[ad_1]

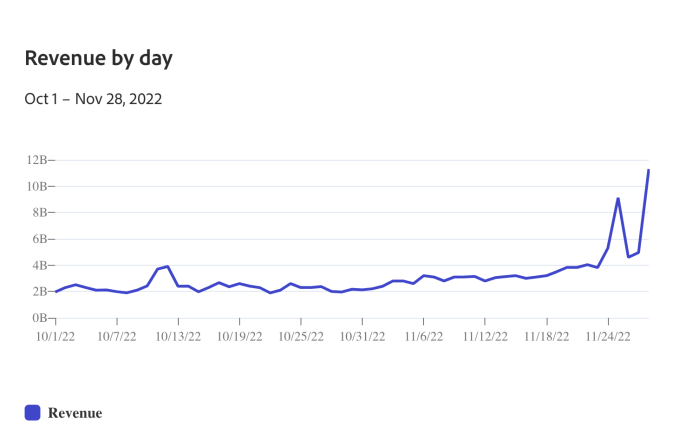

Expectations for this 12 months’s vacation spend on-line had been lukewarm, however preliminary exercise — pushed by deep reductions — has bucked predictions. Cyber Monday pulled in $11.3 billion in gross sales on-line in line with figures from Adobe Analytics, which tracks seasonal e-commerce exercise. That is 5.8% greater than customers spent on the identical day final 12 months (when $10.7 billion was recorded in gross sales, a drop on 2020’s $10.8 billion), and units a file each for the day and the 12 months up to now.

The day is usually the most important of the lengthy weekend — partially as a result of gross sales proceed however folks have returned to work — and it rounds out 5 days that general exceeded estimates. As we reported, Thanksgiving noticed $5.29 billion in gross sales and Black Friday had $9.12 billion in gross sales — each additionally up on earlier forecasts. The weekend between had $9.55 billion in gross sales. Altogether, “Cyber Week” — the interval together with these holidays and the times again at work as folks proceed to buy on-line — will attain $35.27 billion in gross sales on-line, up 4% over final 12 months and accounting for 16.7% of all gross sales within the months of November and December.

Picture Credit: Adobe Analytics (opens in a brand new window) beneath a CC BY 2.0 (opens in a brand new window) license.

Adobe expects $210 billion in gross sales for the 2 months, and up to now within the season cellular has accounted for 44% of gross sales.

Salesforce individually launched its personal preliminary figures of $6 billion for Cyber Monday within the night Monday. We’ll replace these as we get extra full outcomes.

Notably, though inflation is unquestionably being felt within the U.S., Adobe stated that these figures had been based mostly on extra transactions general. On the peak, folks had been spending $12.8 million per minute on Monday, and Adobe stated that its digital value index, which tracks costs throughout 18 classes, stated that costs have been almost flat in current months.

Deep reductions — retailers maybe anticipating needing to have one thing extra to lure consumers — have performed an enormous function, too, as have the sheer availability of products after shortages of the years earlier than.

“With oversupply and a softening shopper spending surroundings, retailers made the fitting name this season to drive demand by way of heavy discounting,” stated Vivek Pandya, lead analyst, Adobe Digital Insights, in an announcement. “It spurred on-line spending to ranges that had been greater than anticipated, and strengthened e-commerce as a significant channel to drive quantity and seize shopper curiosity.”

Reductions on electronics had been as sturdy as 25% off (they had been 8% in the identical interval final 12 months), and the most important gross sales had been in toys with common reductions of 34%.

Adobe says it calculates its knowledge based mostly on one trillion visits to U.S. retail websites, protecting 100 million SKUs, and 18 product classes.

Plenty of the shopping for was being carried out in preparation for the vacations, and that’s mirrored in hottest classes. High merchandise included video games, gaming consoles, Legos, Hatchimals, Disney Encanto, Pokémon playing cards, Bluey, Dyson merchandise, strollers, Apple Watches, drones, and digital cameras, it stated. Toys as a class noticed a 452% enhance in gross sales versus a day in October.

In different tendencies, buy-now-pay-later transactions (BNPL) continued to be power in how purchases are being made, though they gave the impression to be down barely on Monday in comparison with Black Friday and the weekend: a part of the rationale has to do with shopping-cart sizes, Adobe stated: individuals are extra doubtless to make use of BNPL when totals are greater. Total Cyber Week BNPL orders had been up 85% over final week, with revenues up 88%.

Cellular additionally continues to account for an enormous proportion of shopping for, though Cyber Monday’s 43% of all on-line gross sales when individuals are again at their desks, was undoubtedly down from the 55% of purchases on Thanksgiving.

The large query now will probably be whether or not on-line retailers, and consumers, maintain this exercise or whether or not this was an outsized push round reductions that can cool down within the days and weeks to return. Layoffs that we’ve been seeing within the e-commerce sector, and depressed valuations for corporations within the house, are two indicators of tougher instances to return.

[ad_2]

Source link