cemagraphics

The S&P 500 (SPY) continued its robust rally to a excessive of 4195 final week, helped on by a Fed which just about gave bulls all they may have hoped for. Technicals are wanting higher and higher, and with the break of 4101, the chart now has a better excessive to go together with the upper low at 3764. Mixed with the break within the trendline and worth buying and selling above all of the shifting averages in each timeframe, do the bears have any hope?

In an try and reply that, quite a lot of technical evaluation strategies can be used to have a look at possible strikes for the S&P 500 within the week forward. Identical to earlier weeks, the market can be considered in possible outcomes utilizing inflection factors – whether it is taking place, the place is it more likely to go? Whether it is going up, the place is it doubtless to check?

The S&P 500 chart can be analyzed on month-to-month, weekly and day by day timeframes, then the knowledge collated into an actionable abstract on the finish.

The Market Narrative

The Fed did not actually put up a lot of a battle towards the inventory rally. Certainly, slowing the tempo of hikes to 25bps and affirmation they assume the “disinflationary course of has began” added gasoline to the fireplace. A pause seems doubtless quickly, and lots of are calling for “another and completed.” Furthermore, the assembly led to an additional 10bps of cuts added to the 50bps already priced in for later this yr.

Rising expectations for price cuts oddly juxtaposed with extra robust knowledge as NFP beat considerably and ISM Providers got here in at 55.2. Earnings had been largely in-line and the heavyweights did not drag the index down. Additionally, share of firms beating estimates rose from 67.8% the week earlier to 69.6%. The query appears not whether or not there can be a gentle touchdown, but when there can be any touchdown in any respect.

All of the above is ideal for the bulls and for the S&P500 rally, however would not appear so as to add up. If the economic system is simply too robust, and the labor market too tight, inflation will not fall and the Fed will not lower. Bulls cannot actually have all of it. This can give the bears some hope as cracks are sure to seem sooner or later and the S&P500 seems priced for perfection.

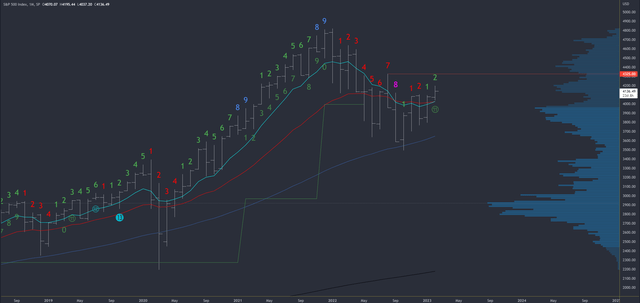

S&P 500 Month-to-month

A brand new month-to-month bar for February began on Wednesday after the January bar closed with an ‘inside bar’ i.e., the January vary was fully contained inside the vary of December. This can sign indecision and a reversal, however the robust January shut quickly adopted by means of with new highs above 4101. The February bar now must commerce again below 4101 and the 4070 open to begin forming a reversal bar.

SPX Month-to-month (TradingView)

The 4325 on the excessive of August is the subsequent resistance. Assist is on the 4101 break-out degree and the February low of 4037.

There aren’t any exhaustion alerts in both course (utilizing Demark strategies), though draw back exhaustion was very almost registered in October so we are able to say that is being reset with the present rally.

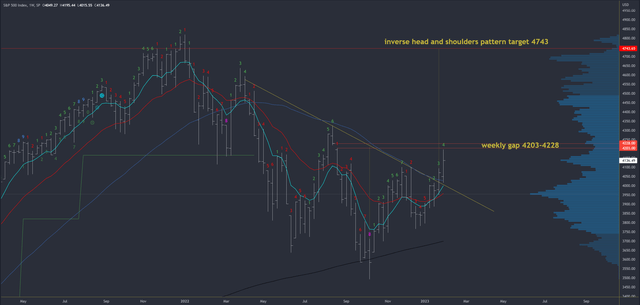

S&P 500 Weekly

Final week’s rally to 4195 got here very near the subsequent weekly reference at 4203. There’s now an lively inverse head and shoulders sample with a goal of 4743, however that is solely related within the medium time period i.e., not subsequent week.

SPX Weekly (TradingView)

Resistance is available in at 4203-4228 on the giant weekly hole, with 4325 month-to-month resistance above that. Assist is on the 50dma at 4025 and final week’s low of 4015.

Once more, there aren’t any exhaustion alerts in both course.

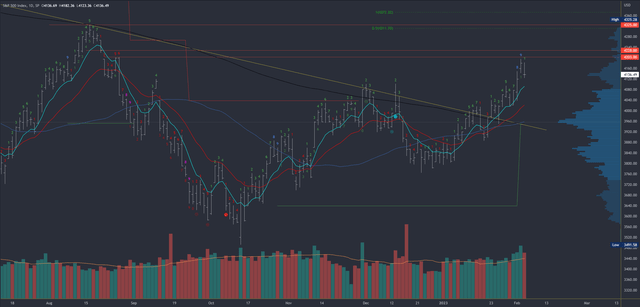

S&P 500 Every day

The day by day chart held the primary assist degree of 4015 identified final week and continued into weekly resistance. Every day upside exhaustion did full on Thursday so this warns of no less than slowing / a pause to come back. Friday was weak however did not injury the development and there’s no actual proof of a reversal.

SPX Every day (TradingView)

Value is now above all shifting averages and with solely weekly/month-to-month references as resistance. Quick assist is at 4119, then 4101 and the break-out degree. Beneath that’s 4037 on the pre-FOMC low / low of February.

The bar is about fairly excessive to flip the chart bearish as this might solely include a break under the 200dma and trendline round 3940.

As talked about earlier, an upside exhaustion depend is full.

Situations for Subsequent Week

Bullish

A break of 4203-4228 ought to result in a take a look at of 4325. Dips ought to maintain 4101-4119 to keep up the bullish momentum.

Bearish

Bears must defend 4203-4228 and break again under 4101 to focus on 4037 and 4015. A big drop would goal the important thing space round 3940.

Conclusion

Bulls have the higher hand, and whereas a pause seems doubtless round 4203, so long as 4101 now holds, the technicals are optimistic. Bears want a catalyst for a reversal. Chair Powell’s speech on Tuesday and CPI the next week look doubtless candidates, however a big drop is required to flip the view again bearish.

Editor’s Be aware: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.