JHVEPhoto

Alphabet Inc. (NASDAQ:GOOGL) has employed a constant capital return program to shareholders by means of share buybacks. Moreover, the corporate has demonstrated a transparent strategic deal with diversifying its income streams, which has enabled it to reduce its dependence on the efficiency of its core Google search enterprise. Additional to this, the corporate has recognized the cloud computing market as a key space for progress, which is a market that’s presently experiencing vital growth. Given the latter and together with robust fundamentals, I imagine GOOGL is a purchase. Let´s dive into the enterprise.

Enterprise Overview

GOOGL operates a enterprise mannequin that facilities round promoting and cloud computing providers. GOOGL promoting income is generated primarily by means of Google search engine, YouTube, and Google Networks which quantities to approx. 90% of whole revenues. The Google Promoting section is accountable for almost all of the corporate’s income, because it advantages from a large person base and the rising use of digital promoting. The remaining 10% of the income is generated by means of Google Cloud and to a a lot small extent Different Bets. Google Cloud section is chargeable for the corporate’s efforts to diversify its income streams and is changing into an more and more essential a part of its enterprise.

Monetary Overview

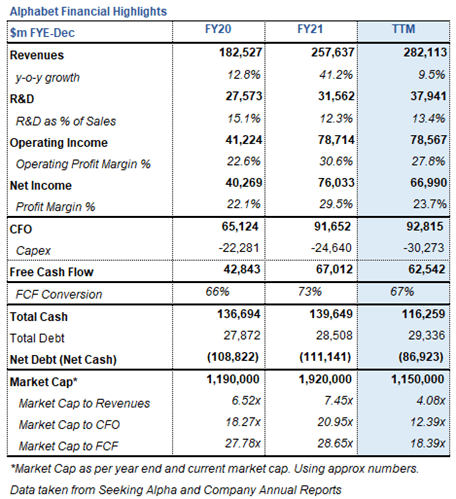

Alphabet Monetary Highlights (In search of Alpha & Firm Annual Report)

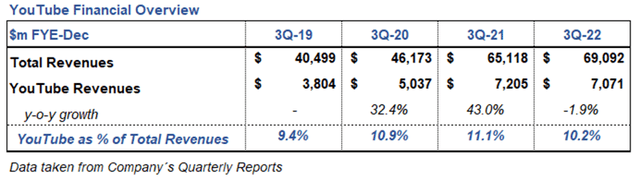

By way of monetary efficiency, GOOGL reported trailing twelve months revenues of $282 billion, money circulation from operations of $92.8 billion, and free money circulation of $62.5 billion. These numbers showcase the corporate’s monetary power and talent to generate money circulation constantly. Google Search has been the first contributor to GOOGL income streams, nevertheless, lately, YouTube has skilled vital progress and has begun to characterize a notable share of general income, approaching 10% (Please confer with desk under). It’s value noting that this dynamic aligns with the corporate’s technique of diversifying income streams. You will need to acknowledge that whereas YouTube’s income is primarily generated by means of promoting, it represents a definite income channel.

YouTube Monetary Highlights (Firm Quarterly Reviews)

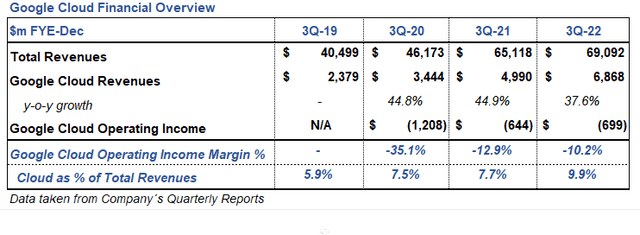

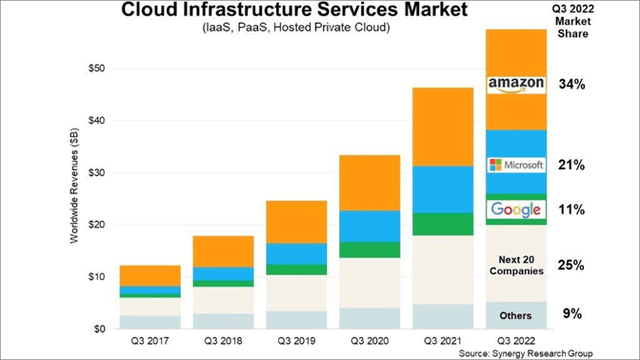

On the subject of the cloud market, Google Cloud competes with business leaders Amazon (AMZN) AWS and Microsoft (MSFT) Azure. As per the third quarter of 2022, AWS accounted for 34% of the market, Azure with 21% and Google Cloud at third place with 11% of market share. Regardless of being a distant third, Google Cloud has been rising quickly and has been an essential contributor to the corporate’s income. The desk offered under shows the income progress of Google Cloud, as evidenced by the third quarter and prior third quarter intervals. As it may be seen the cloud section has skilled double-digit will increase in income on a year-over-year foundation. Though the section remains to be not worthwhile, it’s projected to make a major contribution to the corporate’s backside line within the close to future.

Google Cloud Monetary Highlights (Firm Quarterly Reviews)

To maintain up with the competitors and preserve its technological edge, the corporate´s administration has been investing closely in analysis and improvement, spending $38 billion over the past twelve months to reinforce its technological capabilities and develop new services and products. These huge investments assist GOOGL stay a dominant participant within the digital promoting and the cloud computing markets. GOOGL fundamentals are really strong, the corporate has a fortress in its steadiness sheet, which is bolstered by $116 billion in money and money equivalents, and a considerably low debt place of $30 billion.

Shareholder Returns

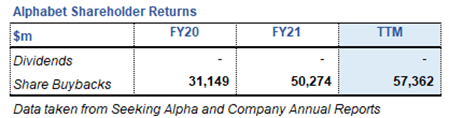

Along with diversifying revenues and investing in R&D, administration has additionally been centered on returning worth to its shareholders. In April 2022, the Board of Administrators approved administration to repurchase as much as $70 billion of its Class A and Class C shares. This comes as a high up from the earlier $50 billion share buyback program, in essence the corporate has been approved to repurchase its personal widespread inventory to the tune of $120 billion lately. Administration didn’t waste time and has spent $81.4 billion in share repurchases throughout 2020 and 2021. As of September 2022, $43.5 billion stays obtainable underneath the present buyback program. We will anticipate administration to proceed repurchasing inventory as GOOGL share worth has dropped over 40% since its peak in November 2021.

Shareholder Returns (In search of Alpha and Firm Annual Reviews)

Key Areas for Development

One of many priorities and key areas for progress for GOOGL is the worldwide cloud computing market. The market is anticipated to succeed in $1.2 trillion by 2027, pushed by the rising adoption of cloud expertise throughout varied industries. To reap the benefits of this rising market, GOOGL has been investing closely in its infrastructure, safety, knowledge administration, analytics, and AI. These efforts have helped the corporate to extend its market share and place itself as a robust participant within the world cloud market, presently holding the third largest place with round 11% market share. Based mostly on the idea that Google Cloud is ready to preserve a market share of roughly 8% within the world cloud market, which is projected to succeed in a complete dimension of $1.2 trillion, it’s attainable that the section might generate revenues within the vary of $100 billion sooner or later. You will need to observe that the earlier projection is a hypothetical situation and must be thought of as such. It’s primarily based on plenty of assumptions, together with market circumstances and the corporate’s efficiency.

Cloud Market (Synergy Analysis Group)

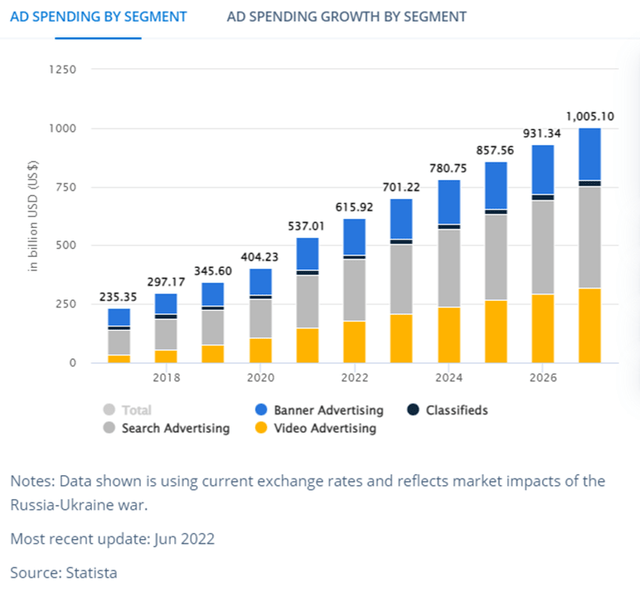

One other key space for progress for GOOGL is the digital promoting market. Digital advert spend is anticipated to succeed in $1 trillion by 2027 (Please confer with graph under), pushed by the rising use of digital promoting. To reap the benefits of this rising market, GOOGL has been specializing in its core enterprise of internet marketing, primarily by means of its Google Search engine, Google Community and YouTube which has been rising quickly. For reference YouTube income grew from $15.1 billion in 2019 to $28.8 billion in 2021. A 3rd key space for progress is the synthetic intelligence market. The market is anticipated to succeed in $400 billion by 2027.

Promoting Spending (Statista)

I can’t talk about “Different Bets” on this article because it nonetheless has methods to go and has little or no influence on the corporate financials.

Valuation

GOOGL has skilled a major decline in market valuation of over 40% from its peak very near $2 trillion on November 2021 to its present market valuation of $1.2 trillion. This represents a a number of of 12.4x money circulation from operations and 4x gross sales. Regardless of this decline in worth, the corporate’s long-term progress prospects stay strong, given its potential to seize a major share of the rising cloud computing, synthetic intelligence, and digital promoting markets. These markets current a major alternative for GOOGL to proceed its progress sooner or later.

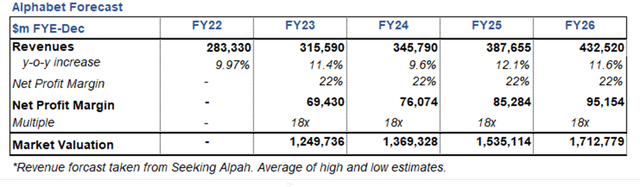

For the valuation of the corporate, I’ve used the market a number of methodology, utilizing future forecasted earnings to a 18x a number of. I’m utilizing this methodology as a result of the corporate is anticipated to proceed repurchasing shares from the open market within the coming years. As talked about above, throughout 2020 and 2021, administration has spent over $80 billion in share buybacks, additional to this the corporate nonetheless has over $40 billion obtainable within the just lately approve $70 billion share buyback program. The continuing share buyback exercise is anticipated to have a major influence on EPS.

Alphabet Forecast (Writer Estimates and In search of Alpha Knowledge)

I’ve obtained the analysts’ revenues forecast from In search of Alpha knowledge and have utilized web revenue margin of twenty-two%, which is under the typical of the earlier 3 years web revenue margin of 21%, 22% and 29.5%, respectively. Given these assumptions, I’ve utilized a a number of of 18x, this a number of is under the corporate historic worth to earnings ratio, which traditionally has been above 18x. Utilizing this methodology, I’ve arrived at a market valuation for GOOGL of $1.7 trillion by 2026.

Dangers

Dependence on promoting Revenues: GOOGL generates a good portion of its revenues from promoting. This is the reason it is vital for GOOGL to diversify revenues streams, as its monetary efficiency might be impacted by modifications within the digital promoting market. The administration group has been actively implementing methods to diversify income streams. Essential to notice right here that administration has achieved to diversify a portion of revenues away from Google Search with YouTube and Google Cloud each accounting for 10% of whole revenues, respectively.

Regulatory dangers: Given GOOGL operates in several geographies, it’s topic to a number of laws. Because it has been seen all through the years, fines by regulating entities are usually not a uncommon event. Let´s not overlook the dent within the firm´s financials by the European Fee nice of $1.7 billion in 2019. Elevated regulatory scrutiny can influence GOOGL which might have damaging penalties for its monetary efficiency.

Backside Line

GOOGL has demonstrated a robust observe file of diversifying its income streams away from Google Search, this has been a major issue within the firm’s ongoing success. Moreover, the corporate has constantly invested in analysis and improvement, which has enabled it to stay aggressive inside the digital promoting and cloud computing markets. Moreover, GOOGL capacity to generate substantial revenues and free money circulation has enabled it to return worth to shareholders by means of huge share buyback packages. Based mostly on the corporate’s robust fundamentals and progress prospects in markets the place it’s already a dominant participant, the corporate is nicely positioned for continued success sooner or later.