Irina Kashaeva

The Canines of the Dow technique gained reputation in 1991 when it was printed in Michael B. O’Higgins’ e-book, Beating the Dow. On this e-book is the place Mr. Higgins coined the phrase “Canines of the Dow.”

For these of you unfamiliar, the Canines of the Dow technique seems on the 10 highest yielding dividend shares throughout the Dow Jones Industrial Common on the conclusion of the 12 months.

On the finish of 2022, listed here are your 10 Canines of the Dow:

- Verizon (VZ) 6.2% dividend yield

- Walgreens (WBA) 5.2%

- Intel (INTC) 4.9%

- Dow, Inc. (DOW) 4.8%

- 3M (MMM) 4.6%

- Worldwide Enterprise Machines (IBM) 4.5%

- Chevron (CVX) 3.2%

- Amgen (AMGN) 3.1%

- Cisco Techniques (CSCO) 3.1%

- JPMorgan Chase (JPM) 2.8%

This technique is utilized by not solely dividend buyers however worth buyers as effectively as a result of in spite of everything as a inventory worth goes down a dividend yield goes up. Nonetheless, simply because a inventory is on this checklist doesn’t essentially imply it had a nasty 12 months over the previous 12 months. In any case, Chevron was top-of-the-line performing shares within the S&P 500 final 12 months, not to mention the DJIA.

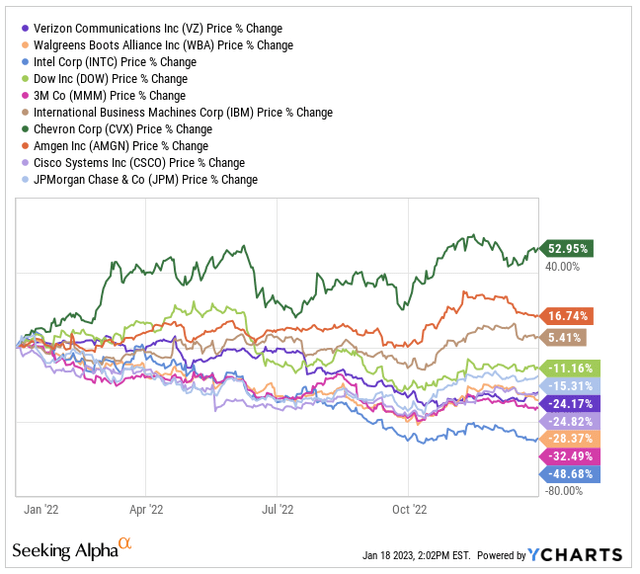

Here’s a take a look at how all 10 of those Canines of the Dow shares carried out in 2022:

ycharts

As you may see within the chart, Chevron shares we up over 50% in 2022, far surpassing all of the others. Solely 3 of those 10 shares have been optimistic on the 12 months, as Amgen and IBM additionally joined CVX in optimistic territory.

Intel, 3M, and Walgreens have been the three worst performing shares on this checklist, as Intel was down practically 50% on the 12 months.

3 Canines of the Dow For 2023

Canine of the Dow #1 – Intel Corp (INTC)

As we noticed above, Intel was the worst performing inventory out of all 10 Canines of the Dow. The corporate has gone via quite a lot of modifications and delays within the current years, which has led to a lack of market share. Superior Micro Units (AMD) has been progressing quick within the chip area, and is correct on the cusp of surpassing INTC with regards to market cap.

INTC has a market cap of $122 billion in comparison with AMD having a market cap of $115 billion.

Though the corporate has been down, I’m not counting them out. INTC has had quite a few hiccups alongside the best way, many having to do with the execution or lack thereof and delays from a lot of their new chips, which has allowed firms like AMD and NVDA to take benefit.

The corporate is led by very long time Intel worker Pat Gelsinger who took over the CEO reigns in February 2021.

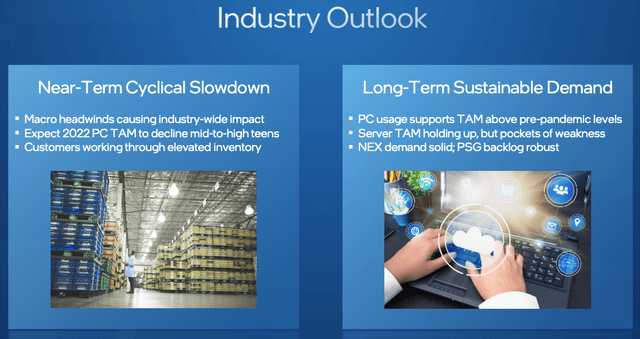

Intel management is assured they will flip issues round from an operations standpoint, and as they do, the business is prepared. Macro headwinds equivalent to increased rates of interest and slowing financial progress, which pose near-term headwinds for the corporate.

The entire addressable market has surpassed pre-pandemic ranges as demand stays sturdy, which is a long-term tailwind for a corporation like Intel.

INTC Q3 Investor Presentation

Mr. Gelsinger has got down to “proper dimension” the corporate, through which they introduced layoffs on the finish of 2022 and additional layoffs could possibly be coming. That might be an fascinating level to comply with up on when the corporate studies This autumn earnings subsequent week.

Intel remains to be flush with money as they’ve over $25 billion of money and short-term investments on the steadiness sheet as of Q3, which ought to give dividend buyers consolation a minimum of within the near-term.

The corporate pays a $1.46 per share dividend, which was elevated 5% in 2022, and is anticipated to get one other hike subsequent week when the corporate releases earnings. The dividend yield presently sits at 4.9%.

Canine of the Dow #2 – 3M (MMM)

3M has lengthy been an industrial bellwether that’s discovered in lots of dividend portfolios. Nonetheless, like Intel, 3M had a tough 12 months as they have been the second worst performer on the checklist, because the inventory fell over 30% on the 12 months.

3M is thought for having a diversified portfolio of merchandise, extra well-known for objects like their post-it notes, masks, scotch tape, and MANY different merchandise.

Nonetheless, 2022 was much less about these major merchandise letting them down and extra a couple of single product letting them down. The corporate has discovered themselves wrapped up in hundreds of lawsuits, over 200,000 to be extra exact, with reference to earplugs that have been offered by one of many firm’s subsidiaries. Navy personnel who’re those suing the corporate, have acknowledged that they’ve encountered a lack of listening to attributable to faulty earplugs.

The subsidiary, Aearo Applied sciences, ended up submitting for chapter, however a federal decide noticed this as 3M trying to offset the legal responsibility from their books, which was denied, however 3M has since appealed that call. In 2018, 3M paid $9.1 million to the Division of Justice to resolve any allegations, however the present lawsuits are actually coming from particular person navy personnel.

Navy Instances

Publicity estimates are fairly large from $10 billion to $80 billion. Whether it is on the upper facet, it may actually pose a menace to 3M, however I imagine as the method performs out via appeals, issues will come out nearer to the decrease finish, however that’s simply my opinion.

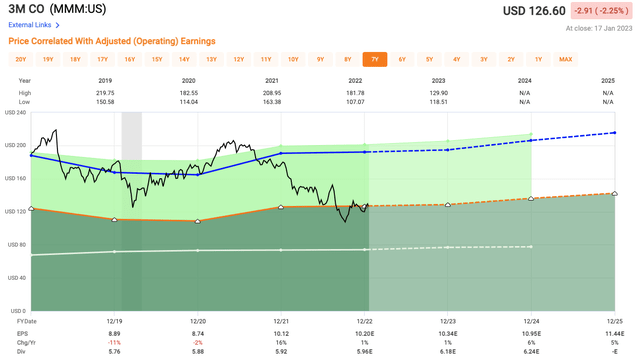

As such, there’s loads of danger with regards to 3M, however on the identical time you might be getting the chance so as to add shares at a really low cost valuation with regards to their historic common.

Shares of 3M presently commerce at 12x subsequent 12 months’s earnings in comparison with a 5-year common of 18.8x. The danger is there, however the worth is reasonable, plus you get 4.6% dividend yield.

Quick Graphs

Canine of the Dow #3 – JPMorgan Chase (JPM)

JPMorgan Chase (JPM) is the third Canine of the Dow for 2023, and simply thought-about the most secure funding between the three shares we have now checked out at this time.

Intel is a top quality firm that has had failed execution and 3M has loads of authorized points to take care of, so each of these shares have some dangers that come together with them. JPMorgan however is led by the good Jamie Dimon.

Given the present state of the financial system and the rising price surroundings we’re going via, banks may show to be an awesome funding. As charges improve, so does Web Curiosity Earnings, or NII, which is the distinction between the curiosity revenue you obtain from merchandise like loans and the curiosity you pay out on merchandise like financial savings accounts.

Charges are anticipated to proceed to extend within the near-term, albeit at a slower tempo, however we’re additionally anticipated to stay at far more elevated charges than we’re accustomed to seeing the previous few years, which advantages monetary shares.

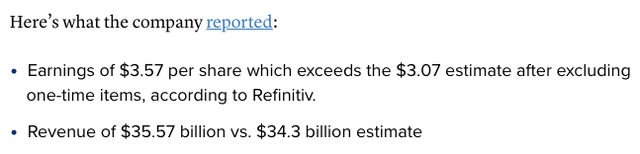

The factor to look at carefully with banks is the energy of the buyer. JPM reported This autumn earnings final week that beat analyst expectations, however we did see them apply more money in direction of their credit score loss reserve. As well as, throughout the earnings name, JPM alluded to a “gentle recession.” If we get a gentle recession, banks could possibly be an enormous winner within the markets, however a average or large recession, would show to be dangerous.

CNBC

JPMorgan had been rising their dividend yearly for 9 straight years, however that resulted in 2022, as we didn’t see any improve. The dividend yield presently sits at 2.8%.

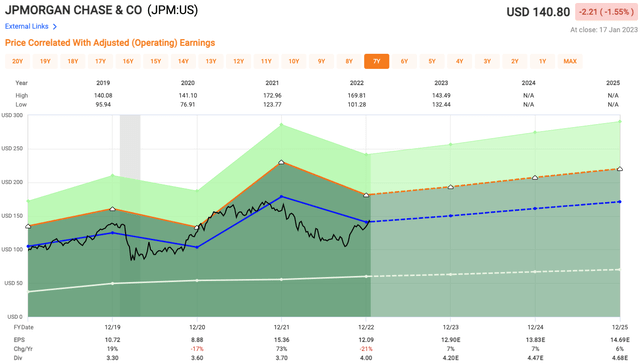

By way of valuation, JPM shares presently commerce at 10.9x based mostly on 2023 estimates, which is beneath their historic common of 11.7x.

Quick Graphs

Investor Takeaway

The Canines of the Dow is each seen as a dividend technique in addition to a price technique. Shares on the checklist doesn’t essentially imply they carried out poorly the 12 months prior, however relatively that they pay a excessive yield.

These three shares, INTC, MMM, and JPM, all have inherent dangers, some bigger than others.

Intel is an organization that should flip issues round and they’re investing some huge cash in an try to do this.

3M has been an awesome firm for over 100 years, however they’ve fallen on powerful instances as a result of navy earplug concern they’re dealing with proper now, the place over 200,000 navy personnel have entered a case in opposition to the corporate for promoting a faulty product. Publicity quantities are all around the map, but when it is available in on the low finish, these ranges are going to show to be an awesome shopping for alternative.

JPMorgan is the most important US financial institution when it comes to property, and in addition some of the effectively run banks below the management of Jamie Dimon. If we do get a gentle recession, I imagine banks like JPM will show to be a significant success.

Let me know down within the feedback part beneath, which Canine of the Dow inventory you want for 2023.