[ad_1]

By Graham Summers, MBA

During the last 25 years, the monetary system has been in what I name the “period of serial bubbles”: a time by which central banks create asset bubbles, mentioned asset bubbles burst, and central banks reply by creating one other, bigger bubble in a extra systemically essential asset class.

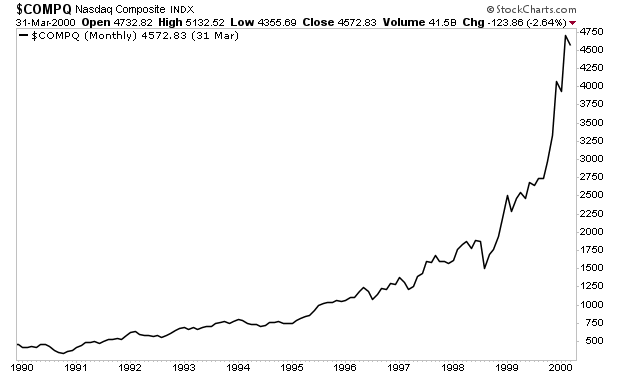

The primary main bubble was the Tech Bubble of the late Nineteen Nineties. Whereas that bubble was remoted to a selected sector in a selected asset class (Tech Shares), it was egregious in scope. A 3rd grader might have checked out a chart of the NASDAQ and instructed you the state of affairs wouldn’t finish nicely.

When that bubble burst, the Fed opted to create one other bubble by using extraordinary financial insurance policies. Particularly, the Fed stored rates of interest too low for too lengthy, basically making credit score free. And since congress handed laws that lowered lending requirements to potential owners, the next bubble came about in actual property: a a lot bigger, systemically essential asset class.

Nonetheless, this time round, the bubble grew to become actually world in scope, courtesy of Wall Avenue derivatives that the Fed ignored/ refused to manage. In easy phrases, Wall Avenue packaged up rubbish mortgages into “property” that have been offered to everybody from hedge funds to pension funds, banks and extra. On this method, poisonous mortgages in Florida, Las Vegas, and many others. ended up on the steadiness sheets of everybody from Japanese banks to Spanish hedge funds.

So, when the housing bubble burst, all of those property needed to be revalued at a lot decrease values… ensuing within the world banking system imploding in the course of the Nice Monetary Disaster of 2008.

What did the Fed do to handle this case?

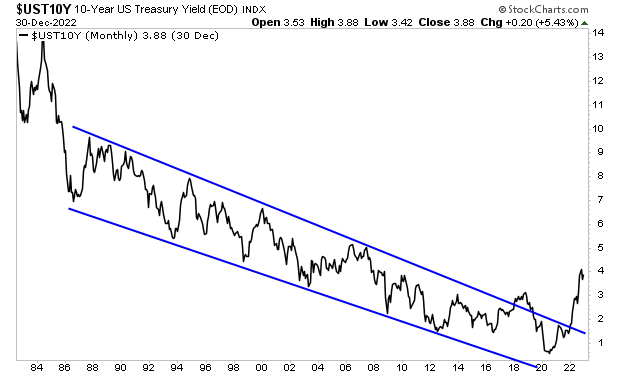

It tried to nook/ create a bubble in U.S. sovereign bonds, additionally referred to as Treasuries.

These are the senior most asset class on the earth. These bonds act because the bedrock of our present monetary system, with their yields representing the “threat free” price of return in opposition to which all property (shares, bonds, actual property, and many others.) are valued.

Put merely, when the Fed created a bubble in these bonds it was truly making a bubble in EVERYTHING, as a result of ALL asset courses would finally be repriced primarily based on Treasuries have been doing.

For this reason I coined the time period “the Every little thing Bubble” in 2014.

And that bubble has now burst.

The yield on the all-important 10-year U.S. Treasury has damaged its 35 12 months down pattern. The period of Serial Bubbles is over. And there’s nothing the Fed can do to repair this case.

In any case, what can it do? There isn’t a bigger extra systemically essential asset class the Fed might use to create one other bubble. And introducing extra extraordinary financial coverage would make the state of affairs worse.

What does this imply?

The Nice Disaster of our lifetimes is lastly right here.

[ad_2]

Source link