[ad_1]

Shares of Pinterest, Inc. (NYSE: PINS) dropped this week after the image-sharing platform reported weaker-than-expected This fall revenues and issued cautious steering for the primary quarter. After turning worthwhile just a few years in the past, the corporate has maintained optimistic earnings in virtually each quarter, regardless of the disruptions attributable to the pandemic.

Whereas its distinctive enterprise mannequin provides the corporate a bonus over different social media platforms, the present weak spot within the promoting market is placing stress on revenues. The inventory made robust features forward of Monday’s earnings, reflecting the market’s optimism in regards to the firm’s funds. However the short-lived momentum waned quickly after the announcement and the shares have dropped about 8% since then.

Valuation

PINS maintained an uptrend all through final 12 months, although it skilled excessive volatility, and entered 2013 on a excessive word. The query is whether or not it will create moderately good shareholder worth this 12 months. Proper now, the valuation is affordable, however softening income development and the administration’s weak steering present that Pinterest shouldn’t be resistant to the headwinds the expertise sector is presently going through. So, it doesn’t appear to be the correct time to both purchase or promote the inventory. Potential traders can contemplate including it to the watchlist.

Examine this house to learn administration/analysts’ feedback on quarterly studies

At the moment, the corporate’s development technique is concentrated on integrating the web buying characteristic in any respect ranges and additional growing monetization, leveraging the continued improve in income per consumer. The corporate has expanded its consumer base at a gradual however regular tempo in current quarters and ended the fiscal 12 months with round 450 million customers, which is up 4% from 2021.

Financials

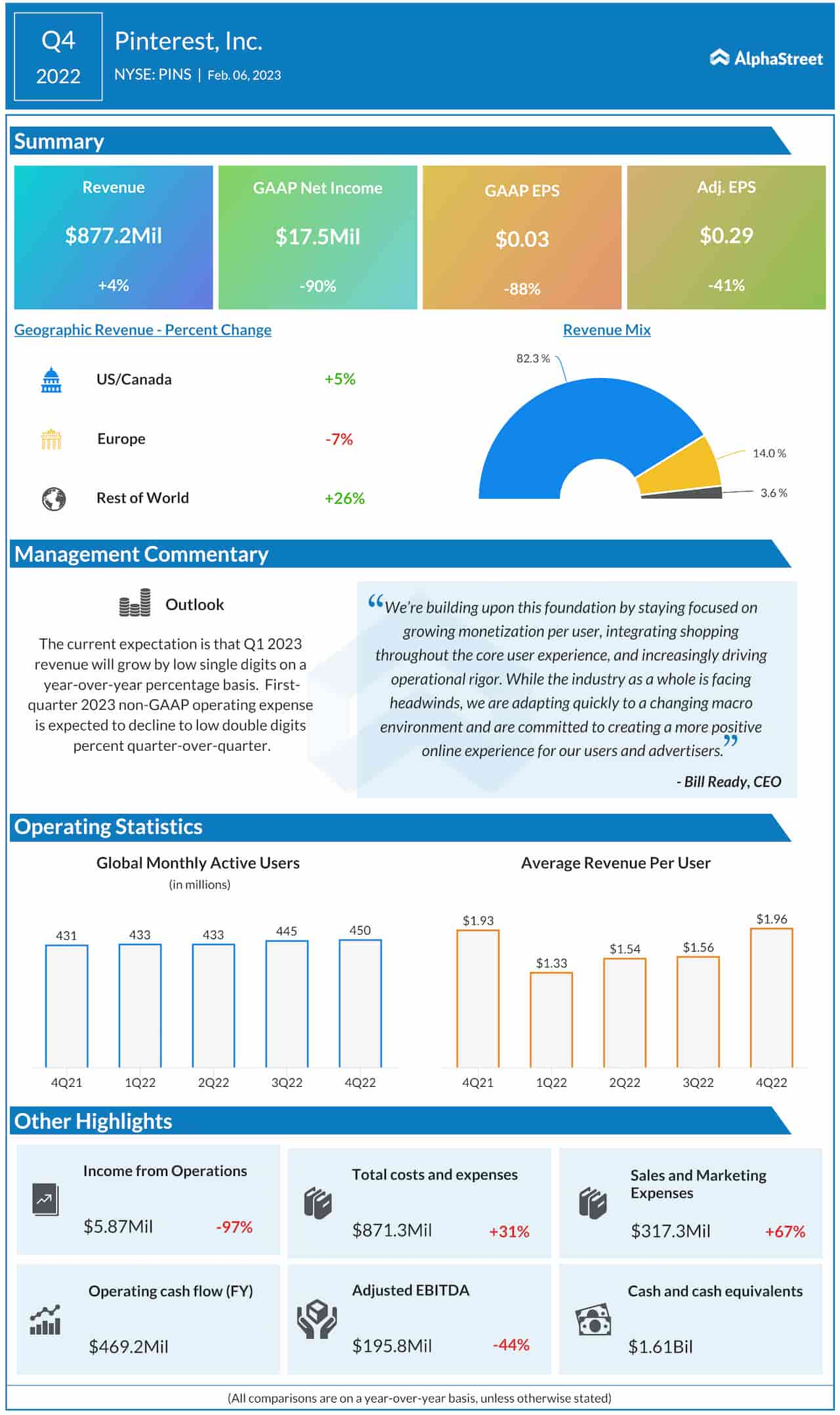

It’s estimated that commercial earnings would get better in the long run as the current challenges ease – such because the uneven macro setting and decreased advert spending because of excessive inflation. Within the fourth quarter, adjusted earnings beat estimates for the second time in a row, although the most recent quantity dropped 41% from final 12 months to $0.29 per share. A rise in revenues within the US/Canada markets greater than counterbalanced the contraction in Europe, and the highest line moved up 4% yearly to $877.2 million.

Commenting on the outcomes, Pinterest’s CEO Invoice Prepared mentioned, “we constructed and shipped new advert tech and measurement options that resulted in improved returns for our advertisers. And we’re simply getting began. I’ve a robust conviction that we are going to proceed to innovate and ship worth to our customers and enterprise companions. We grew world MAUs in This fall to 450 million, up each sequentially and 12 months over 12 months. Our world cell app customers, which account for over 80% of our impressions and income, grew 14%. And our U.S. and Canada cell app customers grew 5%, accelerating from final quarter.”

Outlook

The administration presently expects first-quarter revenues to develop by low single digits, which is sharply beneath the consensus estimates. The weak steering primarily displays the weak spot in enterprise spending, and it echoes the issues raised by ad-supported social media friends like Meta Platforms, Inc. (NASDAQ: META) and Alphabet, Inc. (NASDAQ: GOOGL, GOOG), which reported unimpressive working outcomes just lately.

AMZN Earnings: All that you must learn about Amazon’s This fall 2022 earnings outcomes

Pinterest additionally introduced the departure of Todd Morgenfeld, its chief monetary officer and head of enterprise operations He can be stepping down in July this 12 months. Earlier, the corporate had laid off round 150 workers as a part of streamlining the enterprise.

Pinterest’s inventory remained within the crimson after the post-earnings sell-off and traded decrease all through Wednesday’s session. Nevertheless, all alongside it stayed above the 52-week common.

[ad_2]

Source link