Marko Geber

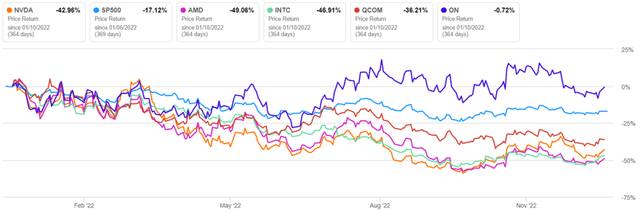

We’ve got beforehand coated Nvidia’s (NASDAQ:NVDA) right here as a post-FQ2’23-earnings article in September 2022. At the moment, the US authorities’s new restrictions might trigger the corporate to lose a big $400M in gross sales derived from China, assuming delays in licensing approval for its accelerators and information center-related chips. Mixed with the a number of headwinds of its PC destruction, lowered ahead steering, and the Fed’s aggressive price hikes by way of 2023, we had projected that the inventory could also be decimated with little catalysts for short-term restoration. True sufficient, the inventory hit a backside at $108.13 by mid-October 2022.

For this text, we might be specializing in NVDA’s large tailwind for restoration by way of China’s reopening cadence and approval of overseas/home video games. Due to this fact, its GPU and cloud gaming merchandise might even see elevated home demand, probably boosting its monetary efficiency. The corporate’s GeForce Now AAA cloud video games can even be provided in choose autos underneath accomplice automakers, equivalent to Hyundai, Polestar, and BYD, proving its ambition in offering bundled providers. Lastly, by diversifying into the IoT and Automotive markets, the administration expands its strategic publicity to many finish markets, supporting its premium valuations certainly.

The GPU & Cloud Gaming Funding Thesis

The macroeconomic outlook stays unsure by way of 2023, as a result of rising inflationary stress impacting world discretionary spending. The US client index for computer systems has been declining by -4.4% YoY and -2.7% sequentially by November 2022, with the Info expertise commodities plunging drastically by -11.5% YoY and -1.8% sequentially. Will issues carry within the intermediate time period? Market analysts assume so, as a consequence of NVDA’s projected income CAGR of 10.1%, EPS of 8.6%, and Free Money Circulate era of 17.1% by way of FY2025 (the equal of CY2024).

Then again, we’re extra bullish because the subsequent cycle for GPU and PC replacements might be someday in 2024. That is attributed to the hyper-pandemic demand for company and private gadgets in 2020, when NVDA recorded a large YoY soar in income at 52.7%, Intel (INTC) at 8.2%, and Microsoft (MSFT) at 14.18%. Moreover, with a mean product substitute cycle of GPUs for 5 years and PC CPUs for six years, NVDA’s projected high and backside line development in 2024 might naturally be revised upward.

As well as, the Fed’s current assembly minutes counsel that rate of interest cuts might happen from 2024 onwards, suggesting a notable deceleration in inflation charges then. With the development in macroeconomics, we might even see world client demand returning, triggering the uplifting of market sentiments as properly.

We may see a wholesome rebound for GPU and gaming merchandise within the brief time period, attributed to China’s reopening cadence. After three years of steady lockdowns, market analysts undertaking a flurry of ‘revenge’ spending, considerably aided by the speedy loosening of gaming rules within the nation after 18 months of restrictions. The Nationwide Press and Publication Administration, China’s online game regulator, has lastly granted publishing licenses to 44 overseas video games on 29 December 2022, on high of the 468 home video games for the entire 12 months. This marks a big reversal within the authorities’s stance, which has not authorised of any overseas video games because the begin of the crackdown, in opposition to the 180 in 2019.

NVDA notably commanded 88% of the world’s discrete GPU offered by Q3’22. Since China’s home choices fall wanting the corporate’s merchandise, it’s unsurprising that NVDA’s PC/ gaming chips stay extremely well-liked amongst Chinese language shoppers. As well as, China (together with Hong Kong and Taiwan) accounted for 58.1% of the corporate’s income in 2022 and 52.7% in 2019. Because of this, the inventory has recovered reasonably by 13.3% with the current sport approvals, aided by the discharge of a trade-compliant A800 GPU in November 2022. Jensen Huang, CEO of NVDA, stated:

So our expectation is that for the US and in addition for China, we can have numerous merchandise which can be architecturally suitable, which can be inside the limits and that require no license in any respect. (Tech Wire Asia)

China stays a big participant within the world video games market, with over 685M players comprising almost half of the nation’s inhabitants. Its home gaming income development has sadly declined by -5.4% YoY to $43.5B in 2022, as a consequence of strict gaming rules. Nonetheless, issues might quickly rebound, with the market anticipated to achieve $50.78B by 2023, attributed to the large pent-up demand and new sport approvals. As compared, the US gaming market is valued at $90.13B in 2022, suggesting its main place globally.

As well as, NVDA partnered with Tencent Video games (OTCPK:TCEHY), a Chinese language leisure large with as much as 54% of the home gaming market share in 2022, to develop the START cloud gaming infrastructure and joint gaming innovation lab in 2019. New AI purposes might be explored for sport developments, sport engine optimizations, and new lighting strategies, extremely depending on the previous’s main GPU expertise.

This additionally builds upon NVDA’s main cloud gaming service, GeForce Now, which options premium subscription providers of as much as $19.99 per 30 days or $99.99 for six months. With greater than 1.5K sport titles in its library, together with high video games from Ubisoft, Epic Video games, and Digital Arts, it’s no surprise that the corporate has established itself as one of many world gaming leaders.

Within the meantime, NVDA continued to report respectable development within the information heart phase at 0.7% QoQ and 30.6% YoY within the newest quarter. Notably, the corporate recorded spectacular automotive pipeline wins of over $11B in FQ2’23 for the following six years, rising by 37.5% YoY.

That is considerably aided by NVDA’s partnership with BYD (OTCPK:BYDDF), which is predicted to provide 1.78M autos in 2022, with a formidable deliberate capability of as much as 4M by 2024. Mixed with the long run launch of its GeForce Now cloud gaming in accomplice automakers equivalent to Hyundai (OTCPK:HYMTF), Polestar (PSNY), and BYD, there isn’t a doubt that the corporate is dedicated to sustaining its management within the GPU and cloud gaming market certainly. Danny Shapiro, Automotive VP in NVDA, stated:

The power to stream these well-liked titles from players’ libraries, together with dozens of free video games, will carry the in-vehicle infotainment expertise to new heights. These are the primary automakers to supply NVIDIA cloud gaming of their vehicles. With accelerated computing, AI and cloud streaming, we’re delivering new ranges of car automation, security, comfort, and pleasure to the automobile. (Tech Wire Asia)

As a result of outlier nature of the previous three pandemic years, it’s unrealistic to count on that NVDA will report related outsized development within the coming years. Nonetheless, as a consequence of its strategic diversification, the corporate might proceed rising its high and backside line excellently. The worldwide EV and industrial IoT market are anticipated to develop to $1.1T and $1.74T in worth by 2030, at a CAGR of twenty-two.5% and 20.47%, respectively. Whereas the competitors for IoT finish markets stays intense with many gamers, equivalent to Qualcomm (QCOM), ON Semiconductor (ON), MediaTek (OTCPK:MDTKF), Texas Devices (TXN), and STMicroelectronics (STM), the market is inherently giant sufficient to accommodate a number of gamers.

Resulting from these measures, NVDA could possibly mitigate its strategic publicity to future demand destructions, stopping an analogous influence on the PC finish market witnessed in 2022.

The Premium Funding Thesis

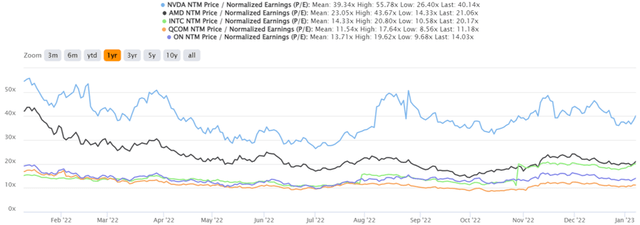

NVDA, AMD, INTC, QCOM, 1Y P/E Valuations

S&P Capital IQ

Now, does this imply that NVDA deserves its premium valuation? Not directly, it could be arduous to justify P/E valuations of 40.14x, as a result of supposed 70% probability of a recession in 2023. The inventory additionally trades with immense baked-in premiums, in comparison with its friends equivalent to Superior Micro Units (AMD), INTC, QCOM, and at last, ON.

These shares are related certainly, since NVDA competes with AMD on AI/information heart/ GPU chips, INTC on AI/information heart/GPU chips, and QCOM on automotive chips/ Superior Driver Help Methods [ADAS]. Whereas NVDA might not share similarities with ON, the latter’s give attention to automotive/renewable Silicon Carbide chips counsel its dominant place in a non-direct business.

Notably, NVDA trades almost double AMD’s and INTC’s valuations at NTM P/E of 21.06x and 20.17x, respectively. Regardless of QCOM’s stellar automotive pipeline wins of over $30B, rising aggressively by $11B QoQ/ $20B YoY, and ON’s development within the automotive/ renewable/ industrial long-term provide agreements by $5.3B QoQ to $14.1B, NVDA additionally trades almost triple each.

In our opinion, the reason being easy. Resulting from intense competitors and big R&D efforts related to cutting-edge digital chips, it’s naturally tough to find out which firm affords one of the best chips for every class. Nonetheless, it can’t be denied that NVDA has its finger in all of those pies, with a sustained give attention to innovation in the direction of the info facilities, AI, IoT, gaming, and automotive end-markets. That is attributed to the elevated R&D bills of $6.85B, the equal of 23.9% of its revenues over the past twelve months, regardless of the short-term influence of PC decline. Resulting from this motive, we reckon {that a} sure premium is justified.

NVDA 1Y Inventory Worth

Searching for Alpha

Then again, the advanced yardstick and the ever-changing market choices make it nearly unimaginable for anybody to find out the precise P/E valuation that NVDA deserves. The ratio has clearly been impacted by the pessimism within the inventory market as properly. Due to this fact, we should spotlight that NVDA stays a speculative play, solely appropriate for buyers with excessive conviction.

Naturally, we commend anybody who had been opportunistic sufficient to load up on the current rock-bottom P/E ranges of 32.50x or low entry level of $112.27 in October 2022. That might have offered many long-term buyers with the uncommon probability to greenback price common from the hyper-pandemic ranges.

So, Is NVDA Inventory A Purchase, Promote, or Maintain?

Primarily based on NVDA’s projected FY2025 EPS of $5.69 and NTM P/E of 40.14x, we’re taking a look at an aggressive value goal of $228.39. This quantity mirrors the consensus estimate’s goal of $207.29 as properly, suggesting a wonderful 32.64% upside potential from present ranges.

The query can be whether or not it’s nonetheless clever so as to add at present ranges, because the NVDA inventory has additionally recorded an incredible rally of 39.2% since mid-October 2022. It actually is determined by particular person buyers’ danger tolerance and investing trajectory.

We select to proceed score the NVDA inventory as a purchase right here, with the caveat that it ought to consequently match or cut back the investor’s greenback price common. By doing so, the portfolio can be much less uncovered to short-term macroeconomic uncertainties. Then again, bottom-fishing buyers might choose to attend for one more low $100s entry level, since it’s nonetheless early within the 12 months. It isn’t essential to chase the rally.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.