[ad_1]

Notice from Charles Sizemore, Chief Editor: Right now in The Banyan Edge, now we have a particular visitor contributor becoming a member of us.

His title is Keith Kaplan, founder and CEO of TradeSmith — an organization with a strong software program that I personally contemplate to be a necessary instrument for each investor.

In reality, I consider there’s no higher approach to increase your returns (whereas limiting losses) then with the software program Keith and his group have developed. With years like 2022, and what’s prone to be one other humdinger in 2023, the timing couldn’t be higher to see the nice work the TradeSmith group is doing.

That’s why Ian King is sitting down with Keith on Tuesday night to placed on a particular occasion they’re calling THE 1000% PROJECT. There, you’ll be able to find out how Keith and his group can put you in the perfect place to land 1,000% winners — even on this bear market.

[Reserve your spot here.]

And to present you an concept of the work Keith is doing, try the nice article beneath. I feel you’ll actually take pleasure in it.

The Dangers of Being a Human Investor in 2023

Should you noticed the information in late December about Cathie Wooden, CEO of Ark Make investments and portfolio supervisor of the Ark Innovation ETF (ARKK), you’d have heard that ARKK was down as a lot as 65% final 12 months.

Or how Wooden spent most of final 12 months doubling down on shares that simply stored sinking additional.

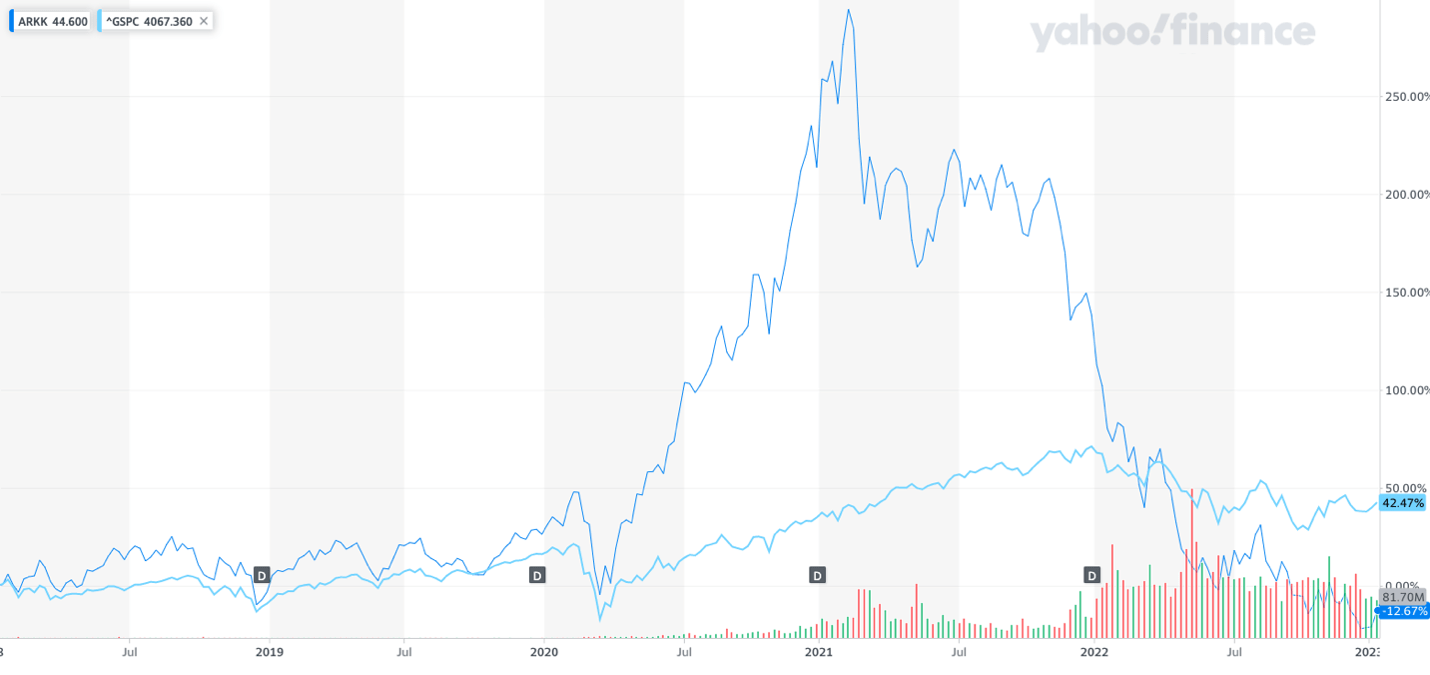

Or how during the last 5 years, the S&P 500, which began monitoring 500 shares in 1957 and could possibly be thought of a “senior citizen” at 65 years outdated, has carried out higher (42.47%) than ARKK (-12.67%), a fund that focuses on investing in new and disruptive know-how.

However what you’re not listening to is why this has occurred.

I’m not right here to personally choose on Wooden. I may speak about her genius aspect, and that she may in all probability be doing 98% of issues proper.

What I wish to speak about is the two% that she has executed flawed, as a result of it’s that a part of her decision-making course of that despatched the ARKK value plummeting from a excessive of $156.58 on February 5, 2021, to a gap value Friday of $35.33.

Woods’ downside is that she’s appearing human. And if you’re managing $7.5 billion in property (only for ARKK, not her different ETFs), that you must be a machine.

Machines are calculated, work inside a set framework and don’t have any emotion. They’re programmed for one job and execute it.

As compared, people are flawed and emotional. We promote too early, we purchase too excessive and we throw within the towel when shares sink.

We will’t handle our feelings … and it leads us to doing the precise reverse of what we should be doing within the inventory market.

Happily for us, now we have instruments at TradeSmith that allow us execute like machines, taking the emotion out of investing and discovering the perfect instances to purchase and promote.

What Cathie Wooden Did Flawed

Wooden has made one of the vital basic investor errors: not having an exit technique. That comes from not having a completely shaped plan that considers what to do when issues go south.

Had she simply put in a trailing cease on all her profitable positions, her outcomes may’ve been a lot totally different (and, I believe, way more profitable).

A trailing cease is a cease value set at an outlined proportion beneath the present market value of the place. That cease additionally rises together with the inventory value, locking in your features.

At TradeSmith, we tie our trailing stops on any inventory to one thing we name its Volatility Quotient (VQ), our proprietary measure of every inventory’s inherent threat.

These good trailing stops assist us reap the benefits of the pure ebb and stream of value motion, to maximise any features whereas guaranteeing we don’t get stopped out too quickly.

Trying on the high holdings in ARKK, I see that 5 of the largest positions after Tesla all hit the pink zone, or their stop-loss level. Nonetheless, Wooden stored them within the fund, the place they proceed to lose cash to at the present time.

See for your self:

- Zoom Video Communications Inc. (ZM) — entered the Crimson Zone on Sept. 15, 2021, at $279.12; and has since fallen 76.6% to $65.36.

- Roku Inc. (ROKU) — entered the pink zone on Nov. 23, 2021, at $226.06; and has since fallen 82.8% to $38.80.

- Block Inc. (SQ) — entered the pink zone on Dec. 20, 2021, at $158.30; and has since fallen 67.4% to $51.51.

- Shopify Inc. (SHOP) — entered the pink zone on Jan. 21, 2022 at $88.21; and has since fallen 70.9% to $25.67.

- Teladoc Well being Inc. (TDOC) — entered the pink zone on Might 3, 2021 at $163.21; and has since fallen 86.3% to $22.29.

Notice: All loss percentages are for the interval between the date of pink zone entry and January 12, 2023.

My guess is that Wooden believes they are going to finally flip round, as do all traders who’re clinging to those shares and hoping for a rebound.

That’s the human facet of investing and buying and selling that we wish to keep away from.

We wish to use instruments like trailing stops and our VQ system as an alternative of our feelings.

With that in thoughts, let’s put ARKK beneath the microscope of our system to see how we are able to use instruments and methods to our benefit.

ARKK Will get the TradeSmith Remedy

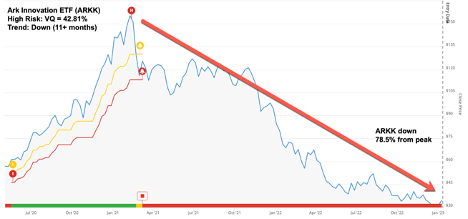

ARKK triggered an entry sign on Might 22, 2020, at $61.27. From there, it soared to $155.30 earlier than tumbling to its stop-loss at $109.36 on March 8, 2021 — managing a achieve of 78.5%.

At the moment, ARKK stays within the pink zone and has been in a downtrend since January 19, 2022, so additional losses could also be on the best way. Our timing algorithms recommend that ARKK is in a peak zone, confirming a bearish outlook.

With a VQ of 42.94%, it’s a high-risk alternative, however taking the pattern and peak flip space into consideration, it’s seemingly not value any potential reward at this level.

Not one of the high-profile billionaires we monitor within the Billionaires Membership maintain this ETF, nor does it match any methods within the TradeSmith Concepts Lab.

Should you’re drawn to this fund since you consider in its mission of bundling progressive, disruptive firms, like Tesla, Zoom and Roku, I’d recommend placing it on a watchlist and ready for an additional entry sign.

Cathie Wooden and Ark Make investments function a cautionary story that nobody, regardless of how sensible, is immune from feelings and the impression they’ve on our cash.

Staying in shares with the hopes they’ll flip round is tantamount to throwing darts at midnight; if all you’re counting on is a intestine intuition, your chance of success tapers considerably.

You wish to know what to purchase, when to purchase it and most significantly, when to promote it.

At TradeSmith, now we have the instruments that will help you in every of those three essential areas.

That’s why I encourage you to affix me Tuesday for my interview with Ian King.

There, I’ll showcase our latest innovation …

A brand new funding methodology that may put you in the perfect place to make 1,000% features whereas mitigating your threat as a lot as potential.

Enroll proper right here. And for those who add your telephone quantity to my VIP record, you’ll obtain my brand-new particular report — When to Promote the 50 Most Standard Shares — 100% free.

Sincerely,

Keith Kaplan

CEO, TradeSmith

[ad_2]

Source link