The S&P 500 (SP500) on Friday superior 2.47% for the week to shut at 4,070.56 factors, whereas its accompanying SPDR S&P 500 Belief ETF (NYSEARCA:SPY) added 2.48%.

The advance provides to the benchmark index’s total constructive begin to the brand new 12 months. The S&P 500 has now posted good points in three of 2023’s first 4 weeks.

Buyers jumped again into progress shares throughout the week, with client corporations and expertise firms leaping probably the most. Market individuals squared up their positions and purchased into equities forward of the Federal Reserve’s first financial coverage committee assembly subsequent week. The central financial institution is extensively anticipated to downshift to a 25 foundation level charge hike, and the overall consensus is that the Fed’s aggressive rate of interest hikes at the moment are off the desk.

The week additionally noticed the fourth quarter earnings season kick into excessive gear. Outcomes from many main firms have rolled in and have largely been a blended bag. The expertise sector noticed studies from stalwarts reminiscent of Microsoft (MSFT), IBM (IBM) and Intel (INTC), with all three disappointing traders. However, electrical car maker Tesla’s (TSLA) numbers and steering had been cheered.

Dow 30 parts 3M (MMM), Verizon (VZ), Vacationers (TRV), Johnson & Johnson (JNJ), Boeing (BA), Visa (V), American Categorical (AXP) and Chevron (CVX) had been among the many different firms to report their outcomes.

Subsequent week will see the earnings season turn into even busier, with family names reminiscent of Apple (AAPL), Amazon (AMZN), Meta (META) and Alphabet (GOOG) (GOOGL) on faucet.

There was additionally a bunch of financial knowledge throughout the week. Core private consumption expenditures inflation moderated in December, which supplied a lift to sentiment.

Nonetheless, manufacturing knowledge continued to level to indicators of slowdown within the financial system, with the January S&P World Composite PMI displaying a contraction in enterprise exercise for a seventh straight month and the January Richmond Fed manufacturing survey coming in worse-than-expected.

In the meantime, the preliminary estimate for U.S. This autumn GDP progress got here in stronger-than-anticipated, however confirmed a deceleration from Q3. Furthermore, the variety of People submitting for weekly jobless claims hit a nine-month low, persevering with to level to resilience within the labor market.

Buyers additionally parsed by means of the next State Avenue Investor Confidence Index for January, an easing in enterprise uncertainty on income, a bigger-than-expected climb in December sturdy items orders, and an increase in December new properties gross sales and pending house gross sales.

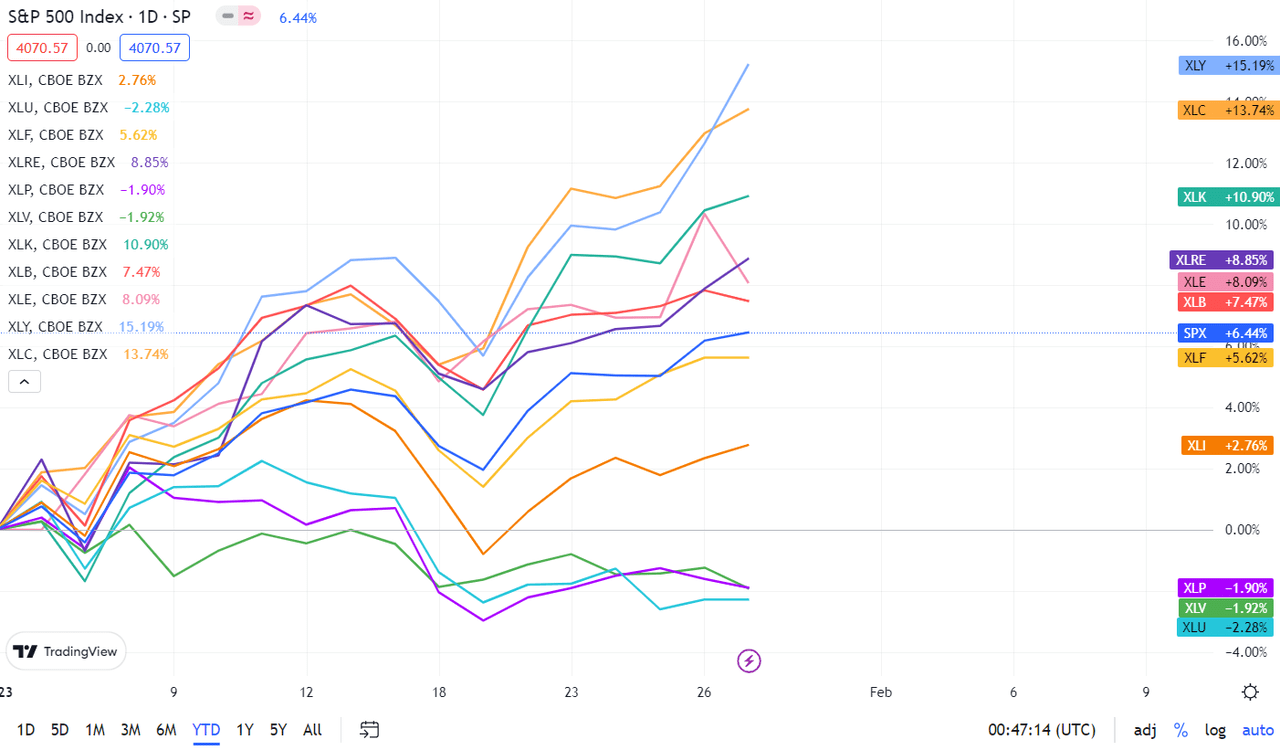

Of the 11 S&P 500 (SP500) sectors, 9 ended this week within the inexperienced, led by heavyweight sectors Client Discretionary and Info Know-how. Utilities and Well being Care had been the 2 losers. See beneath a breakdown of the weekly efficiency of the sectors in addition to their accompanying SPDR Choose Sector ETFs from Jan. 20 near Jan. 27 shut:

#1: Client Discretionary +6.38%, and the Client Discretionary Choose Sector SPDR ETF (XLY) +6.41%.

#2: Info Know-how +4.07%, and the Know-how Choose Sector SPDR ETF (XLK) +4.08%.

#3: Communication Providers +3.28%, and the Communication Providers Choose Sector SPDR Fund (XLC) +4.12%.

#4: Actual Property +2.82%, and the Actual Property Choose Sector SPDR ETF (XLRE) +2.88%.

#5: Financials +2.53%, and the Monetary Choose Sector SPDR ETF (XLF) +2.55%.

#6: Industrials +2.13%, and the Industrial Choose Sector SPDR ETF (XLI) +2.17%.

#7: Power +0.76%, and the Power Choose Sector SPDR ETF (XLE) +0.83%.

#8: Supplies +0.71%, and the Supplies Choose Sector SPDR ETF (XLB) +0.75%.

#9: Client Staples +0.43%, and the Client Staples Choose Sector SPDR ETF (XLP) +0.33%.

#10: Utilities -0.49%, and the Utilities Choose Sector SPDR ETF (XLU) -0.49%.

#11: Well being Care -0.89%, and the Well being Care Choose Sector SPDR ETF (XLV) -0.78%.

Beneath is a chart of the 11 sectors’ YTD efficiency and the way they fared in opposition to the S&P 500. For traders wanting into the way forward for what’s taking place, check out the In search of Alpha Catalyst Watch to see subsequent week’s breakdown of actionable occasions that stand out.