[ad_1]

On November 22, different financing startup Pipe introduced that its three co-founders have been stepping down from their government roles and {that a} seek for a brand new, “veteran” CEO had commenced.

In an unique interview, co-founder and former co-CEO Harry Hurst advised TechCrunch that the trio have been “0-1 builders, not at-scale operators.” He stated the corporate’s income was rising year-over-year and that the corporate had 5 years of runway.

Discovering the suitable successor might take some time, nevertheless. For starters, Pipe — which has raised greater than $300 million from buyers because it was based in 2019 — has only one outdoors board member in Peter Ackerson, a common companion at Fin Capital who himself turned a VC simply three years in the past. Hurst and fellow founders Josh Mangel and Zain Allarakhia are the one different administrators on the board.

Extra, detractors appear bent on elevating questions on the way in which the enterprise has been run. Since that article was revealed, a number of sources who wished to stay nameless — together with one investor who says he handed on investing within the startup in its early days — have stated that they’ve “heard” that Pipe made roughly $80 million in loans to 1 or a number of crypto mining firms. The outfit or outfits have since gone out of enterprise and the $80 million is believed to have been utterly written off, stated these people.

Requested in regards to the allegations, an organization spokesperson advised TechCrunch that Pipe didn’t subject $80 million value of loans to crypto mining firms and that Pipe didn’t must utterly “write off” any associated receivables. As an alternative, she confirmed that Pipe “has offered entry to financing to crypto mining internet hosting firms” and stated — when requested if Pipe has misplaced any amount of cash on loans to crypto mining entities — that as a non-public firm, Pipe doesn’t share its firm financials.

The startup declined to call its crypto mining-related prospects, however notably, Pipe had a public partnership with Compass Mining, a now beleaguered crypto mining firm that’s reportedly dealing with its personal fair proportion of struggles.

There are different grumblings. One supply alleged that Hurst and the opposite two founders offered hundreds of thousands of {dollars}’ value of their very own shares in a secondary sale, a observe that turned pretty frequent in the course of the pandemic throughout quite a few younger firms. (The founding father of Hopin, additionally based in 2019, has reportedly cashed out shares value not less than $195 million.) After we requested Hurst final week simply how a lot buyers had let the co-founders take off the desk already, he declined to reply.

One fintech investor additionally raised questions in regards to the sophistication of Pipe’s know-how. Requested whether or not there was any associated subject with Pipe’s underlying loans, the corporate’s spokesperson stated, “Whereas we’ve seen some delinquencies on the platform like many fintechs on this present macro setting, we don’t count on buy-side buyers to expertise losses that haven’t already been communicated to them or part of the bigger threat profile communicated by the corporate.”

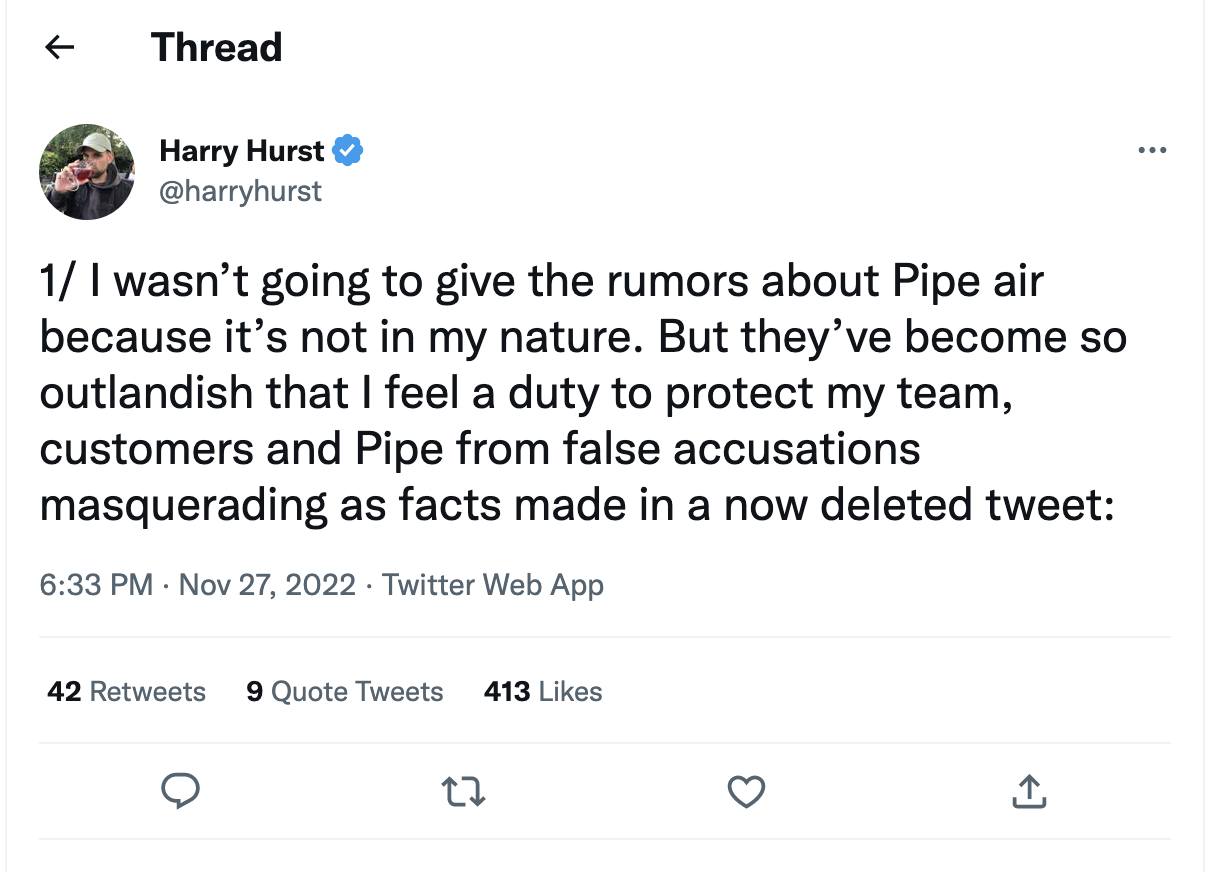

Hurst has apparently been listening to in regards to the conjecture round his firm. In a Twitter thread final night time, he ranted towards “VCs and others hating on our firm primarily based on rumors. Fairly apparent there are dangerous actors with their very own agendas spreading BS with no regard for the individuals it damages.” He additionally wrote: “As a pacesetter, I received’t let this noise distract us or undermine the unimaginable arduous work our staff places into reaching our mission to empower firms in all places to develop on their phrases.”

In the meantime, the CEO search continues. Certainly, Pipe’s spokesperson reiterated at this time what the corporate stated publicly final week, that “Josh [Mangel] is now interim CEO and Harry remains to be on the firm in his new capability as Vice Chairman. They each wish to see Pipe attain its final potential and are dedicated to discovering a brand new CEO as reported and introduced…”

As soon as Pipe’s new CEO is known as, she added, that particular person will assume Hurst’s seat on the board.

As for who helps with the search, she stated the reply is that “lots of Pipe’s stakeholders are a part of the CEO search course of, together with senior administration and buyers.”

Picture Credit: Twitter

Moreover Fin Capital, different VCs to steer investments in Pipe on the a part of their funding companies embrace Marlon Nichols, a managing director at MaC Enterprise Capital, and Ashton Newhall, a longtime investor with Greenspring Associates and now a companion with StepStone Group, which acquired Greenspring in September of final 12 months.

None responded to requests for remark.

One other investor in Pipe, Matthew Cowan of Next47 Capital, advised TechCrunch that he was “not allowed to remark.”

Different backers within the firm embrace Morgan Stanley’s Counterpoint International, CreditEase FinTech Funding Fund, 3L, Japan’s SBI Funding, Marc Benioff, Alexis Ohanian’s Seven Seven Six, Republic and Craft Ventures, which led the corporate’s $6 million seed funding in February 2020.

In the meantime, a Kind-D signed by Pipe Senior Counsel Peter Chiaro with the U.S. Securities and Alternate Fee in late September reveals that the corporate not too long ago secured $7.12 million in debt financing, which may very well be construed as a constructive different to the sort of extremely structured inside spherical that many startups are closing at the moment.

Pipe co-founder and chief enterprise officer Michal Cieplinski, whose identify was absent from the corporate’s announcement final week, was listed as Pipe’s “government officer” within the submitting, which declined to reveal its income vary.

TechCrunch’s weekly fintech e-newsletter, The Interchange, launched on Might 1! Enroll right here to get it in your inbox.

Received a information tip or inside details about a subject we’ve coated? We’d love to listen to from you. You may attain me at maryann@techcrunch.com. Or you may drop us a be aware at suggestions@techcrunch.com. If you happen to want to stay nameless, click on right here to contact us, which incorporates SecureDrop (directions right here) and varied encrypted messaging apps.

[ad_2]

Source link