at a weighted common cap charge of seven.2%.

From a debt perspective, GMRE maintains a wholesome stability sheet, with its debt carrying a weighted common rate of interest of three.9% and a weighted common remaining time period of 4.2 years. Roughly 80% of the debt is fixed-rate ($558.4 million), with a weighted common rate of interest of three.75%. The corporate has employed a number of ahead swap buildings that convey the weighted common rate of interest on fastened debt to lower to roughly 3.67% in 2023, 3.50% in 2024, and three.43% in 2025. (Supply: GMRE web site)

GMRE Web site

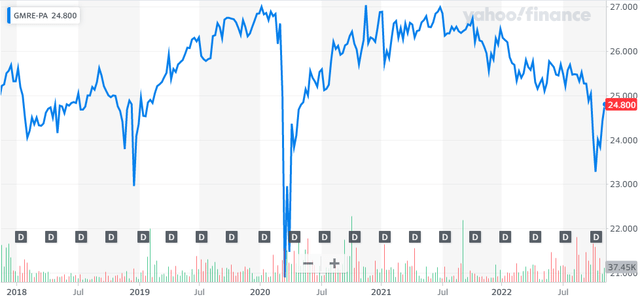

GMRE is executing nicely and rising its portfolio. However we see an amazing fixed-income alternative in its attractively priced most popular – GMRE-A. Within the 5 years of the safety’s existence, there are uncommon moments the place it traded beneath the $25 par worth.

Yahoo Finance

Right this moment, GMRE-A trades at a slight low cost to par worth and carries a sexy 7.5% yield. Notably, GMRE-A is buying and selling publish its name date. Given the present rate of interest atmosphere, we don’t anticipate GMRE to redeem the popular. Consequently, we will construct positions slowly and maintain for a very long time, accumulating dividends.

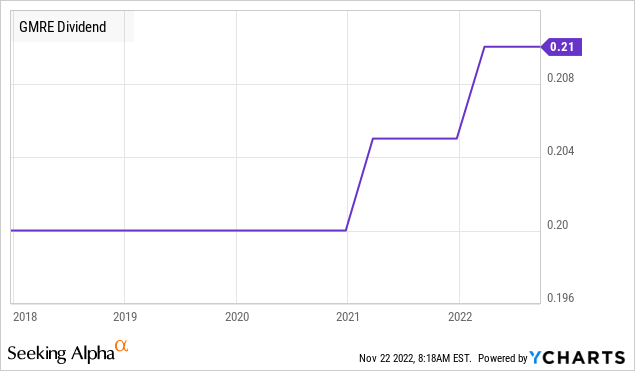

GMRE-A is a cumulative most popular, that means that the popular dividends should be paid in full earlier than widespread shareholders can obtain any dividends. That is significantly good within the case of GMRE-A for the reason that widespread share dividends have been displaying a progress trajectory previously 5 years. This supplies a pleasant “cushion” for the popular shares in a black swan occasion. Not that the cushion is more likely to be wanted, GMRE did not even scale back the widespread dividend throughout COVID.

GMRE spends little or no on most popular dividends. In the course of the 9 months of 2022, GMRE reported roughly $75 million in Adjusted EBITDAre, which supplies comfy protection to the $15 million in curiosity bills and $4.5 million in direction of most popular dividends. The corporate’s 3.8x protection of curiosity and most popular dividend funds may be very favorable for most popular traders. This implies the corporate is in little hazard of defaulting on its commitments to most popular shares and debt holders, with a large cushion.

Decide #2: GNL-A, Yield 8.5%

International Internet Lease, 7.25%% Collection A Cumulative Redeemable Most well-liked Inventory (GNL.PA)

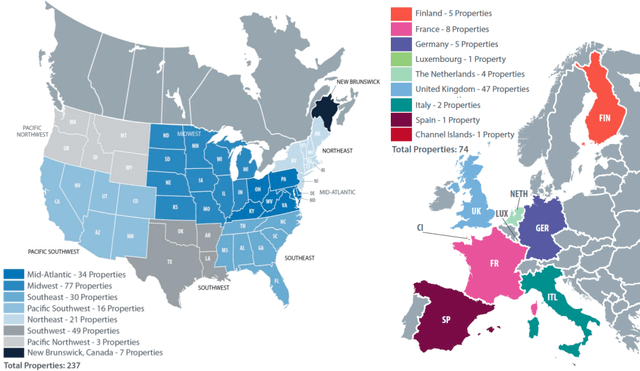

International Internet Lease (GNL) is a Actual Property Funding Belief (‘REIT’) that operates a portfolio of 237 properties within the U.S. and Canada, complemented by a 74-property Europe portfolio. The REIT operates a globally diversified portfolio of business and workplace properties leased to high-credit high quality tenants underneath long-term, triple-net leases. On the finish of Q3 2022, GNL’s tenant base was adequately diversified throughout 141 tenants in 51 industries. (Supply)

November 2022 GNL Investor Presentation

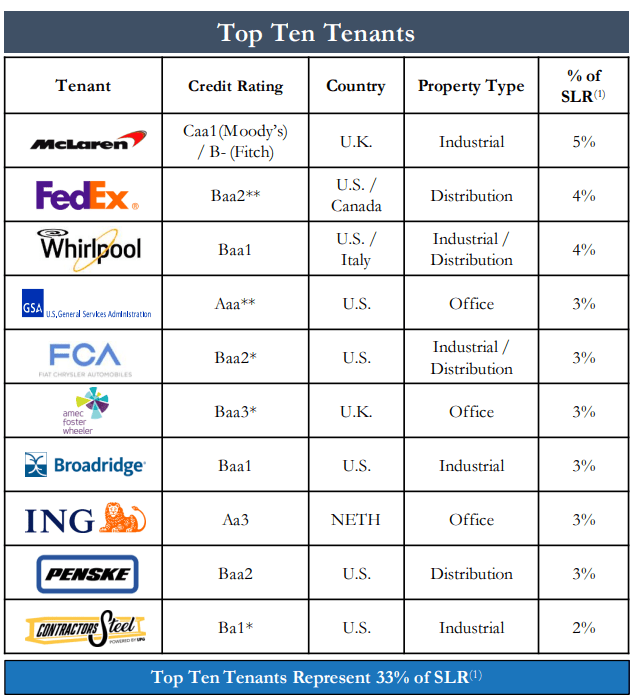

GNL maintains a high-quality web lease portfolio. 33% of GNL’s Straight-Line Lease (‘SLR’) comes from well-known tenants with various property varieties which have little influence on their bodily operations as a result of digital transformation.

November 2022 Investor Presentation

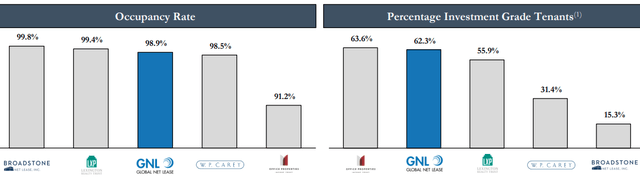

GNL maintained excessive hire collections via the pandemic (they reported collections at or above 97% for every quarter in 2020) and presently has a excessive occupancy charge of 98.9%. 62.4% of their REIT’s tenants have investment-grade scores, and these components put GNL on the high of its peer group of REITs.

GNL Investor Presentation

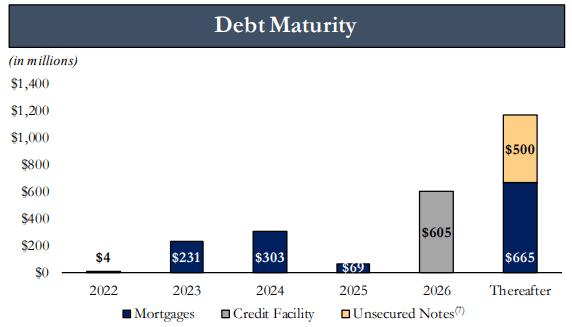

As of Q3 2022, practically 94% of GNL’s leases featured annual rental will increase, with 64% SLR-based fixed-rate, and 26% based mostly on the Client Value Index (‘CPI’), respectively, making GNL’s enterprise resilient to inflationary pressures. GNL additionally maintains a sexy debt schedule with staggered maturities and ~12% of its debt due within the subsequent 14 months. Fitch Rankings has rated GNL’s senior unsecured notes BB+ with a steady outlook and tasks the corporate’s leverage ratio to enhance in coming quarters, pushed by robust enterprise execution.

November 2022 Investor Presentation

We like many issues about GNL, particularly its portfolio high quality, diversification, and enterprise fundamentals. Whereas we’re danger averse to its complete leverage and monetary engineering parts, we see important security with wholesome upside potential and excessive yields via the GNL-A most popular shares, which ranks above widespread fairness on the capital ladder as the popular safety. Furthermore, this safety is cumulative, that means missed funds will routinely pause GNL widespread dividends till the popular holders are compensated for all missed distributions.

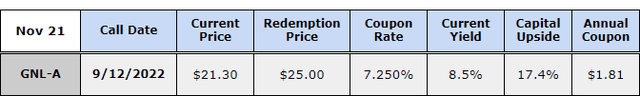

Writer’s calculations

Yahoo Finance

GNL-A trades at a ~15% low cost to par and carries a sexy 8.5% yield. Be aware that GNL-A is buying and selling post-call date, that means the REIT can redeem the securities anytime (with 30-60 days’ discover) and traders would instantly notice the capital upside. Nonetheless, we don’t anticipate this redemption within the close to time period because the preferreds don’t value the REIT a lot yearly and so they have higher use for capital right now.

GNL reported $128 million in money on its stability sheet on the finish of Q3. The REIT spends ~18 million yearly on most popular dividends and $23.5 million on curiosity bills. With FY 2021 AFFO of $173 million and YTD AFFO of $130 million, it’s secure to say that the debt curiosity and most popular dividends are adequately coated by GNL’s money place and the working earnings.

Notably, the Q3 AFFO coated the REIT’s $41 million widespread dividend. This widespread dividend protection is a bonus for the popular shareholders, and the extra constant this protection stays in subsequent quarters, the nearer to the $25 par worth GNL-A will transfer in direction of.

Conclusion

The market cap for most popular securities is far smaller than that of widespread shares; due to this fact, this market shouldn’t be as liquid. The dimensions of the popular inventory market is round $270 billion, in keeping with the S&P Dow Jones Indices, in distinction with the $46.5 trillion U.S. equities market.

At HDO, we keep an intensive portfolio of ~50 most popular securities with a ~9% common yield. A few of these picks are fixed-rate, whereas others are rate-reset kind and floating-rate most popular. Collectively, the target is to make sure sustainable earnings throughout good and unhealthy occasions and assist retirees beat the long-term results of inflation on their high quality of life. Resulting from their low quantity and small market caps, we solely focus on a couple of of our picks in public articles.

Mr. Market is wanting away from fixed-income securities as a result of a notion that there are risk-free options. Make no mistake, the danger in these “risk-free” securities is their costs additionally fall. A Treasury Bond is barely risk-free when you intend on holding it to maturity. Promoting earlier than maturity may lead to a decrease return or perhaps a loss. Most well-liked equities can present dramatically larger earnings in trade for taking over a modest quantity of danger.

It’s crucial to diversify your earnings stream to make sure reliability throughout good and unhealthy economies. Two most popular shares with as much as 8.5% yield that can assist you shield your earnings stream from financial fluctuations.