fotofrog/E+ through Getty Photographs

Introduction

I’ve talked about in a number of articles on SA that I work as an M&A analyst overlaying Latin America, and I’ve written about some corporations from the area, e.g. Betterware de Mexico (BWMX) right here. One factor that stands out in regards to the Mexican inventory market is that native corporations want to record within the USA, because the valuations they get on dwelling soil are sometimes low and there may be restricted liquidity. This additionally applies to many different Latin American international locations, however it appears extra pronounced in Mexico, the place a number of corporations have been speaking about delisting over the previous yr. There hasn’t been a single IPO on the Mexican inventory trade since 2017. For my part, this opens up some fascinating alternatives, and as we speak I wish to discuss poultry producer Industrias Bachoco (NYSE:IBA).

Overview of the enterprise and financials

Industrias Bachoco is concerned in breeding, processing, and advertising and marketing rooster, eggs, swine, and balanced animal feed and has over 1,000 services and greater than 32,000 staff. It’s a vertically built-in firm centered on Mexico and the USA, and its subsidiaries embody SASA, RYC Alimentos, and OK Meals amongst others. Whereas round 85% of revenues come from poultry and eggs, Bachoco has been shifting its enterprise to turn out to be a multi-protein producer and on December 2, it revealed that it’s shopping for Mexican pork firm Norson which exports its merchandise to the USA, Japan, China, and Korea amongst others. Bachoco can be concerned within the manufacturing of animal feed by means of CAMPI and vaccines and prescribed drugs for veterinary use by means of Pecuarius.

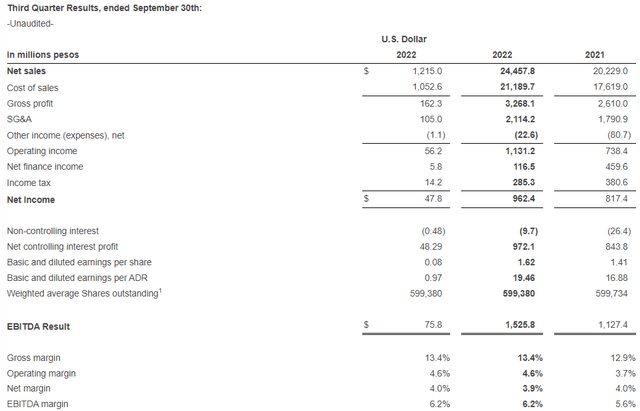

Turning our consideration to the monetary efficiency of the enterprise, I feel that Q3 2022 outcomes have been strong as web gross sales got here in at $1.22 billion whereas web revenue rose to $47.8 million. Yeah, it is not a high-margin enterprise (web margin of simply 4% because the merchandise are just about commodities) however the client staples sector tends to carry out nicely throughout recessions. There’s some seasonality in Bachoco’s enterprise, with margins sometimes being greater throughout the first half of the yr in comparison with the third quarter as a result of decrease demand within the Mexican poultry market. As well as, the Q3 2022 margins have been negatively affected by excessive corn and soybean meal costs, which have been about 20% above the degrees from a yr earlier. But, this was compensated for by greater promoting costs due to an enchancment within the product combine.

Bachoco

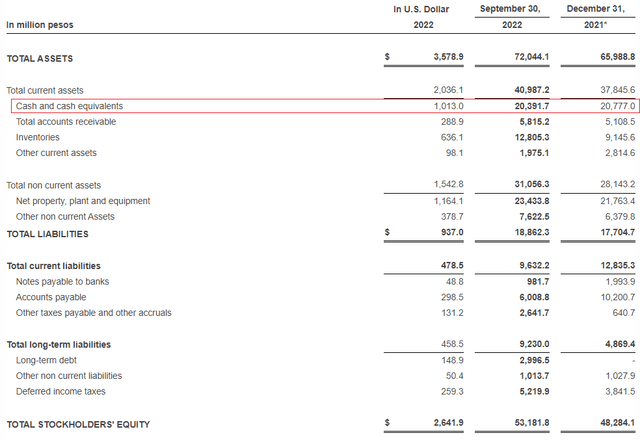

Bachoco has a conservative administration staff and goals to develop at a daily charge of about 6% per yr by means of market growth in addition to small acquisitions. For my part, what makes the corporate stand out is its robust stability sheet, and extra particularly, its money pile. As of September 2022, Bachoco had simply over $1 billion in money, as web money circulate from working actions for the primary 9 months of the yr stood at $221.3 million. As fellow SA contributor Tomas Andrade Campanini stated in January 2022, Bachoco has had a big money place since 2014 and the corporate may very well be ready for a downturn cycle within the trade to hold out bigger acquisitions.

Bachoco

Bachoco has a complete of 600 million shares excellent, with every ADR listed on the NYSE being equal to 12 shares. This provides the corporate a market capitalization of $2.52 billion as of the time of writing, whereas the enterprise worth stands at simply $1.71 billion. And should you assume this valuation is low, you aren’t alone because the founders, the Robinson Bours household, determined in March 2022 to launch a young supply for the 26.75% they didn’t personal with the thought of delisting Bachoco from each the Mexican and New York inventory exchanges. There have been protests from minority shareholders that the provided value was too low. The tender supply led to November, and the Robinson Bours household purchased a complete of 86,589,532 shares at $4.06 per share and now the offeror, together with associates and associated events, owns round 87.77% of Bachoco’s share capital. Nevertheless, corporations want the holders of not less than 95% of shares to approve a delisting from the Mexican inventory trade, which is why Bachoco stays listed as we speak. For my part, the launch of one other tender supply is more likely to happen in 2023, and I count on a share value premium of not less than 10%. Even when a brand new tender supply doesn’t materialize, I feel that Bachoco looks like a great funding for these turbulent occasions and the dividend charge is first rate. For the time being, the dividend yield stands at 1.9%.

Apart from the dearth of a brand new tender supply, I feel that one other danger right here is the low liquidity, because the every day buying and selling quantity on the NYSE not often surpasses 10,000 ADR. Because of this any main adverse information, e.g. chicken flu, in Mexico is more likely to result in a big decline within the share value.

Investor takeaway

Bachoco has turn out to be a significant participant within the Americas poultry market, and I feel it appears to be like low-cost contemplating it’s buying and selling at beneath 7.5x ahead value to earnings and has over $1 billion in money. The founding household launched a young supply in 2022 with the purpose of delisting the corporate however failed to amass sufficient shares, and it’s unlikely they’ve given up on this plan. I feel there’s one other tender supply on the way in which, and this one is more likely to embody a better value.

Sadly, liquidity is kind of low and there are not any choices obtainable for Bachoco. Whereas the share costs of client staples corporations are likely to carry out nicely throughout recessions, any adverse occasions are more likely to result in excessive share value volatility as a result of low liquidity and I feel that it may very well be finest for risk-averse traders to keep away from this inventory.