jetcityimage

A number of months in the past, I reviewed the Guggenheim Strategic Alternatives Fund (GOF). My total impression of GOF was that it was paying a distribution yield that far exceeded the fund’s earnings energy.

Not too long ago, I got here throughout GOF’s sibling fund, the Guggenheim Lively Allocation Fund (NYSE:GUG). How does GUG evaluate to GOF?

Though GOF is marketed as an ‘opportunistic’ fund and GUG is marketed as an ‘asset allocation’ fund, going by way of the small print, I discover the 2 funds have very related portfolio compositions and holdings. The important thing distinction is that the GOF fund trades at a 20% premium to NAV whereas paying a 17.3% of NAV distribution whereas the GUG fund trades at a 14% low cost to NAV whereas paying a 9.1% of NAV distribution.

GOF buyers might want to promote the ‘costly’ GOF fund and swap into the ‘discounted’ GUG fund, as I estimate there may be much less threat of a distribution minimize for GUG.

Fund Overview

The Guggenheim Lively Allocation Fund (“GUG”) is a closed-end fund centered on present revenue and capital appreciation. The GUG fund pursues an asset allocation technique, allocating publicity to securities and asset courses with engaging threat/reward traits. The GUG fund has over $500 million in web belongings and expenses a 1.93% expense ratio.

Technique

To realize its funding goal, the GUG fund employs a dynamic asset allocation technique, allocating the fund’s publicity to totally different asset courses that provide engaging threat/reward. Inside an asset class, the fund additionally pursues a relative worth technique, using quantitative and qualitative evaluation to determine funding alternatives.

The fund combines a fixed-income portfolio with a diversified pool of different investments and fairness methods that the supervisor believes will outperform on an absolute foundation.

The GUG fund additionally employs leverage to reinforce returns. As of December 30, 2022, the fund had $198 million in leverage towards $714 million in managed belongings for 28% leverage.

Portfolio Holdings

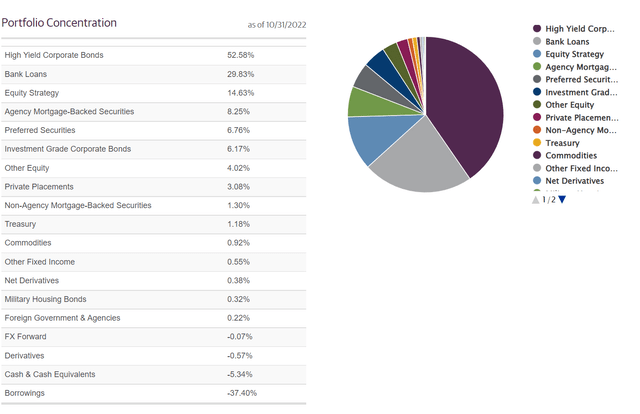

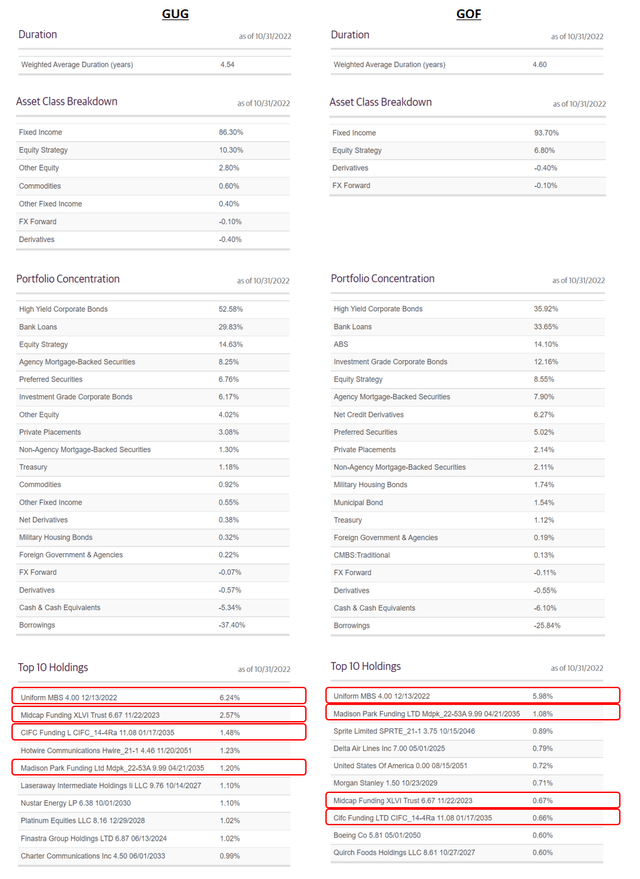

Just like the GOF fund I not too long ago reviewed, the GUG fund resembles an open-ended credit score hedge fund with its funding portfolio largely invested in excessive yield bonds (52.6%), senior loans (29.8%), and equities (14.6%) (Determine 1). The GUG fund has a weighted common length of 4.6 years.

Determine 1 – GUG portfolio composition (guggenheiminvestments.com)

The fund’s asset allocation can range rather a lot in between intervals, because the excessive yield bond allocation was 46.7% in Could 31, 2022 and the fairness allocation was 33.1%.

Returns

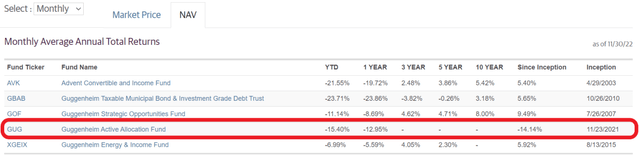

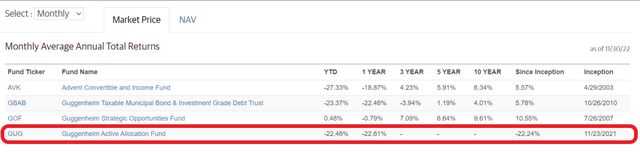

The GUG has restricted working historical past, with an inception date of 11/23/2021. Nonetheless, in its quick historical past, the fund has not carried out nicely, with a 1Yr NAV return of -13.0% to November 30, 2022.

Determine 2 – GUG fund returns (guggenheiminvestments.com)

GUG’s poor efficiency will be partly defined by the fund’s heavy publicity to excessive yield bonds and equities. Each belongings courses have suffered in 2022.

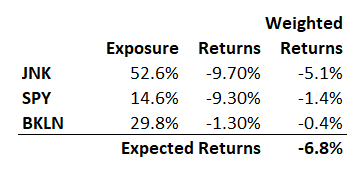

Nonetheless, it’s notable that the GUG fund seems to have underperformed its underlying asset courses. On a 1 Yr foundation to November 30, 2022, the SPDR Bloomberg Excessive Yield Bond ETF (JNK) returned -9.7%, the SPDR S&P 500 ETF Belief (SPY) returned -9.3%, and the Invesco Senior Mortgage ETF (BKLN) returned -1.3% respectively.

If we use the most recent asset allocations from Determine 1 as a reference (overlaying 97% of web belongings of GUG), one would anticipate the GUG fund to have returned -6.8% prior to now 12 months (Determine 3). As a substitute, the fund returned -13.0%. So the GUG fund should have skilled detrimental safety choice and/or allotted to totally different asset courses at inopportune occasions to underperform by over 600 bps.

Determine 3 – Easy return decomposition for GUG (Creator created with fund exposures from guggenheiminvestments and asset class returns from the assorted ETF fund web sites)

Distribution & Yield

The GUG fund pays a really excessive month-to-month distribution of $0.11875 or 10.6% present yield on market worth. On NAV, the present yield is 9.1%.

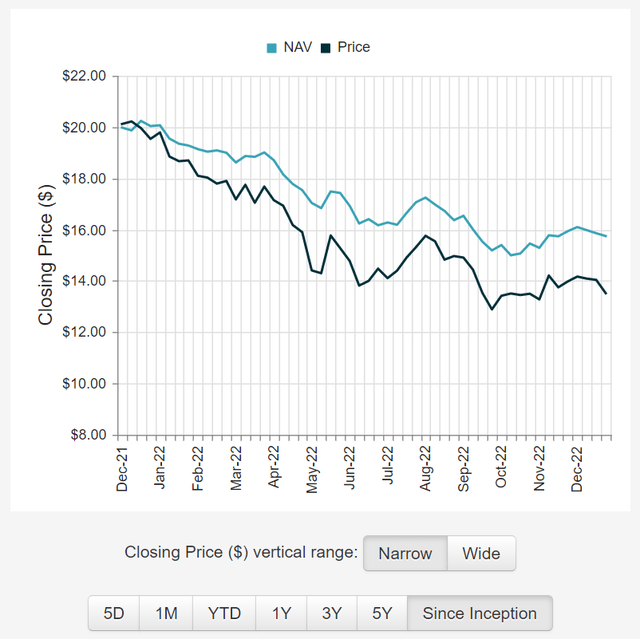

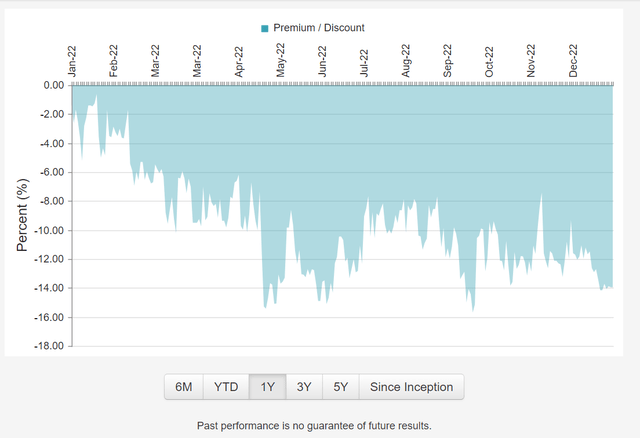

At first look, GUG’s distribution seems to be unsustainable within the long-run, as it’s above the fund’s returns. Since inception, the fund’s NAV has declined from $20 to $15.63 at present, from a mix of detrimental funding efficiency (-14.1%) and paying out its excessive month-to-month distribution (Determine 4).

Determine 4 – GUG’s NAV has declined by 22% since inception (cefconnect.com)

Going by way of the fund’s 19a notices, we will see that the GUG fund’s distribution has solely been partially funded from web funding revenue (“NII”). The attribution to capital features and return of capital have been as excessive as 100% for the November distribution.

The key downside with funding distributions by way of capital features and return of capital is that because the NAV declines, there may be much less curiosity incomes belongings to assist future distributions. Finally, the fund is pressured to chop its distribution and buyers are left with a loss in each principal and revenue.

GUG vs. GOF

As talked about above, the GUG fund may be very related in technique and portfolio composition to the bigger GOF fund. Determine 5 compares the 2 funds side-by-side.

Determine 5 – GUG vs. GOF (Creator created with information from guggenheiminvestments.com)

We are able to see that each funds have roughly the identical common length, in addition to related asset allocations (each are predominantly invested in excessive yield bonds and financial institution loans). There’s additionally important overlap within the high 10 positions.

When it comes to NAV returns (from Determine 2 above), we will see the GOF fund has barely outperformed, with a 1Yr return of -8.7% vs. -13.0% for GUG. Nonetheless, what jumps out upon nearer examination is the funds’ respective market worth efficiency, with the GUG fund declining by 22.6% to November 30, 2022 vs. -0.8% for the GOF fund (Determine 6).

Determine 6 – GUG and GOF market worth returns (guggenheiminvestments.com)

This creates an attention-grabbing dynamic the place the GOF fund trades at a 20% premium to NAV whereas the GUG fund trades at a 14% low cost (Determine 7).

Determine 7 – GUG trades at a 14% low cost to NAV (cefconnect.com)

Because the funding portfolios are fairly related between the 2 funds, GOF buyers might want to swap out of the ‘costly’ GOF fund and into the ‘discounted’ GUG fund.

Moreover, if we evaluate the 2 funds’ distribution yields, I’m far more involved about GOF’s distribution, because the GOF fund pays a month-to-month distribution of $0.1821. This equates to a 14.4% present yield on market worth or an eye-watering 17.3% yield on NAV. Discover that 17.3% is greater than double the GOF fund’s 10-Yr common annual NAV return of 8.0% (from Determine 2). Clearly, this distribution price is unsustainable within the long-run.

Conclusion

The Guggenheim Lively Allocation Fund is a brand new CEF launched by Guggenheim Investments in late 2021. It employs a tactical asset allocation technique to generate revenue and capital features. Sadly, my evaluation above signifies the GUG fund has underperformed a static allocation to excessive yield bonds, equities, and financial institution loans. This places Guggenheim’s tactical asset allocation skills into query.

Evaluating between the GUG fund and the bigger GOF fund, I discover the 2 funds have very related composition and returns. Nonetheless, the GOF fund trades at a 20% premium to NAV whereas paying an unsustainable 17.3% of NAV distribution. In distinction, the GUG fund trades at a 14% low cost to NAV whereas paying a 9.1% of NAV distribution.

GOF buyers might want to promote the ‘costly’ GOF fund and swap into the ‘discounted’ GUG fund, as I estimate there may be much less threat of a distribution minimize for GUG.