[ad_1]

Should you’re following the information, issues are fairly tough on the market…

Document-high inflation. Hovering mortgage charges. The worst inventory sell-off in 50 years.

Effectively, in line with my analysis, that’s only a preview of much more insanity in retailer for the markets over the subsequent few years. However, the excellent news is, with know-how accelerating, there’ll be extra alternatives to earn a living than ever. You simply should know learn how to navigate the markets.

How do you try this?

I lately went looking for the reply to that very query.

I needed to search out the easiest way to make order from chaos in any market. A means for my readers to guard themselves from the losses we’ve seen lately, whereas nonetheless giving themselves the chance to make large good points.

Not way back, I discovered what I used to be in search of.

I got here throughout a person named Keith Kaplan. Keith’s one in every of America’s prime knowledge scientists. He’s additionally the pinnacle of TradeSmith, one of many largest monetary knowledge analytics firms on the earth.

He and his group have spent over $18 million and 50,000 man-hours creating a system that tracks just about each asset available on the market — shares, bonds, funds, you identify it — and pinpoints the optimum time to get out and in for an opportunity at most good points.

It’s the kind of know-how I noticed the highest corporations on Wall Avenue use after I labored there … however Keith’s system is particularly not for Wall Avenue. It’s for the on a regular basis particular person.

And it’s an absolute retirement game-changer…

That’s why I requested him to take a seat down with me right this moment for an interview on his unique system. Learn on under, and be taught why proper now’s the very best time to start out utilizing it.

TradeSmith Helps You Beat the Billionaires With 1 Click on:

An Interview With TradeSmith CEO Keith Kaplan on the “TradeStops” System

Ian: Thanks for taking a while out of your busy schedule right this moment to reply a couple of questions for my Banyan Edge readers and me, Keith.

I needed to interview you as a result of, frankly, you and your group are doing nice work over at TradeSmith.

You’ve spent the final 15 years constructing monetary know-how instruments for the Important Avenue investor. They’re the identical varieties of instruments that I used at hedge funds, however a lot simpler to function.

I discover your work fascinating. Are you able to inform me a bit of bit extra about your TradeStops system?

Keith: Thanks for having me, Ian … and completely!

All of it begins with understanding the chance and well being of any particular person inventory or fund. That’s key.

We constructed a number of algorithms that let you know simply that. They take a look at every of the 1000’s and 1000’s of securities in our system.

(To make this easier, I’ll simply say “shares” to any extent further. However I would like your readers to know that our programs covers the whole lot from shares and mutual funds to exchange-traded funds and commodities. Even cryptocurrencies!)

We assign a quantity to every inventory, and the decrease the quantity, the decrease the chance. And we assign a colour: inexperienced is wholesome, yellow is warning and crimson is unhealthy.

However there’s one other level we take a look at: the shopping for and promoting exercise of billionaires. Are you aware how we get the information on what shares they’re shopping for and promoting, Ian?

Ian: Positive, Keith. Each quarter, billionaires should file a report with the SEC known as a 13F. This report covers tells the SEC the whole lot these people purchased and bought over the past quarter.

Keith: Sure, precisely! In our TradeStops system, we seize each quarterly 13F submitting from the SEC and cargo the shares that just about 30 billionaires are shopping for and promoting into our product.

Which means that anytime you need, you possibly can log into our system to see what these billionaires are shopping for and promoting every quarter. It’s actually cool.

From there, you possibly can see which shares are wholesome and which aren’t. And you can too discover the extent of threat every inventory has at present.

Ian: I agree, that’s actually cool. And it’s distinctive.

I’ve actually seen some programs on the market that do comparable work. However what you do on a stock-by-stock stage with well being and threat is not like something I’ve seen prior to now for Important Avenue.

So, are you able to present our readers how folks can act on these billionaires’ inventory picks?

Keith: Right here’s the place issues get actually enjoyable.

Individuals don’t sometimes know the way a lot cash to place right into a inventory, or a number of shares, that they’re shopping for.

On the click on of a button, our system can let you know not solely how dangerous or wholesome a inventory is … however how a lot of that inventory to purchase. Particularly when evaluating it to your current portfolio or different shares that you just’re shopping for on the similar time.

And we now have a complete set of tremendous user-friendly instruments that enable you decide what to purchase, when to purchase it, how a lot to purchase and when to promote it.

Ian: And also you pull that every one collectively in your Pure Quant Portfolio Builder device (which I really like, by the way in which).

Keith: Sure, we do. The Pure Quant Portfolio Builder device pulls collectively the whole lot we do in our system right into a easy and sleek three-step course of.

It’s constructed on actually 15 years of analysis, again testing, algorithms and knowledge in our system…

First, you inform the device what supply of shares you want. That may be something from a broad index, just like the S&P 500 Index … to your Strategic Fortunes e-newsletter, Ian … to something you need.

You then inform it how a lot cash you need to make investments, comparable to $10,000 or no matter you’d like. And eventually, you inform it what number of shares you’d like to purchase.

The device then does all of the work to construct you a superbly risk-balanced and diversified portfolio of shares.

The outcomes learn like a recipe for investing, and it’s so easy to make use of.

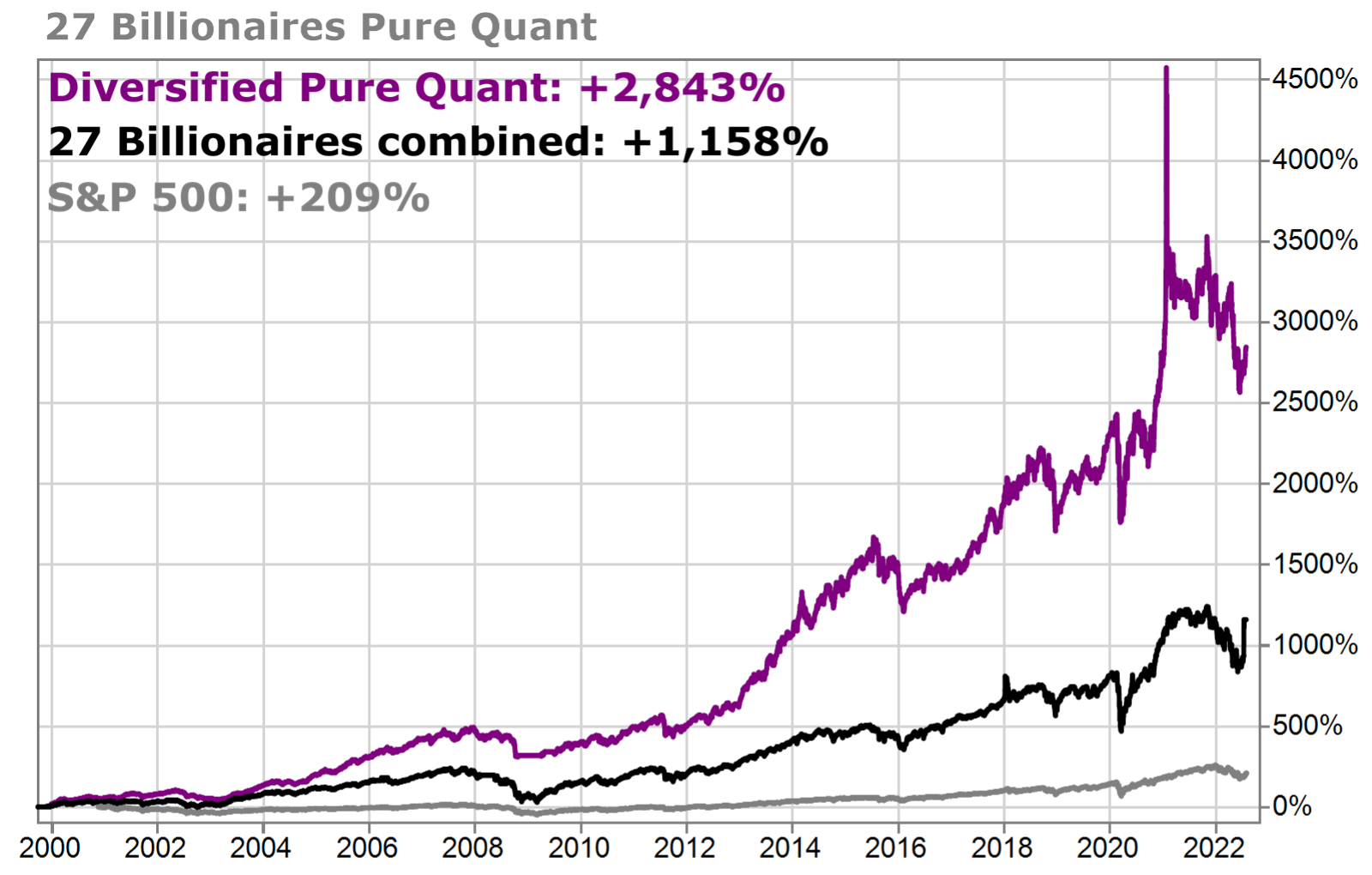

Right here’s an important instance of simply utilizing these billionaires’ shares in our system over practically 20 years. You’ll see two issues:

- The shares the billionaires purchased over this time period tremendously outperformed the S&P 500. That’s unbelievable by itself.

- We greater than doubled the billionaires’ efficiency by utilizing their similar shares and leveraging the Pure Quant Portfolio Builder alongside the way in which.

Ian: Keith, you place collectively nice instruments that aren’t solely simple to make use of, however that additionally do some actually refined stuff behind the scenes.

Having instruments that assist Important Avenue buyers know what to purchase, when to purchase it, how a lot to purchase and when to promote is an absolute game-changer for people with out entry to hedge funds and Wall Avenue. You’re doing unbelievable stuff right here!

Thanks very a lot for becoming a member of me right this moment.

Keith: You’re welcome! All the time a pleasure. And I look much more ahead to our reside webinar subsequent Tuesday.

Construct & Defend Your Portfolio: Be a part of Us for the “1000% Undertaking”

Up to now, over 68,000 buyers have used TradeSmith’s instruments to develop — and most significantly, defend — over $30 billion in wealth.

Jon L. stated: “I actually averted disaster by utilizing this.”

Patti S. famous: “This has saved me some huge cash on this risky market.”

Theresa H. commented: “I really feel a lot safer with you on my group. Sustain the good work. You guys are mathematical geniuses.”

These are just some examples out of a whole neighborhood of people that have been utilizing Keith’s merchandise to get forward of the market’s largest strikes.

However seeing is believing … and you’ll’t totally perceive how huge of a game-changer these instruments may be to your wealth-building efforts and your peace of thoughts with out making an attempt them for your self.

That’s why I’m internet hosting a particular occasion with Keith subsequent week to put all our playing cards on the desk.

We’re calling it the “1000% Undertaking.”

You’ll uncover not simply learn how to construct your portfolio — however learn how to defend it throughout risky occasions.

All you’ll want to do is click on this hyperlink to enroll in our webinar on Tuesday, January 24.

I stay up for seeing you there!

Regards,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Market Edge: It All Comes Again to Danger Administration

A couple of months again, I needed a brand new bike. Or at the least I assumed I did.

I really like taking part in basketball, however my creaky knees aren’t getting any much less creaky with age. I wanted a brand new outlet.

My residence in Lima is only a fast hop, skip and bounce away from the Miraflores Malecón, or sea wall, which has a implausible bike path that runs alongside the ocean. Biking appeared like a no brainer.

However then I went to the bike retailer and was totally overwhelmed.

There have been highway bikes … gravel bikes … hard-tail mountain bikes, full-suspension mountain bikes… and every broad grouping had seemingly infinite subcategories and variants.

I had too many choices, making the expertise overwhelming and burdensome and virtually turning me off to the concept fully.

I ultimately simply requested a buddy who was an skilled bike owner to decide on one for me. His alternative could or could not have been higher than what I’d’ve in the end got here up with by myself. However it made my life so much simpler.

Danger administration may be the identical means. Each sensible investor is aware of they want threat administration in place. However there are infinite threat administration methods to select from, and even one thing so simple as a stop-loss has practically infinite variants.

Studying right this moment’s interview, I nodded knowingly when Ian talked about TradeStops. As a result of I’ve used the service for years. Right here’s why…

Setting a correct stop-loss is one thing I at all times struggled with. I experimented with utilizing a blanket 20% for all positions … however that didn’t actually make sense as a result of some shares are naturally way more risky than others.

I attempted setting stops primarily based on every inventory’s latest help ranges. However that was a bit of too subjective for my tastes, and it didn’t work notably properly for shares that had been in strong uptrends.

That’s after I found TradeStops’ volatility-based stop-losses. The mannequin units a really useful stop-loss for every particular person inventory primarily based on its historic volatility. This helps to separate the sign from the noise.

Now, I don’t put a stop-loss on each place. I personal a couple of “endlessly” shares that I’m snug holding even by way of a nasty bear market. Most of those are dividend-focused shares that I’m assured will proceed throwing off their dividends no matter what occurs. However for the overwhelming majority of the shares I purchase, setting stop-losses helps convey construction to my investments.

I solely have a lot psychological bandwidth. And by utilizing volatility-based stop-losses, I take one very mentally taxing query off the desk. I don’t should agonize over when to promote a place. I promote it when it hits its cease. Finish of story.

That’s why you’d be doing all your future self an enormous favor to affix Ian King and Keith Kaplan subsequent Tuesday, and be taught what the TradeStops crew has been engaged on for 2023. I assure it’ll provide the peace of thoughts all of us deserve after the volatility of final yr.

Talking of psychological bandwidth … I hope you bought an opportunity to hearken to Mike Carr and myself push our nerd cred to the restrict on yesterday’s podcast. I haven’t had a lot enjoyable with an information set in what seems like years.

Should you missed it, catch the replay right here. See the place the numbers take us!

[ad_2]

Source link