A brand new incentive for low- and moderate-income people to save lots of for his or her post-working years might be on its method.

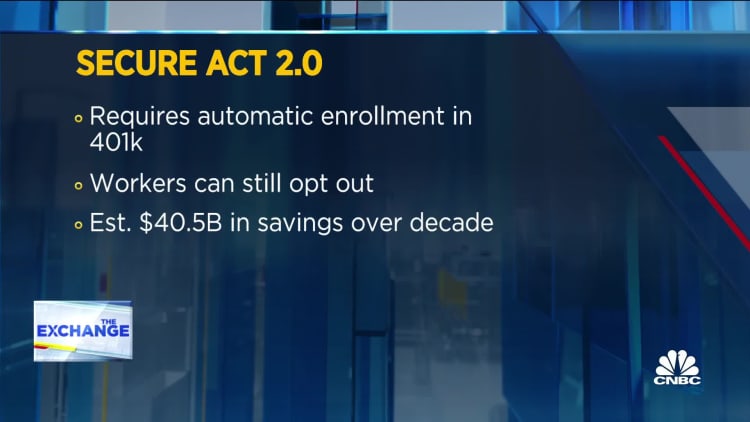

Underneath a provision included in a legislative proposal often called “Safe 2.0” — which is included in an omnibus appropriations invoice that cleared the Senate on Thursday and awaited a Home vote — a retirement “saver’s match” could be carried out, primarily altering how an current tax credit score works.

associated investing information

Ought to the invoice go, folks with revenue beneath set limits who contribute to a certified retirement account — i.e., a 401(okay) plan — would obtain a restricted federal “matching” contribution to their nest egg beginning in 2027. That quantity could be a most 50% of as much as $2,000 in contributions to a qualifying account (so a most $1,000 match per particular person).

The match could be phased out (lowered) at revenue of $41,000 to $71,000 for married {couples} submitting a joint tax return. For single taxpayers, the phase-out vary could be $20,500 to $35,500, and for heads of family filers, $30,750 to $53,250.

The present credit score is not at all times helpful for taxpayers

The transfer to permit a federal matching contribution is being sought as a result of the present tax credit score is nonrefundable, that means that if you happen to owe no federal revenue tax, you aren’t getting the credit score.

“The main disadvantage with the model in legislation immediately is that it is not refundable,” stated Shai Akabas, director of financial coverage on the Bipartisan Coverage Heart.

Extra from Private Finance:

Pell Grants may rise to a most $7,395 subsequent yr

1 in 5 younger adults have debt in collections, report finds

Here is how medical insurance helps to chill inflation

“So people who haven’t any federal revenue tax legal responsibility, which is most low- and moderate-income earners, get no profit from that credit score,” Akabas stated. “This reform is an try to verify these folks obtain an incentive and a profit for placing away cash for his or her future.”

The brand new saver’s match additionally could be out there to some staff who aren’t permitted to make use of the present tax credit score, resembling some authorities staff (i.e., faculty academics) and gig staff, stated Kristen Carlisle, basic supervisor of Betterment at Work.

The match could be “a direct, substantial technique to improve the retirement financial savings of decrease and middle-income staff, and incentivize good retirement planning habits,” Carlisle stated.

Greater than 108 million folks could be eligible for the saver’s match, in accordance with the American Retirement Affiliation.

The prevailing tax break continues to be out there

Within the meantime, the present tax credit score stays out there and would would keep intact by way of 2026 if the supply in Safe 2.0 turns into legislation. Nevertheless, solely 48% of staff know it, in accordance with a 2021 report from the Transamerica Heart for Retirement Research.

The present tax credit score generally is a most of $1,000 (50% of $2,000 in contributions) for single tax filers with as much as $20,500 of revenue in 2022 and heads of households with as much as $30,750 in revenue. For joint filers, the utmost credit score is $2,000 (50% of $,4000 in contributions) for these with as much as $41,000 of revenue.

Above these revenue limits, the credit score phases out — is lowered to both 20% or 10% from 50% — as much as revenue of $34,000 (singles), $68,000 (joint filers) and $51,000 (heads of family).