David Ramos

Thesis

Verizon (NYSE:VZ) has an older demographic of consumers who’re higher-income earners and laggards in know-how innovation adoption. With this perception, administration’s technique is smart; to prioritize current margins slightly than progress in consumer base volumes and to chop capex, favoring near-term shareholder yields versus long run know-how management. The issue is, I believe that is exactly what’s resulting in a creep up in churn charges and a sluggish bleed in market share. One thing has to vary lest Verizon stays an underperformer.

My Learn on This fall FY22 earnings

Verizon reported its This fall FY22 outcomes final week. The important thing highlights for me had been threefold:

1. Steering reduce

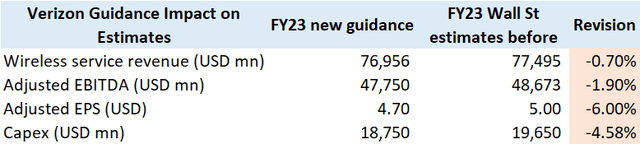

Verizon Steering Cuts vs Consensus Estimates (Firm Filings, Capital IQ, Writer’s Evaluation)

Because the desk above exhibits, Verizon upset Wall St on its revised FY23 steering on key working parameters of wi-fi service revenues (which makes up 78% of whole firm revenues), adjusted EBITDA and adjusted EPS.

Some buyers and analysts might view the ~4.6% reduce in FY23 capex as welcome information, as it might indicate better money accessible for shareholder distributions. Nonetheless, primarily based on additional evaluation mentioned on this article, I don’t view this as a very constructive signal.

2. Lack of progress aggression from commentary

You possibly can anticipate Verizon to compete, however I wish to underline once more that we won’t sacrifice financials for volumes. We proceed to give attention to enhancing our value of acquisition and retention and imagine present promotional incentives usually are not sustainable for the trade in the long term. Though we’ve participated, to some extent, on this dynamic, anticipate us to pursue extra methods to maneuver away from the aggressive handset subsidies.

– CEO Hans Vestberg in This fall FY22 earnings name (bolded emphasis is mine)

This clearly indicated to me that Verizon just isn’t going to prioritize progress. Additional evaluation under reveals seemingly causes as to why I imagine Verizon just isn’t incentivized to develop.

3. Continued rise in churn charge

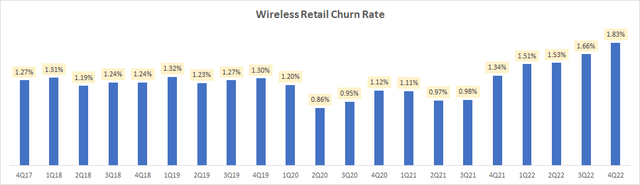

Wi-fi Retail Churn Charge (Firm Filings, Writer’s Evaluation)

It is a key metric to trace as a result of shopper wi-fi retail makes up 34% of whole firm revenues. The breakup is as follows; shopper wi-fi service makes up 58% of whole shopper income, which corresponds to 44% of whole firm income. About 79% of whole shopper wi-fi is offered via the retail channel.

Verizon’s churn charge right here continues to climb up for the sixth consecutive quarter in a row to 1.83%. This highlights potential market share loss.

Evaluation of Verizon Buyer Tendencies

My evaluation of Verizon’s buyer traits from a Statista Shopper Insights examine reveals insightful shade on Verizon’s aggressive positioning and technique. For context, 76% of Verizon’s whole income and 86% of the overall adjusted EBITDA comes from the patron section, making this evaluation and the insights drawn from it very materials to the long run prospects of Verizon.

The surveys used within the evaluation under embody a large pattern measurement of 8,800 smartphone customers in the US.

Verizon Wi-fi is dropping market share

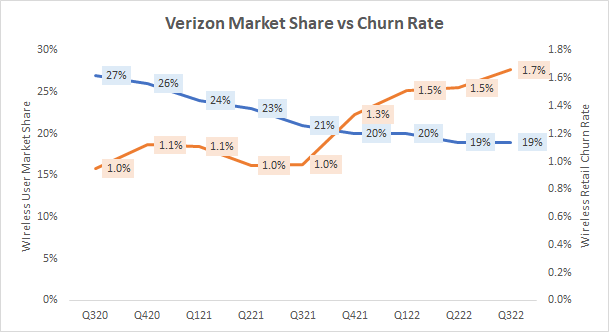

Verizon Market Share vs Churn Charge (Statista, Firm Filings, Writer’s Evaluation)

As suspected, the upper churn charges do certainly coincide with a loss in wi-fi consumer market share.

Verizon’s customers are older

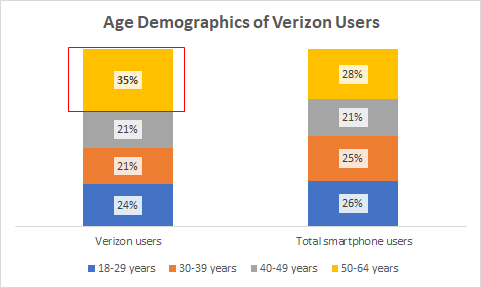

Age Demographics of Verizon Customers (Statista, Writer’s Evaluation)

The chart above exhibits a a lot larger proportion of customers within the 50-64 years age group in comparison with the overall group of smartphone customers. Assuming low telecom community supplier switching results, then I infer that Verizon is left with a buyer combine with a comparatively decrease buyer lifetime worth (LTV).

Naturally, this may be mitigated if extra shoppers change to Verizon. Nonetheless, at present, the market share and churn charges usually are not in Verizon’s favor. However what about sooner or later? What does it take to modify a shopper to a different telecom community supplier? I imagine the switching value of a telecom supplier just isn’t excessive, however the switching impetus should be sturdy. Folks don’t change suppliers until they get a greater deal on costs, there’s a lack of community protection, disappointment in service high quality or a motivation emigrate to a greater know-how.

Given the US’ mature telecom community, community protection and repair high quality is unlikely to be a foremost concern. The important thing drivers inflicting customers to modify suppliers then can be pricing and superior know-how:

Pricing cuts are unlikely as Verizon’s foremost consumer base has larger incomes

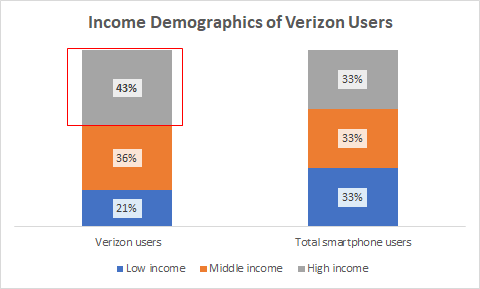

Revenue Demographics of Verizon Customers (Statista, Writer’s Evaluation)

Unsurprisingly, the upper proportion of upper older (by age) Verizon customers coincides with a better proportion of excessive earnings earners. I believe the possibilities of Verizon willingly participating in intense pricing competitors to enhance the age demographics of customers and probably LTV of its customers is low, as that will imply leaving cash on the desk for its current clients. This can be why Verizon’s administration just isn’t as hesitant to chop costs to the identical extent as its competitors.

Verizon unlikely to prioritize know-how management on account of larger mixture of laggard innovation adopters

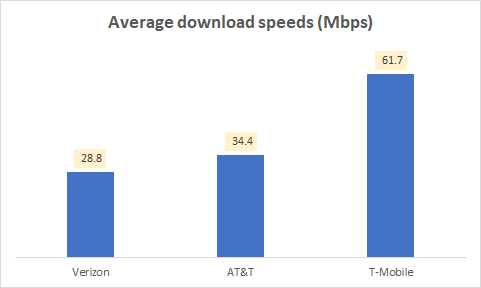

Common obtain speeds (Open Sign, Writer’s Evaluation)

In response to information from Open Sign, Verizon has 16% and 44% decrease obtain speeds in comparison with its two foremost rivals – AT&T (T) and T-Cell (TMUS). That is an indicator of Verizon’s laggard place within the know-how curve. Word that below this lens, the capex reduce talked about earlier within the article is one other indication of a strategic option to not prioritize progress.

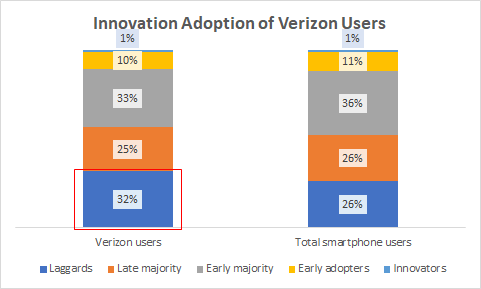

Innovation Adoption of Verizon Customers (Statista, Writer’s Evaluation)

Furthermore, with a better proportion (32% vs group common of 26%) of customers who’re laggards in know-how adoption, I contend that Verizon lacks the impetus to be a know-how chief.

Valuation

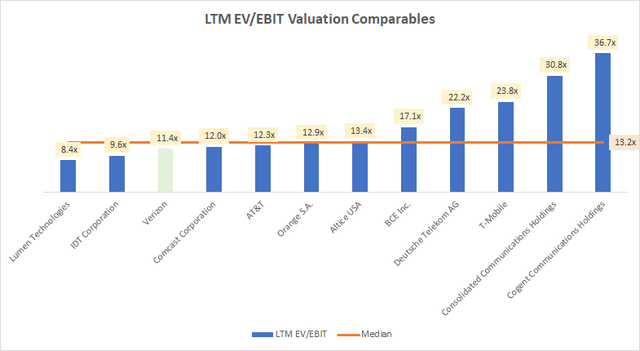

LTM EV/EBIT Comparables (Capital IQ, Writer’s Evaluation)

Friends set contains Verizon (VZ), Lumen Applied sciences (LUMN), IDT Company (IDT), Comcast Company (CMCSA), AT&T (T), Orange S.A. (ORAN) (OTCPK:FNCTF), Altice USA (ATUS), BCE Inc. (BCE) (BCE:CA), Deutsche Telekom AG (OTCQX:DTEGY), T-Cell (TMUS), Consolidated Communications Holdings (CNSL) and Cogent Communications Holdings (CCOI)

At an 11.4x LTM EV/EBIT, Verizon trades at a reduction of 13.3% to the peer-set median a number of of 13.2x. Given the corporate’s demographic positioning, continued indicators of decline in market share and comparatively decrease incentives for pursuing progress management, I imagine this low cost is warranted.

Takeaway

I believe Verizon’s current buyer combine and its traits is holding the corporate again from creating alternatives for market share acquire and growth of buyer LTV. In the end, this leads to a strategic path that doesn’t prioritize progress. As a substitute, I anticipate a sluggish bleed in market management. With its present technique, I believe Verizon will underperform its friends.

I charge Verizon a ‘maintain’, but when I had been a shareholder, I might exit this inventory in favor of one thing higher, which I’ll share in one other article quickly.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.