RapidEye

I could not love you any higher, I like you simply the best way you’re, proper – Billy Joel

So Far, So Good

There are at present solely 9 energetic positions in our Funds Macro Portfolio (“FMP”) versus 500 positions held by the SPDR® S&P 500® ETF Belief (NYSEARCA:SPY).

As of Dec. 20, 2022, these are the ETF’s prime 10 holdings:

| Title | SPY Weight | |

|---|---|---|

| Apple Inc. (AAPL) | 6.18% | 6.18% |

| Microsoft Company (MSFT) | 5.63% | 5.64% |

| Amazon.com Inc. (AMZN) | 2.36% | 2.36% |

| Berkshire Hathaway Inc. Class B (BRK.B) | 1.70% | 1.70% |

| Alphabet Inc. Class A (GOOG) | 1.66% | 1.66% |

| UnitedHealth Group Integrated (UNH) | 1.52% | 1.52% |

| Alphabet Inc. Class C (GOOGL) | 1.48% | 1.48% |

| Johnson & Johnson (JNJ) | 1.44% | 1.44% |

| Exxon Mobil Company (XOM) | 1.37% | 1.37% |

| NVIDIA Company (NVDA) | 1.25% | 1.25% |

Whereas the ETF’s distribution yield is 1.66% (30 Day SEC Yield: 1.61%) and the S&P 500 Index’s (“SPX”) dividend yield is 1.75%, FMP’s common* annual yield is ~3.37%*, i.e. about twice as a lot as SPY.

*Primarily based on 6.85% yield that has been generated since FMP’s inception date, almost two years in the past)

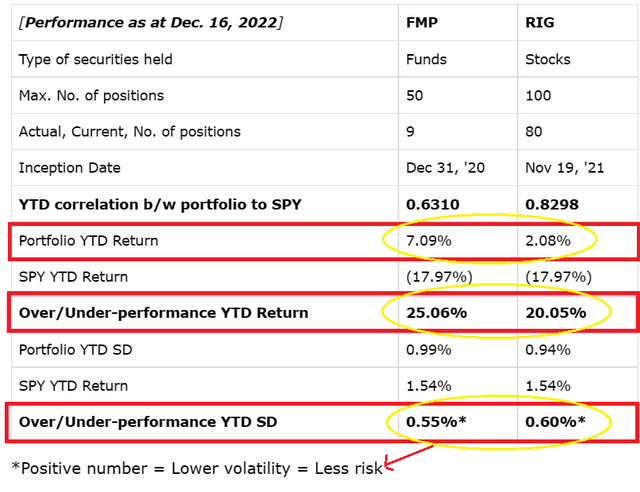

Whereas the ETF’s whole return YTD is down -18.55%, our FMP is up +6.76%, leading to an outperformance of 25.31% for 2022 alone.

(Word that the under picture incorporates information legitimate for the top of the earlier buying and selling week.)

Macro buying and selling Manufacturing facility (“MTF”)

Our FMP is not solely outperforming SPY by 25.3% YTD, but it surely’s doing so whereas taking about 36% much less danger (measured by the distinction in the usual deviations: 0.99%/1.54% = 64% >>> FMP is 36% much less risky/dangerous).

Greater than absolutely the return, it is the relative return we give attention to.

Greater than the relative return in comparison with the benchmark, it is the relative return in comparison with the danger taken we’re pleased with essentially the most.

As a result of on the finish of the day, you are not (solely) pretty much as good as absolutely the return you are delivering however (principally) as accountable as the danger you take.

Aiming for an outstanding return whereas taking an much more phenomenal danger is an funding “technique” that will not final over time.

If age comes earlier than magnificence, danger (administration) comes earlier than (producing) return.

No Fed Pivot (This is not 2018)

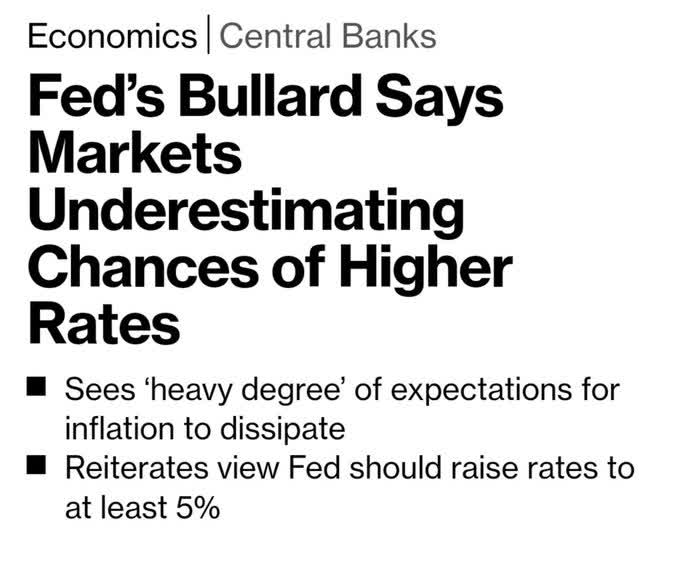

As soon as once more, the Fed’s James Bullard is doing the soiled job for Chair Jay Powell with some uber-hawkish remarks he got here up with yesterday (Nov 29, 2022).

Bloomberg

The Fed’s John Williams additionally got here for assist along with his personal (much less hawkish, nonetheless removed from being dovish) remarks:

- Unemployment price is predicted to rise to 4.5%-5% subsequent 12 months.

- 4.5% represents a extra “benign state of affairs” however larger (unemployment price) is feasible.

- Recession is “clearly a danger.”

December 2018: CPI print was 2.5percentY/Y.

October 2022 (Most up-to-date determine): CPI print is 7.7% Y/Y.

Given excessive inflation, the Fed is unlikely to “pivot” quickly, absolutely not on the subsequent FOMC (as some nonetheless hope).

Conserving It Easy

On the finish of the day, issues are pretty easy:

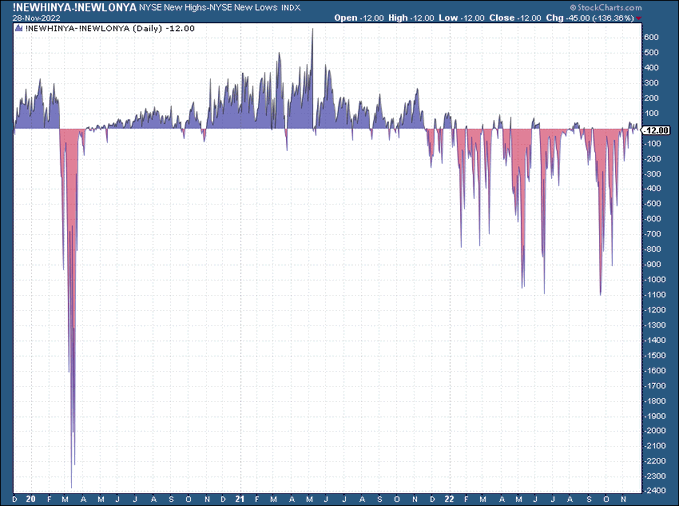

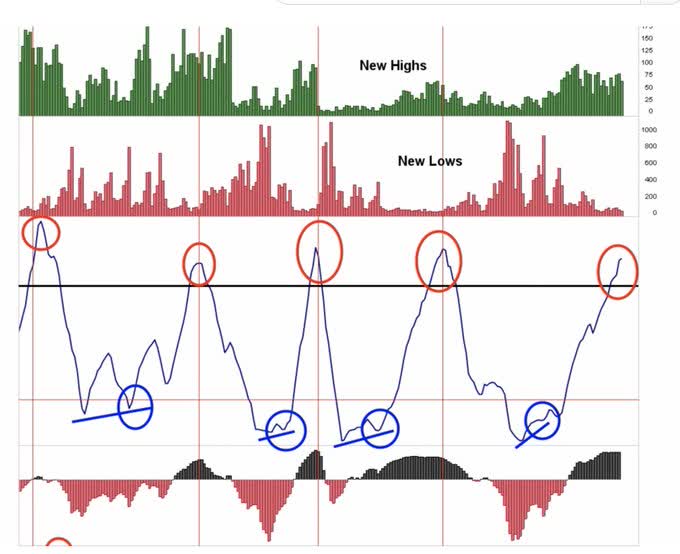

- New Lows > New Highs = Bear Market

- New Highs > New Lows = Bull Market

It is not (and does not must be) any extra difficult than that.

Due to this fact, till we see extra new highs climbing (=larger absolute quantity in addition to relative to new lows) for greater than only a random week or two, now we have to:

- Function beneath the belief we’re nonetheless very a lot in a bear market.

- Stay skeptical and suspicious.

- Chorus from pondering (maybe convincing ourselves) that shares have already bottomed.

The final a number of head pretend (inventory market) rallies have been transient blips (together with short-lived ‘New Highs > New Lows’ episodes).

The final bounce appears to be growing related traits.

StockCharts

Inventory Market Severely Overbought

The “new highs – new lows” indicator is at a degree that has put an finish to the previous 12 months’s numerous pretend aid rallies.

All Star Charts

SPX is approaching the 200-DMA degree when the index already is extraordinarily overbought. That is not an encouraging mixture.

A deteriorating economic system, probably heading towards recession, absolutely does not add an excessive amount of optimism to the combination.

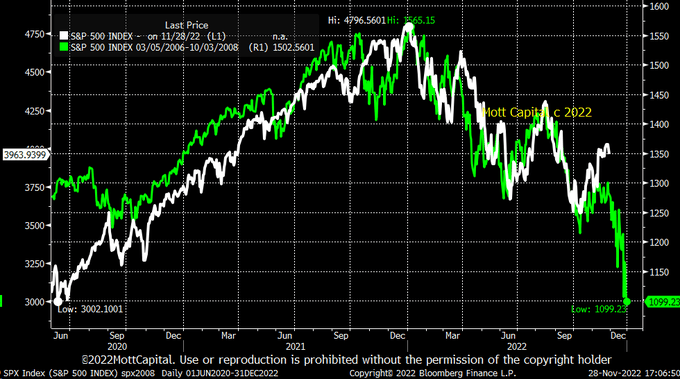

Historical past Typically Rhymes

It is onerous to not suppose that the following vital SPX transfer (>10%) shall be down. In that case, the SPX 2022 vs. 2008 analogy can be bolstered – and that is not excellent news for shares.

Mott Capital

SPY(ware)

Pay attention to SPY!

Bear in mind: Analysts are nonetheless forecasting a 5% SPX EPS progress in 2023.

Which means that a recession is not priced in, and (subsequently) shares can transfer down much more.

As already occurred this previous 12 months.

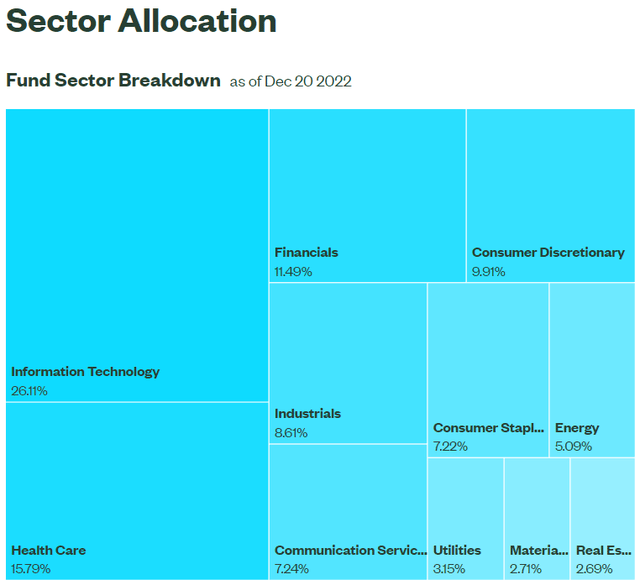

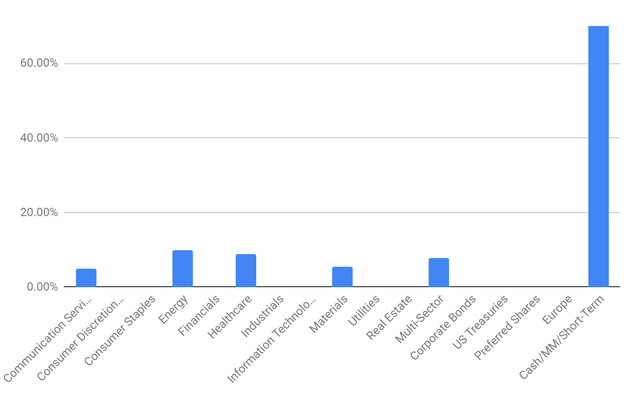

What’s the essential danger of SPY? Sector allocation.

SPDR® S&P 500® ETF Belief

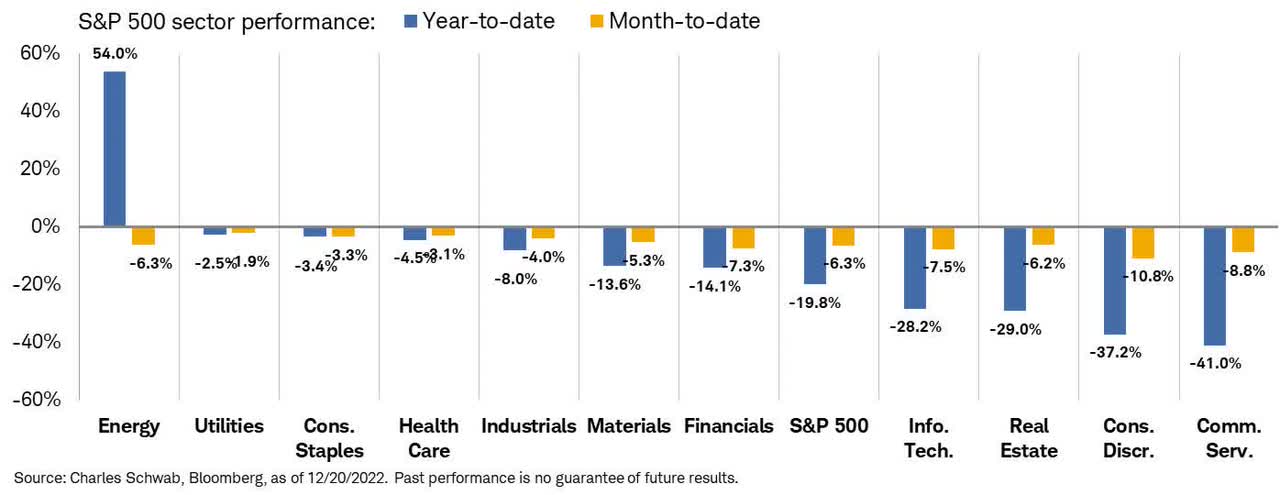

Out of SPY’s six largest sector allocations – Tech (XLK), Healthcare (XLV), Financials (XLF), Client Discretionary (XLY), Industrials (XLI), and Communications (XLC) – 4 are among the many index’s worst 5 performing sectors for the 12 months.

Out of SPY’s 5 smallest sector allocations – Client Staples (XLP), Vitality (XLE), Utilities (XLU), Supplies (XLB), and Actual Property (XLRE) – 4 are among the many index’s prime six performing sectors for the 12 months.

Charles Schwab

Placing it otherwise, SPY has had giant allocations to the worst (growth-oriented) swimming pools, and small allocations to one of the best (value-oriented) swimming pools.

That is not solely a danger (wanting again at 2022) but additionally a problem (wanting into 2023), as a result of most all people – together with yours really – is anticipating 2023 to be one other 12 months by which worth goes to outperform progress.

FMP = Discovering Mojo Patiently

Not like the SPY, we have been early (maybe too early) to establish the value-growth development.

Bloomberg

The problem is not to decide on “worth” and/or “progress,” however to evaluate the dangers related to every investing fashion (and related sectors) in the beginning of yearly.

On the finish of the day, danger administration is not flipping a coin (in the beginning of the 12 months) and performing based mostly on the “head” (worth) or tail (progress). As an alternative, it is about modeling and analyzing each dangers and (potential) rewards and (based mostly on these) figuring out whether or not taking the danger is well worth the potential reward.

Regardless of whether or not you are a bull, a bear, a hawk, or a dove, one factor should be very clear to you:

[Hawkish comments] + [No Pivot in the foreseeable future] + [Overbought equities] + [Weak New Highs/New Lows Indicator] + [2008 Flashbacks] = Elevated Fairness Threat = Decrease Publicity to Shares.

Precisely how the FMP is positioned.

Though there have been transient, short-term, durations the place we raised the extent of danger (i.e. publicity) inside the FMP, we have been predominantly defensive since mid 2021.

In the course of the second half of 2021, this strategy brought on us to underperform the SPX, however then got here 2022 and never solely have we absolutely compensated for the 2021 lag, however now we have constructed a pleasant buffer nicely and above the shortfall.

The under chart presents our present exposures on a web foundation, i.e. with out taking leverage results into consideration. We’re now about 70% (!) in money, however extra importantly than that we’re solely ~40% invested on a leveraged, web foundation.

Macro buying and selling Manufacturing facility (“MTF”)

What does “leveraged, web foundation” precisely imply?

If an instrument has a leveraged constructed into it (e.g. SOXL or TQQQ) there is a money publicity (=how a lot cash precisely is invested into the instrument) and there is the portfolio publicity (=how a lot worth is in danger once we account for the leverage that’s a part of the instrument).

For instance: If I put $100 into SOXL, the money publicity is $100 (actual cash) however the portfolio publicity is $300 (because of the 3x-leverage impact).

Wanting on the exposures on a leverage foundation, we’re lengthy ~63%, quick ~23%, and that is what brings us to a web publicity, together with leverage, of ~40%.

Nonetheless, 40% is a really low publicity, even decrease than the 50% we usually do not get under.

The primary danger for us proper now’s that we’re under-invested and so if the SPY runs larger – we’re more likely to underperform, and maybe considerably.

Then again, if the SPY retains heading south, our hedge (stance) is our edge (efficiency), and we will outperform SPY.

Because the FMP is aiming to outperform SPY on a risk-adjusted foundation, that is each a danger and problem.

The danger is that we could underperform by an excessive amount of, and the problem is to search out the correct (not good!) time to place more cash to work, to ensure that the FMP to be nearer within the lengthy publicity to the SPY’s fixed 100% lengthy publicity.

Principally, we already know what we want to do and the place the FMP is heading to (by way of exposures and allocations) in 2023.

Nonetheless, not all our investing preferences going into 2023 have been carried out as of but inside our FMP, and there is a good distance (for us) to go between what we wish to do and the way/when precisely we will try this.

Going into 2023, we preserve seeing a too excessive degree of danger (versus a fairly restricted upside) that retains us in our seats for now. As quickly as this modifications, and the danger/reward turns enticing (or, at the least, balanced), relaxation assured we are going to act. Shortly and swiftly.

So 70% in money is by far the very best share of “dry powder” the FMP has ever saved since its inception, and we’re able to deploy once we really feel the time is correct.

And the time shall be “proper” not once we really feel that we will make a “killing” (=exceptionally excessive and harmful) return fairly once we know that we’re not topic to a “killing” danger.

‘Trigger you are superb Simply the best way you’re – Bruno Mars