vm

Shoals Applied sciences (NASDAQ:SHLS) had a very good yr in 2022.

The inventory value efficiency might not instantly recommend this, sustaining that Shoals-like volatility that holders have come to count on, however the underlying enterprise strengthened.

The corporate delivered progress that exceeded aggressive expectations and is zoning in on new markets shifting into 2023. With Shoals elevating the decrease finish of This fall steering, a powerful end to FY22 is predicted.

The enterprise is proving to be a worthwhile enabler of the renewable transition because it strikes into new verticals, that is arguably one of many largest and most vital tendencies of the approaching many years. I’m bullish on its prospects.

Q3 outcomes recap

Though the Q3 outcomes had been delivered round two months in the past now, I’ll give readers a refresher together with a few of my ideas.

Here’s a abstract of the important thing takeaways:

- Income of $90.8M (+52% Y/Y)

- Adjusted EBITDA of $26.6M (+57% Y/Y)

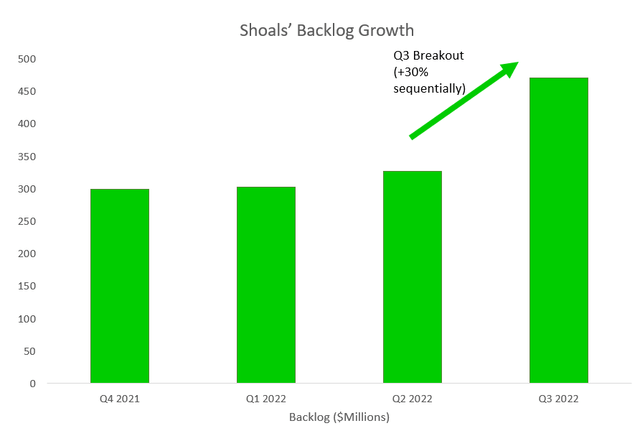

- Backlog of $471M (+74% Y/Y)

I’ve highlighted the backlog progress as a result of I imagine it’s the finest indicator of demand for Shoals’s merchandise. The backlog underpins the EBOS (electrical steadiness of techniques) suppliers’ progress prospects, which is significant for a premium-priced photo voltaic title that’s pulling ahead a number of future progress in immediately’s costs. $144M of that backlog construct got here in Q3 alone, reinforcing Shoals because the go to supplier of EBOS options. To match, Shoals noticed a rise of simply $25M in Q2. This has given me larger confidence that Shoals has the perfect patented choices out there.

Compiled by writer from firm accounts

Working money circulation was $11.7M for the quarter, down round $8M sequentially. This decline will be attributed to a lower in working capital, administration anticipated to see a decline in OCF as they put money into growth – Q2 was a one-off in that regard.

The sturdy demand for Shoals’ suite of options allowed the corporate to lift the underside finish of their steering, they now count on FY income to be between $310 to $325M with adjusted EBITDA at $80-$86m, this constitutes to a margin of 26.6%. The corporate based mostly this on:

Present market situations and enter from our prospects and group.

To develop income by 49% and EBITDA by 37% in 2022 is significantly spectacular contemplating the appreciable headwinds that Shoals had confronted in the beginning of the yr. Most notably, the numerous reductions in photo voltaic installations seen on account of value will increase and provide chain constraints.

Shoals’ inventory value has remained risky for the reason that information, initially surging over $30 earlier than pulling again to the low $20s and now recovering once more. If an investor is in search of an argument towards the environment friendly market speculation, I do not assume they should look a lot additional than Shoals. It’s risky and vulnerable to giant inventory value swings which can be unrelated to any basic adjustments within the enterprise. I remind buyers that inventory costs are usually much more risky than the underlying enterprise.

Transfer into eMobility

Development shares ought to have a big ‘pie’ (‘TAM’) and needs to be taking a big and rising share of that pie. That is the technique for Shoals and it is working to this point. There are a number of tailwinds in photo voltaic alone, the identical applies to eMobility. There is no such thing as a income section breakdown at this level (seemingly as a result of pure photo voltaic and America signify a major a part of income) however EV share is predicted to expand contributions – it’s already contributing to backlog in line with Jason Whitaker on the convention name:

From an e-mobility perspective, clearly, very enthusiastic about what we have been capable of accomplish, launching that product out. What I can let you know is, it’s contributing to our backlog and awarded orders and count on that can proceed to be the case over time. Suggestions from prospects has been nothing in need of superb and really excited that we have been capable of accomplish not solely a profitable launch, however launch over 15 completely different states with validating that worth proposition that we’re capable of convey with that 20% to 30% financial savings on set up time and price whereas additionally sustaining our common company margin profile. So very, very, very thrilling jobs from that perspective and solely see that proceed to develop.

Gearing up for 2023 – an thrilling yr for Shoals

Backlog to supply time (after they can truly file income) is usually 9-12 months, so backlog progress in This fall goes to be an vital indicator for the income progress we must always count on to see in 2023. The market sees $506M in income with EBITDA of $154M, this may give Shoals an EBITDA margin of 30.4%, up 300bp Y/Y.

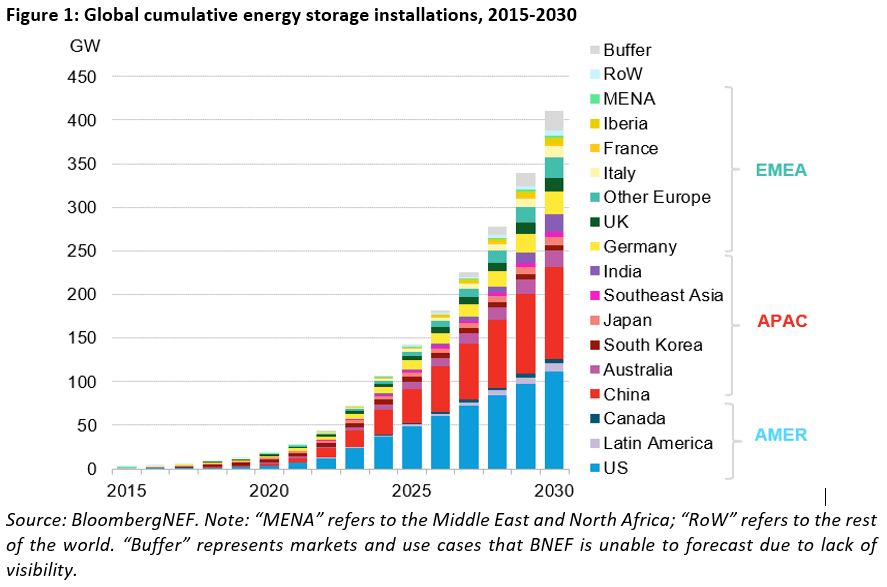

I’m excited by the eMobility alternative together with Shoals’ transfer into battery storage. In each circumstances the chance afoot could be very massive, EV infrastructure and storage are each seeing giant capital inflows and large progress is predicted. BloombergNEF forecasts say that the worldwide power storage market to develop 15-fold by 2023, sure that is right – 1500%.

BloombergNEF

Shoals solely developed their storage options in 2021, with what they known as the launch of ‘Shoals 2.0’, so they’re actually in the beginning of their journey into the power storage business. Shoals has the good thing about utilizing present experience with Photo voltaic EBOS and present partnerships with giant EPCs to develop a footprint in storage.

The corporate is specializing in each photo voltaic with storage and storage as a standalone – this can enable them to construct up credibility in storage via agreements that present a mixture of options. The corporate introduced in November that it might provide BLA and storage options to one of many largest photo voltaic plus initiatives within the U.S when full. This can be a vital milestone for Shoals in turning into an even bigger competitor within the storage area.

This demand has include a particular give attention to High quality, which is actually on the middle of what Shoals’ does and is its edge towards rivals. Combining high quality and an understanding of buyer wants with effectivity is the corporate’s specialty and I count on the ‘high quality hole’ to proceed to increase because the business evolves and Shoals scales and onboards a bigger variety of companions.

The necessity to enhance power safety within the western world has change into a major focus for the reason that onset of the Ukrainian-Russian battle and while 2022 was the yr of oil and fuel, it has additionally set the renewable business up for accelerated progress sooner or later as international locations look to extend power capability whereas additionally specializing in sustainability.

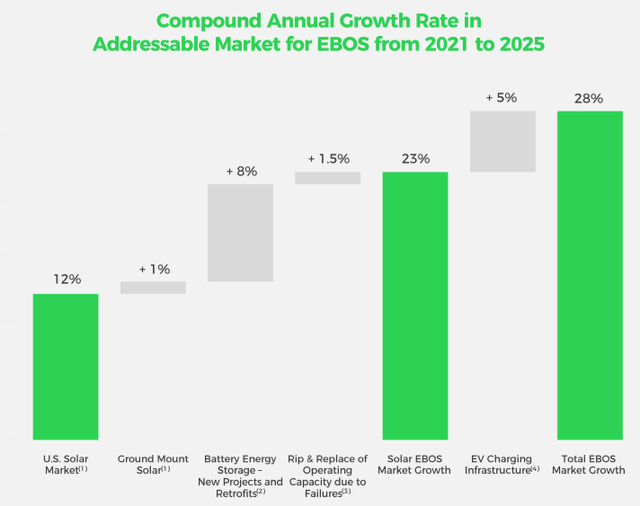

The renewable business struggled in 2022 on account of rising prices and provide chain disruptions however many of those points began to alleviate on the finish of the yr. Even with these struggles, photo voltaic was the shining star and the identical is predicted in 2023 – progress is anticipated to come back in at 20-30%. Photo voltaic power is predicted to surpass coal energy by 2027 with EBOS, extra particularly, rising even quicker:

Shoals Investor Presentation

Dangers

CEO, Jason Whitaker, shall be stepping down from his position in early 2023 resulting from well being causes. Mr. Whitaker has finished an exceptional job throughout his 13-year tenure at Shoals and I wish to want him properly sooner or later. This leaves some uncertainty relating to succession however I’m assured they are going to discover a appropriate substitute earlier than the tip of March.

Shoals’ inventory can be costly based mostly on immediately’s costs, the inventory is buying and selling on 32x ’23 EBITDA, with First Photo voltaic (FSLR) as a comparability buying and selling on 28x ’23 EBITDA. I feel the expansion potential of Shoals is bigger with the transfer into EV charging infrastructure and storage, Shoals’ TAM has expanded considerably and I imagine they will take a bigger share of each of these markets via their revolutionary EBOS expertise.

Lastly, Shoals’s debt stood at $274M on the finish of Q3 whereas the money place was simply $10M. Shoals lately introduced an fairness providing of two million class A shares to assist fund the termination of its Tax Receivable Settlement ($58.1M), this could not be funded by present assets resulting in the providing. The money place is kind of precarious however the working money circulation is wholesome and administration have proven they will handle this money place properly.

The Backside Line

Shoals is offering the important ‘plumbing infrastructure’ for among the largest photo voltaic initiatives in America. After increase its EBOS experience over a protracted interval, the corporate is now shifting into new verticals; eMobility and storage, each of which I imagine present vital progress alternatives for the enterprise.

Like a lot of the renewable business, Shoals prices a premium, however I imagine it is a premium value paying. The photo voltaic enabler is not the primary inventory that involves thoughts when the renewable power business is mentioned however its important position in power infrastructure will show to be invaluable because the business scales for my part. Lengthy Shoals.