lindsay_imagery

Introduction

Aris Water Options, Inc. (NYSE:ARIS) seems richly valued at present costs, buying and selling at 18X earnings. The inventory has been a “darling” of Wall Road for some unusual cause since its IPO, buying and selling at considerably increased multiples than its opponents, Choose Power Companies, Inc. (WTTR), for instance.

I wrote them up in the midst of final 12 months with a positive ranking, however the firm is now 20% decrease than it was then. A truth attributable extra to the oil value sag, malaise that is saved the microcaps like ARIS and WTTR from realizing the beneficial properties seen by the large colours, than an issue with their enterprise mannequin per se.

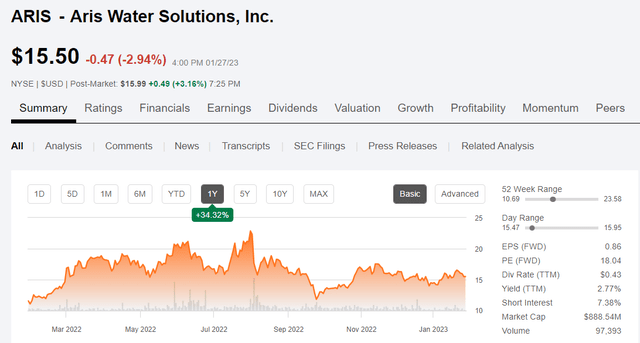

ARIS value chart (In search of Alpha)

It is time to face details. ARIS has been a canine, going primarily nowhere in 2022, and never giving a lot signal of transferring increased thus far in 2023. Will it stay a canine? That’s the query we’ll deal with on this article. The inventory nonetheless has the backing of Wall Road, which is keen to assign them an obese ranking at 18X earnings and 9.5X EV/EBITDA, with a value goal as excessive as $24 per share.

What are the analysts seeing that has them allocating increased multiples to ARIS than Halliburton (HAL) – now buying and selling at 13X earnings, and 8X EV/EBITDA? Let’s take a look to see if we will discover a cause for this bullishness.

The thesis for ARIS

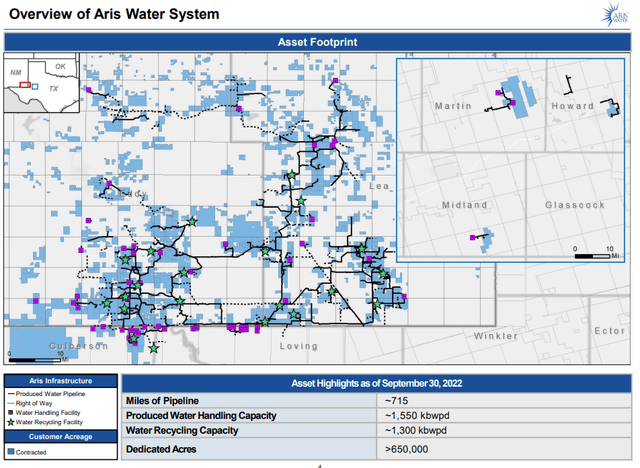

ARIS is solely targeted on the Permian basin, as proven within the map beneath. Particularly, one of the best a part of it when it comes to exercise in Lea and Eddy counties in New Mexico, and the Northern part of Loving county within the Delaware basin, and Martin, Howard, and Midland counties of Texas within the Midland basin. These counties account for over 230 of the 350 or so rigs working within the Permian.

ARIS footprint (ARIS)

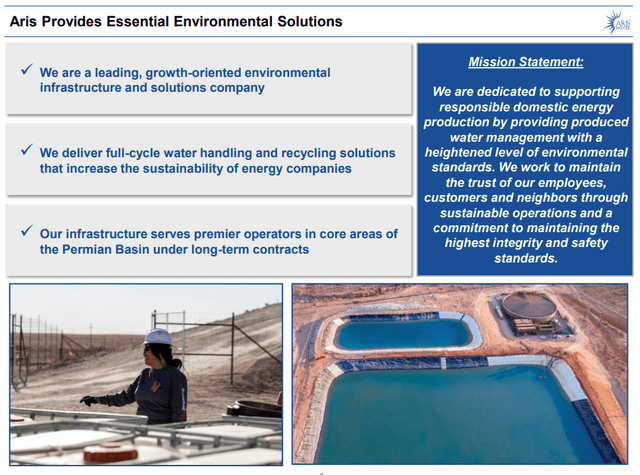

In contrast to opponents WTTR and TETRA Applied sciences (TTI), ARIS is a water administration pure play. Their enterprise is unfold equally over the frack water flowback and cleanup, and the produced water enterprise.

Produced water is the long-term driver on this enterprise, because it entails taking this water to million barrel impoundments for cleanup and conversion to frac water, or, on the horizon, desalinization to a near-fresh commonplace for potential agricultural use. West Texas is a desert with most recent water sources coming from underground aquifers which might be being drawn down a lot sooner than the sparse rainfall on this space can replenish. Desalinating water from oil wells is a big alternative to acquire a brand new supply of recent water and decrease the usage of disposal wells. This type of disposal is coming beneath growing scrutiny as seismic exercise within the Permian basin turns into extra pronounced. Earthquakes are usually not widespread within the Permian, and their growing frequency has drawn the eye of regulators.

ARIS Companies scope (ARIS)

Their capability to deal with practically 3 mm bbls each day is massive driver for his or her enterprise and helps to attract commitments from giant turbines like ConocoPhillips (COP) and Chevron (CVX). A degree price noting and on which we’ll broaden upon within the wrap-up part is these commitments are driving capex because the infrastructure is constructed out to deal with the water volumes. To this point there isn’t any earnings being generated, however that can change later this 12 months. Amanda Brock, President of ARIS feedback on monetization of those assets-

After we did the Chevron transaction and we indicated that we have been going to be spending roughly $50 million to $60 million, we additionally indicated that there was a lag of about six months to 9 months till we might see the good thing about these volumes. So, you will note extra volumes coming into the system from Chevron subsequent 12 months as we full the entire hookups and the infrastructure wanted.

Supply.

So, higher days are forward on the income entrance.

Lengthy-Time period Catalysts for ARIS

Clearly, the long-term contracts with Chevron and ConocoPhillips are transformative. These are strategic, which means that the businesses are going to be working collectively on quite a few water-related initiatives. (Press launch.) Amanda Brock, CEO, feedback on the broad outlines of those agreements:

We’re additionally happy to announce our strategic settlement with Chevron and ConocoPhillips to collectively deal with advancing alternatives for helpful reuse. Collectively, we’ll determine, develop and pilot proprietary and differentiated applied sciences for potential functions in non-consumptive agriculture, low-emission hydrogen manufacturing and direct air seize of atmospheric CO2.

Supply.

One thing this tells us is that as we shut out 2023, amongst different issues, ARIS’ water processing volumes probably are going increased. And, that brings further scale to the corporate with most likely probably the most volumes within the trade.

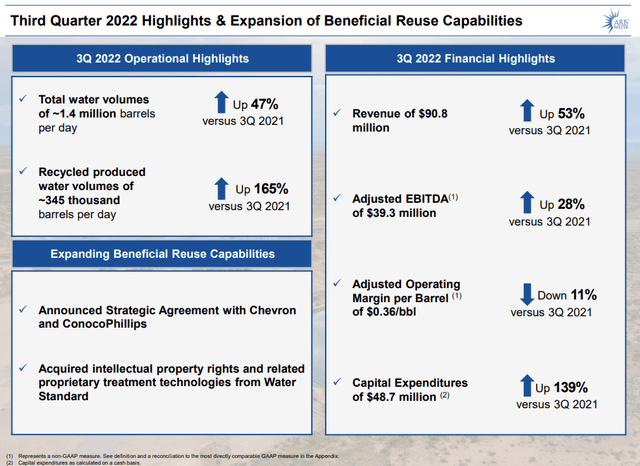

ARIS third Qtr Highlights (ARIS)

Subsequent now we have the know-how settlement with Water Customary, a privately held diversified water therapy tools producer, and excessive know-how filtration tools to incorporate reverse osmosis and nanofiltration. Whereas the main points of this know-how settlement weren’t disclosed, Water Customary makes simply the kind of tools that can grow to be helpful in these partnerships with CVX and COP.

Water Customary superior know-how (Water Customary)

Moreover, they’ve introduced a know-how switch steward into the fold with the hiring of Lisa Henthorne as Chief Scientist from Water Customary. That is the best way to deliver on new know-how from exterior. If it comes with no champion who understands it and has the authority to maneuver key initiatives ahead, it could possibly languish.

Lastly let’s not overlook the underpinning of all this curiosity in water reclamation, hydrogen manufacturing, and carbon seize. The Inflation Discount Act of 2022, gives direct funding and tax credit extra many of those initiatives. Future income streams will probably be enhanced from authorities largesse for a few years.

Q3 2022 Outcomes

Revenues grew 20% QoQ to $90.5 mm, whereas EBITDA rose a modest 8% to $35 mm. A one-off working capital construct associated funding newly acquired main contracts contributed to this end result. LT Debt stood at $393 mm with money at $25 mm. Liquidity stood at $165 mm inclusive of their RCA which is being tapped to assist fund the Chevron buildout. ARIS can be paying a small, $0.43 dividend on an annual foundation, at the moment yielding 2.7%.

Steerage for 2023

Stephan Tompsett, CFO commented on the outlook for 2023-

Latest trade experiences and preliminary manufacturing targets from a few of our giant prospects point out 15% to 25% year-over-year oil manufacturing will increase within the areas by which we function for 2023. We count on to develop alongside this growing manufacturing and look ahead to offering an replace to our 2023 outlook once we present our fourth quarter ‘22 outcomes.

Supply.

Dangers

I do not see quite a bit draw back for Aris Water Options, Inc. inventory. Their core business-frac and produced water therapy is programmed for development. Notably produced water and derivatives that come from the simply starting initiatives. This enterprise shouldn’t be tied to rig rely.

The first danger I see is sustained useless cash as traders shun the inventory, tying it to the rig rely. This danger ought to diminish as volumes enhance through the 12 months as beforehand mentioned.

Your takeaway

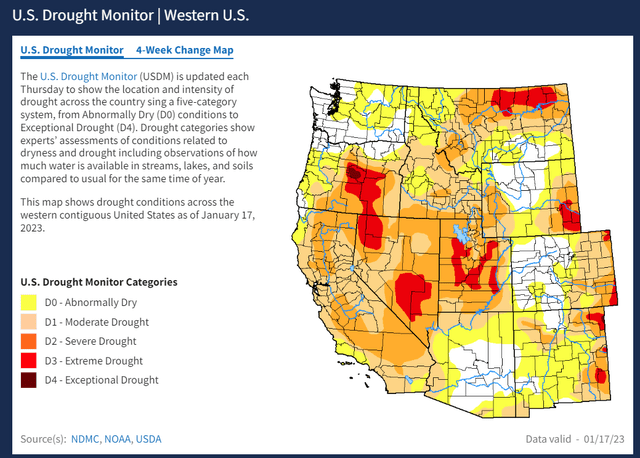

Let’s perceive one thing, water is valuable and changing into scarcer. The map beneath from the Drought workplace of the U.S. authorities is illustrative. This has actual world implications for a lot of U.S. cities. They’re working out of water.

Drought monitor (Drought.gov)

Towards that context, the steps ARIS is taking to tie up massive volumes of water begin to make sense. It additionally maybe provides us a glance into how analysts could also be viewing the corporate and giving it a better a number of than they might for an organization with strict oilfield prospects. ARIS has clearly set its sights on a bifurcation right into a extra technological method to water administration.

For those who can see previous the subsequent couple of quarters, ARIS may be a great guess for development. They’re shedding their oilfield startup standing, and look like on observe to be valued as a know-how participant within the environmental house, like Clear Harbors (CLH), buying and selling at 13.5X ahead EV/EBITDA, or just lately acquired at 28X earnings Evoqua Water Applied sciences, (AQUA) and 18X EV/EBITDA by Xylem Inc. (XYL) itself buying and selling at 23X EV/EBITDA.

Multiples get increased the farther you go from the oilfield! (Now, I nonetheless do not suppose they fee a better a number of than Halliburton-which can be a tech firm, however that is life.)