ryasick

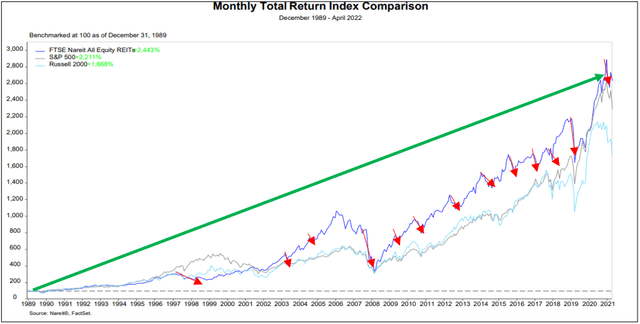

Traditionally, it has at all times been a good suggestion to purchase actual property within the type of publicly listed REITs (VNQ) after a market crash. From the chart beneath, you possibly can see that they have an inclination to drop an excessive amount of because the market corrects, however they then additionally shortly get better thereafter:

NAREIT

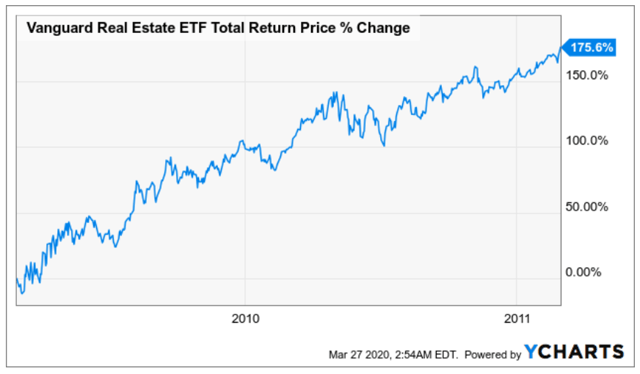

To present you two current examples:

Following the crash of the monetary disaster, REITs practically tripled in worth in simply two years!

YCHARTS

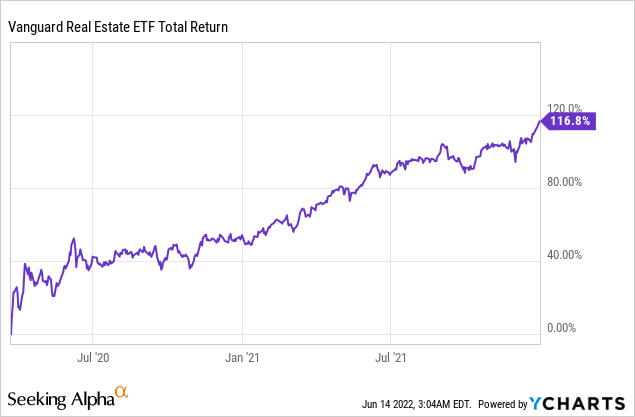

Then following the pandemic crash of 2020, REITs greater than doubled in just some:

YCHARTS

In the present day, REITs are as soon as once more down considerably and we expect that buyers are more likely to earn important returns within the coming years as they get better.

This time, REITs crashed as a result of fears of rising rates of interest, however as now we have defined in earlier articles, these fears are largely overblown as a result of:

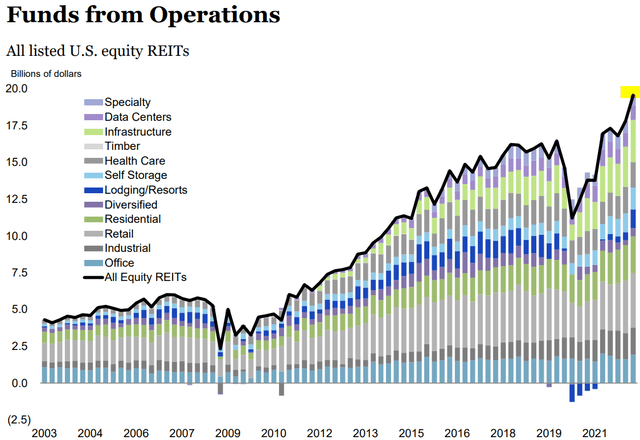

- REITs steadiness sheets are the strongest ever with low leverage at 35% on common and lengthy maturities at practically 10 years.

- Rents are rising the quickest in a few years as a result of inflation.

- And by the point many of the debt must be refinanced, rates of interest can have seemingly come again down, however rents will not, leaving REITs with larger money move than ever:

NAREIT

Subsequently, we expect that REITs are as soon as once more providing some generational alternatives to construct wealth by shopping for actual property at a reduced value.

In what follows, we spotlight two of our favourite alternatives to purchase right now:

Vonovia is already our largest worldwide holding and we proceed to purchase extra of it. The explanation why we’re investing so closely in it’s that we expect that it provides a generational alternative to high-quality German residence communities at simply 35 cents on the greenback.

Vonovia

Vonovia is often perceived to be a blue chip and it has by no means in its historical past traded at a big low cost to NAV till this 12 months when its share value collapsed as if the world was coming to finish.

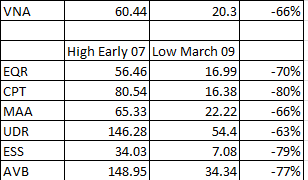

I not too long ago noticed a tweet from a fellow shareholder (since deleted) who identified that Vonovia’s drop is equal to that of US residence REITs throughout the nice monetary disaster. The LTVs have been equal at round 40-45% and US residence REITs (EQR; CPT; MAA; UDR; ESS; AVB) traded at their peak at 20-25x FFO, which can also be in keeping with Vonovia’s peak valuation of 24x FFO:

Again then, shopping for residence REITs at pennies on the greenback proved to be a generational alternative and buyers made fortunes within the restoration.

In the present day, we expect that Vonovia isn’t any completely different. In truth, I’d argue that purchasing Vonovia right now is probably an excellent higher alternative than shopping for US residence REITs in 2008-2009 due to two foremost causes:

Purpose 1) Extra resilient fundamentals: One thing that is underappreciated by buyers is that German residence communities behave very otherwise from these within the US. Again in 2008-2009, rents dropped fairly considerably within the US. It is a free market and rents fluctuate primarily based on provide and demand, which makes income much more cyclical. The German residential market is way more closely regulated, which limits lease progress throughout good years but in addition reduces and even eliminates the draw back throughout powerful instances since demand at all times exceeds provide. Rents in Germany didn’t drop in 2008-2009 and right now, rents are regulated too low and are nonetheless catching as much as the current inflation. Subsequently, we see no risk of a significant decline in rents. Quite the opposite, lease progress is accelerating for the time being, regardless of the collapsing share value.

Purpose 2) A lot smaller existential risk: again then, your entire banking system immediately stopped working, and refinancing debt turned unattainable. This put US residence REITs at excessive danger and compelled many to difficulty extremely dilutive fairness simply to outlive. On the similar time, rents have been dropping, leverage was rising, and the entire setting was very unsure. In the present day, as compared, Europe is dealing with a extreme disaster, however the banking system is working simply nice, leverage is affordable, and rents are rising. I think that Vonovia is down a lot as a result of buyers concern that the rising charges may trigger asset costs to drop and trigger Vonovia’s leverage to change into extreme. However as we clarify in a current article, we expect that that is unlikely for quite a few causes. Scope scores not too long ago launched an outlook for the European residential sector and it properly captures our ideas:

“Drastic asset devaluations look much less seemingly given present asset values of firms are considerably beneath reinstatement prices. Extreme deterioration of the credit score high quality of residential firms is unlikely. Rental progress and money move prospects stay optimistic supported by upward lease changes; shifting demand from potential homebuyers in direction of renting as a result of rising rates of interest; housing shortages in a number of European markets; and optimistic demographics in massive European cities.”

In different phrases, Vonovia’s NAV estimate already is considerably beneath the alternative price of its properties and we’d like extra, not much less, housing. Rents are rising quickly and the demand considerably exceeds the provision. There additionally continues to be good demand for these belongings within the non-public market from decrease risk-tolerant institutional buyers like pension funds and life insurers that want resilient, inflation-protected money move to satisfy their long-dated liabilities.

For these causes, we expect {that a} main drop in asset values is unlikely. After all, values could drop a bit of, however pricing Vonovia at simply 35 cents on the greenback appears approach overdone.

The CEO, CFO, and different insiders have been shopping for extra shares all year long, and the corporate additionally expects to do buybacks – all whereas paying down debt with retained money move and asset tendencies.

We anticipate 100%-plus upside and earn a close to 8% dividend yield whereas we wait. We expect that the dividend is sustainable, however we might truly welcome a minimize if it allowed them to speed up the deleveraging and push for extra aggressive buybacks. It might solely result in extra upside in the long term.

What’s the principle danger you would possibly ask? The warfare in Ukraine spirals uncontrolled, turns into a bigger battle, and causes persistently excessive inflation and better rates of interest whilst Europe enters a extreme recession. I view this as unlikely provided that Russia is shedding the warfare simply towards Ukraine, however I intently monitor the scenario in Ukraine and its influence on the European financial system, its inflation, and rates of interest.

Alexandria Actual Property (ARE):

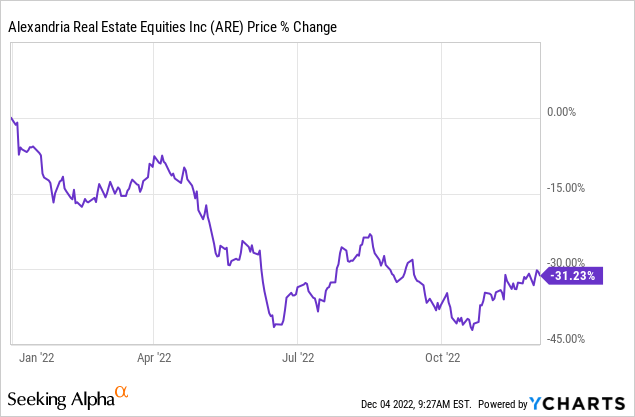

Alexandria Actual Property (ARE) is the biggest holding in our Retirement Portfolio. It owns primarily life science buildings and it’s down closely in 2022 as a result of the market fears that its lease progress will decelerate as even the larger Biotech firms like Vertex (VRTX) and Regeneron (REGN) have a tougher time accessing capital.

Alexandria Actual Property

The rising rates of interest then add gas to the hearth.

However what the market seems to have missed is that ARE’s rents are already deeply beneath market, which gives a predictable “reserve” of future progress because it hikes rents nearer to market. Even when lease progress slows down within the close to time period, ARE will nonetheless have speedy progress prospects forward of it. Within the final quarter, ARE once more hiked rents by practically 30% on expiring leases. On a money foundation, its same-property NOI rose 10.6% year-over-year throughout your entire portfolio, which is the third-highest progress price within the firm’s whole historical past.

In addition they have a robust investment-grade steadiness sheet with low debt at 27% of gross belongings and no main maturities for a few years to come back so there’s little to fret about right here. Here’s a word that the CEO made about their steadiness sheet on final earnings name:

“The execution of our capital plan this 12 months was distinctive given the macro setting. We did $1.8 billion of 12 and 30-year bonds with a weighted common price of three.28% in a time period of 22 years, which was accomplished in February.”

The CEO additionally famous on the earnings name that their progress has been “exceptionally sturdy” with close to double-digit FFO per share progress they usually even barely hiked their steering.

So briefly, the corporate is doing higher than ever, and I feel it is only a query of time earlier than the market realizes this and reprices its shares at over $200, unlocking no less than 50% upside from right here. The dividend yield is small at 3.2%, however it’s additionally rising quickly.

Once more, what’s the principle danger? Rates of interest may stay larger for longer and it may trigger buyers to lose curiosity in higher-growth REITs for an extended time frame. It may trigger a REIT like ARE to underperform for some time, however in the end, we might nonetheless anticipate to earn good returns in the long term as a result of this would not have a significant influence on the corporate’s fundamentals. Extra so on its market sentiment.

Alexandria Actual Property

Closing Word:

There are over 200 REITs on the market and we put money into the most effective ~25 of them at Excessive Yield Landlord as we try to outperform the market. Vonovia and Alexandria are two of them.