Maximilien Dufau

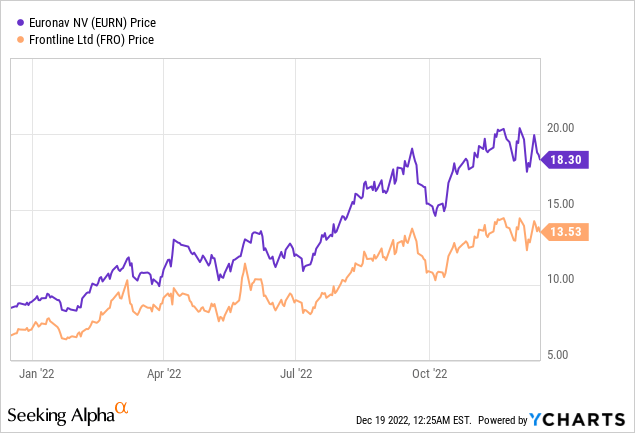

Main international crude tanker firm Euronav (NYSE:EURN) had initially seemed set for a tie-up with Frontline (FRO), however the deal might come underneath vital stress within the coming months. The roadblock right here is main shareholder Saverys Group, which has just lately taken its shareholding as much as ~25%. Recall that they’ve been against the deal from the beginning, citing the necessity for EURN to transition towards clear power and decarbonizing the delivery and heavy trade as an alternative of doubling down on crude oil transport. With a merger additionally depending on FRO clearing a excessive 75% acceptance threshold at its upcoming tender supply, a deal appears unlikely at this level. Given FRO’s NAV outperformance relative to EURN in current months, a no-deal state of affairs doubtless entails relative upside for FRO and draw back for EURN inventory. Internet, the present EURN low cost to the merger trade ratio appears justified, for my part.

A Main Roadblock Emerges because the Saverys Group Builds Up its Euronav Stake

By means of its holdings in Compagnie Maritime Belge (CMB), the Saverys group has taken its EURN shareholding as much as ~25% per a current 13D submitting with the SEC. For context, Euronav was previously a Compagnie Maritime Belge subsidiary earlier than being spun off in 2004 and subsequently changing into a number one publicly-listed tanker firm by way of natural progress and M&A. Alongside the submitting, the group additionally connected a letter to EURN’s Supervisory Board setting out an in depth case for the termination of the FRO merger. The crux of the problem is that the merger is at odds with the group’s plan to transition the EURN enterprise towards clear power and the decarbonization of delivery as an alternative of accelerating its publicity to the crude oil transport enterprise.

Having initially pushed for a merger between Euronav and the CMB.Tech platform, the Saverys group seems to be altering tack. Per a current interview, Alexander Saverys “guidelines out Plan A, which is the merger,” but additionally sees a merger with Frontline as “mathematically unattainable.” He additionally cited the prospect of mixing two main crude tanker corporations as “a large number.”

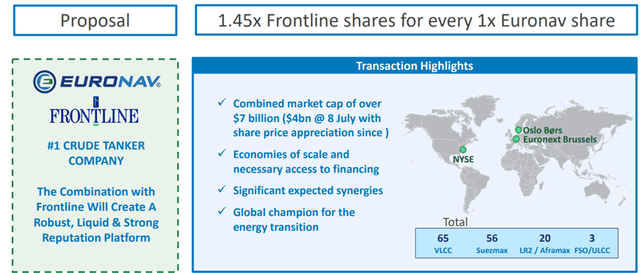

Against this, the EURN administration and Board view are that the EURN/FRO merger is sweet for shareholders, offering a much less value-destructive path ahead for the corporate than the CMB various. Per deal phrases, FRO will permit EURN CEO Hugo De Stoop to steer the mixed entity however with Frontline because the surviving entity, and EURN shareholders might be granted a bigger slice of the mixed firm (per the 1.45x trade ratio).

On stability, I think the proposed FRO mixture is probably going the extra accretive step ahead – the financial good thing about a extra consolidated crude tanker market (assuming no antitrust blocks) ought to greater than outweigh any execution difficulties with integration of this scale. In distinction, the Saverys’ proposal for EURN to desert its core enterprise and as an alternative transition into ‘cleantech’ is dangerous. Whereas a ‘inexperienced’ EURN would entice ESG flows, it’s maybe a step too far past the corporate’s competencies and, thus, presents vital execution danger.

Modified Monetary Phrases Level to a Probably Deal Break

Per the present merger phrases, each corporations will trade inventory at a 1.45x ratio of FRO shares per EURN share. The trade mechanism will see FRO buying all ~202m of issued and excellent EURN shares for ~292m FRO shares. On a pro-forma foundation, this can end in a EURN/FRO shareholding cut up of 59%/41% of the merged entity, which can bear the Frontline identify.

Euronav

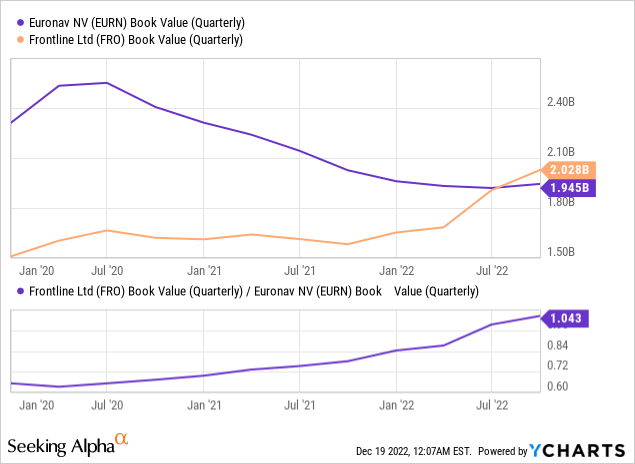

Whereas this had been a good ratio on the time on a NAV-to-NAV foundation, the efficiency differential between each corporations means the phrases are a lot much less engaging to FRO shareholders. With FRO’s e-book worth at a bigger premium to EURN in the present day, a decrease trade ratio would current a fairer deal for FRON shareholders; thus, a renegotiation looks as if a believable final result from right here. Plus, FRO additionally has a higher-quality and youthful fleet – the FRO fleet has a mean age of <6 years in comparison with the EURN fleet age of >8 years. In essence, a merger at present phrases would even be dilutive to FRO shareholders on a fleet-on-fleet foundation.

Euronav-Frontline Merger Dealing with a Roadblock

Whereas FRO has proven intent to finish the EURN merger as deliberate, there’s now an actual chance that the deal falls via. The just lately scheduled FRO shareholders assembly on December twentieth to re-domicile within the EU (from Bermuda to Cyprus) signifies intent, however main shareholder strikes current potential roadblocks forward. Of word, the most important FRO shareholder, John Fredriksen, has disposed of ~2m Euronav shares in current weeks; this was adopted by Saverys’ stake rising to 25%. Given Saverys has been clear on its stance in opposition to the deal, the 75% acceptance threshold could possibly be out of attain.

A deal-break state of affairs would not be all unhealthy, for my part. Whereas there are scale advantages from the merger, each corporations are additionally worthwhile and will do fantastic as standalone entities. Within the meantime, the tanker market seems to be holding up nicely heading into the winter, greater than offsetting any extra capability headwinds. Whereas EURN trades beneath the 1.45x deal trade ratio, the upper chance of a no-deal state of affairs, in addition to its NAV outperformance in current months, means any EURN upside is probably going capped for now.