alvarez

Introduction

With market caps starting from $72 to $238 billion, there are six diversified healthcare giants that dominate the market of instruments, gear, and providers. They’re Thermo Fisher (TMO), Danaher (DHR), Abbott (ABT), Medtronic (MDT), Merck KGaA (OTCPK:MKKGY), and Becton, Dickinson (BDX). All are comparatively robust firms, however buyers need the most effective. Subsequently, I took a monetary method evaluating key metrics, with a concentrate on progress and profitability. Whereas each funding has its execs and cons, together with each investor’s particular person wants, generally it’s good to take a wider view to see the place alternative might come up. I’ve executed an identical rank evaluation for Biotech and Pharmaceutical pipelines, so test these out as nicely.

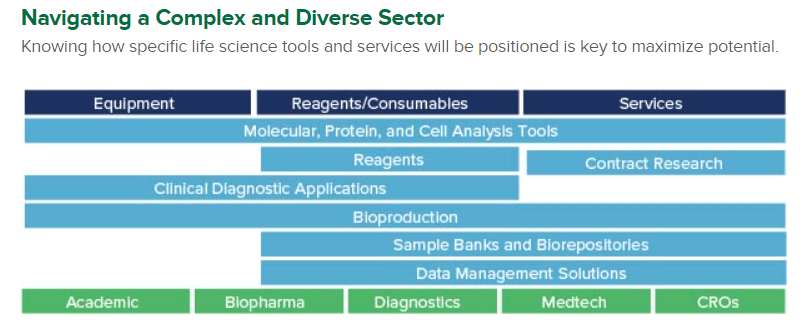

Leaders in Sturdy, Numerous Markets

To help drug discoveries and researchers like Pharmas, Biotechs, and academia the healthcare trade has a key trade surrounding instruments and providers. I may also group in diversified firms that present gear as nicely, however concentrate on solely the most important and most diversified firms. Provisions embody analytical and diagnostic gear, uncooked supplies, medical gadgets, the mandatory software program, and extra, even contracted analysis. The trade is broad, and that’s the reason there are a number of $100 billion firms. For a narrower look, I might suggest my article on Lab Instrument chief Bruker (BRKR). As an alternative, the businesses I named above are the driving drive beneath drugs and analysis and are important for the whole healthcare trade’s success.

Well being Advances

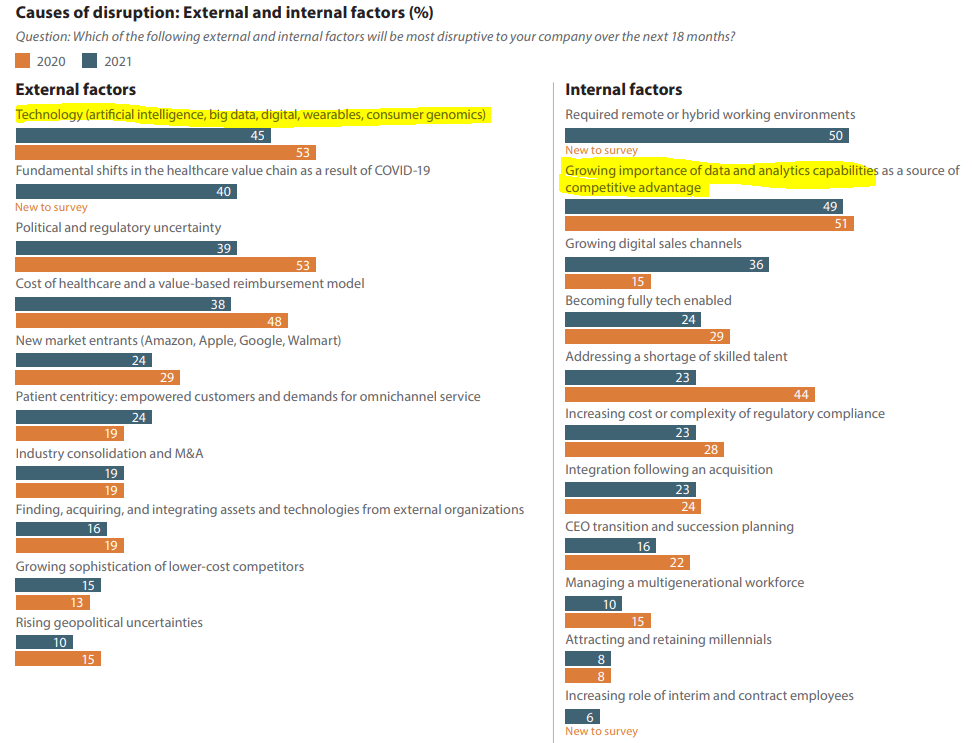

Because of the underlying total healthcare system, these firms provide robust monetary profiles primarily based on the important providers they supply. Why so important? Effectively, the current surveys by Heidrich & Struggles point out that the most important weak factors for the time being revolve round technological disruption, and the provisioners are capable of step in and supply the mandatory instruments or consumables. Examples embody the speedy want for COVID diagnostics, and subsequent vaccine manufacturing gear and supplies, together with varied superior detection instruments for visualizing and concentrating on illnesses resembling cancers. A lot of the innovation battle is happening with the smaller friends, however with acquisitions and inside R&D, a lot of the conglomerates can maintain their very own.

Heidrich & Struggles

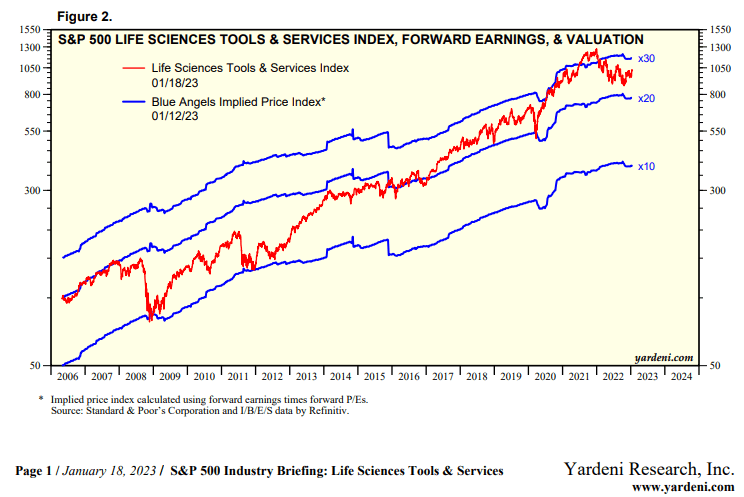

For a way of how favored and well-performing the sector is, I present index knowledge by Yardeni Analysis within the picture under. As proven, the Life Sciences Instruments & Service index has carried out nicely since 2006. Nevertheless, the implied valuation of the index is rising as nicely over time. Some buyers might consider that the valuation stays excessive, however enhancements in greater margin instruments and providers, progress, and diversification all help greater valuations. Not less than coming into into 2023, valuations are down and returning in the direction of truthful territory. However, because the article implies, I’ll concentrate on discovering the most effective of the group.

Yardeni Analysis

Firm Summaries

Beneath, I summarize the businesses alphabetically, highlighting their various vary of experience. Diversification is essential, as distinct enterprise teams can all present distinctive progress or revenue alternatives. Most firms personal moats over their segments, though competitors with small caps is the primary danger issue. Whereas some firms present weaknesses or strengths for the time being, I consider all have the power to carry out nicely sooner or later, in the event that they handle themselves accurately. I hope these summaries and following rankings assist buyers choose the best high quality holdings.

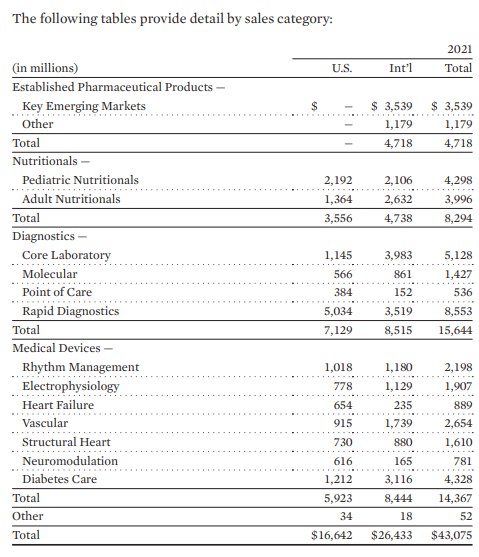

Abbott

Abbott is an previous, seasoned, and diversified healthcare title with 4 main working segments: Worldwide Prescription drugs (AbbVie (ABBV) and friends handle US gross sales, most are generics), Nutritionals (resembling Guarantee and Pedialyte), Diagnostics (lab evaluation instruments and consumables), and Medical Gadgets (specializing in cardiovascular, neurological, and diabetes therapy areas). Though a smaller section, the nutritionals provide distinctive publicity for healthcare buyers as no different main firm presents these merchandise. The corporate can be investing closely in revolutionary new medical gadgets, and these might disrupt section leaders like Edwards (EW) and DexCom (DXCM). As such, my outlook stays constructive.

Abbott

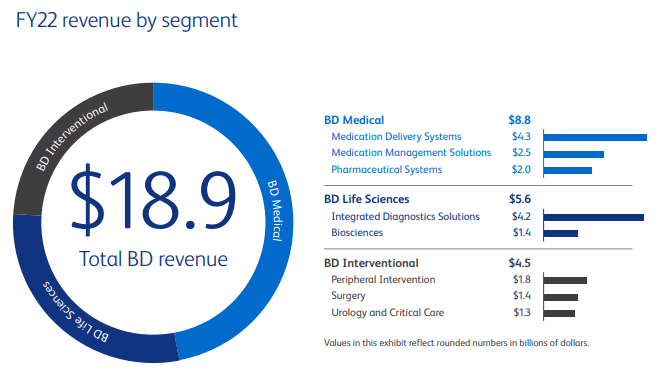

Becton, Dickinson

Becton, Dickinson, or BD is a diversified provider of healthcare consumable provides, and the gadgets that require them. Examples embody surgical hand instruments, anesthesia gadgets, dyes for in vivo diagnostics, automated drug supply programs, and extra. BDX’s high line progress has been constant for the previous decade, however they’re dropping on the underside line with EPS flat over the previous 10 years. Regardless of the diversification, competitors within the decrease margin consumables (needles, hand instruments, and so forth.) will proceed to plague progress. The corporate might want to both innovate new excessive margin instruments and providers or improve the effectivity of present operations to succeed.

Becton, Dickinson

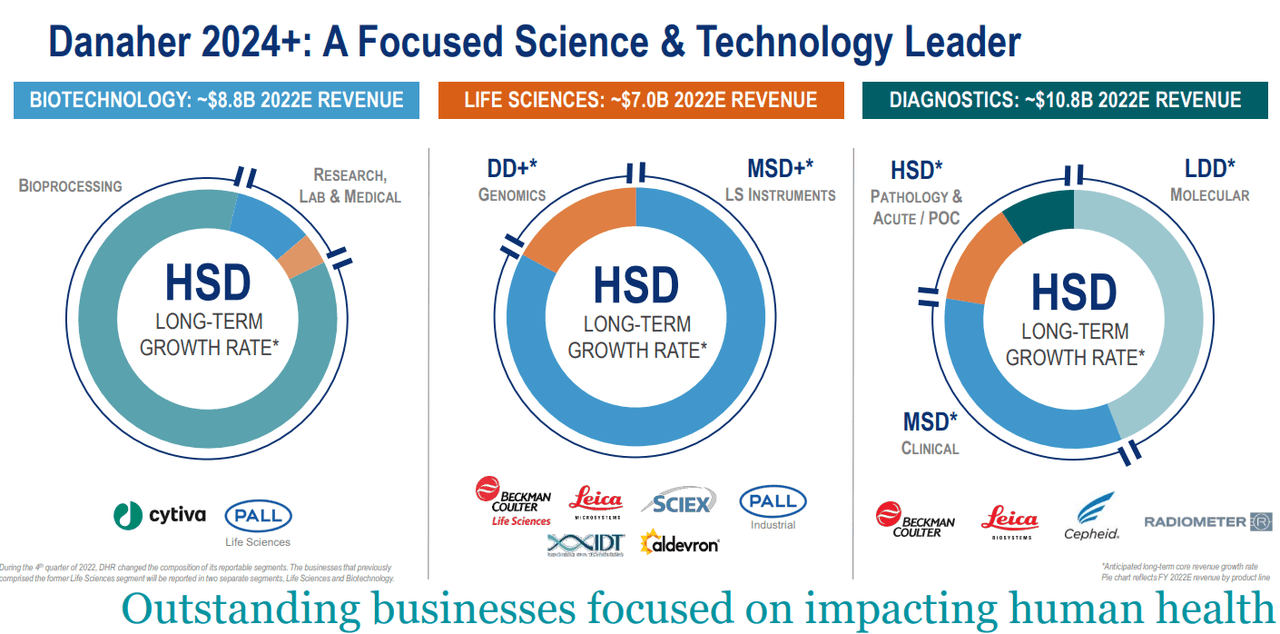

Danaher

Danaher is a conglomerate of various and distinctive companies that span the whole well being care market. Even past healthcare and into the bodily sciences, the spinoff of their environmental and utilized options section within the coming quarters will result in a wholly life sciences focus. The brand new firm will likely be a rising chief within the biologics manufacturing trade by way of promoting gear for bioprocessing (assume mobile, antibody, or different molecular therapies), the following era of medicines. Danaher additionally has vital publicity to diagnostics and consumables, principally utilized in laboratory settings for pre-clinical or tutorial analysis. Look ahead to natural and inorganic progress, and the ensuing synergies, lead in the direction of continued speedy earnings progress.

Danaher

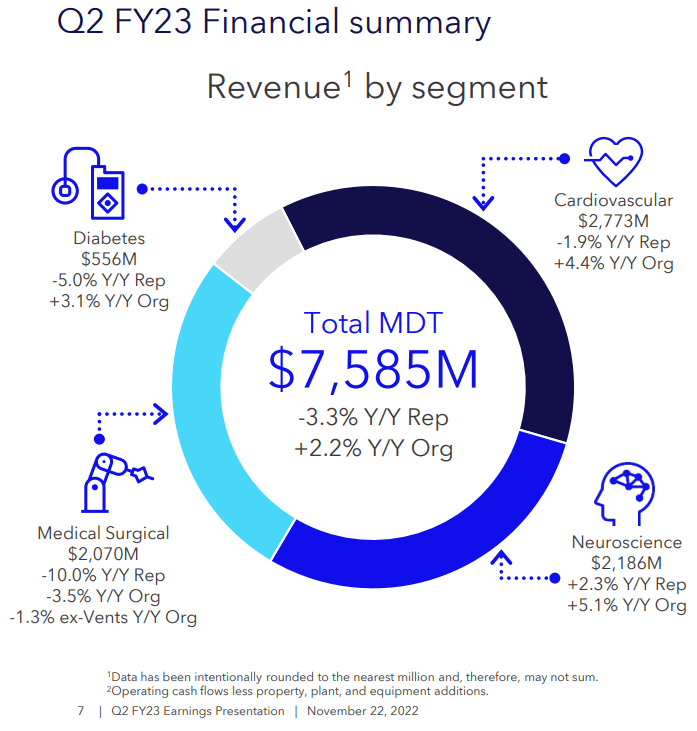

Medtronic

Because the chief in medical gadgets, Medtronic has created a worthwhile moat. Nevertheless, competitors within the house is immense, stopping Medtronic from rising quickly. Additionally, regardless of over 10 acquisitions up to now 5 years, backside line progress has not saved up with revenues, indicating an incapability to search out synergies and enhance effectivity. The expense of each continued innovation and inside enhancements might proceed to hinder whole returns, regardless of the moat throughout all areas of the medical system trade. Search for some main modifications, whether or not acquisitions or divestitures, to be introduced within the coming quarters.

Medtronic

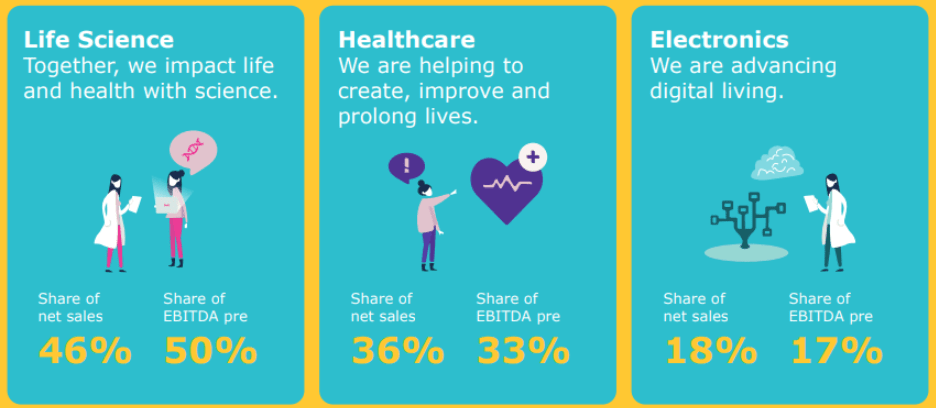

Merck KGaA

As I’ve mentioned in a current article, German Merck is much totally different from US Merck (MKR). Because the house owners of Sigma Aldrich and Millipore (now Millipore Sigma), the group is the dominant supplier of a wide range of merchandise to the life sciences trade (particularly chemical compounds and uncooked supplies). Merck KGaA additionally has an inside healthcare section that has a large pipeline of therapies, in contrast to the opposite firms on this listing. Then there’s the electronics division, predominantly a provider of semiconductor uncooked supplies/feedstocks, one other differentiating issue. Because of this diversification in three extremely worthwhile, quick rising segments, Merck has emerged as one of many quickest rising firms of the group.

Merck KGaA

Thermo Fisher

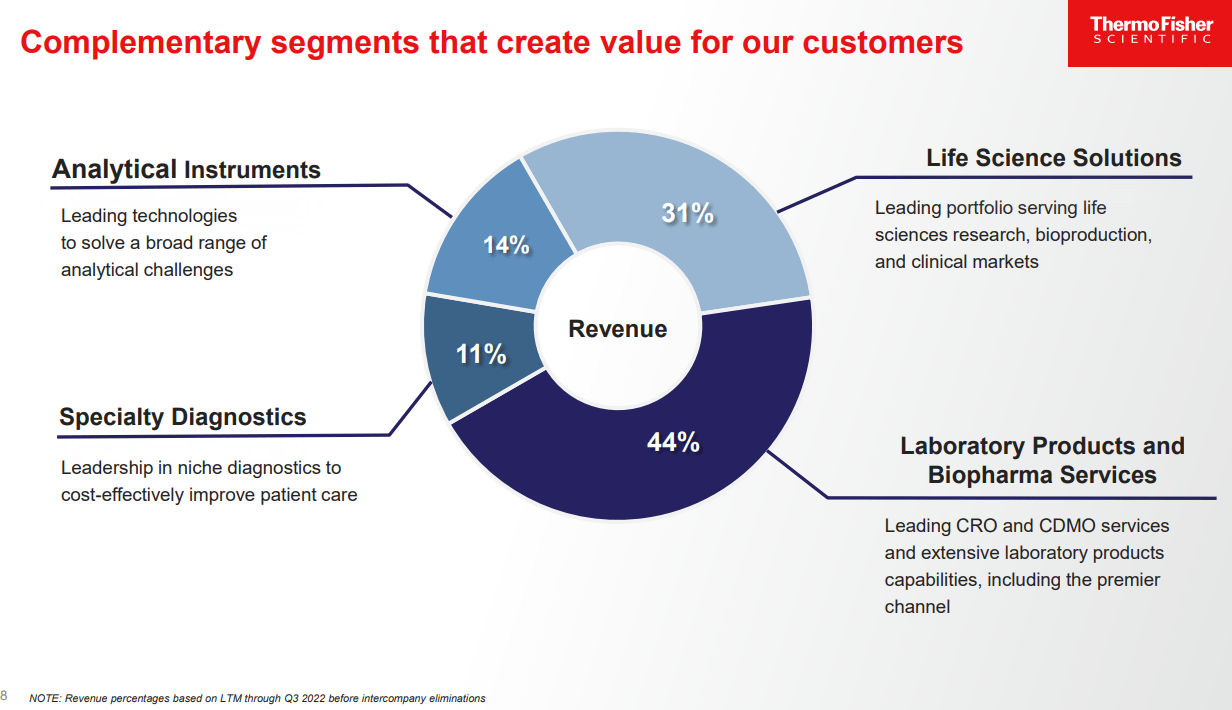

I’m positive anybody who has frolicked in a analysis laboratory is accustomed to most of the firms on this listing, however even these undergraduates who had an elective bio lab class might keep in mind seeing Thermo Fisher merchandise. As the most important firm of the group, TMO can be essentially the most diversified. Whereas well-known for his or her devices, diagnostics, and consumable merchandise, Thermo can be one of many main contract analysis and drug manufacturing firms on the earth. This quickly rising section is critical for Massive Pharma firms who need to outsource their new biologics manufacturing to scale back inside capex prices. With intensive natural and inorganic progress alternatives, there are few impediments to TMO’s continued success.

Thermo Fisher

The Rankings

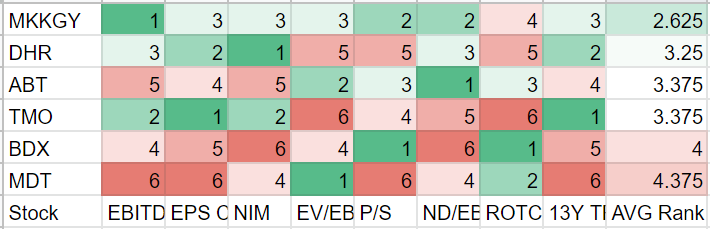

This set of firms was ranked on just a few key monetary metrics that centered on the long-term sustainable progress of earnings. I started by taking a look at historic 10-year EBITDA and EPS CAGR. Then, I centered on profitability with the present 5 12 months common Web Revenue Margin and 10-year common Return on Complete Capital, together with leverage (Web Debt / EBITDA). After that got here the valuation metrics EV/EBITDA and P/S, as P/E is a extra unstable and fewer helpful indicator. Lastly, I measured the full return of the group, courting again to 1/01/2010. The outcomes are as follows:

Creator. Based mostly on SA and Koyfin knowledge.

As you’ll be able to see, German Merck is on high with constant scores throughout the board. In reality, one of many few firms to be constant like this regardless of rating first in varied metrics. On the finish of the listing, Medtronic sadly suffers from weak progress, regardless of excessive profitability. That is evident with the weak whole return, dividends included. Until the dividend yield is your solely requirement for an funding, Medtronic must be averted. Complete return was not the one requirement although, as excessive flyers Thermo Fisher and Danaher undergo from overvaluation and low returns on whole capital. It’s a toss-up for the center ranked firms, however a stability of MKKGY and ABT might pan out nicely at present costs.

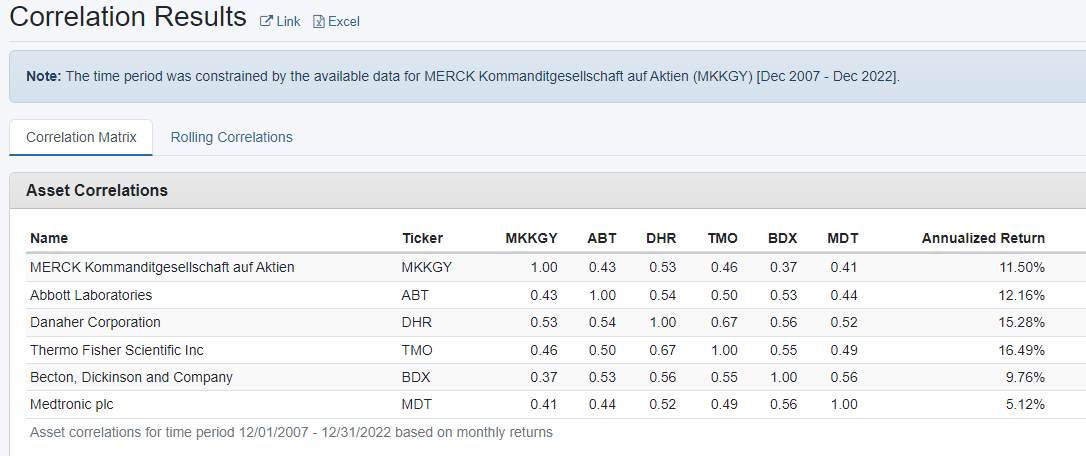

Sooner or later, progress buyers can shift into TMO or DHR, whereas worth buyers can revisit BDX and MDT if their efficiency improves. For a broader image, we are able to simply have a look at the correlation outcomes supplied by Portfolio Visualizer. With return knowledge courting again to December 2007, we are able to see that annualized whole returns fluctuate broadly throughout the small group. For diversification functions, holding all six names is barely partially correlated, however the variations between progress and worth names are distinct. Bear in mind, these returns embody the reinvestment of dividends, so is Medtronic’s valuation or excessive yield actually value it?

Portfolio Visualizer

Conclusion

Whereas this rating system is only one issue to contemplate out of many when contemplating an funding, I consider the outcomes are correct. Subsequently, the upper on the listing, the higher the chance. I proceed to consider that Merck KGaA is the most effective purchase of the bunch, whereas Medtronic has systemic points to work out regardless of the low valuation. It’s clear that regardless of moats or management, the ensuing financials and valuation are an important components.

For now, buyers should mirror on their very own targets and incorporate these components into their investments. I might suggest recurring investments throughout the board slightly than attempting to time the market, though trimming overvaluation for undervaluation may be worthwhile. Be happy to share your ideas and method to those healthcare leaders within the feedback under.

Thanks for studying.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.